Hamilton County Transfer on Death Deed Revocation Form

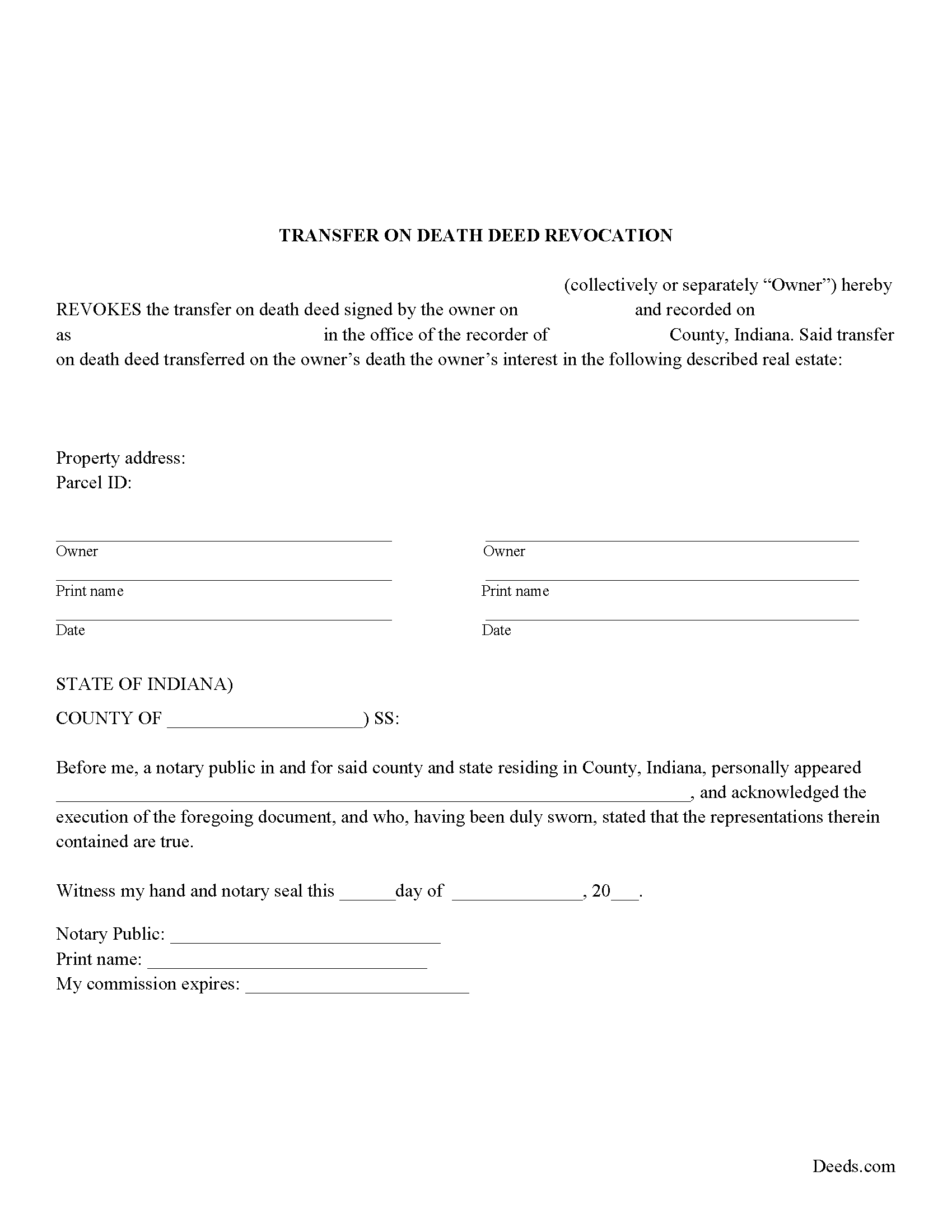

Hamilton County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

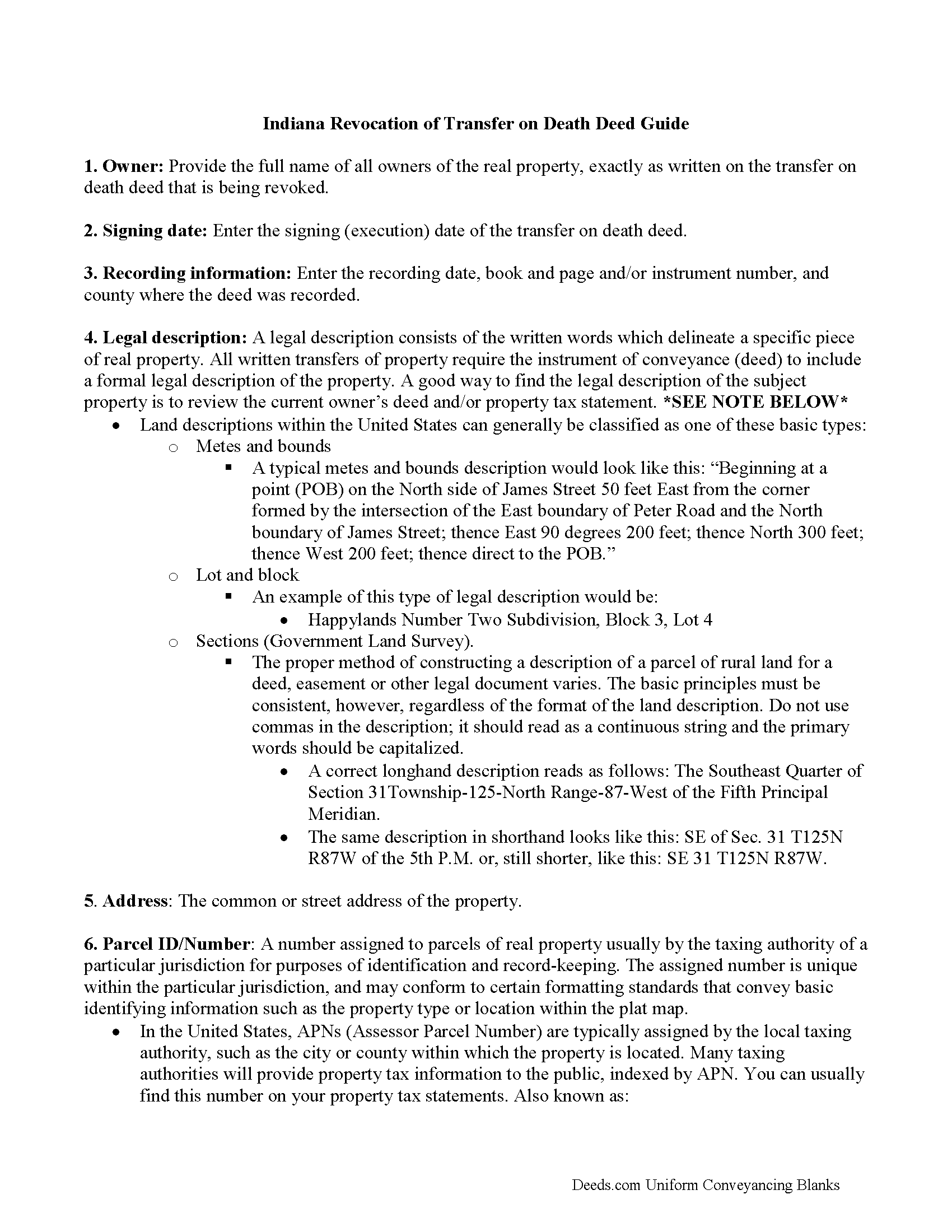

Hamilton County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

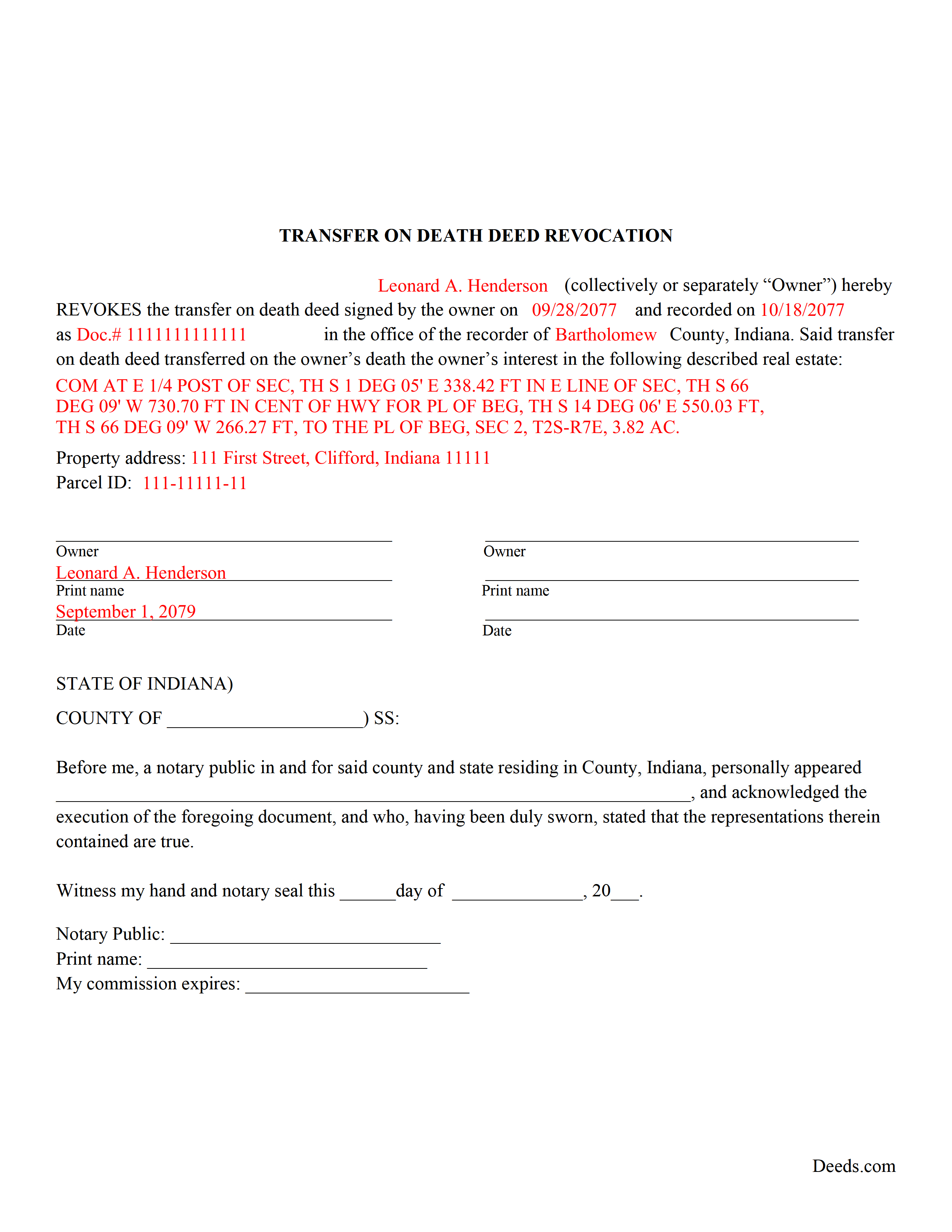

Hamilton County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Hamilton County documents included at no extra charge:

Where to Record Your Documents

Hamilton County Recorder

Noblesville, Indiana 46060

Hours: 8:00am to 4:30pm M-F / Recording deadline 4:15pm

Phone: (317) 776-9618

Recording Tips for Hamilton County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Hamilton County

Properties in any of these areas use Hamilton County forms:

- Arcadia

- Atlanta

- Carmel

- Cicero

- Fishers

- Indianapolis

- Noblesville

- Sheridan

- Westfield

Hours, fees, requirements, and more for Hamilton County

How do I get my forms?

Forms are available for immediate download after payment. The Hamilton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hamilton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hamilton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hamilton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hamilton County?

Recording fees in Hamilton County vary. Contact the recorder's office at (317) 776-9618 for current fees.

Questions answered? Let's get started!

Use this form when the land owner wishes to completely cancel a previously recorded transfer on death deed. A revocation of transfer on death deed allows the owner to formally revoke the future conveyance and enter that change in the public record.

According to IC 32-17-14-16, there are two primary ways to revoke a transfer on death deed in Indiana:

If the real estate owner (grantor) decides to change the beneficiary or modify the way in which beneficiaries will hold title to the property when the owner dies, he/she simply completes and records a new transfer on death deed with the updated information.

If the land owner wishes to completely cancel a previously recorded transfer on death deed, a revocation may be a better idea. A properly executed revocation of transfer on death deed allows the owner to formally revoke the future conveyance and enter that change in the public record.

(Indiana Transfer on Deed Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Hamilton County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Revocation meets all recording requirements specific to Hamilton County.

Our Promise

The documents you receive here will meet, or exceed, the Hamilton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hamilton County Transfer on Death Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Beverly D.

January 12th, 2021

Thank You, Job well done. So nice not to have to leave house and drive all over to record these documents. Very satisfied.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy K.

February 23rd, 2021

Your customer service is superb. I ordered the wrong form, and you were so quick to resolve my problem. I will be using your site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael W.

October 21st, 2022

Easy to use and fast

Thank you!

Susan J.

June 29th, 2020

very fast service. immediate response and kept me informed along the way. the county was not cooperating and this was communicated to me and my fee was refunded, just like that. will definitely use this company again

Thank you!

Gail W.

July 2nd, 2019

Easy to use!!

Thank you!

Jennifer A.

May 20th, 2020

Great site

Thank you!

Lajeanne F.

March 31st, 2019

Your service was as you promoted and I was able to get a copy of my deed and find the information on it I needed. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas M.

September 21st, 2020

EXCELLENT resource for ALL state documents! The forms come with explanations and examples. A real Deal!!!

Thank you!

Alison L.

February 16th, 2021

Wonderful and easy to use platform. I was using a more complicated platform that wouldn't load half the time. Makes for filing deeds in the pandemic quick and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacqueline C.

August 15th, 2019

Was relieved to see your site actually delivered what I paid for.

Thank you!

Prentis T.

September 9th, 2019

So far so good

Thank you for your feedback. We really appreciate it. Have a great day!

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Nicole P.

February 13th, 2021

The forms are great. I kinda expected the guide to be bigger, maybe have some more information. Overall I'm satisfied thus far.

Thank you!

Janice U.

July 26th, 2019

So far everything is going really well. Thank you!

Thank you!

Kathryn C.

January 2nd, 2020

I truly appreciate you and you service for all you do to help me ThankYou kathrynchertock

Thank you for your feedback. We really appreciate it. Have a great day!