Elkhart County Trustee Deed without Warranty Form

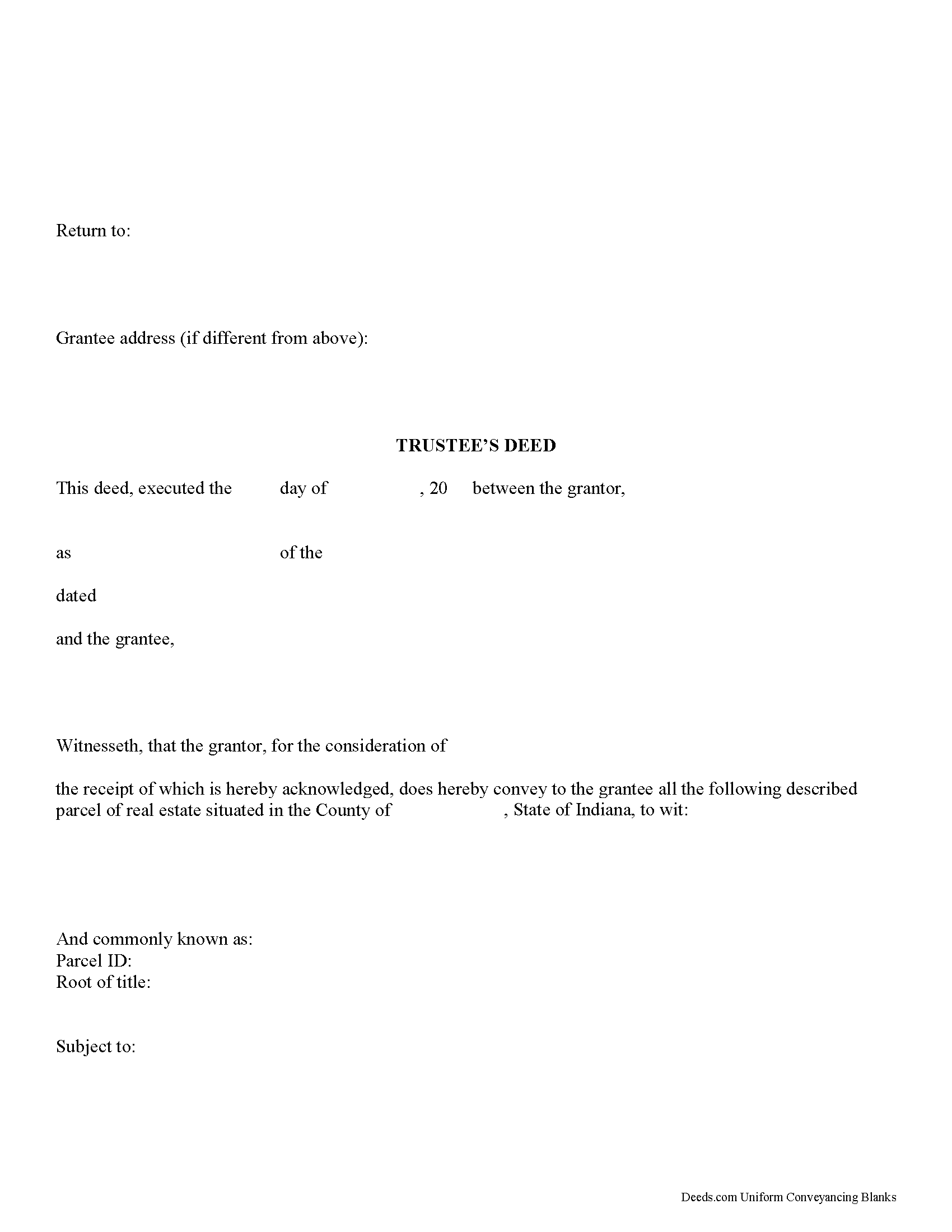

Elkhart County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

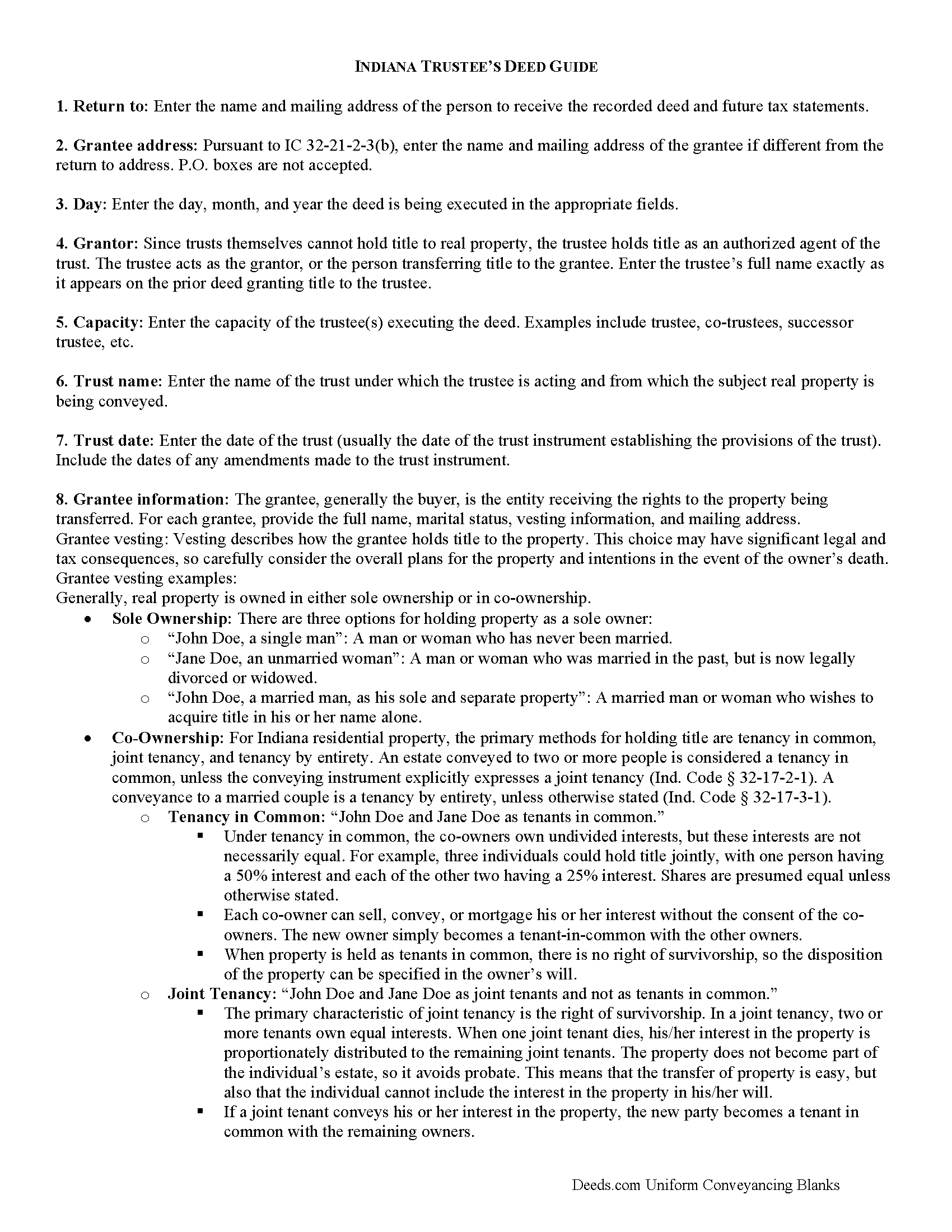

Elkhart County Trustee Deed Guide

Line by line guide explaining every blank on the form.

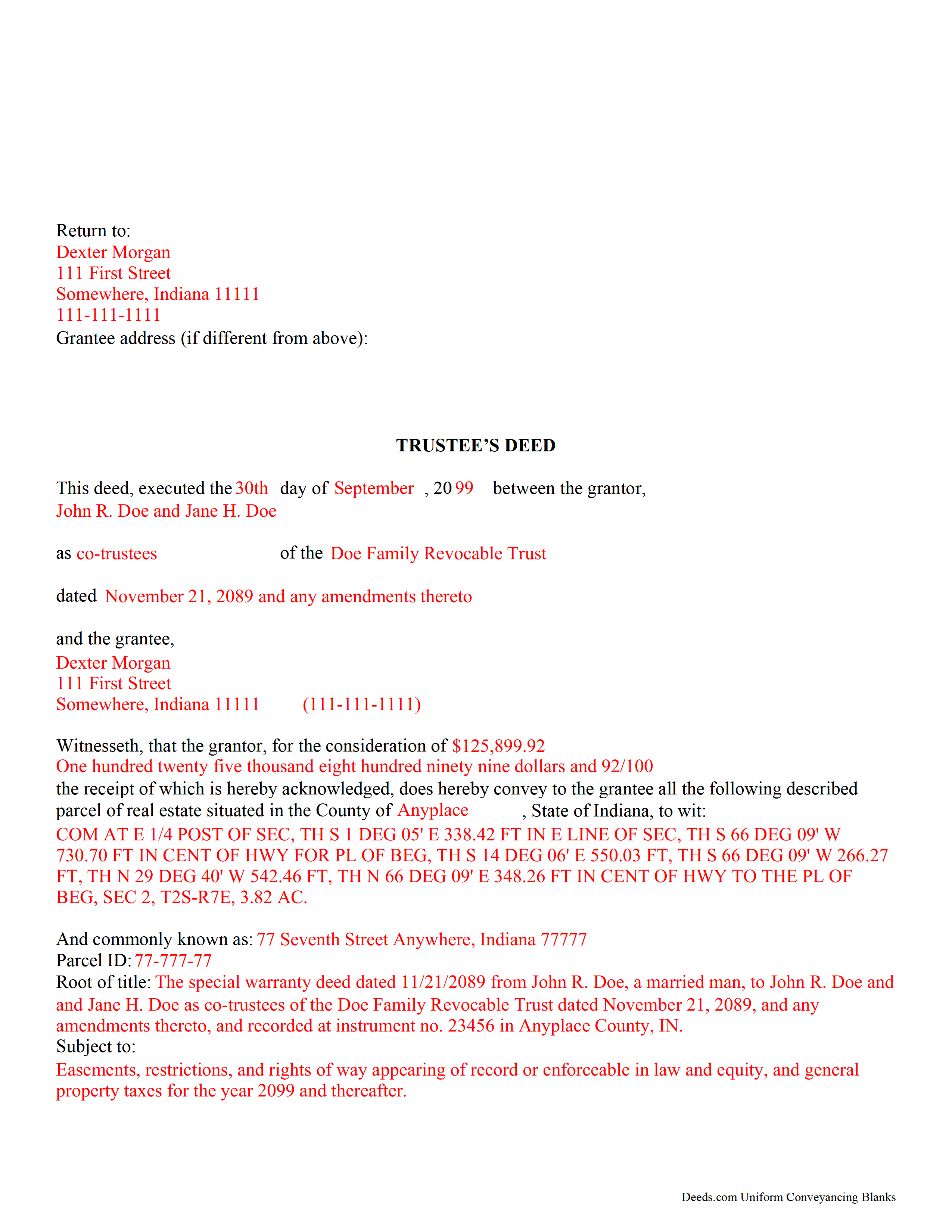

Elkhart County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Elkhart County documents included at no extra charge:

Where to Record Your Documents

Elkhart County Recorder

Goshen, Indiana 46526

Hours: Mon 8:00 to 5:00; Tue-Fri 8:00 to 4:00

Phone: (574) 535-6756

Recording Tips for Elkhart County:

- Ask if they accept credit cards - many offices are cash/check only

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Elkhart County

Properties in any of these areas use Elkhart County forms:

- Bristol

- Elkhart

- Goshen

- Middlebury

- Millersburg

- Nappanee

- New Paris

- Wakarusa

Hours, fees, requirements, and more for Elkhart County

How do I get my forms?

Forms are available for immediate download after payment. The Elkhart County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Elkhart County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Elkhart County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Elkhart County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Elkhart County?

Recording fees in Elkhart County vary. Contact the recorder's office at (574) 535-6756 for current fees.

Questions answered? Let's get started!

Use this form to transfer real property located in Indiana out of trust, without warranties of title. The deed should be executed by the trust's acting trustee(s).

A trustee's deed is an instrument used in trust administration to convey real property out of a trust. Unlike other forms of conveyance, which are named for the type of warranties they carry, the trustee's deed is named after the executing trustee.

The trustee is the administrator of a trust who is appointed by the settlor. The settlor is the person who funds the trust with assets -- in this case, real property. The settlor executes a trust instrument, which contains the provisions of the trust, including a designation of the trust's beneficiaries. This document is generally not of public record.

The trustee serves as the grantor in the trustee's deed. If there are multiple trustees or the trustee appears as a successor, this information is included also. The settlor does not enter directly into the transaction . In addition, the deed states the trust name and date under which the trustee is appearing, as well as any amendments made to the trust instrument.

All instruments of conveyance in Indiana require a legal description of the property begin conveyed, the grantee's information, and the root of title, as well as a "prepared by" statement and affirmation statement regarding the redaction of Social Security Numbers. All acting trustees must sign the deed in the presence of a notary public before the deed is recorded in the county in which the real property is situated.

Because trustees act in a fiduciary capacity, they may be asked to provide a certification of trust, demonstrating that the trust exists and their authority to enter into transactions on behalf of the trust.

The trustee's deed may require additional information depending on the situation. These instruments may or may not include warranties of title, so make sure to use the correct form for the situation. Consult a lawyer with specific questions or guidance in preparing a trustee's deed.

(Indiana Trustee Deed without Warranty Package includes form, guidelines, and completed example)

Important: Your property must be located in Elkhart County to use these forms. Documents should be recorded at the office below.

This Trustee Deed without Warranty meets all recording requirements specific to Elkhart County.

Our Promise

The documents you receive here will meet, or exceed, the Elkhart County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Elkhart County Trustee Deed without Warranty form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Josephine A.

June 9th, 2020

Being a first timer, I was hesitant at first to use the service. I was genuinely surprised at how easy it is to set up an account, upload my document, and pay the invoice. The next day I downloaded my document duly recorded. Good work, guys!

Thank you for your feedback. We really appreciate it. Have a great day!

Don M.

February 17th, 2023

The process was easy going. The process is one thing, the results another. I have attempting to resolve this matter, of claiming sole ownership of the property for several YEARS. I lost my Bride of 65 years in 2015. A lawyer I hired failed in his attempt, so I'm waiting to see the actual results. I also have two parcels in New Mexico under the same situation, so if this is successful, I'll gladly be back. Thank You so very much. Don Martin

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

nannette b.

October 27th, 2019

got what I needed quick and easy thank you!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Francisco C.

January 25th, 2023

well first time my company is using and this what can say. excellent service im very happy, you guys did my job very professional and quickly so congratulations... i will recommend to every one.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Clifford J.

July 4th, 2022

a lil pricey but i was able to knock out what needed to be done within 2 hours and not all day.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen Z.

April 22nd, 2019

Very simple. By creating the deed and filing it myself, I am saving a legal fee of $300!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hilary C.

October 9th, 2020

Within 10 minutes I had my Deed!!! Fantastic!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Marion Paul W.

January 31st, 2019

Quick service .Easy download.I ordered Quit Claim and should have ordered warranty deed. I will make it work

Thank you!

Robert A.

June 9th, 2021

First timer with Deeds.com - excellent experience. I am a lawyer and do not record often. Did not have to pay membership- fast and easy upload of documents- fast response - fast recording time from county recorder- very legible documents- very reasonable price. I give 6 stars out of 5!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrew B.

January 3rd, 2022

Very easy to use and I appreciate the fees being charged after the submission.

Thank you!

Norma J H.

April 27th, 2022

Your forms have been very helpful. I thank you very much for making them easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Sylvia H.

December 22nd, 2023

Deeds.com really made the process of completing and submitting the Lien application easy. Thank you, and I will be using you whenever I need a real estate document that you carry.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen M.

May 6th, 2019

This was a very easy and organized system to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Joe F.

January 11th, 2021

TOOK ME SEVERAL DAYS TO FIND A SITE THAT DIDNT CHARGE $100 JUST TO USE ONE FORM. THANKS

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn L.

September 3rd, 2020

Good!!

Thank you!