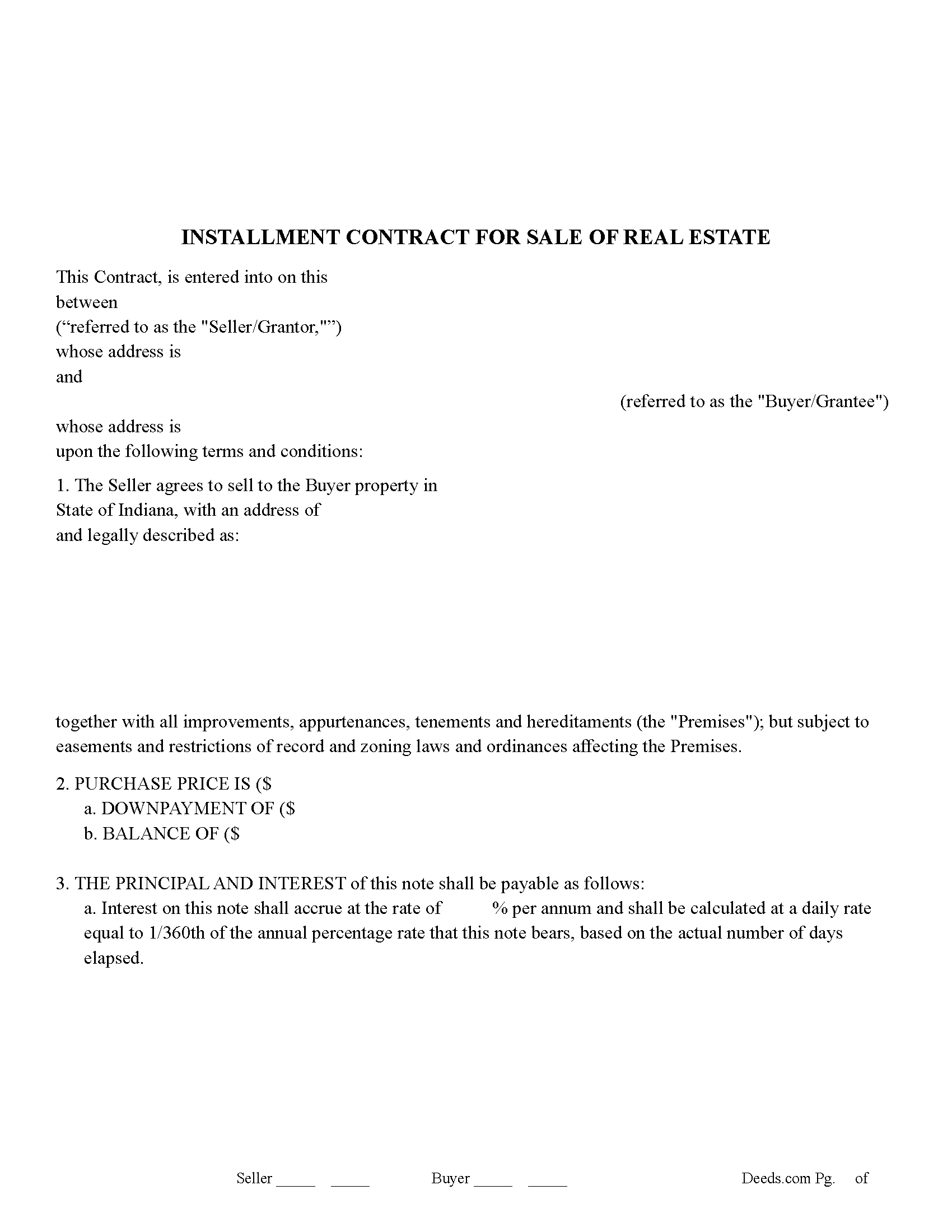

Elkhart County Installment Contract for Sale of Real Estate Form

Elkhart County Installment Contract for Sale of Real Estate Form

Fill in the blank Installment Contract for Sale of Real Estate form formatted to comply with all Indiana recording and content requirements.

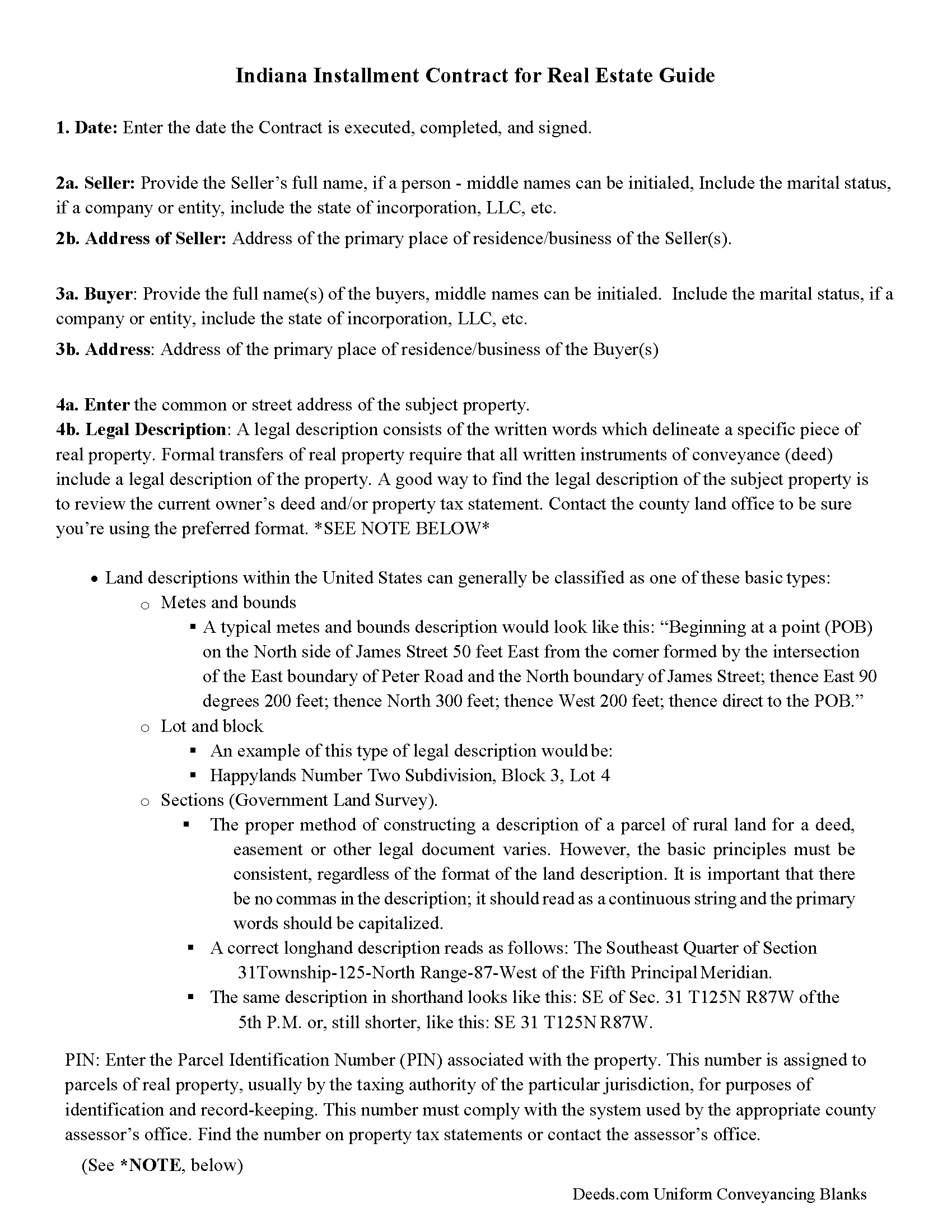

Elkhart County Installment Contract for Sale of Real Estate Guide

Line by line guide explaining every blank on the Installment Contract for Sale of Real Estate form.

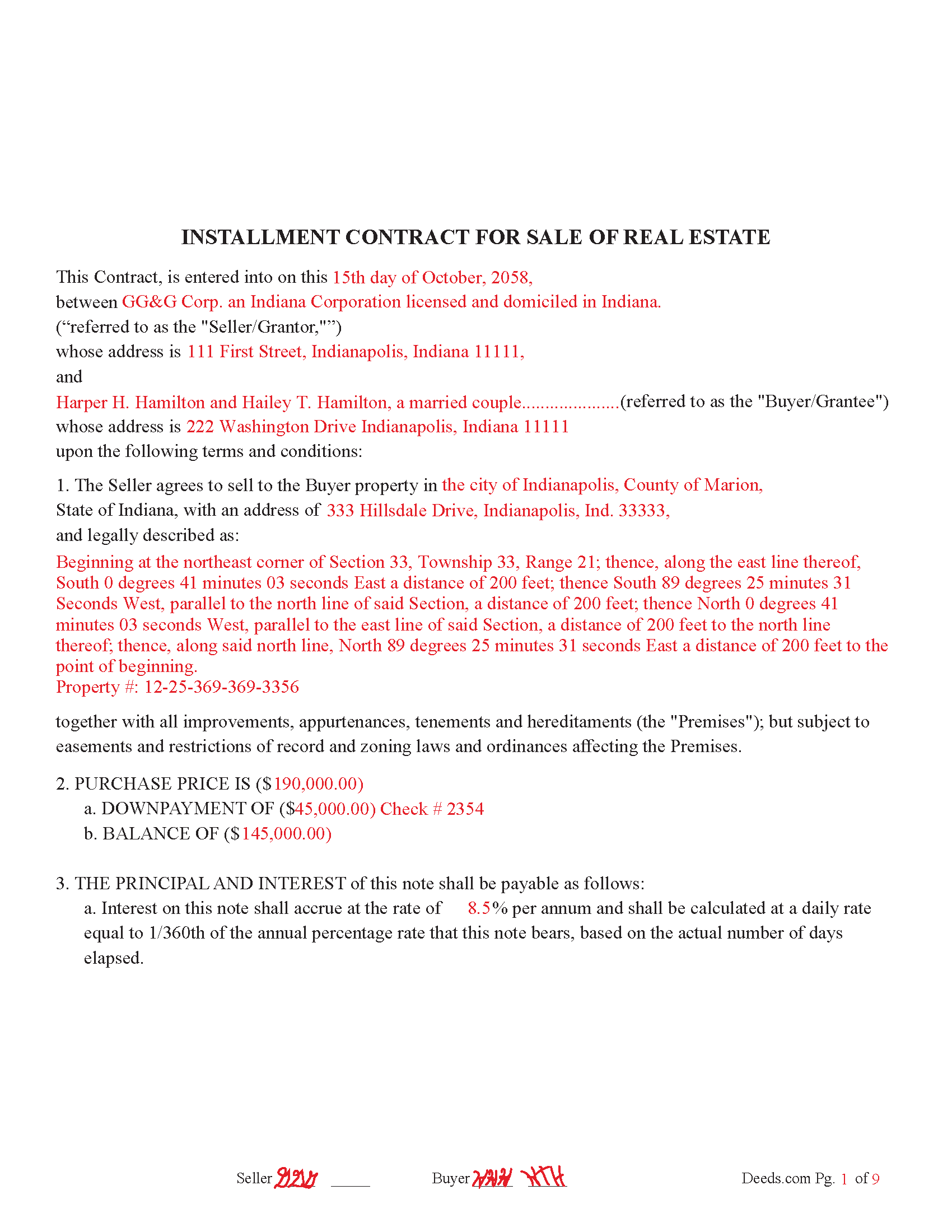

Elkhart County Completed Example of the Installment Contract for Sale of Real Estate Document

Example of a properly completed Indiana Installment Contract for Sale of Real Estate document for reference.

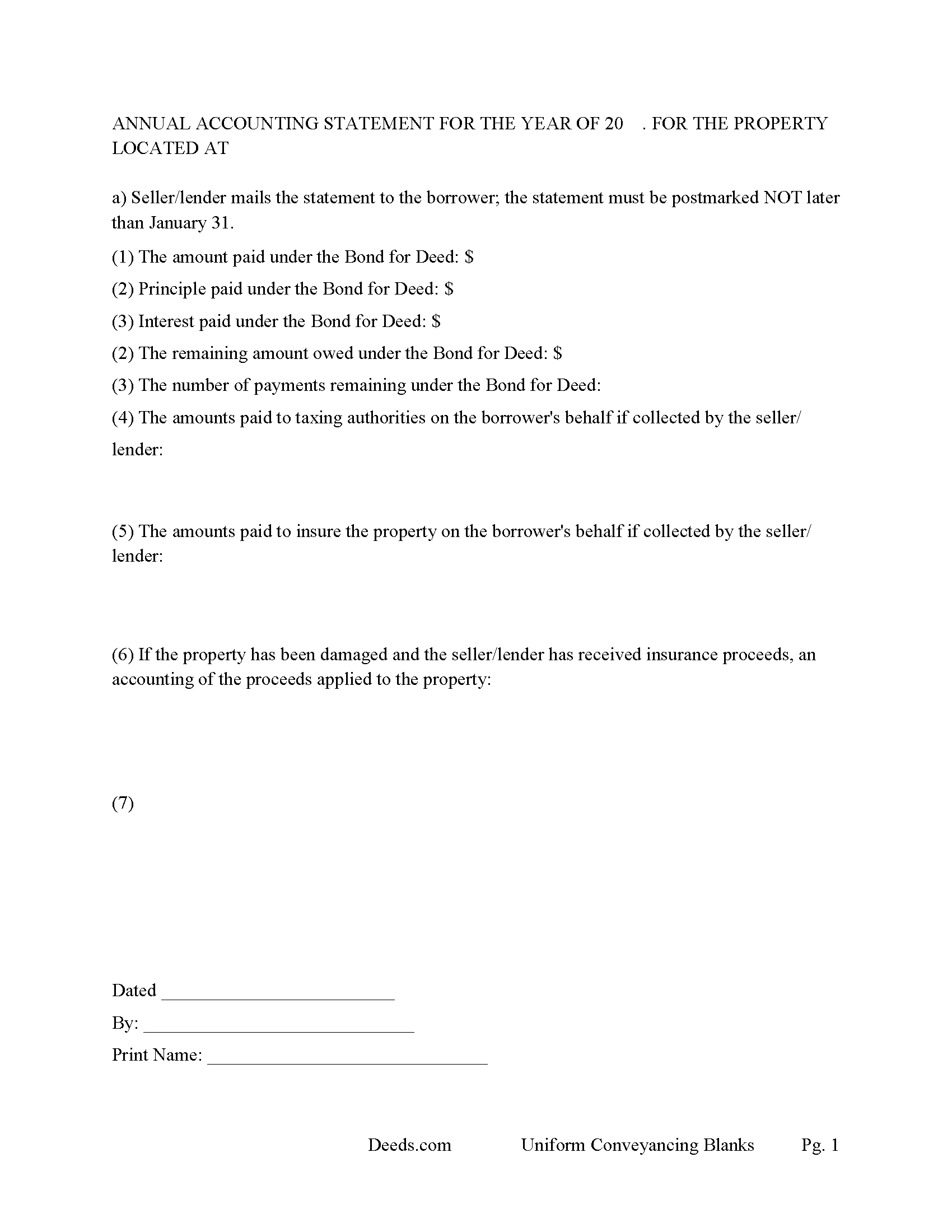

Elkhart County Annual Accounting Statement Form

Issue to Buyer(s) for fiscal year accounting reporting.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Elkhart County documents included at no extra charge:

Where to Record Your Documents

Elkhart County Recorder

Goshen, Indiana 46526

Hours: Mon 8:00 to 5:00; Tue-Fri 8:00 to 4:00

Phone: (574) 535-6756

Recording Tips for Elkhart County:

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Elkhart County

Properties in any of these areas use Elkhart County forms:

- Bristol

- Elkhart

- Goshen

- Middlebury

- Millersburg

- Nappanee

- New Paris

- Wakarusa

Hours, fees, requirements, and more for Elkhart County

How do I get my forms?

Forms are available for immediate download after payment. The Elkhart County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Elkhart County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Elkhart County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Elkhart County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Elkhart County?

Recording fees in Elkhart County vary. Contact the recorder's office at (574) 535-6756 for current fees.

Questions answered? Let's get started!

An "Installment Contract for Sale of Real Estate", also known as a Contract for Deed, Land Contract, or Contract for Sale) is a legal agreement/contract where the buyer makes payments directly to the seller in exchange for the right to use the property. The buyer receives the deed and full ownership of the property only after all payments have been made.

A land contract form can be used in Indiana when both the buyer and seller agree to an installment sale of real property, where the buyer makes payments directly to the seller over time, rather than obtaining a traditional mortgage from a bank. The seller retains the legal title to the property until the full purchase price is paid, at which point the title is transferred to the buyer. Here are some common scenarios where an INSTALLMENT CONTRACT FOR SALE OF REAL ESTATE might be used:

1. Buyer Lacks Access to Traditional Financing

Credit Challenges: The buyer may have difficulty qualifying for a traditional mortgage due to poor credit, insufficient credit history, or other financial issues.

Income Verification: The buyer may be self-employed or have income that is difficult to verify, making it harder to secure a conventional loan.

2. Seller Financing Preferences - Investment Strategy: The seller may prefer to finance the sale as an investment, earning interest over time instead of receiving the full purchase price upfront. Speed of Sale, a land contract can be an attractive option in a slow market, enabling the seller to reach a deal with a buyer who might not qualify for a traditional mortgage.

3. Flexible Terms - Custom Payment Arrangements: The buyer and seller can negotiate terms that suit their needs, such as the payment schedule, interest rate, down payment, and the duration of the contract. Possession Before Full Payment: The buyer can take possession of the property and start using it while making payments, even if they cannot pay the full purchase price upfront.

4. Buyer's Intent to Improve Property -Rehabilitation Projects: The buyer may intend to rehabilitate or improve the property before obtaining full financing. A land contract allows them to take possession and make improvements before completing the purchase.

5. Simplified Process - Reduced Costs: A land contract may reduce the costs associated with closing, as it often bypasses the need for a traditional lender and related fees.

Faster Execution: The process of negotiating and executing a land contract can be faster than obtaining a traditional mortgage.

6. Unique Property - Non-Conforming Properties: For properties that may not meet the standards required by traditional mortgage lenders (such as rural, unique, or non-conforming properties), a land contract can be a viable option.

7. Inter-Family Transactions - Family Agreements: A land contract can be useful in family transactions where a parent is selling a home to a child or another relative, offering a flexible payment arrangement that suits both parties.

Procedures for Using a Contract for Deed

1. Drafting the Contract:

The contract must include all essential terms: purchase price, payment schedule, interest rate, penalties for default, responsibilities for taxes and insurance, and the date when the deed will be transferred.

2. Indiana Code § 32-21-7 - Land Contracts

This statute outlines the requirements and procedures for recording land contracts. It requires that the contract be recorded in the recorder's office in the county where the property is located within 45 days after the contract is executed. The purpose of recording is to provide notice to third parties, thereby protecting the buyer's interest in the property.

Failure to record the contract can affect the enforceability of the buyer’s interest against third parties.

3. Payment and Maintenance:

The buyer makes monthly installment payments to the seller, who retains legal title until the contract is fully paid. (This contract allows for a Balloon payment). The buyer takes on responsibilities such as property taxes, insurance, and maintenance.

Terms and uses

1. TITLE AND TITLE INSURANCE. Seller shall provide Buyer with a standard form owner’s policy of title insurance in the amount of the purchase price. The title policy to be issued shall contain no exceptions other than those provided in said standard form plus encumbrances or defects approved by Buyer as provided below. As soon as reasonably possible after escrow is opened Buyer shall be furnished with a preliminary commitment. Said preliminary commitment shall include legible copies of all documents forming the basis for any special exception set forth. If Buyer chooses an extended owner’s policy, Buyer shall pay the difference in cost between the standard owner policy, and the extended owner’s policy.

2. DEED Of CONVEYANCE. Upon receipt of Buyer's payment in full of the balance of the purchase price, Seller shall furnish a General Warranty Deed, conveying to Buyer title to the property.

3. LATE CHARGE: Any above noted payment which is at least days past due, shall be subject to a late charge of $ And an additional $ per day until the payment is received. If any balloon payment is late, it shall be subject to a late fee of $ per day.

4. Uses include residential property, rental property up to 4 units, condominiums, and planned unit developments. Traditional installment payment with or without a balloon payment.

A contract for sale with stringent default terms can be beneficial to the seller.

Important: Your property must be located in Elkhart County to use these forms. Documents should be recorded at the office below.

This Installment Contract for Sale of Real Estate meets all recording requirements specific to Elkhart County.

Our Promise

The documents you receive here will meet, or exceed, the Elkhart County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Elkhart County Installment Contract for Sale of Real Estate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Cedric W.

January 2nd, 2021

This process was very easy to go through, from beginning to end. It was fast, precise and got the job done without me having to leave my computer. If opportunities arise, I will definitely use deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Cameron M.

June 6th, 2023

This service is amazing. Always same day recording. Quick and easy. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darrell W.

November 10th, 2021

Fast and easy to use. Nice to have available online.

Thank you for your feedback. We really appreciate it. Have a great day!

David M.

April 24th, 2019

Why is Dade County not listed for the Lady Bird Deed?

Because on November 13, 1997, voters changed the name of the county from Dade to Miami-Dade.

Lori F.

January 20th, 2021

That was easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia H.

October 15th, 2020

The process was so easy and result was excellent and expedient. I will definitely recommend your company for future recording needs.

Thank you!

Anabel H.

April 22nd, 2020

Everything went smoothly, quickly and efficiently.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

samantha b.

February 18th, 2019

excellent instructions and the examples made completing the forms so very simple. thanks so much.

Thank you Samantha.

JOHN M.

October 20th, 2019

THANKS FROM A 92 YEAR OLD LADY

Thank you!

Lisa m.

April 25th, 2020

Very fast and easy! Thanks!!

Glad we could help. Thank you!

ZENOBIA D.

November 11th, 2021

I Love Deeds.com. They have all of the documents you need to take care of your needs. IT is also safe and convenient way to send your documents safely and secure.

Thank you!

Shabaz W.

June 5th, 2020

Very convenient

Thank you!

Essence L.

September 19th, 2020

Ordered and filled out the quitclaim forms. Had no issues with preparing or recording, smooth process.

Thank you!

Miranda C.

August 16th, 2023

very expensive

Thank you for your continued trust and repeated purchases with us over the past year. We deeply value our loyal customers and understand the importance of providing value for your investment. Our pricing reflects the meticulous care, research, and expertise we put into each of our legal forms. However, we always strive to improve and genuinely value your feedback.

Sue D.

November 28th, 2019

Great program

Thank you!