Marshall County Affidavit of Surviving Spouse Form

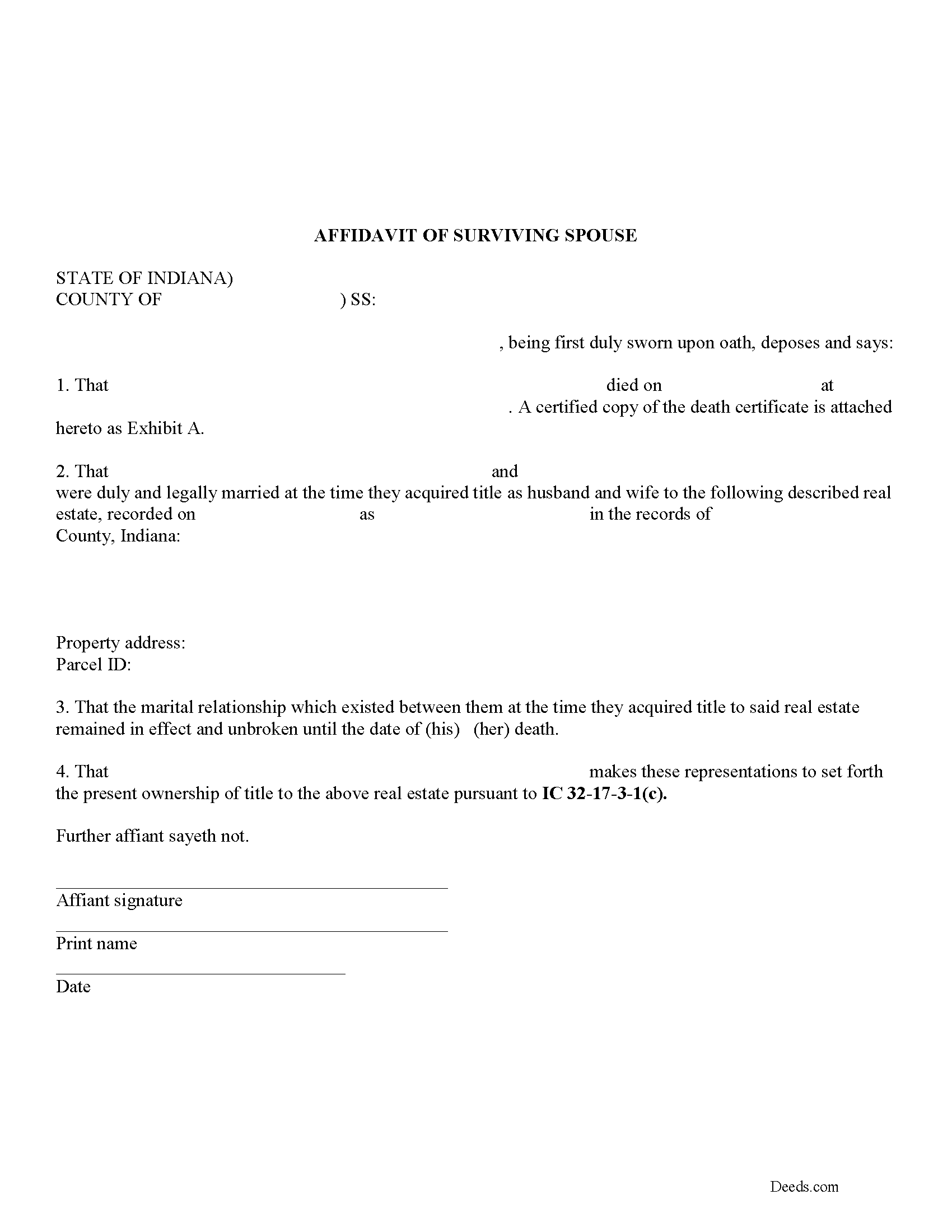

Marshall County Affidavit of Surviving Spouse Form

Fill in the blank form formatted to comply with all recording and content requirements.

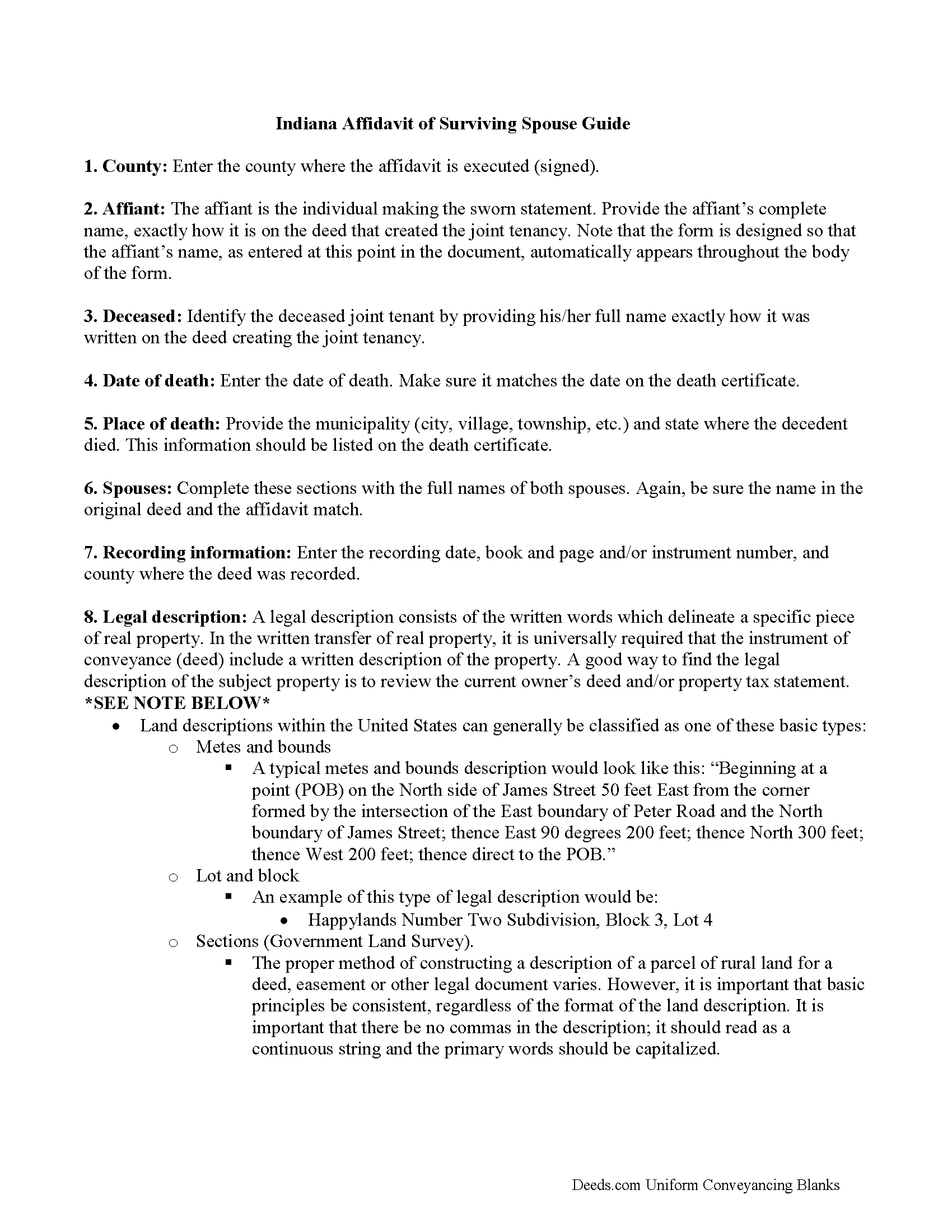

Marshall County Affidavit of Surviving Spouse Guide

Line by line guide explaining every blank on the form.

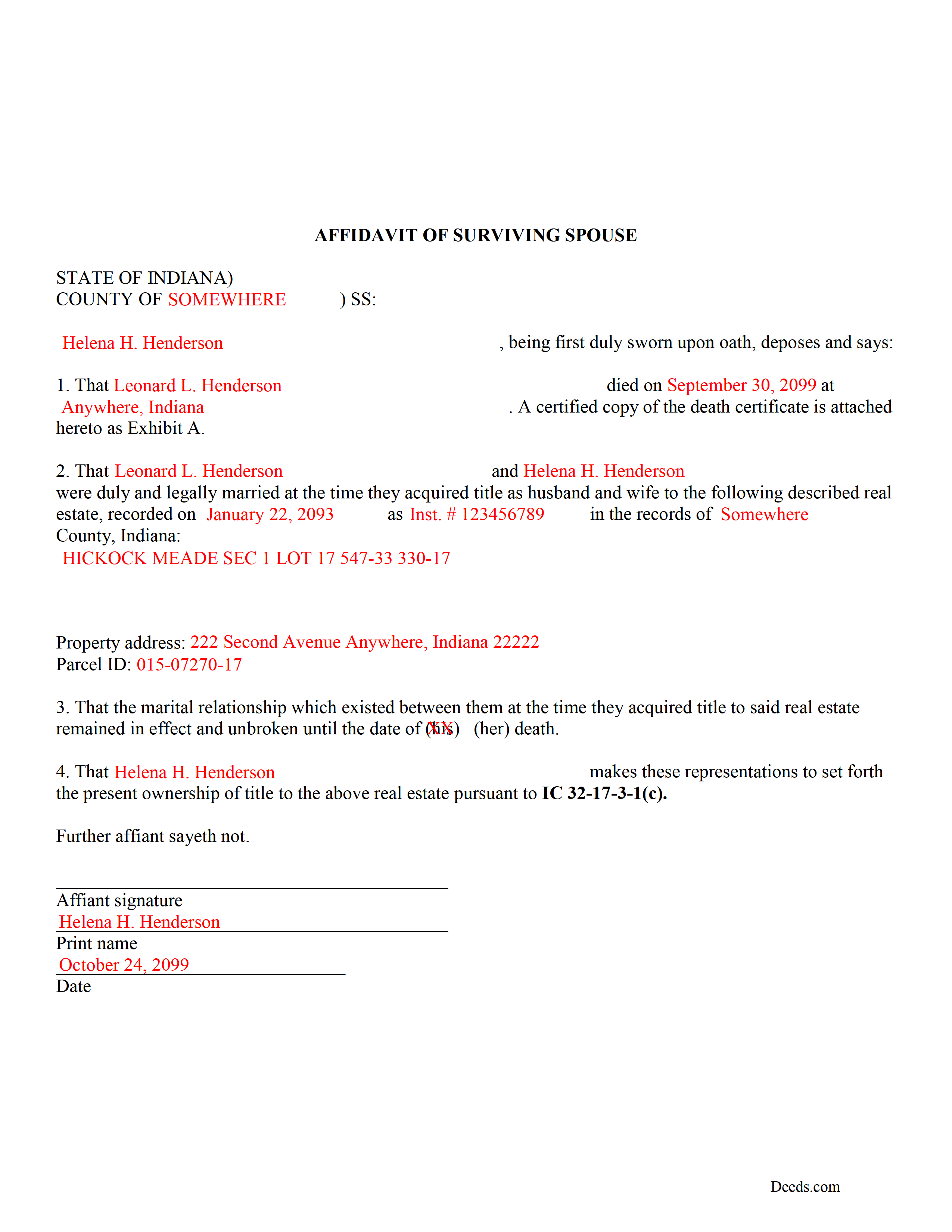

Marshall County Completed Example of the Affidavit of Surviving Spouse Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Recorder

Plymouth, Indiana 46563

Hours: Monday to Friday 8:00 - 4:00

Phone: (574) 935-8515

Recording Tips for Marshall County:

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Argos

- Bourbon

- Bremen

- Culver

- Donaldson

- Lapaz

- Plymouth

- Tippecanoe

- Tyner

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (574) 935-8515 for current fees.

Questions answered? Let's get started!

Married couples in Indiana may hold title to real estate as tenants by the entireties. This means that when one spouse dies, the other gains full ownership of the property by function of law, and without the need for probate. Use this instrument to formalize the acceptance of ownership rights conveyed when a spouse dies. Complete and sign the affidavit and submit it, along with a certified copy of the decedent's death certificate, to the recorder for the county where the real estate is located.

In order to gain full ownership, the husband or wife submits a completed affidavit of surviving spouse, along with an official copy of the death certificate of the deceased spouse, to the recorder for the county where the land is located.

This does not, however, remove the deceased's name from the deed. To accomplish that, the survivor must execute and record a new deed from the married couple to the remaining spouse only. After completing this final step, the public record and current deed will contain the most up-to-date information.

(Indiana Affidavit of Surviving Spouse Package includes form, guidelines, and completed example)

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Affidavit of Surviving Spouse meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Affidavit of Surviving Spouse form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Nathan M.

April 6th, 2020

It had the info, but when I would type into the document the items I needed in adobe all that would print out was the info I typed and none of the document information.

Thank you!

Pamela B.

November 23rd, 2019

Fantastic system, so easy to use even for a simpleton like me.

Thank you!

CINDY P.

July 30th, 2019

Such any easy process! Thank you!

Thank you Cindy, we appreciate your feedback.

Robin G.

July 3rd, 2020

Very responsive and helpful.

Thank you!

Janet J.

January 17th, 2020

The download process was quick and efficient. Here's hoping the printing process will be as easy. Appreciate this access to forms so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Wanda R.

January 22nd, 2019

Very satisfied with the ease of using your database. Excellent place to get help with deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry J.

May 20th, 2019

we are hoping this is what we need. Thanks

Thank you!

Ida L.

June 9th, 2020

The form was easy to complete and print. Best price found online.

Thank you!

Stephanie B.

May 28th, 2020

Really great, relevant and straight forward forms. Deeds.com is excellent and helps you avoid costly errors on documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Blaine G.

February 4th, 2022

Pretty good promissory note...but unable to delete some of the not needed stuff. Fill in blanks are fine but not all the template language is appropriate in my situation

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth K.

October 8th, 2019

It was fast and easy to use.

Thank you!

Kevin V.

January 5th, 2022

Quick and trouble free experience!

Thank you for your feedback. We really appreciate it. Have a great day!

Kermit S.

October 12th, 2020

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

James C.

October 20th, 2022

was very helpfull, It provided the refernces to the stat laws so I coul have a deeper look into the issue I was trying to deal with.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Miljana K.

January 20th, 2019

I was on several sites but this was the easiest and cost effective. No bait and switch like on several sites where you get a "free trial" and then they started billing you monthly for legal services. Excellent.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!