Starke County Trustee Deed without Warranty Form

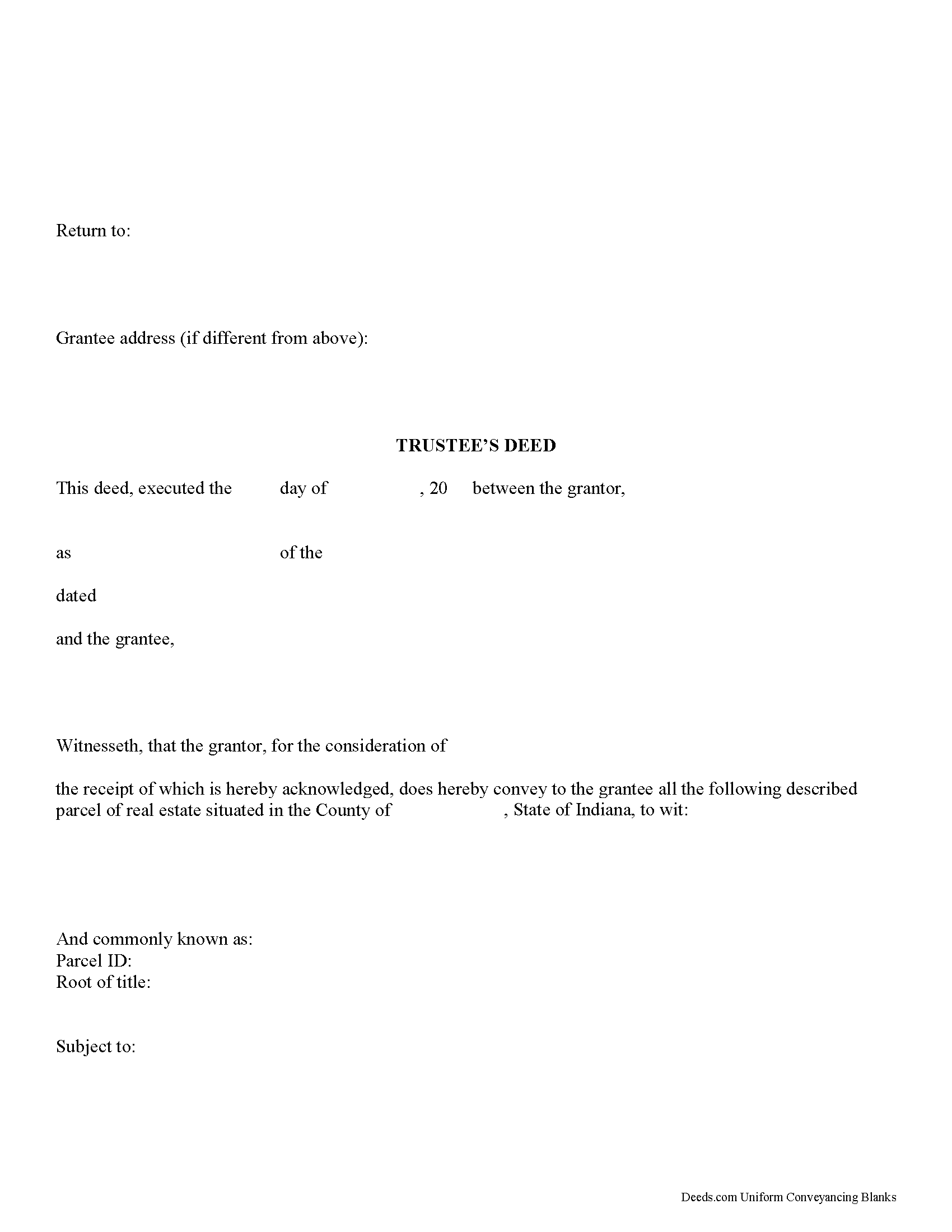

Starke County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

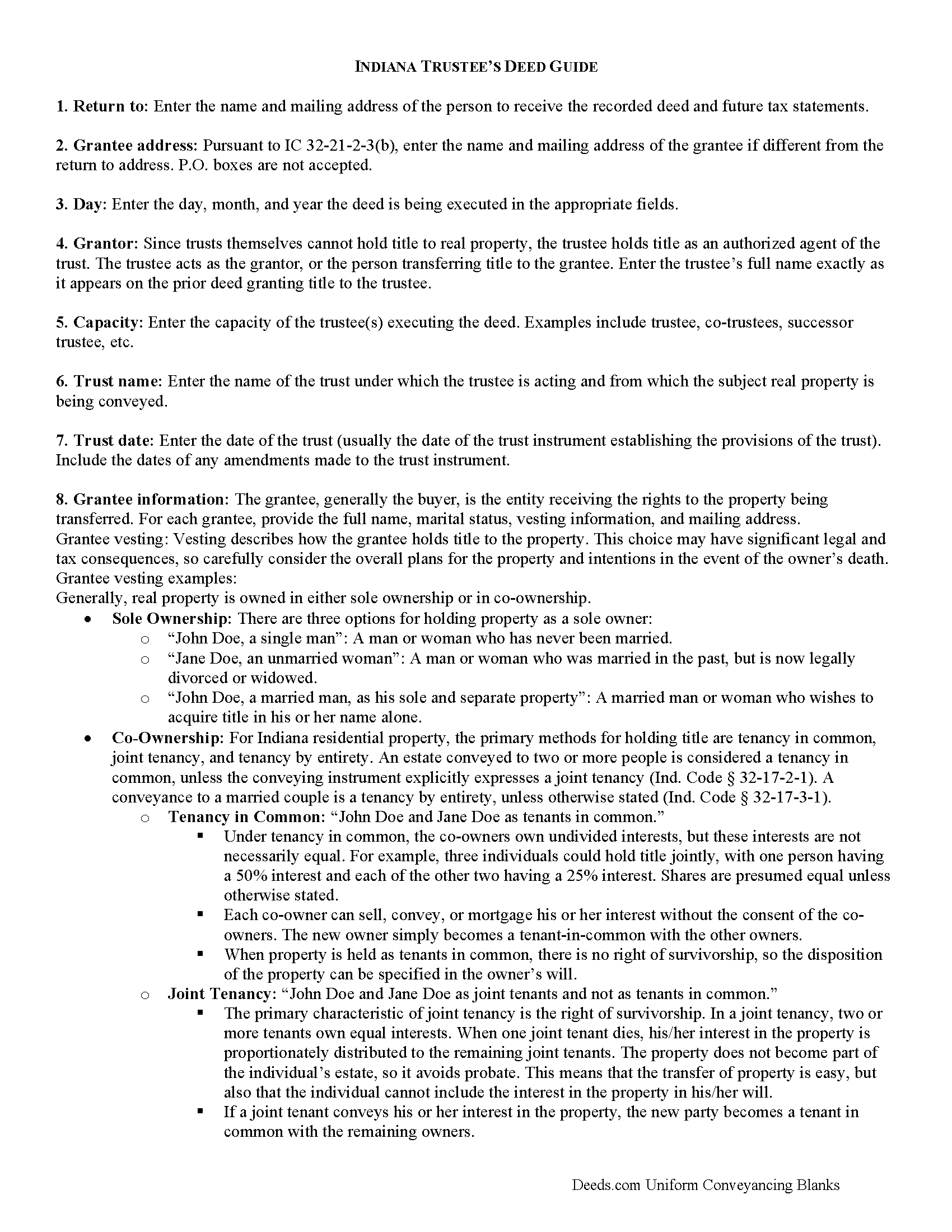

Starke County Trustee Deed Guide

Line by line guide explaining every blank on the form.

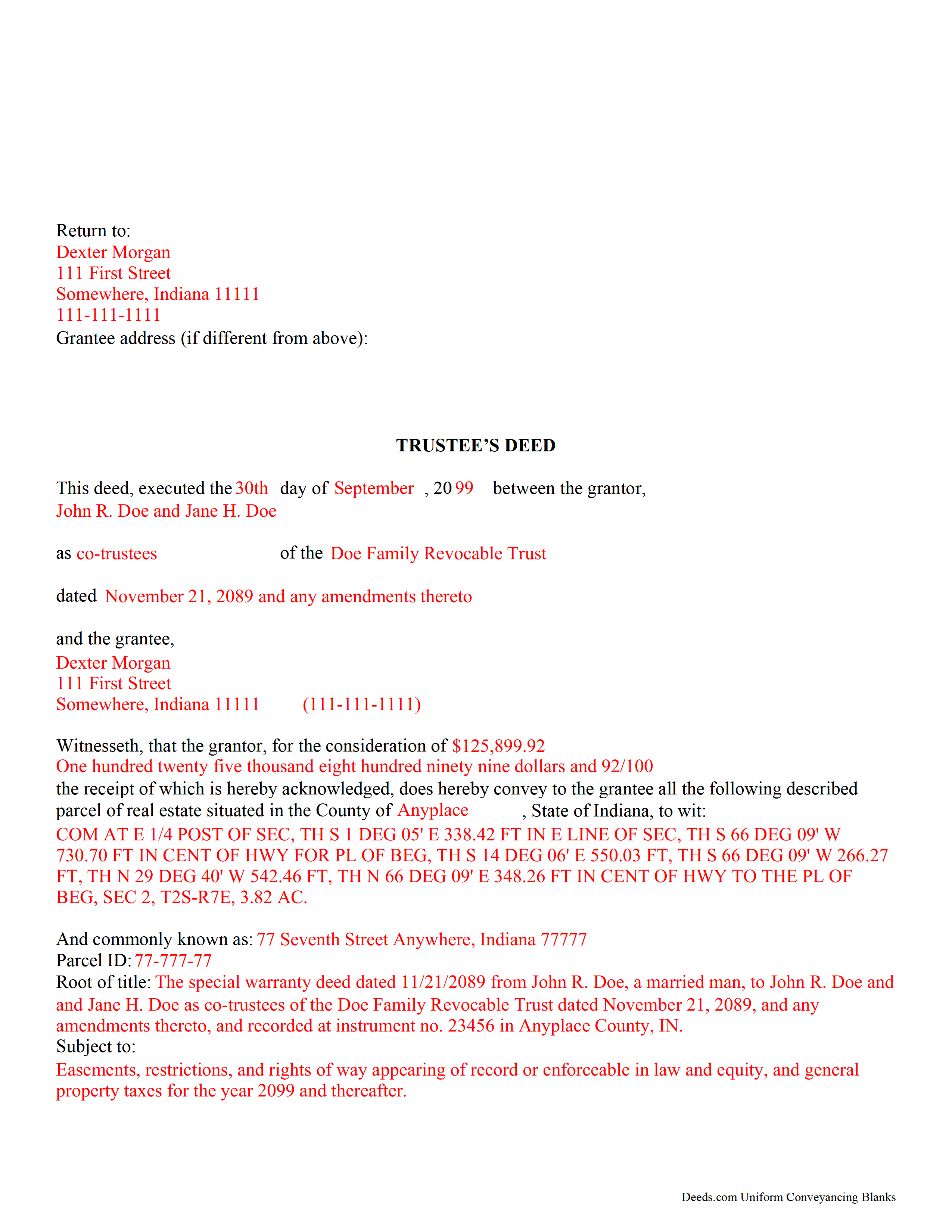

Starke County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Starke County documents included at no extra charge:

Where to Record Your Documents

Stark County Recorder's Office

Knox, Indiana 46534

Hours: Monday - Friday 8:00am - 4:00pm

Phone: 574-772-9109

Recording Tips for Starke County:

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- Ask about their eRecording option for future transactions

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Starke County

Properties in any of these areas use Starke County forms:

- Grovertown

- Hamlet

- Knox

- North Judson

- Ora

- San Pierre

Hours, fees, requirements, and more for Starke County

How do I get my forms?

Forms are available for immediate download after payment. The Starke County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Starke County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Starke County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Starke County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Starke County?

Recording fees in Starke County vary. Contact the recorder's office at 574-772-9109 for current fees.

Questions answered? Let's get started!

Use this form to transfer real property located in Indiana out of trust, without warranties of title. The deed should be executed by the trust's acting trustee(s).

A trustee's deed is an instrument used in trust administration to convey real property out of a trust. Unlike other forms of conveyance, which are named for the type of warranties they carry, the trustee's deed is named after the executing trustee.

The trustee is the administrator of a trust who is appointed by the settlor. The settlor is the person who funds the trust with assets -- in this case, real property. The settlor executes a trust instrument, which contains the provisions of the trust, including a designation of the trust's beneficiaries. This document is generally not of public record.

The trustee serves as the grantor in the trustee's deed. If there are multiple trustees or the trustee appears as a successor, this information is included also. The settlor does not enter directly into the transaction . In addition, the deed states the trust name and date under which the trustee is appearing, as well as any amendments made to the trust instrument.

All instruments of conveyance in Indiana require a legal description of the property begin conveyed, the grantee's information, and the root of title, as well as a "prepared by" statement and affirmation statement regarding the redaction of Social Security Numbers. All acting trustees must sign the deed in the presence of a notary public before the deed is recorded in the county in which the real property is situated.

Because trustees act in a fiduciary capacity, they may be asked to provide a certification of trust, demonstrating that the trust exists and their authority to enter into transactions on behalf of the trust.

The trustee's deed may require additional information depending on the situation. These instruments may or may not include warranties of title, so make sure to use the correct form for the situation. Consult a lawyer with specific questions or guidance in preparing a trustee's deed.

(Indiana Trustee Deed without Warranty Package includes form, guidelines, and completed example)

Important: Your property must be located in Starke County to use these forms. Documents should be recorded at the office below.

This Trustee Deed without Warranty meets all recording requirements specific to Starke County.

Our Promise

The documents you receive here will meet, or exceed, the Starke County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Starke County Trustee Deed without Warranty form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Lori F.

July 16th, 2020

These folks are so amazing! They were very kind, patient and the communication was above and beyond. Basically, THEY ROCK!

Thank you!

QINGXIONG L.

January 1st, 2021

The major problem is too expensive, particularly sometime, only few words need to file correction deed which cost 20 dollars!!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael R.

April 11th, 2023

This process was so easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Curtis G.

May 18th, 2020

Easy to use.

Thank you!

Scott W.

April 8th, 2024

Finding and downloading necessary forms, and especially the example forms, were tremendously easy and trouble free, and the fact the forms were updated recently was a big selling point. If other forms are needed, this is were I'm coming.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kirk G.

October 23rd, 2021

Excellent! I will be back!

Thank you!

James S.

July 16th, 2019

The forms download was quick and easy. The example deed was excellent. However, the payment method should include PayPal, not just credit cards.

Thank you for your feedback James, we appreciate it.

Ramona C.

October 28th, 2020

Easy to use and the sample really helped.

Thank you!

Frank W.

January 19th, 2023

Everything worked smoothly

Thank you!

Jackson J.

June 4th, 2019

Thank you for your help the website is simple and easy to use and dealing with this county for the 1st time there were a few things i was not too sure about but your staff was prompt and responsive and anytime there was a glitch we were promptly able to resolve the issue until the deed was accepted and recorded by the county great service thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Keith L.

March 15th, 2019

Great to have a downloadable form, rather than a cloud solution that gives no guarantee of privacy. Appreciated the sample.......but all of that still left me with open issues about how to tweak the form to serve my particular needs......for example: how to ensure that survivor rights were properly characterized; how far back I should go with the "Source" section + how I should layer my own additions to the chain of ownership, etc. Nonetheless, an overall happy experience. Thank you for your help

Thank you for your feedback. We really appreciate it. Have a great day!

James C.

October 20th, 2022

was very helpfull, It provided the refernces to the stat laws so I coul have a deeper look into the issue I was trying to deal with.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anne M H.

April 23rd, 2020

Appears to be just what I need. Quick and easy to download. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

charles c.

October 14th, 2020

Great service, well worth the $15 fee. Especially helpful was the review of my documentation and the quick responses. Recommending it to associates who might need this service.

Thank you for your feedback. We really appreciate it. Have a great day!

ralph f.

January 31st, 2019

I VERY MUCH APPRECIATE THE PROMPT RESPONSE & HELPFULNESS. I WILL DEFINITELY USE THIS SERVICE IN THE FUTURE. THANK YOU!

Thank you Ralph, we appreciate your feedback.