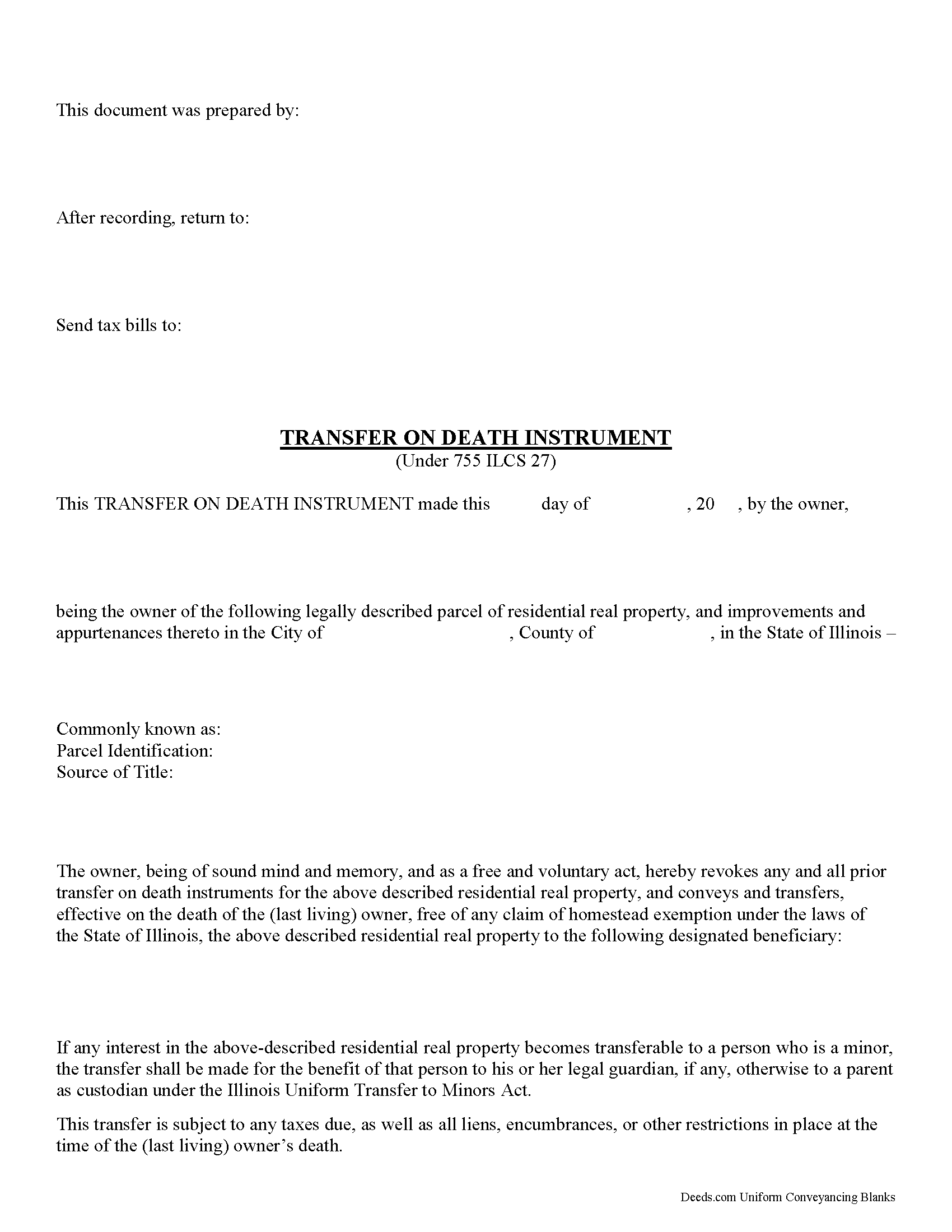

Stark County Transfer on Death Instrument Form

Stark County Transfer on Death Instrument

Fill in the blank form formatted to comply with all recording and content requirements.

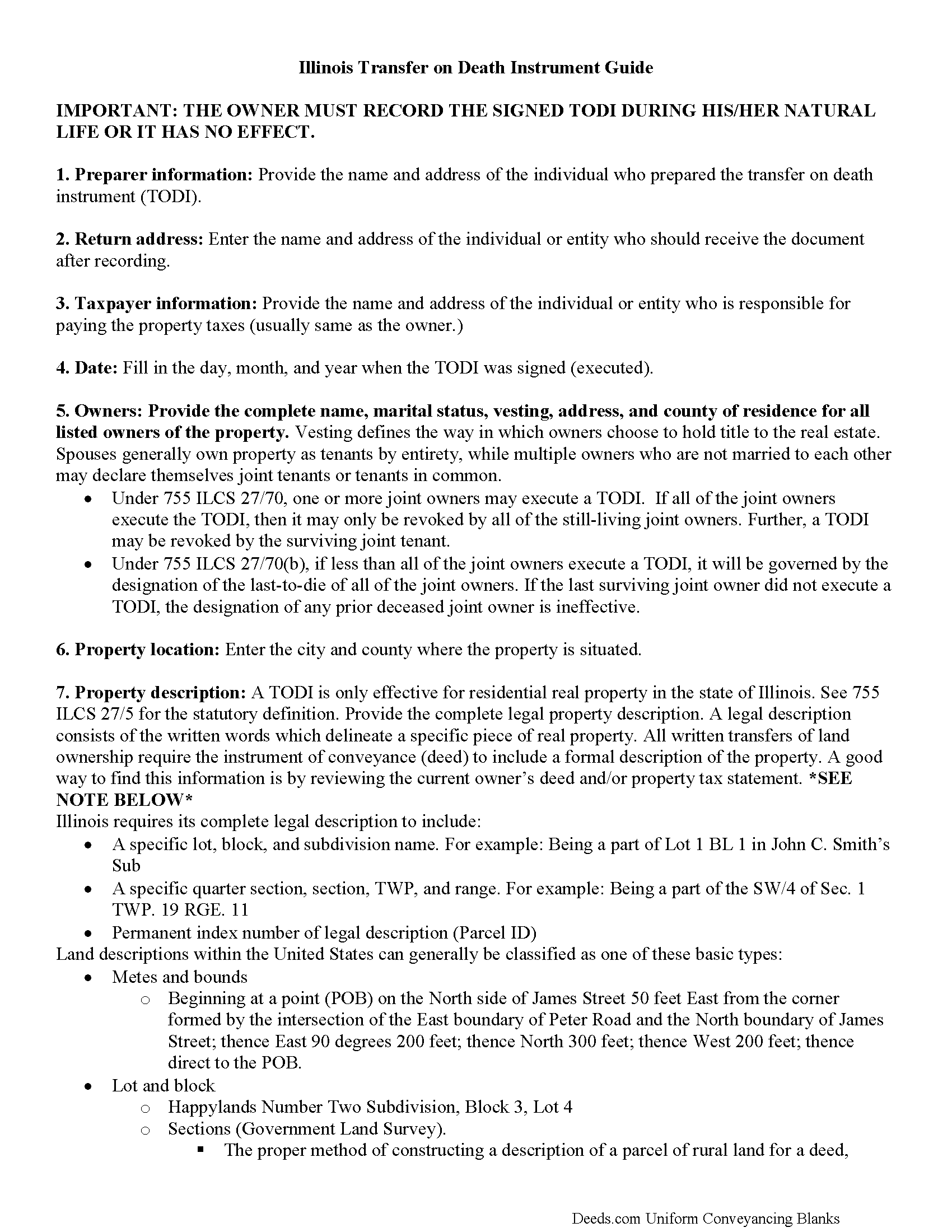

Stark County Transfer on Death Instrument Guide

Line by line guide explaining every blank on the form.

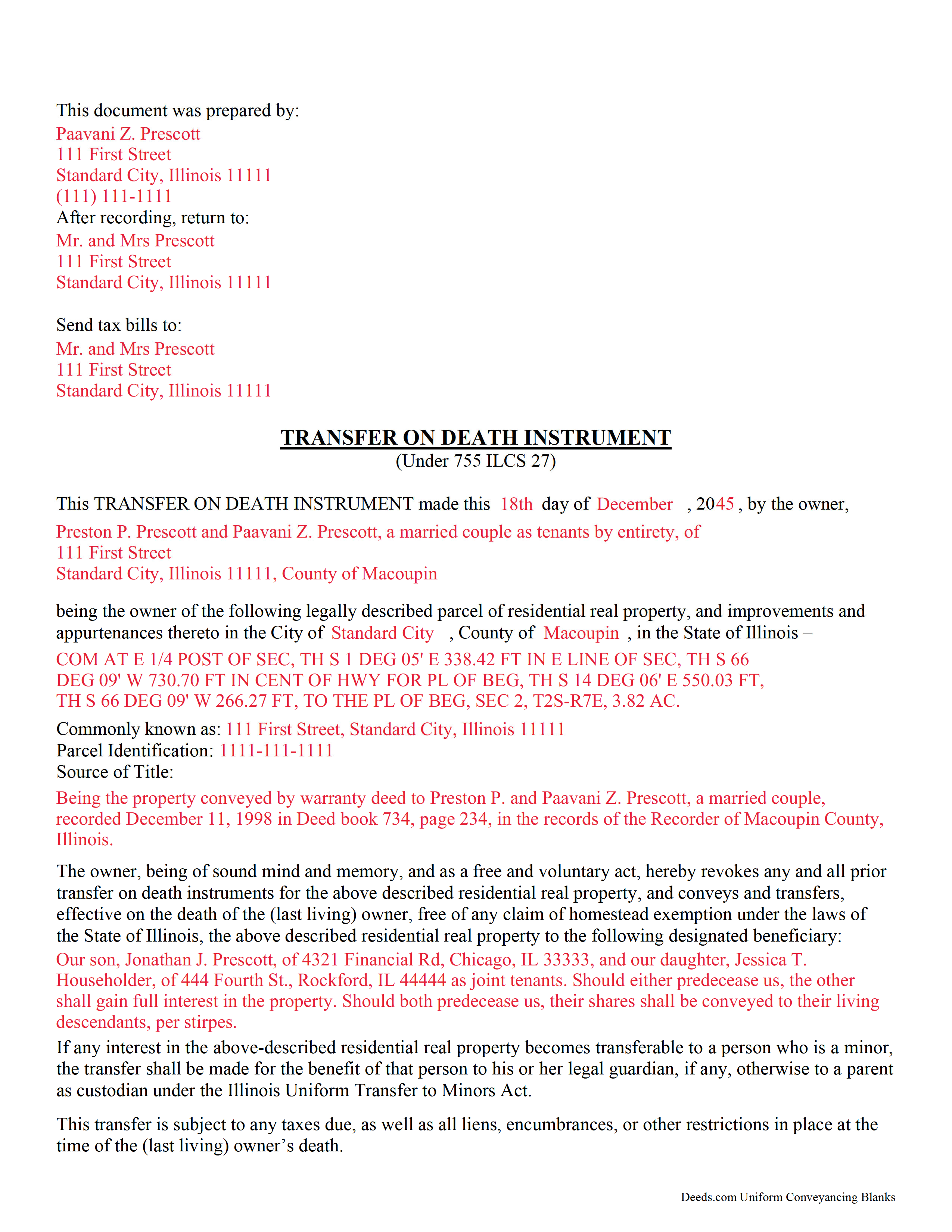

Stark County Completed Example of the Transfer on Death Instrument Document

Example of a properly completed Illinois Transfer on Death Instrument document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Stark County documents included at no extra charge:

Where to Record Your Documents

County Clerk/Recorder

Toulon, Illinois 61483

Hours: 8:30 to 4:30 Monday through Friday

Phone: (309) 286-5911

Recording Tips for Stark County:

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Stark County

Properties in any of these areas use Stark County forms:

- Bradford

- Castleton

- La Fayette

- Speer

- Toulon

- Wyoming

Hours, fees, requirements, and more for Stark County

How do I get my forms?

Forms are available for immediate download after payment. The Stark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stark County?

Recording fees in Stark County vary. Contact the recorder's office at (309) 286-5911 for current fees.

Questions answered? Let's get started!

Comparable to Ladybird, beneficiary, and enhanced life estate deeds, these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner's death, while retaining absolute possession of and control over the property while alive. Because the Illinois document DOES NOT transfer ownership when it's executed, the owner may revoke the transfer at will, and is allowed to reallocate, sell, or otherwise dispose of the real estate as desired with no penalties, restrictions or obligation.

(Illinois Transfer on Death Package includes form, guidelines, and completed example)

Important: Your property must be located in Stark County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Instrument meets all recording requirements specific to Stark County.

Our Promise

The documents you receive here will meet, or exceed, the Stark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stark County Transfer on Death Instrument form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Robert T.

June 10th, 2021

Thanks to Deeds.com, our law office was able to get the deed of trust filed without having to run around town wasting gas and they were very efficient and quick with getting it done in a timely manner.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie P.

January 11th, 2023

It was a seamless process, inexpensive, and probably saved me thousands by having an attorney draw this same form us. Highly recommend!

Thank you!

Catherine J S.

November 17th, 2022

Did not like that the lines aren't lining up smoothly to make the document look more professional.

Thank you for your feedback. We really appreciate it. Have a great day!

Judith O.

January 13th, 2019

Unfortunately, it wasn't the information I needed. I wanted something that could remove my husbands name on our deed, because he passed away last month.

Sorry to hear about your situation Judith. The document you selected is one that would need to be used during the grantor's lifetime. Under the circumstances, we have canceled your order and refunded your payment.

Fred P.

April 1st, 2021

Great website to get your state and county forms.

Thank you!

Russell B.

March 15th, 2023

complete package as promised at a very reasonable cost. Easy forms to complete. Thank you. Definitely 5 stars!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Margarette S.

November 27th, 2019

I found your website easy to use and very informative.

Thank you for your feedback. We really appreciate it. Have a great day!

Bill M.

March 10th, 2021

PROS: Quick communication. Completed the task expediently. CONS: Deciphering what was being referred to on the website when needing the proper classification wasn't clear. Had to delve through your unfamiliar territory. But managed. OVERALL: Got the job done swiftly and the end result was satisfactory. Will use again.

Thank you!

Van S.

March 25th, 2022

Easy to use...very informative...ttook care of exactly what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!

Eduardo A.

January 22nd, 2022

Perfect, blank forms, just what I ordered. Easy to download, understand, and complete.

Thank you!

DOUGLAS H.

December 16th, 2020

Just as promised My quitclaim deed went through the county recorders office with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Marcus V.

March 18th, 2024

Awesome and perfect.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Catherine E.

January 7th, 2021

I was referred to your company, but when i tried to process the recording of a deed to a property in City of Philadelphia my service was rejected. I appreciated the feedback i received from one of your representatives who instructed me in the right process for recording a deed in philadelphia. Thank you for all your help. The deed that needed to be recorded was overnighted yesterday. Stay safe and mask up

Thank you!

Barbara E.

March 2nd, 2021

I'm not sure if KVH is the identity to the person who helped me. I hope it is so you know just how much she helped She was great and very patient with me and with Wayne County Register of Deeds. I'm am really glad I had her on my team in this long endeavor.

Thank you for the kinds words Barbara. We appreciate you.

Kathy B.

April 19th, 2019

Used this service in 2016 and had NO problems with getting all the correct paperwork submitted and I would definitely recommend this company

Thank you for your feedback. We really appreciate it. Have a great day!