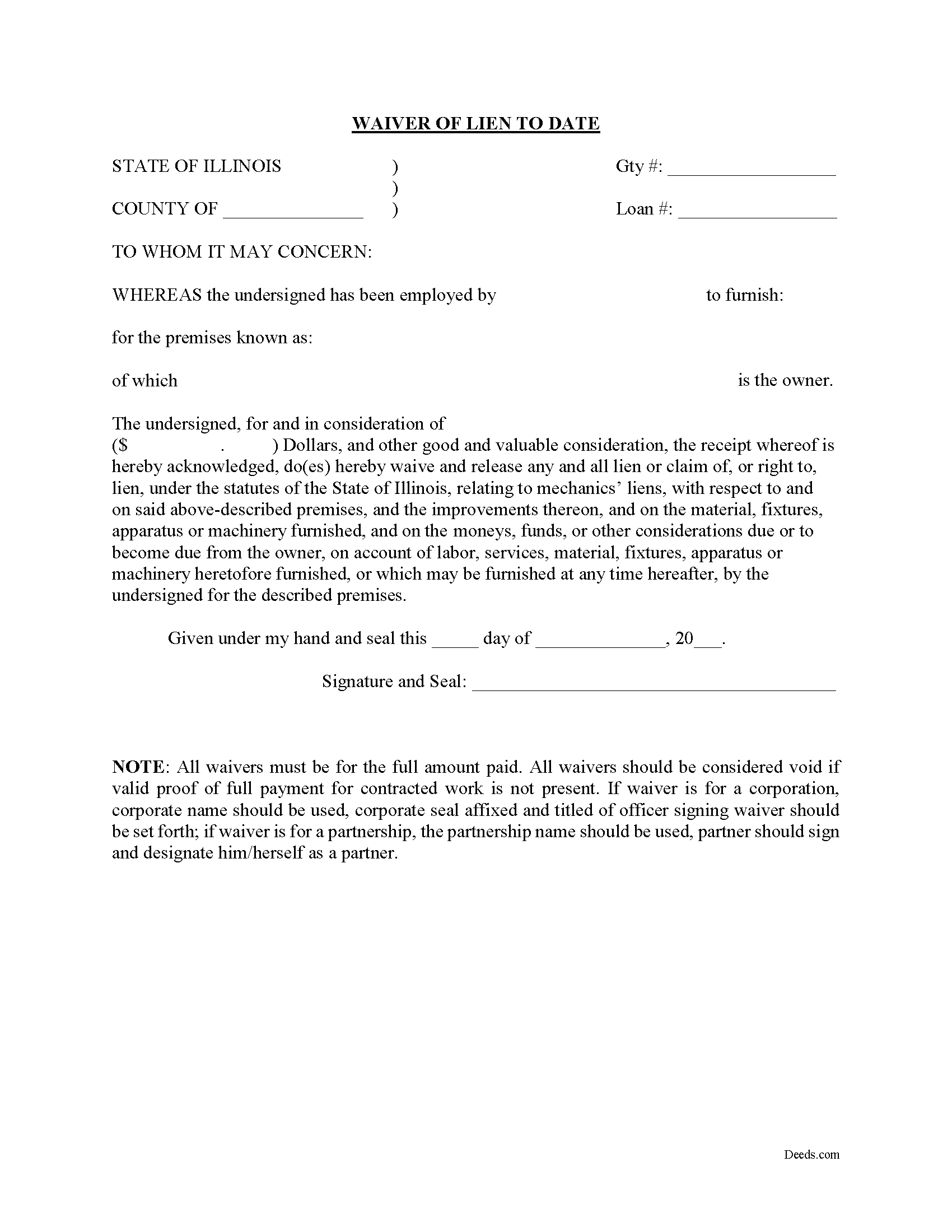

Peoria County Waiver of Lien to Date Form

Peoria County Waiver of Lien to Date Form

Fill in the blank Waiver of Lien to Date form formatted to comply with all Illinois recording and content requirements.

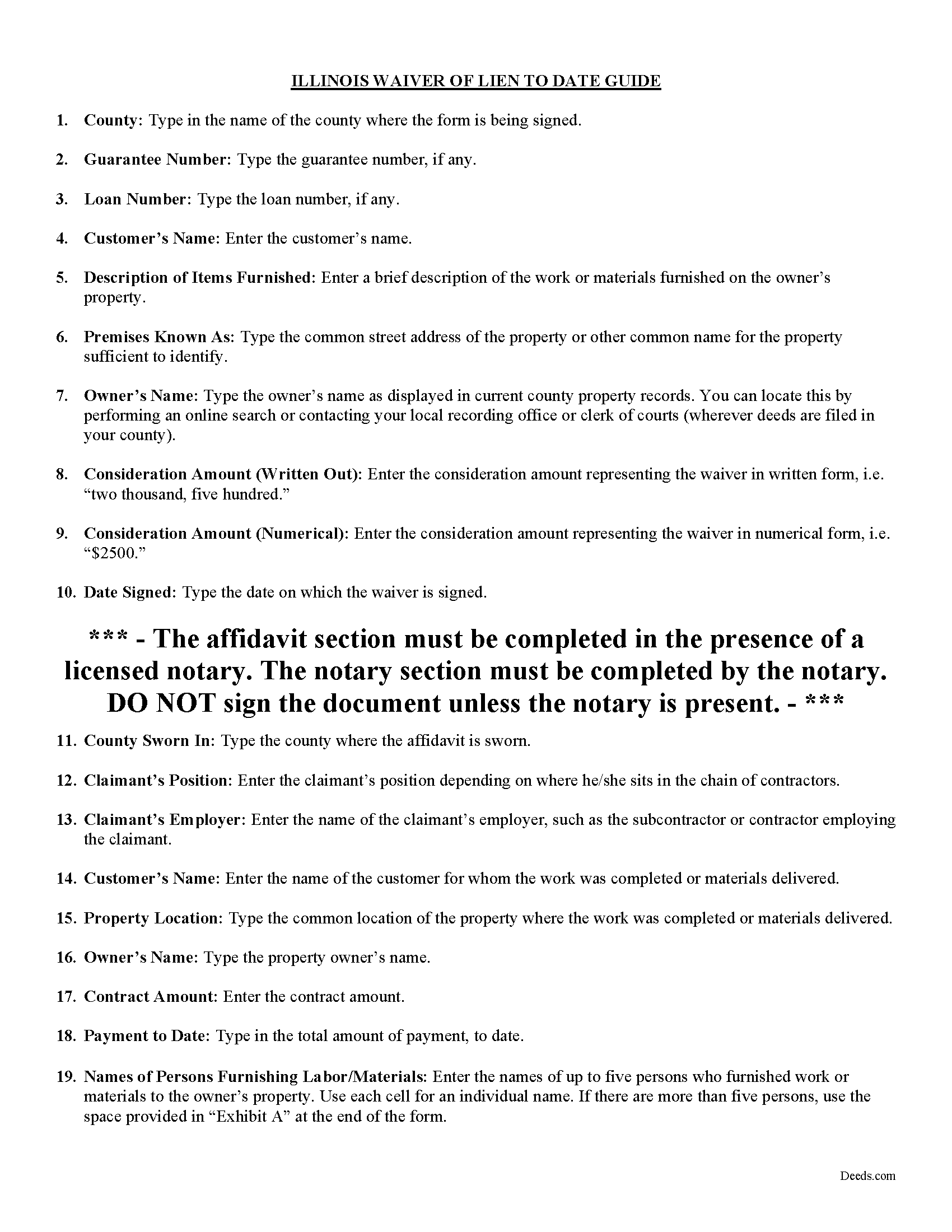

Peoria County Waiver of Lien to Date Guide

Line by line guide explaining every blank on the form.

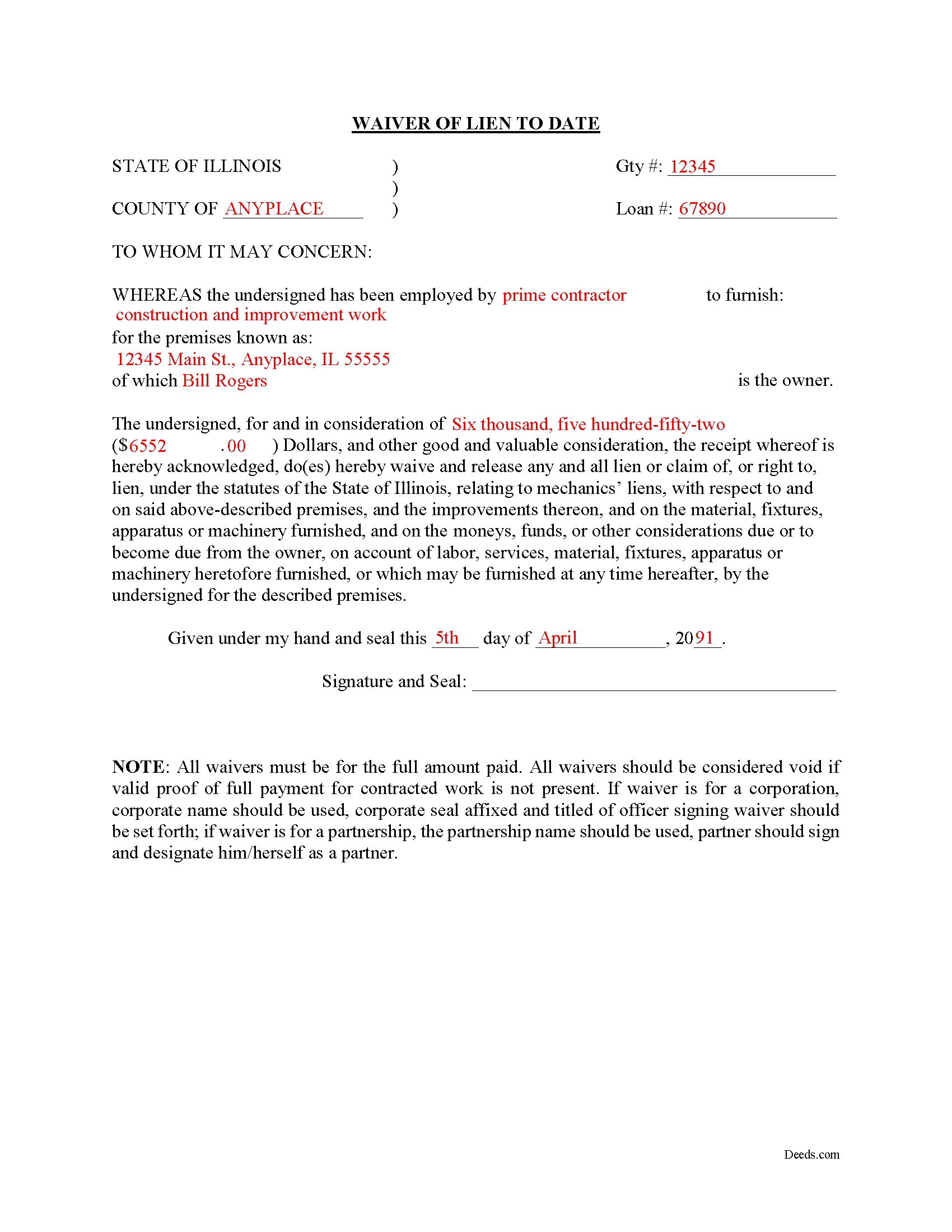

Peoria County Completed Example of the Waiver of Lien to Date Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Peoria County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds

Peoria, Illinois 61602

Hours: Office Hours: Monday–Friday 8:30am–5:00pm / Recording Hours: Monday–Friday 8:30am–4:30pm

Phone: (309) 672-6090

Recording Tips for Peoria County:

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Peoria County

Properties in any of these areas use Peoria County forms:

- Brimfield

- Chillicothe

- Dunlap

- Edelstein

- Edwards

- Elmwood

- Glasford

- Hanna City

- Kingston Mines

- Laura

- Mapleton

- Mossville

- Peoria

- Peoria Heights

- Princeville

- Rome

- Trivoli

Hours, fees, requirements, and more for Peoria County

How do I get my forms?

Forms are available for immediate download after payment. The Peoria County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Peoria County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Peoria County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Peoria County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Peoria County?

Recording fees in Peoria County vary. Contact the recorder's office at (309) 672-6090 for current fees.

Questions answered? Let's get started!

Under 770 ILCS 60, Illinois' Mechanic's Lien Act, lien waivers are a type of document used between a contractor (including a sub or general) and a property owner to induce or encourage final or partial payments in exchange for forfeiting the claimant's right to a mechanic's lien.

A lien waiver is useful for property owners because it assures them that a lien will not be placed on their property, and for contractors because presenting the waiver can encourage the owner to pay. Therefore, a waiver offers a quid pro quo arrangement with benefits for both sides. Waivers can be conditional, meaning they go into effect based upon actual receipt of payment as a triggering event, or unconditional, meaning the waiver takes effect upon being sent to the owner or prime contractor.

The Waiver of Lien to Date is for a subcontractor and contractor to sign upon receipt of a partial payment from the customer. The parties should ensure the payment has been made (meaning any check has been deposited and cleared) before signing the waiver. The Waiver of Lien to Date includes an affidavit to be completed by the contractor listing all parties contracted with, the contract amounts, payment amounts, and balance remaining due. Finally, sign the completed lien waiver in front of a notary public.

Contact an attorney for more information about lien waivers, or any other issues related to mechanic's liens in Illinois.

Important: Your property must be located in Peoria County to use these forms. Documents should be recorded at the office below.

This Waiver of Lien to Date meets all recording requirements specific to Peoria County.

Our Promise

The documents you receive here will meet, or exceed, the Peoria County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Peoria County Waiver of Lien to Date form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Deidre E.

November 18th, 2024

Best thing since sliced bread. Do your homework. Find the documents with Deeds.com and bypass expensive and unnecessary lawyers fees.

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

D. Jeffrey C.

June 10th, 2024

Generally I find the process works well, and the support personnel on the other end are usually fairly helpful.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Barbara J.

February 27th, 2020

I haven't actually used any forms yet, but I am very pleased with the simplicity of the website. I love the nmber and variety of forms offered. Thank you for such a great website,

Thank you!

Lori F.

January 20th, 2021

That was easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Mark S.

September 14th, 2022

Very easy site to navigate. The quit claim deed I downloaded was perfect for my needs. Would like to see a (Deed in Lieu of Foreclosure) added to the forms list.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Micael J.

August 28th, 2021

Easy to follow and fill out forms online.

Thank you for your feedback. We really appreciate it. Have a great day!

Laureen M.

November 5th, 2020

This service was extremely helpful. I truly appreciated the way I was communicated with every step of the way in getting my Deed recorded.

Thank you!

David S.

September 2nd, 2020

It was as I suspected. Very useful.

Thank you for your feedback. We really appreciate it. Have a great day!

William M.

May 30th, 2025

I found your service for deeds easy to use and I was able to quickly get the information (forms, example of forms filled out, and guide for filling out the form) down downloaded. I wish all government services and information was as easy to use as your's was. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARK K.

June 18th, 2020

This is a great service. I submitted the information and the next day my deed had been recorded. Online recording during these times is the most sensible way to record deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather W.

October 11th, 2019

Easy to use Example provided Clear instructions

Thank you for your feedback. We really appreciate it. Have a great day!

Jason B.

May 9th, 2019

Providing .doc versions would be much easier than trying to jam information into a non-editable PDF.

Thank you for your feedback. We really appreciate it. Have a great day!

Biinah B.

December 24th, 2020

Wished I had known about this site earlier. Just what we needed. Get tool to get lip to date legal help.

Thank you for your feedback. We really appreciate it. Have a great day!

Curley B.

January 6th, 2023

So far, I'm pleased. I am a first-time user, as most of my clients are in California. I look forward to working with you more in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

JENNIE W.

November 3rd, 2020

This is so much easier than going downtown to file paperwork! Thanks deeds.com!

Thank you!