Jefferson County Trustee Deed without Warranty Form

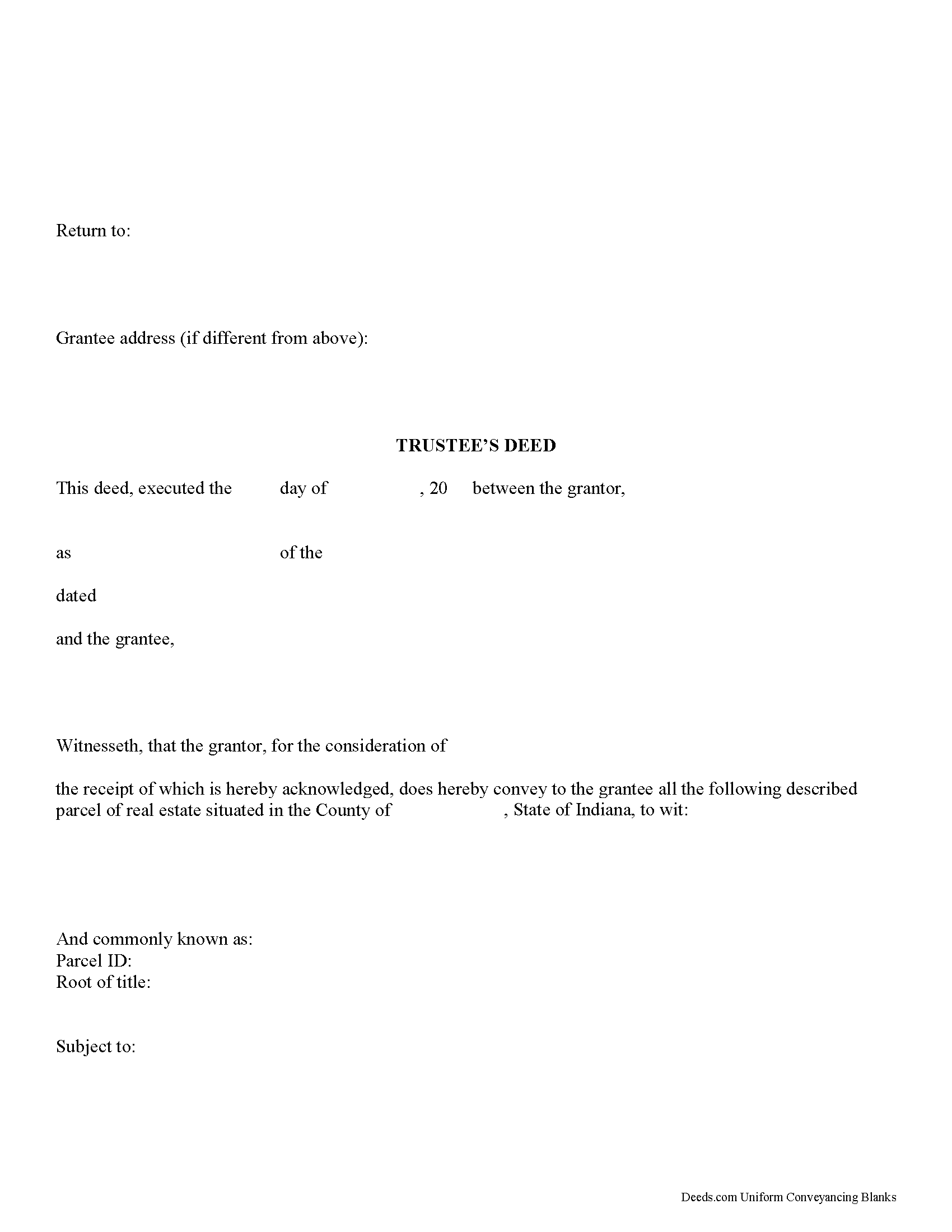

Jefferson County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

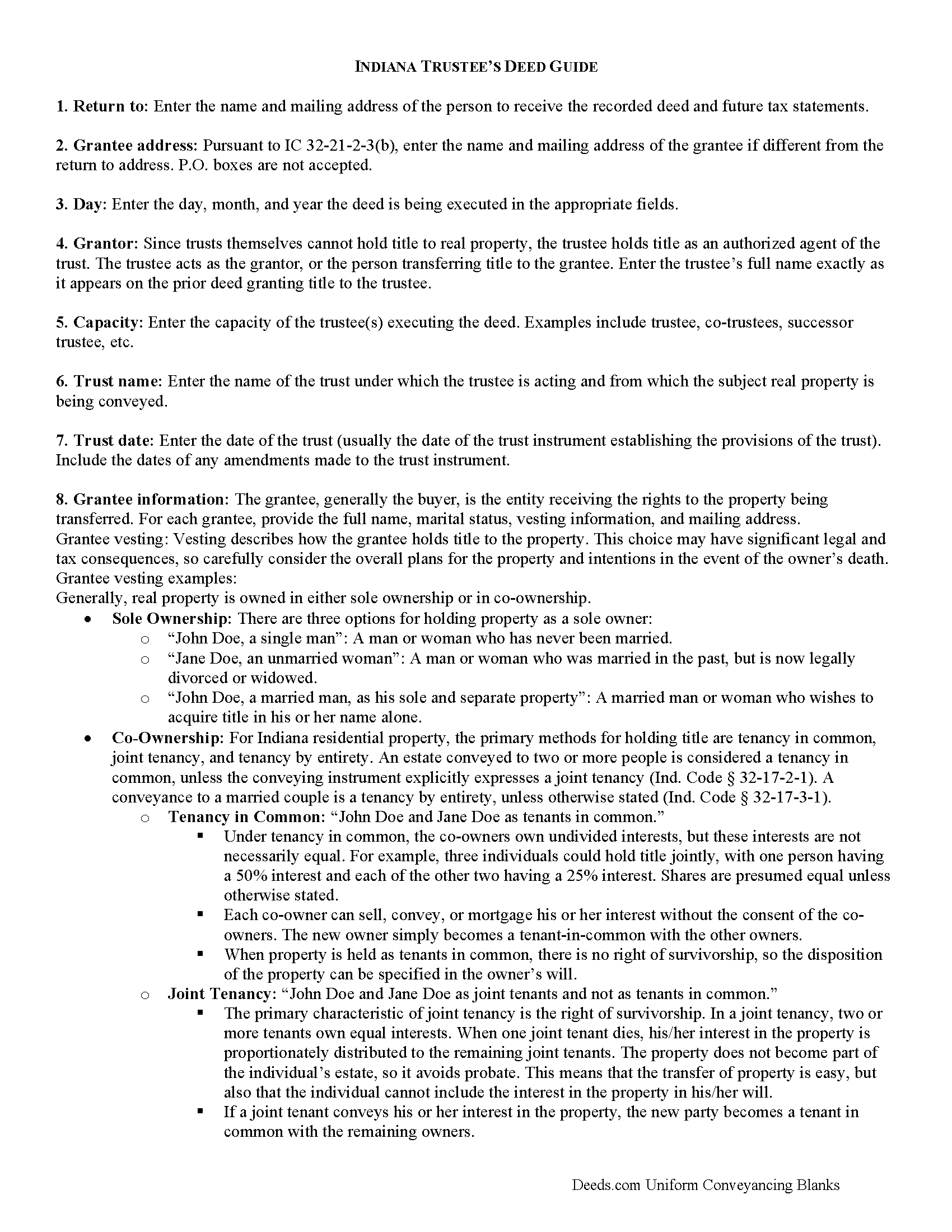

Jefferson County Trustee Deed Guide

Line by line guide explaining every blank on the form.

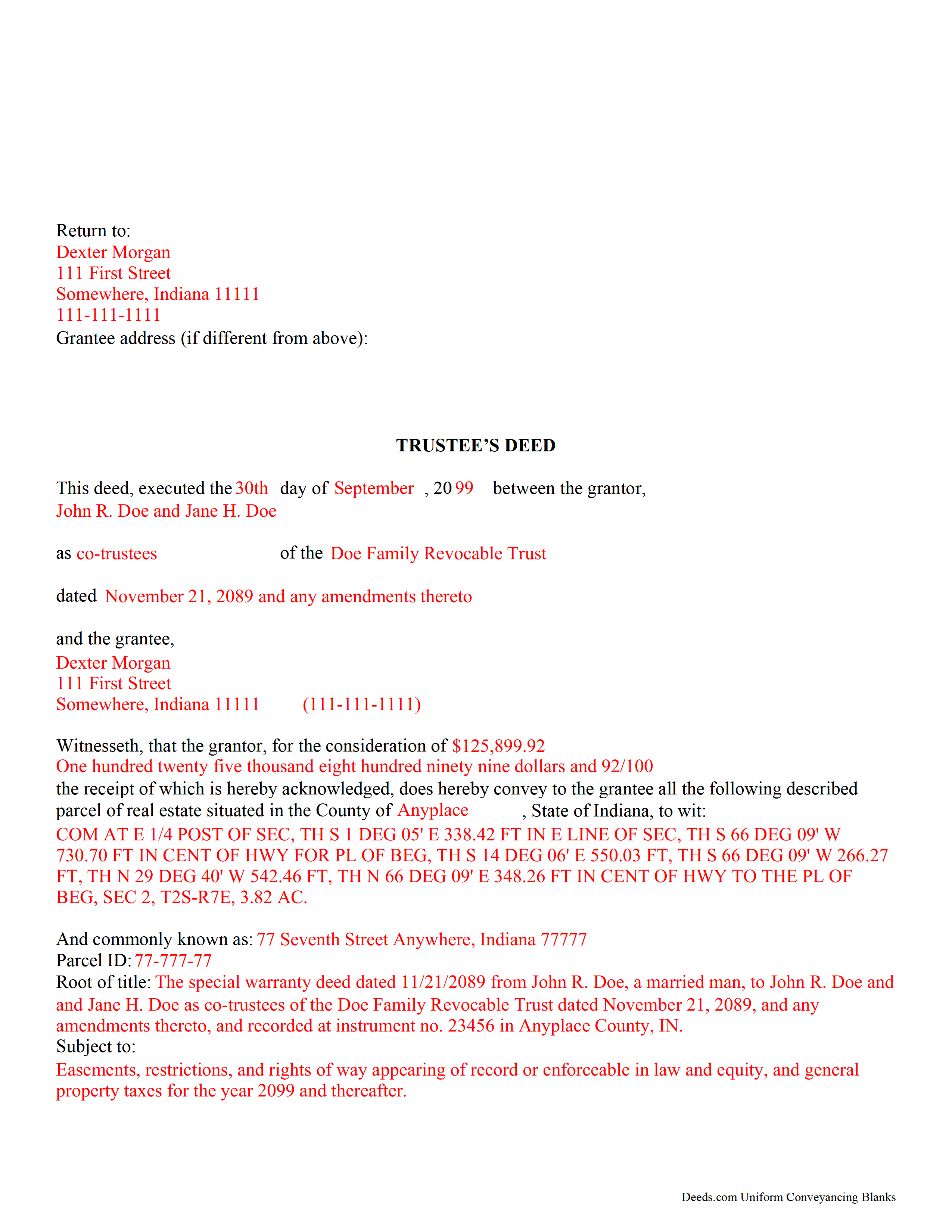

Jefferson County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Jefferson County documents included at no extra charge:

Where to Record Your Documents

Jefferson County Recorder

Madison , Indiana 47250

Hours: 8:00 to 4:00 Monday through Friday

Phone: (812) 265-8902, 8903, 8904

Recording Tips for Jefferson County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Recorded documents become public record - avoid including SSNs

- Some documents require witnesses in addition to notarization

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Jefferson County

Properties in any of these areas use Jefferson County forms:

- Canaan

- Deputy

- Dupont

- Hanover

- Madison

Hours, fees, requirements, and more for Jefferson County

How do I get my forms?

Forms are available for immediate download after payment. The Jefferson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jefferson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jefferson County?

Recording fees in Jefferson County vary. Contact the recorder's office at (812) 265-8902, 8903, 8904 for current fees.

Questions answered? Let's get started!

Use this form to transfer real property located in Indiana out of trust, without warranties of title. The deed should be executed by the trust's acting trustee(s).

A trustee's deed is an instrument used in trust administration to convey real property out of a trust. Unlike other forms of conveyance, which are named for the type of warranties they carry, the trustee's deed is named after the executing trustee.

The trustee is the administrator of a trust who is appointed by the settlor. The settlor is the person who funds the trust with assets -- in this case, real property. The settlor executes a trust instrument, which contains the provisions of the trust, including a designation of the trust's beneficiaries. This document is generally not of public record.

The trustee serves as the grantor in the trustee's deed. If there are multiple trustees or the trustee appears as a successor, this information is included also. The settlor does not enter directly into the transaction . In addition, the deed states the trust name and date under which the trustee is appearing, as well as any amendments made to the trust instrument.

All instruments of conveyance in Indiana require a legal description of the property begin conveyed, the grantee's information, and the root of title, as well as a "prepared by" statement and affirmation statement regarding the redaction of Social Security Numbers. All acting trustees must sign the deed in the presence of a notary public before the deed is recorded in the county in which the real property is situated.

Because trustees act in a fiduciary capacity, they may be asked to provide a certification of trust, demonstrating that the trust exists and their authority to enter into transactions on behalf of the trust.

The trustee's deed may require additional information depending on the situation. These instruments may or may not include warranties of title, so make sure to use the correct form for the situation. Consult a lawyer with specific questions or guidance in preparing a trustee's deed.

(Indiana Trustee Deed without Warranty Package includes form, guidelines, and completed example)

Important: Your property must be located in Jefferson County to use these forms. Documents should be recorded at the office below.

This Trustee Deed without Warranty meets all recording requirements specific to Jefferson County.

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Trustee Deed without Warranty form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4584 Reviews )

Kari G.

July 15th, 2021

The service was prompt and attentive to my questions. I would've just appreciated a heads up that I also needed to contact the county directly (and provide contact info) to receive a certified copy of the document (Notice of Commencement) in order to submit the certified copy to the Building Department. This was an extra step that I haven't had to complete before using another eRecording service. Even if this extra step is a result of the county's system. I would still have expected a head's up (since there wasn't any info regarding this on the county's site for eRecording).

Thank you for your feedback. We really appreciate it. Have a great day!

John C N.

June 17th, 2023

Just the website I needed. Very detailed and efficient.

Thank you for taking the time to provide your feedback John, we really appreciate it. Have an amazing day!

James C.

January 15th, 2021

Satisfactory. I was confused and somwhat lost on what to do and what I was getting.

Thank you!

Stephen B.

August 21st, 2024

This was the first time to use the Deeds.com website for preparing my deed document. This was painless and easy to follow the instructions and sample package for filling in the blank boxes document. The city clerk was impressed to review my document and easily filed my deed record without questions. I would recommend anyone to prepare a legal form that is available from the Deeds.com website.

Your appreciative words mean the world to us. Thank you.

Prentis T.

September 9th, 2019

So far so good

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph H.

May 8th, 2019

Your documents resolved my problem. Thanks.

Thank you Ralph, we appreciate your feedback.

Traci K.

April 29th, 2021

Thk u for the forms I needed so badly I really appreciate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles C.

December 2nd, 2020

This was my first experience with e-recording. Deeds.com was AWESOME! Within one hour, I signed up with Deeds.com, recorded a deed in a neighboring county and had access to a copy of the recorded deed. I also appreciate the fact that there are no monthly or annual fees. Thanks Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Karen O.

June 2nd, 2021

I often think I am smarter than I am. Thankfully there are people that know what they are doing so I can focus on my business and the big picture without worrying about the little things.

Thank you!

Frances B.

June 13th, 2019

Excellent product!!!! Accepted at my courthouse without a hitch. I recommend this company whole heartedly!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

curtice c.

September 30th, 2022

I bought the Transfer on Death Deed documents. Great product and the accompanying example and guides were great.

Thank you for your feedback. We really appreciate it. Have a great day!

Bobette B.

September 26th, 2019

Worked well with clear guide!

Thank you!

MARY LACEY M.

April 17th, 2025

Deeds.com consistently provides excellent service at a fair price, and we rely and are thankful them for assisting with our recording needs.

Thank you, Mary! We truly appreciate your kind words and continued trust in Deeds.com. It means a lot to us to be part of your recording process, and we’re always here to help whenever you need us.

Tim M.

February 2nd, 2024

This is my first time using this amazing service. I wish I was told about this before I went all the way downtown, drove thru construction zones, paid for parking only to be told the computer system had crashed. I was referred to Deeds.com and I will not use the downtown system again.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

LeAnn B.

October 12th, 2021

Excellent service. Very helpful staff that guided me through the process since this was my first time e-recording. We were so surprised to get the recorded deeds within an hour. Thank you very much. LeAnn

We appreciate your business and value your feedback. Thank you. Have a wonderful day!