Whiteside County Transfer on Death Instrument Form

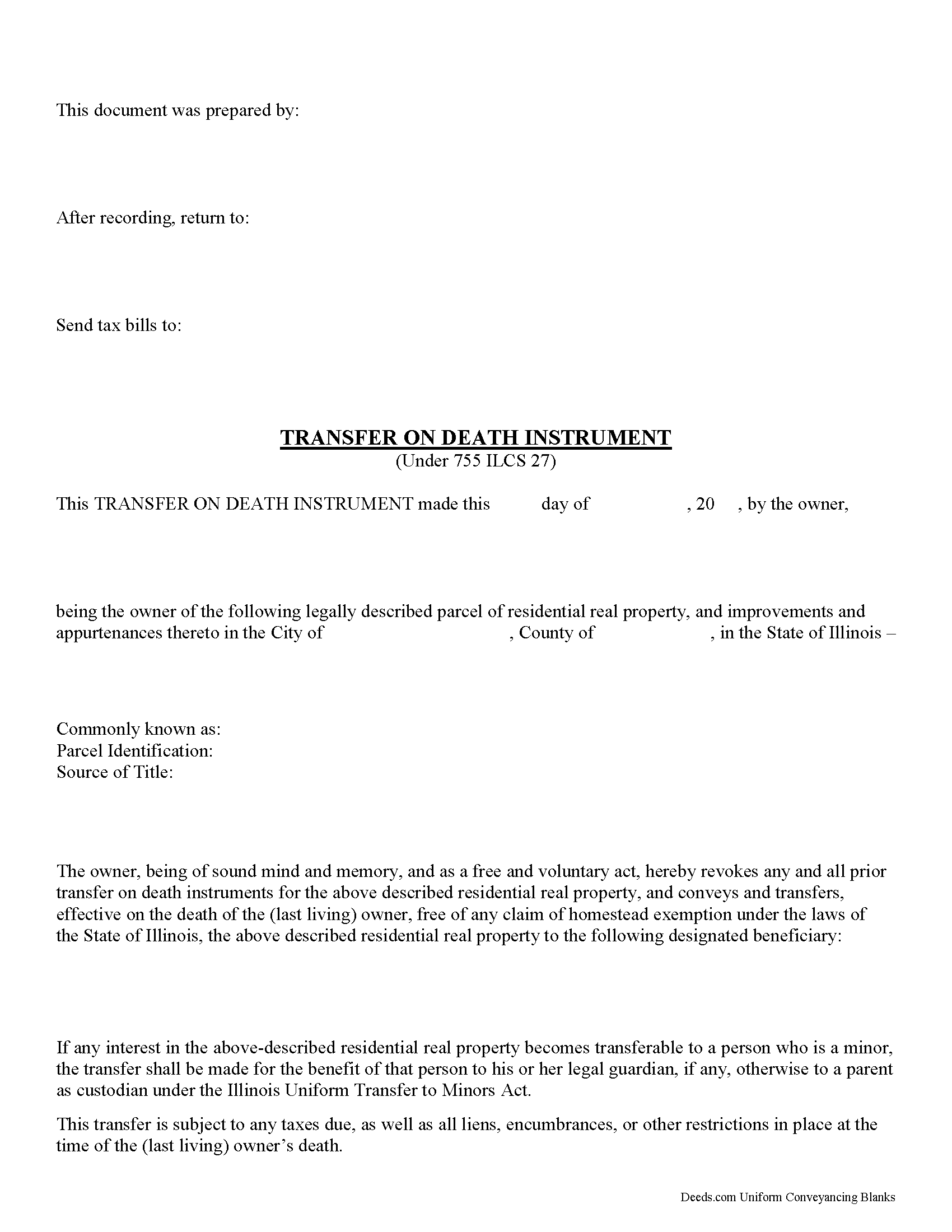

Whiteside County Transfer on Death Instrument

Fill in the blank form formatted to comply with all recording and content requirements.

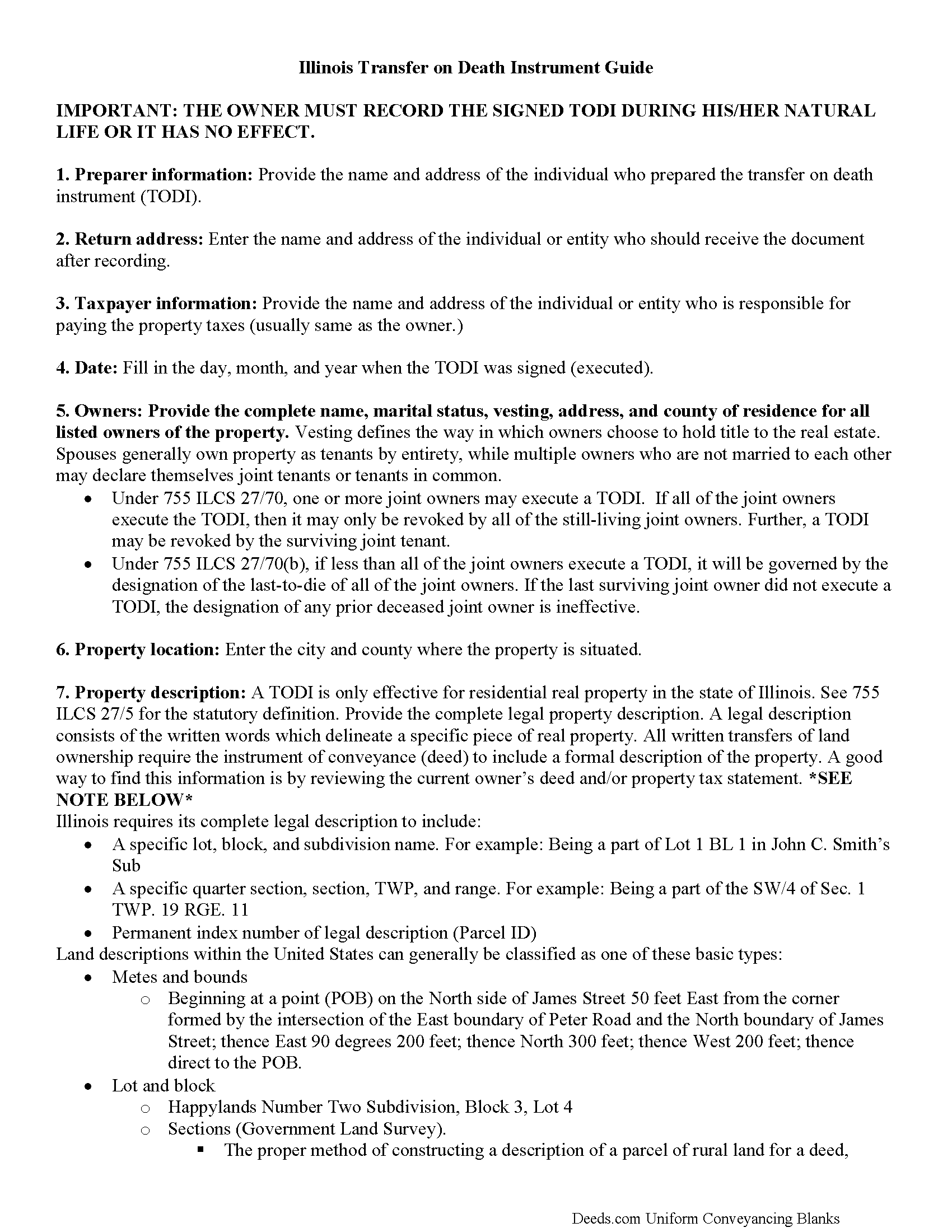

Whiteside County Transfer on Death Instrument Guide

Line by line guide explaining every blank on the form.

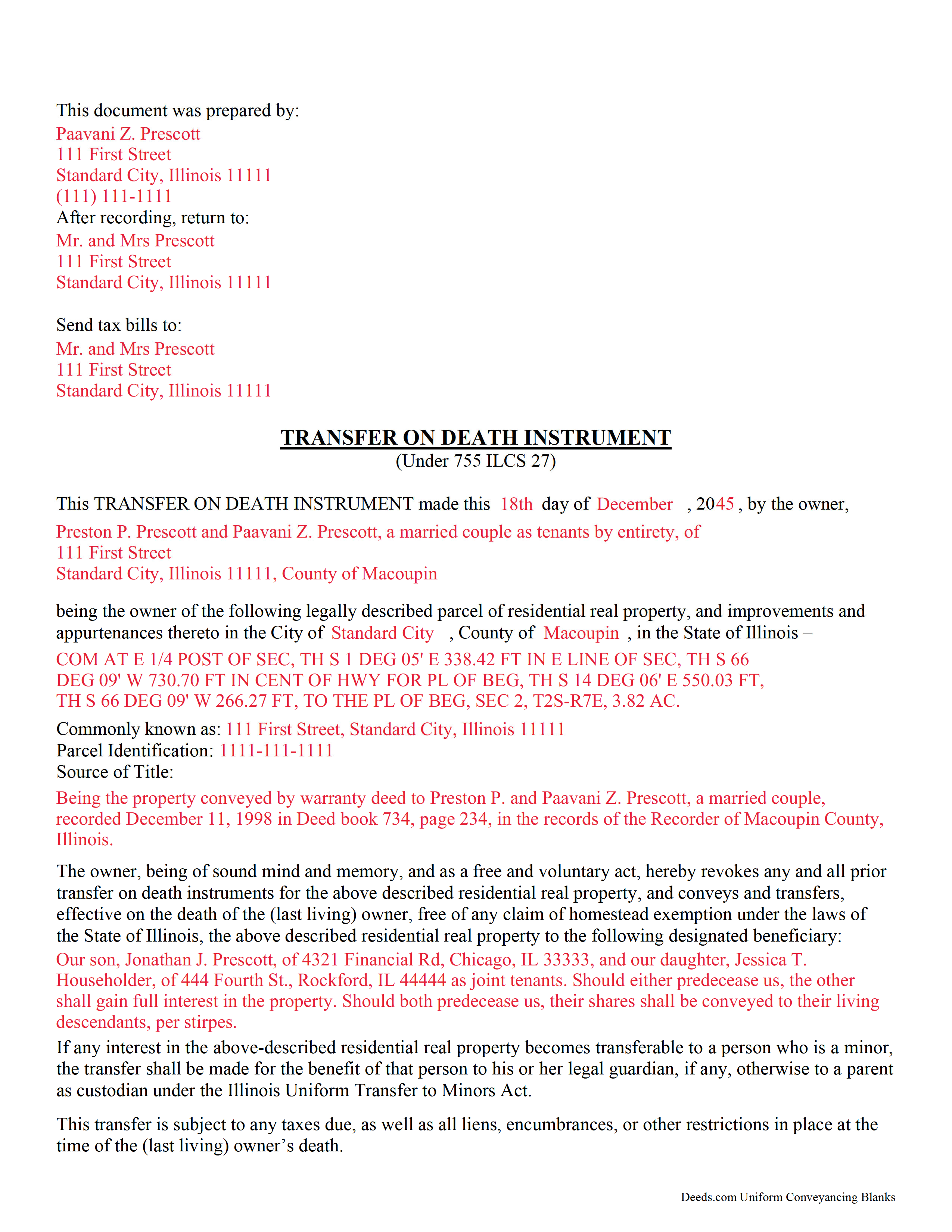

Whiteside County Completed Example of the Transfer on Death Instrument Document

Example of a properly completed Illinois Transfer on Death Instrument document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Whiteside County documents included at no extra charge:

Where to Record Your Documents

Whiteside County Recorder

Morrison, Illinois 61270

Hours: 8:30 to 4:30 Monday through Friday

Phone: (815) 772-5192

Recording Tips for Whiteside County:

- Documents must be on 8.5 x 11 inch white paper

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Whiteside County

Properties in any of these areas use Whiteside County forms:

- Albany

- Deer Grove

- Erie

- Fenton

- Fulton

- Galt

- Lyndon

- Morrison

- Prophetstown

- Rock Falls

- Sterling

- Tampico

Hours, fees, requirements, and more for Whiteside County

How do I get my forms?

Forms are available for immediate download after payment. The Whiteside County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Whiteside County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Whiteside County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Whiteside County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Whiteside County?

Recording fees in Whiteside County vary. Contact the recorder's office at (815) 772-5192 for current fees.

Questions answered? Let's get started!

Comparable to Ladybird, beneficiary, and enhanced life estate deeds, these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner's death, while retaining absolute possession of and control over the property while alive. Because the Illinois document DOES NOT transfer ownership when it's executed, the owner may revoke the transfer at will, and is allowed to reallocate, sell, or otherwise dispose of the real estate as desired with no penalties, restrictions or obligation.

(Illinois Transfer on Death Package includes form, guidelines, and completed example)

Important: Your property must be located in Whiteside County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Instrument meets all recording requirements specific to Whiteside County.

Our Promise

The documents you receive here will meet, or exceed, the Whiteside County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Whiteside County Transfer on Death Instrument form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Johnnie G.

July 6th, 2020

We had hoped, as this was direct through our State recorder's office, State-specific data would be pre-filled in. Also there is no help when transferring the home title from a Revocable Trust to the living Trustee and new spouse (no example given, no help for which code to use). And the example doesn't match the prior deed revision format submitted by our attorney. So, not the best experience. We may have to get an attorney involved...what we were hoping to avoid

Thank you for your feedback. We really appreciate it. Have a great day!

Jennie P.

June 25th, 2019

Thank you for the information you sent.

Thank you!

Elizabeth S.

September 8th, 2022

Easy to download. I like the fact that it gives me an example of how to fill it out and also the instructions. Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Kay Y.

February 27th, 2024

Fast and easy service.

Your words of encouragement and feedback are greatly appreciated. They motivate us to maintain high standards in our service.

Griselle M.

February 9th, 2021

This is my third time using Deeds.com and they don't disappoint. Their customer service is outstanding - absolutely excellent - via messages, I communicated with them immediately and 24/7 - on weekends and at night. I would not even try another service as they provide excellence which is so rare these days.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Catherine B.

September 15th, 2020

Trying to get a hold of someone in the office is very difficult. This made it so much easier, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Dan B.

June 6th, 2022

Excellent service even faster then I expected. Very pleased and a reasonable priced document. I encourage people too use Deeds.Com

Thank you for your feedback. We really appreciate it. Have a great day!

Philippe B.

September 23rd, 2020

I purchased a Quit Claim Deed package a couple weeks ago. The included guide unfortunately didn't answer all the questions about my specific case of how to fill it out, so I sent them a couple questions on Sept 8. It's now the 23rd, and still no reply. The form is a useless waste of money if I don't know how to fill it out in a legally-accurate way.

We certainly do not want you to waste your money Philippe, to that end your order and payment has been canceled. We do hope that you seek the advice of a legal professional familiar with your specific situation. It should go without saying but just to be clear, our do it yourself forms do not include legal representation for $19. Have a wonderful day.

Maria S.

January 10th, 2019

The paperwork/forms are fine, but there isn't enough explanation for me to figure out how to file the extra forms (which I do need in my case). The main form, Deed Upon Death is fine. I think the price is pretty high for these forms. I wouldn't have purchased it because there are places to get them for much cheaper (about 6 dollars), but this site had the extra forms I wanted (property in a trust and another form). Unfortunately these were included as a "courtesy" and there are no instructions for them. So three stars for being clear about what was in the package, having the right forms that I need, but instructions for putting them to use and price took a couple of stars off. Downloading was easy and once you download you can type the info into the PDF--that makes working with the forms much easier.

Thank you for the feedback Maria. Regarding the supplement documents, it is best to get assistance from the agency that requires them. These are not legal documents, they should provide full support and guidance for them.

Rebecca W.

January 24th, 2023

Very easy to find and download.

Thank you!

Paul S.

March 18th, 2021

Very satisfactory

Thank you!

CARRIE T.

March 10th, 2022

Thought it was pretty simple to use.

Thank you!

Karen T.

April 22nd, 2019

Thank you for the feedback. I reviewed this with my client/friend and she is following up with the appropriate people, including the Police and a lawyer. Thank you for your help.

Thank you!

Dee W.

December 11th, 2019

Easy process! Submit payment, fill out forms using the document guide provided, and print!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Georgia R.

March 29th, 2023

Great experience, fast and efficient, no hassle. Will use again!

Thank you for your feedback. We really appreciate it. Have a great day!