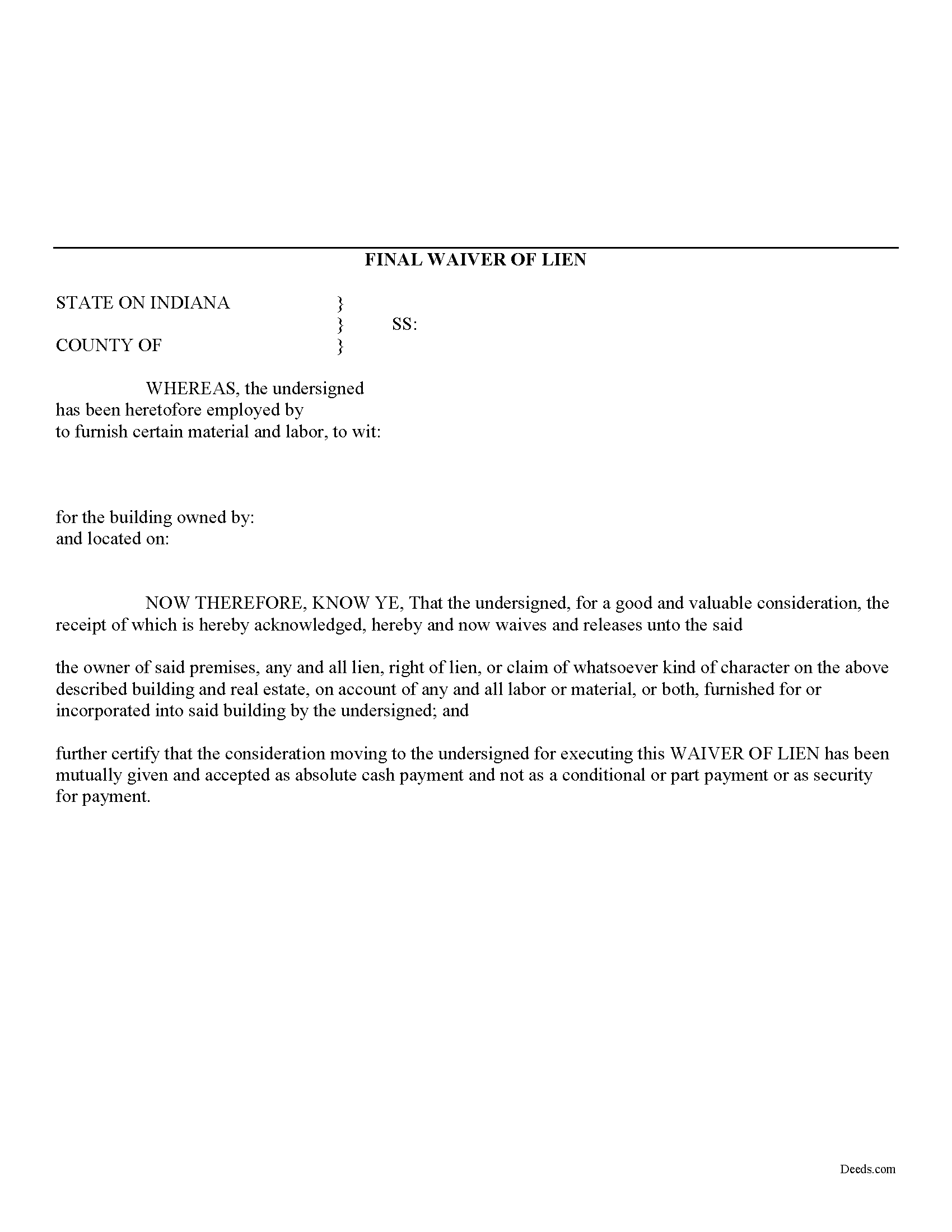

Marshall County Final Lien Waiver Form

Marshall County Final Lien Waiver Form

Fill in the blank Final Lien Waiver form formatted to comply with all Indiana recording and content requirements.

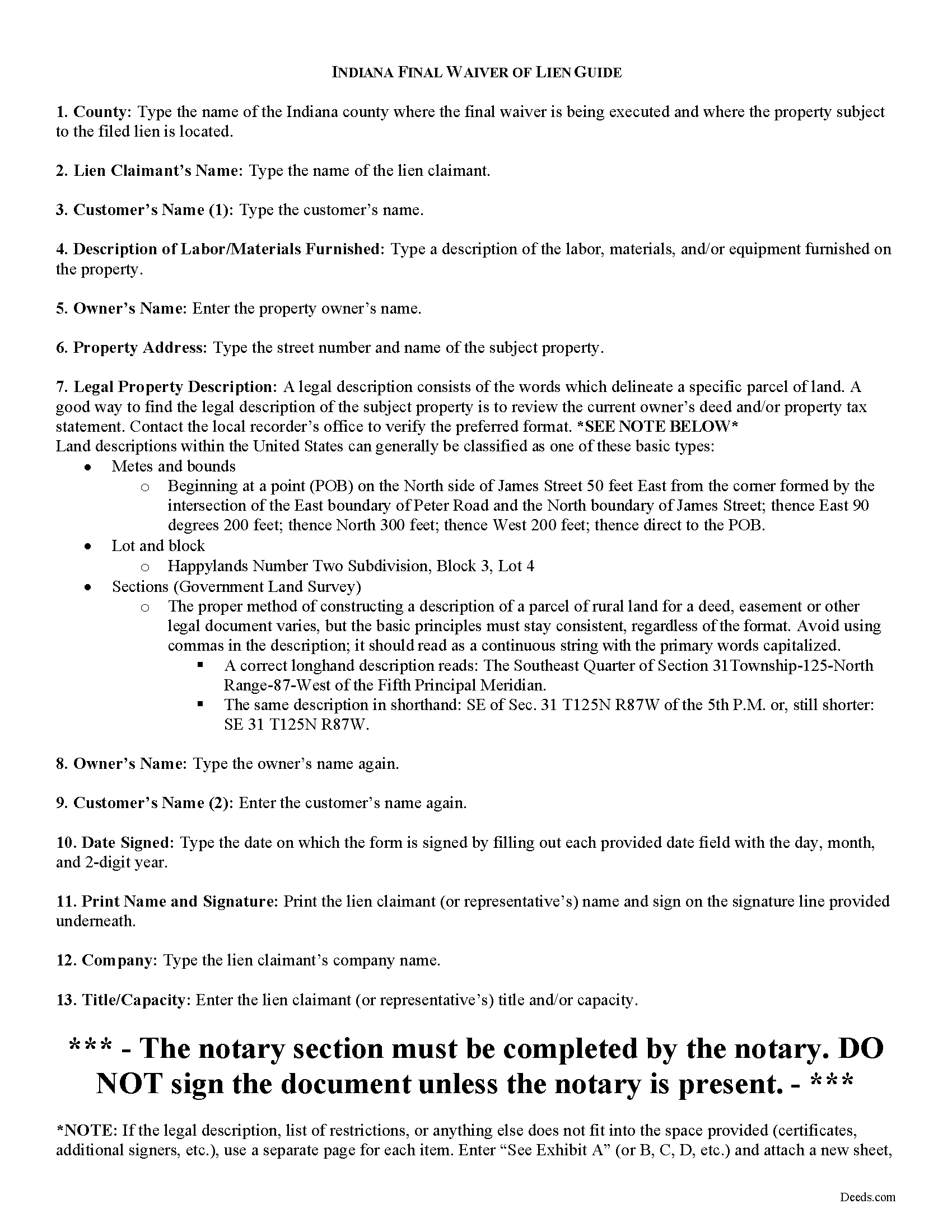

Marshall County Final Lien Waiver Guide

Line by line guide explaining every blank on the form.

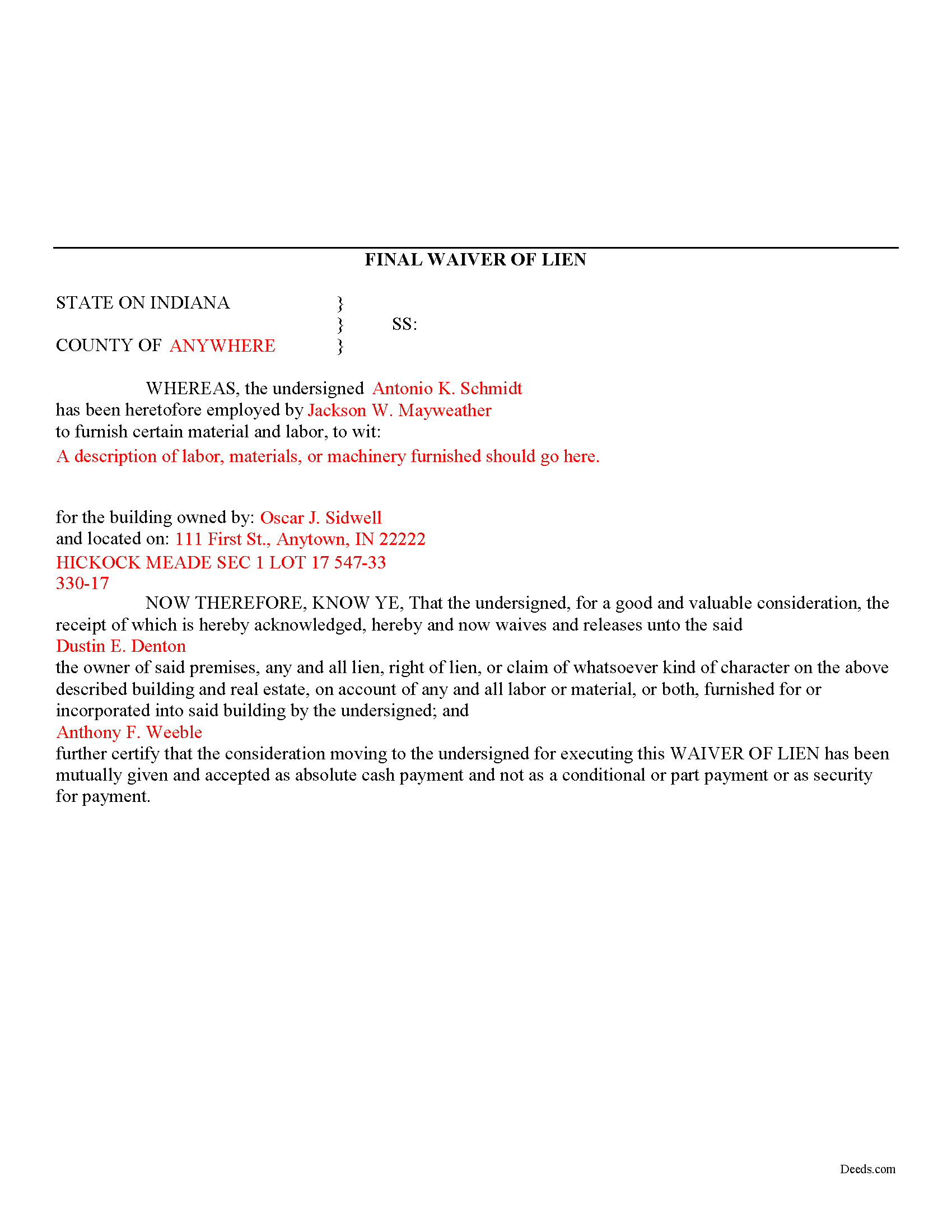

Marshall County Completed Example of the Final Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Recorder

Plymouth, Indiana 46563

Hours: Monday to Friday 8:00 - 4:00

Phone: (574) 935-8515

Recording Tips for Marshall County:

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Argos

- Bourbon

- Bremen

- Culver

- Donaldson

- Lapaz

- Plymouth

- Tippecanoe

- Tyner

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (574) 935-8515 for current fees.

Questions answered? Let's get started!

Mechanic's liens are governed under Title 32 of Indiana Code. A waiver is a knowing relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay. In Indiana, there are no statutory forms for waivers although according to the principles of contract law, the parties may agree to such modifications in writing.

Use the final waiver when a customer makes the final payment, meaning nothing is left due and owing after this payment. This waiver is conditioned upon the payment actually clearing and it will not be effective until that happens.

Waivers must identify the parties, the type of materials/services provided, the location of the job, and the claimant's notarized signature. Record the completed document in the land records for the county where the property is located.

This article is provided for information purposes only and should not be relied upon as a substitute for the advice from an attorney. Please speak with an Indiana attorney with questions about using a lien waiver, or any other issues related to mechanic's liens in Indiana.

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Final Lien Waiver meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Final Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Rosa Leticia A.

March 1st, 2022

Outstanding service, quick and efficient. Provides promptly updates of the process, highly recommended.

Thank you!

Arthur T.

September 9th, 2021

Thanks

Thank you!

Deborah B.

September 30th, 2021

I was skeptical after experiencing other websites. However not only did we get the form we needed for a fraction of the cost vs going to an attorney, the additional resources (guides and samples) made the completion of the Enhanced Life Quitclaim deed quite simple, quick, and painless. We were having difficulty getting my mom to agree to meeting with an attorney or even considering a Lady Bird deed. Deeds.com gave us the ability to move forward with necessary actions with family members walking my mom through the steps, explaining the process and giving her plenty of time to find the needed information. She became part of the process which made it easy for her at a time when decision making was hard. We did everything in the comfort of her own home. I can't think of a better experience or service and I would consider Deeds.com for future needs.

Thank you for the kinds words Deborah. We appreciate you taking the time to share your experience.

Karl L.

January 30th, 2025

Excellent Service Terrific Follow Up and Follow Throught

Your appreciative words mean the world to us. Thank you.

Virginia M.

August 26th, 2020

This was the easiest web page ive ever navigated .Found just what i needed fast !

Thank you!

Eileen C.

October 14th, 2020

Easy, fast, affordable. Satisfied customer

Thank you!

Debby R.

July 6th, 2021

Very easy to use

Thank you!

Sharon L H.

December 30th, 2018

The forms were good enough, hard to get excited about legal forms... The information was very thorough and helpful.

Thank you!

Alicia S.

August 17th, 2021

It's been a difficult time during my divorce. Glad I was able to get the house related documents easily here.

Thank you!

Susan G.

January 11th, 2025

Very easy to use!

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Joe W.

January 22nd, 2020

Effortless transaction and very thorough paperwork and explanations.

Thank you!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela R.

April 8th, 2022

Thank you for this excellent website. Obtaining appropriate forms was very easy. Thank you!

Thank you!

Kimberly F.

April 22nd, 2020

Ordered and received the quitclaim form. Exactly what I expected, perfect.

Thank you for your feedback. We really appreciate it. Have a great day!

Cheryl W.

August 10th, 2019

Have yet to use. Appears over whelming, we will see.

Thank you for your feedback. We really appreciate it. Have a great day!