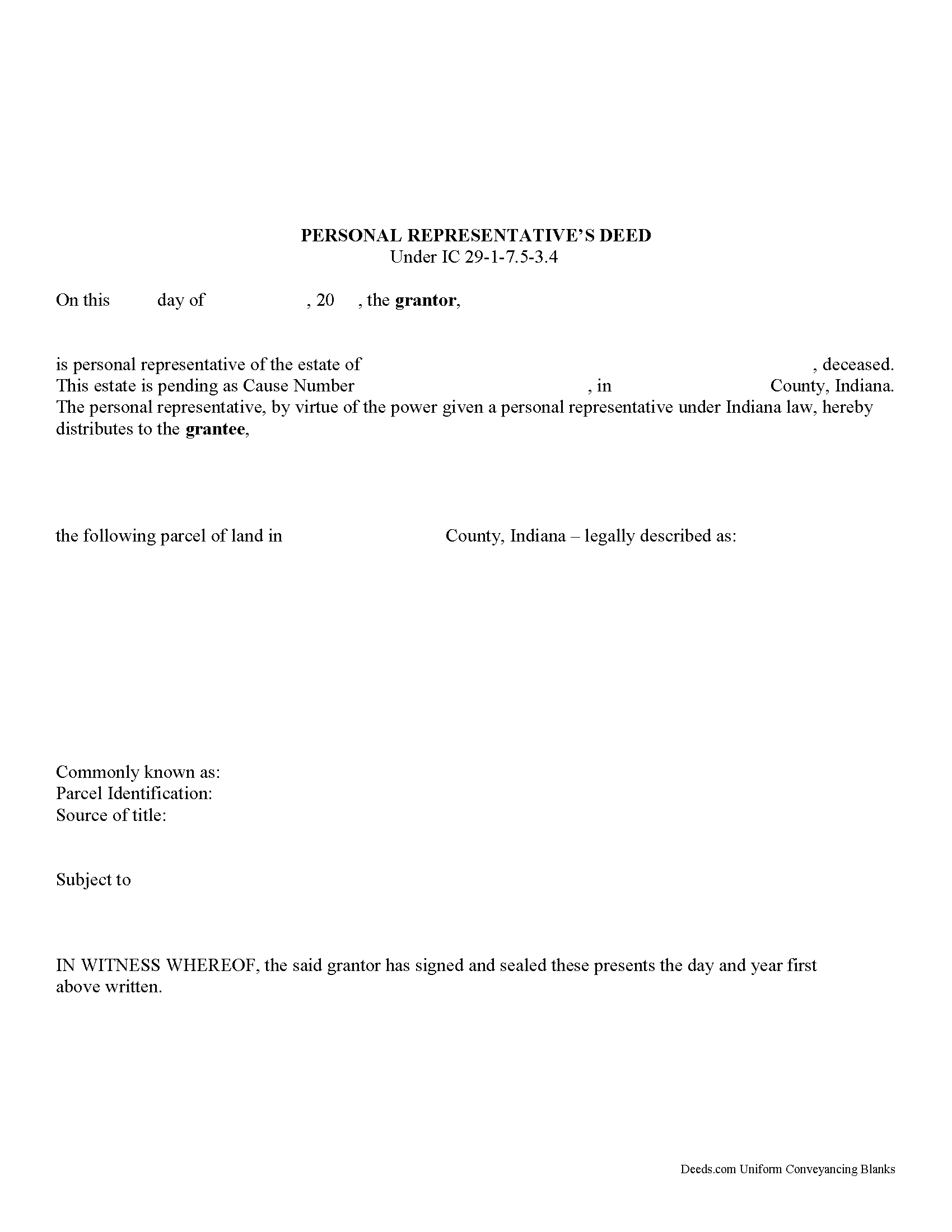

Harrison County Personal Representative Deed for Sale Form

Harrison County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

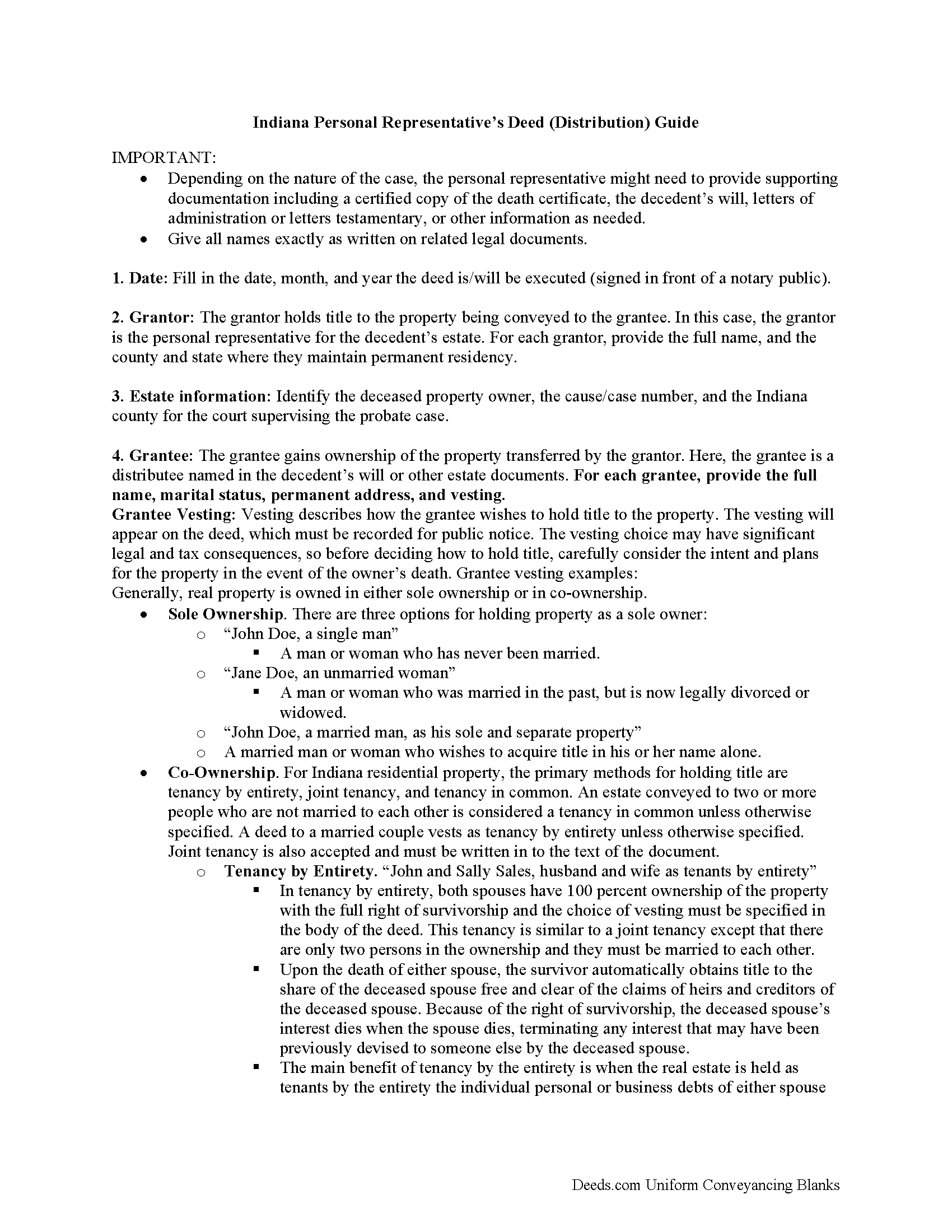

Harrison County Personal Representative Deed of Sale Guide

Line by line guide explaining every blank on the form.

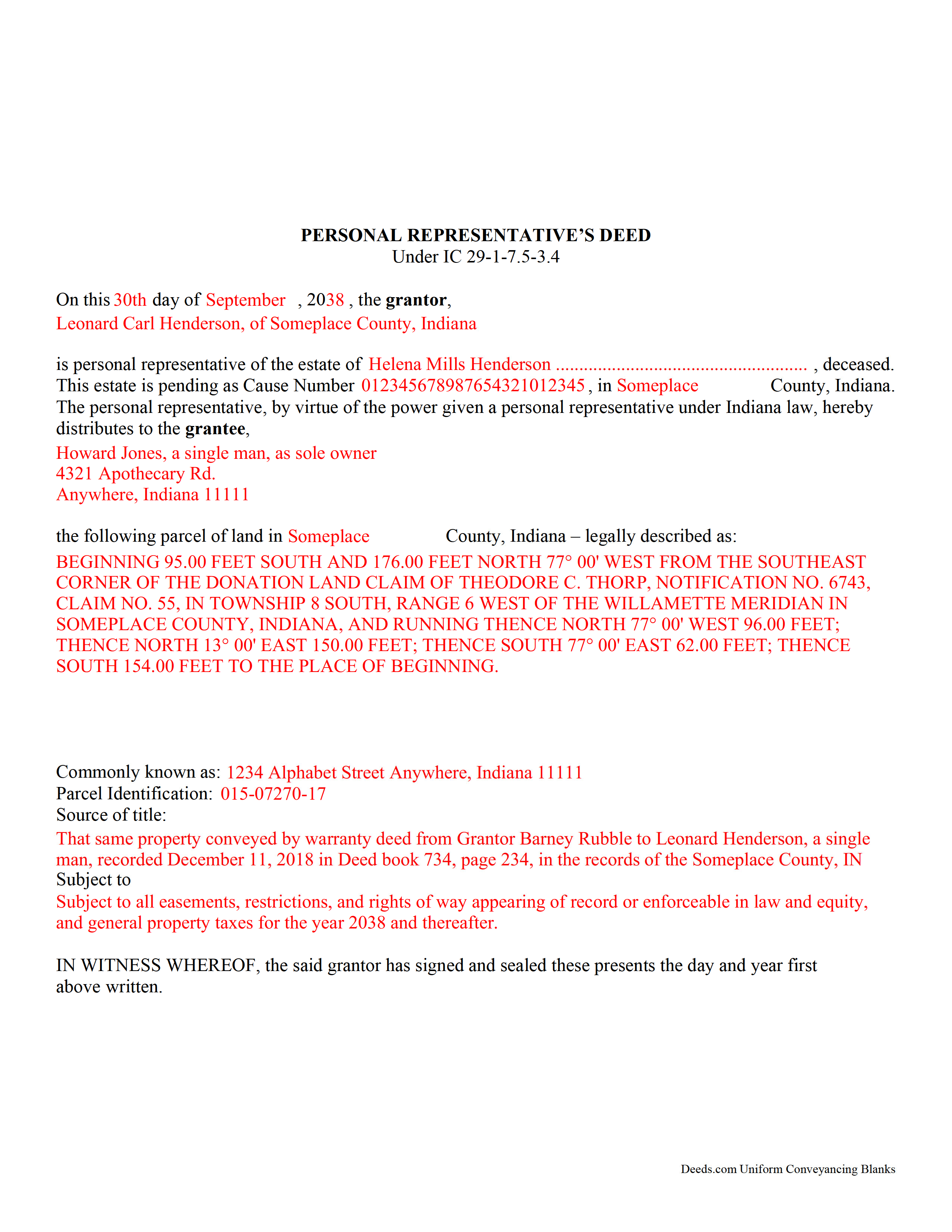

Harrison County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Harrison County documents included at no extra charge:

Where to Record Your Documents

Harrison County Recorder

Corydon, Indiana 47112

Hours: 8:00am - 4:30pm Monday - Friday

Phone: (812) 738-3788

Recording Tips for Harrison County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Harrison County

Properties in any of these areas use Harrison County forms:

- Bradford

- Central

- Corydon

- Crandall

- Depauw

- Elizabeth

- Laconia

- Lanesville

- Mauckport

- New Middletown

- New Salisbury

- Palmyra

- Ramsey

Hours, fees, requirements, and more for Harrison County

How do I get my forms?

Forms are available for immediate download after payment. The Harrison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harrison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harrison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harrison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harrison County?

Recording fees in Harrison County vary. Contact the recorder's office at (812) 738-3788 for current fees.

Questions answered? Let's get started!

Indiana Personal Representative's Deed for Conveyance

Authorized personal representatives can use this form when selling real property from a decedent's estate.

When we die, another person becomes responsible for managing the assets we leave behind. If we die testate (with a will), this person is called an executor. If we die intestate (without a will), or in other specific situations, the court supervising the probate estate appoints an administrator. Once the executor or administrator is in place, Indiana laws identify this individual as a "personal representative," or PR. See IC 29-1-1-3(23) for the list of titles included under this role.

The judge supervising the case gives confirmation of the personal representative's authority by issuing letters testamentary or letters of administration, as appropriate. Note that the PR must apply for the letters within five months of the decedent's death (IC 29-1-7-15.1(b)). Once in place, the PR gains access to the probate estate, defined as "property transferred at the death of a decedent under the decedent's will or under IC 29-1-2, in the case of a decedent dying intestate" IC 29-1-1-3(24).

One common task handled by the PR is transferring ownership of the decedent's real property. Indiana's statutes contain a form related to conveying this real estate (IC 29-1-7.5-3.6). In addition to the statutory requirement to provide relevant facts of the probate case, personal representative's deeds must meet all state and local standards for format and content.

Note that personal representative's deeds to not include warranties of title, so it makes sense for potential purchasers to consider a title search. This can reveal defects in the chain of title (ownership history), and may prevent potential issues in future transactions.

Depending on the circumstances, the PR might provide additional supporting documentation including a certified copy of the authorizing letter, death certificate, will, etc. Also, the transfer might require approval from the court or others with an interest in the estate or the property.

Navigating the complexities of a probate case can be overwhelming, but taking the time to ensure a valid transfer during active probate is much easier than trying to solve problems later on. Please contact an attorney or probate court officer with specific questions or for complex situations.

(Indiana Personal Representative Deed for Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Harrison County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed for Sale meets all recording requirements specific to Harrison County.

Our Promise

The documents you receive here will meet, or exceed, the Harrison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harrison County Personal Representative Deed for Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

GLENN B.

August 21st, 2023

Great affordable quick service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bill M.

March 10th, 2021

PROS: Quick communication. Completed the task expediently. CONS: Deciphering what was being referred to on the website when needing the proper classification wasn't clear. Had to delve through your unfamiliar territory. But managed. OVERALL: Got the job done swiftly and the end result was satisfactory. Will use again.

Thank you!

Linda K.

July 5th, 2019

This service was easy, quick, and to the point. It was a lifesaver! Downloaded quickly and without issues. I was able to fill out a soecifice form for my state and county, which saved me from making errors from a universal form.

Thank you for your feedback. We really appreciate it. Have a great day!

Joshua M.

March 15th, 2023

Fast service, very responsive. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shannon R.

January 10th, 2019

Good forms, served the purpose. would not hesitate to use again if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lance T. W.

August 23rd, 2019

All in all an easy, cost-effective approach to simple legal work.

Thank you for your feedback. We really appreciate it. Have a great day!

Cathy P.

March 18th, 2021

I purchased the La St. Tammany Parish Quit Claim Deed as a gift for a friend. Currently waiting on a lawyer to draft his second version of what a La Quit Claim should look like. I have downloaded this St. Tammany La packet for simplicity and double protection for my friend. So far, I really like what I see from Deeds.com, short and to the point. It's truly a breath of fresh air. Thank you so much. Layperson Cathy for a friend.

Thank you for your feedback. We really appreciate it. Have a great day!

Erlinda M.

August 14th, 2019

Very convenient & easy to use this website. Information was helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Jane E.

November 4th, 2020

The form was incompatible with my son's new computer. I do not have a printer. We did use your form to type a copy into "word" so he could print it.

Thank you!

Kimberly L.

June 27th, 2020

Great to have online resources! I will most definitely refer others! Best regards,

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MATTHEW R.

March 12th, 2021

Absolutely amazing throughout the whole process

Thank you!

Robert B.

June 28th, 2019

Fast and easy and Jefferson County Colorado excepted the forms.

Thank you!

DELORES D.

July 20th, 2022

SO EASY. love that there is an example to follow and instructions.

Thank you!

Carol F.

May 22nd, 2019

Instructions were easy to follow and it was reasonable

Thank you for your feedback. We really appreciate it. Have a great day!

Richard O.

June 2nd, 2020

Thank you for providing this service. It was quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!