Allen County Transfer on Death Deed Beneficiary Affidavit Form

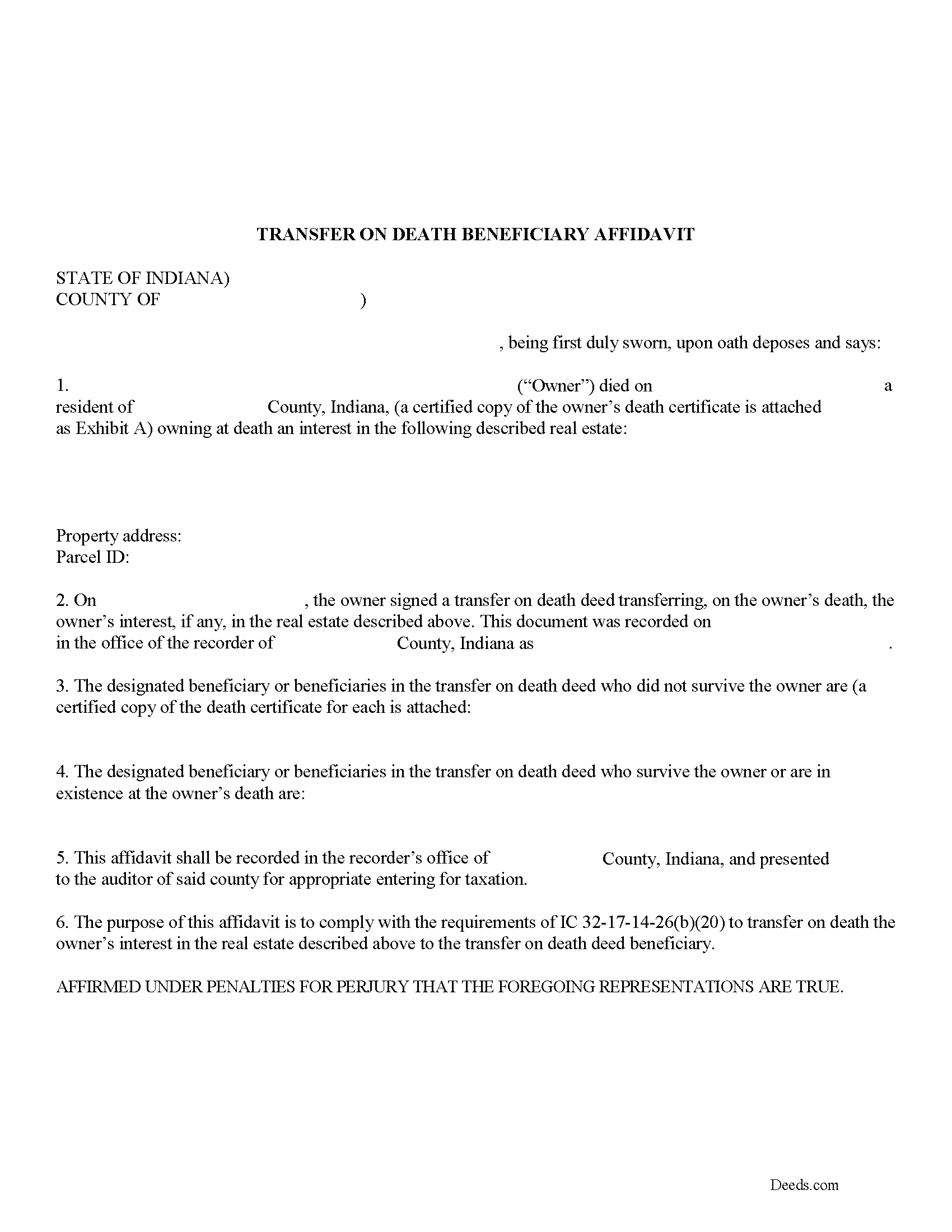

Allen County Transfer on Death Deed Beneficiary Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

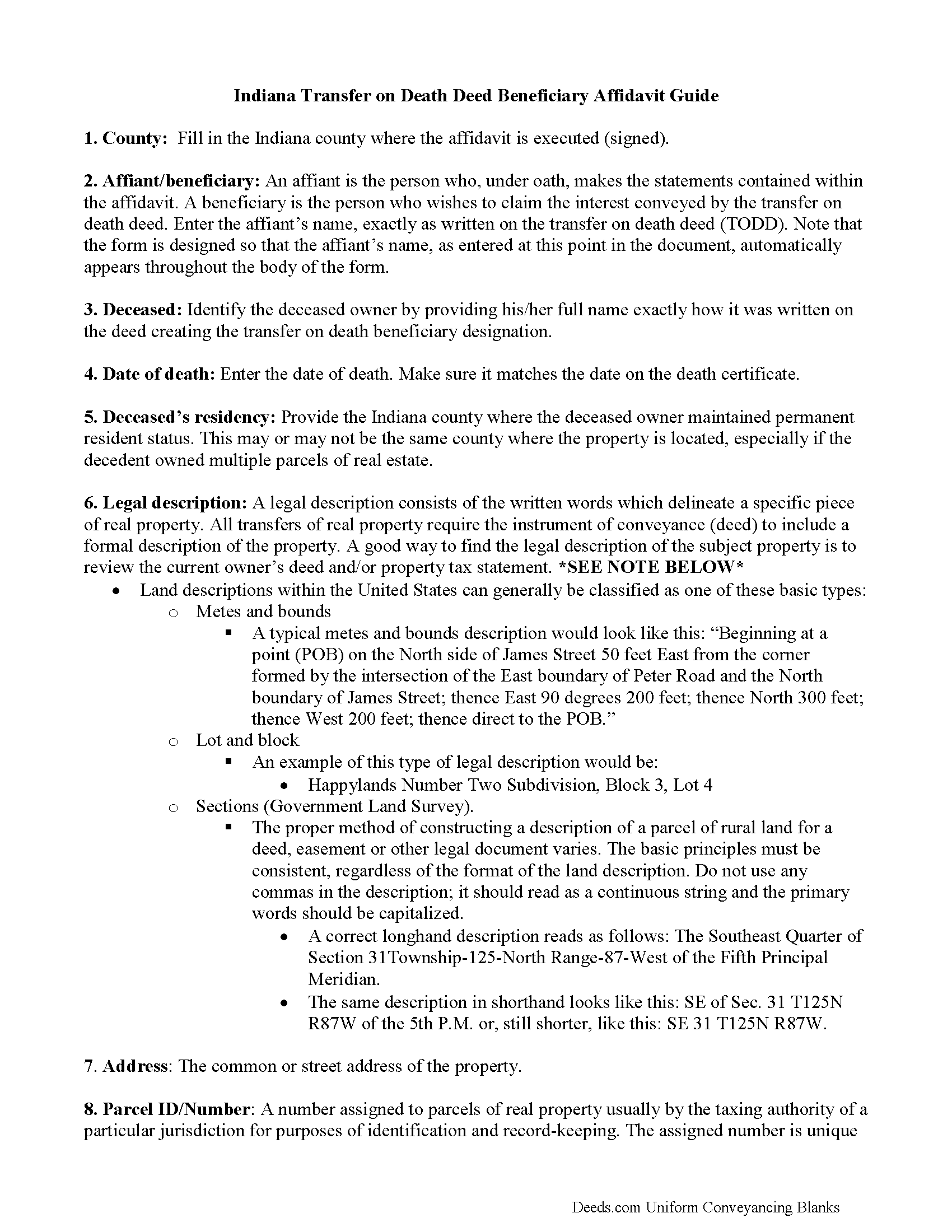

Allen County Transfer on Death Deed Beneficiary Affidavit Guide

Line by line guide explaining every blank on the form.

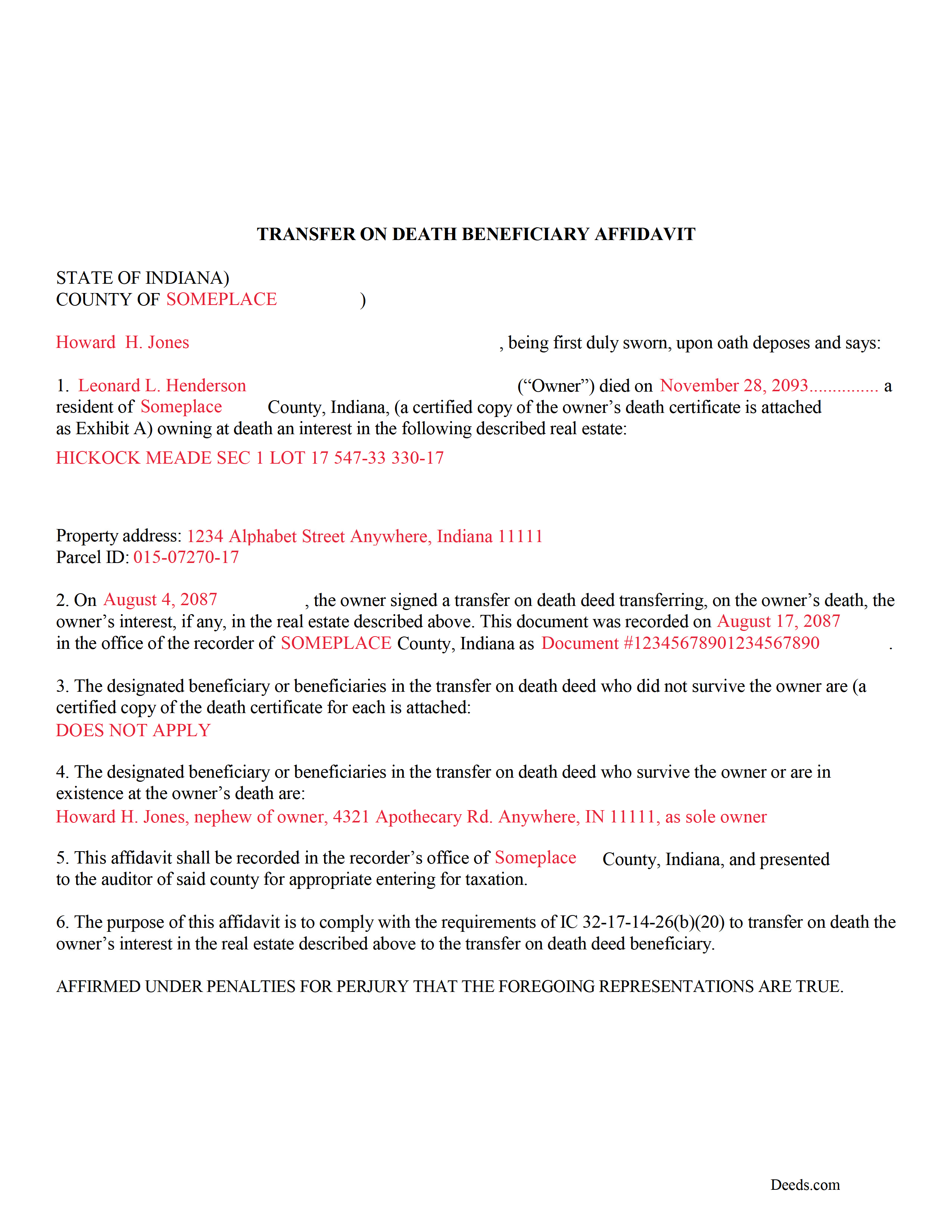

Allen County Completed Example of the Transfer on Death Deed Beneficiary Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Allen County documents included at no extra charge:

Where to Record Your Documents

Allen County Recorder's Office

Fort Wayne, Indiana 46802

Hours: 8:00am to 5:00pm M-F

Phone: (260) 449-7165

Recording Tips for Allen County:

- Double-check legal descriptions match your existing deed

- Ask about their eRecording option for future transactions

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Allen County

Properties in any of these areas use Allen County forms:

- Arcola

- Fort Wayne

- Grabill

- Harlan

- Hoagland

- Huntertown

- Leo

- Monroeville

- New Haven

- Spencerville

- Woodburn

- Yoder

- Zanesville

Hours, fees, requirements, and more for Allen County

How do I get my forms?

Forms are available for immediate download after payment. The Allen County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Allen County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Allen County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Allen County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Allen County?

Recording fees in Allen County vary. Contact the recorder's office at (260) 449-7165 for current fees.

Questions answered? Let's get started!

Indiana's transfer on death deeds are a useful way to convey ownership rights to property without the need for probate. The rules for claiming the property are defined in IC 32-17-14-26(b)(20). Primarily, the statute explains that the beneficiary must complete a transfer on death beneficiary affidavit containing specific details of the deed, present that affidavit to the local auditor to verify any transfer taxes, and then submit it to the county recorder who will enter it, and therefore the finalized conveyance, into the public record.

Beneficiaries listed on Indiana transfer on death deeds may use this form, which meets the statutory requirements, to claim ownership of the real property described in the deed.

(Indiana TOD Deed Beneficiary Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Allen County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Beneficiary Affidavit meets all recording requirements specific to Allen County.

Our Promise

The documents you receive here will meet, or exceed, the Allen County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Allen County Transfer on Death Deed Beneficiary Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Jamie B.

July 14th, 2020

Deeds.com made the recording of our Deed in a county where we do not reside, VERY easy! Customer service was great with all my questions answered immediately via my account portal. Very user friendly service! I wish the available documents were a little less pricey, but all in all, to get the job done right, I'll probably utilize the document downloads in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy B.

August 23rd, 2020

Deeds.com is a godsend! Being able to download the pertinent state and county specific forms reassured me of having the correct t forms in which to proceed. The cost was most reasonable. Thanks for this service.

Thank you!

Nancy R.

October 25th, 2024

Deeds.com is very precise, helpful and friendly. I found the form I needed without any effort and everything worked perfect and smooth. I recommend it 100%. Thank you.

We are delighted to have been of service. Thank you for the positive review!

JOHN M.

October 20th, 2019

THANKS FROM A 92 YEAR OLD LADY

Thank you!

Michael L. G.

October 1st, 2022

Thank you, Deed.com provided the needed forms to change county and state information after the passing of my father, saved me a trip to law office, especially after the lawyers would not return my calls, so I would recommend you check Deed.com for information, saved my family money for lawyer fees, would use Deed.com again. Mike

Thank you for your feedback. We really appreciate it. Have a great day!

Laura R.

August 13th, 2022

Afficavit worked kind of pricey

Thank you for your feedback. We really appreciate it. Have a great day!

Richard O.

February 18th, 2025

It has an easy-to-use interface and well-formatted, detailed forms. Consider adding AI agents to assist in completing these forms from data provided or available from public sources. Overall, I am very satisfied!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Guadalupe G.

November 10th, 2022

Easy but why charge???

Thank you!

EILEEN K.

March 17th, 2022

I received my product in great condition and it works ok. Thankyou!!!

Thank you!

Mary C.

August 30th, 2022

The Deeds.com site made is relatively simple to download a Beneficiary Deed form specific to St Louis, which is great, because neither the city or state provide this. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Mary Ann H.

May 13th, 2020

Great service! Good documents. Easy to use! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Petti V.

February 15th, 2022

Your site was so easy to use. And I got the form and instructions I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard O.

June 2nd, 2020

Thank you for providing this service. It was quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

Alice L.

October 21st, 2021

County accepted Quit Claim Deed without any issues! Saved money using Deeds.com - thank you!!!!

Thank you for your feedback. We really appreciate it. Have a great day!