Hancock County Conditional Lien Waiver upon Progress Payment Form

Hancock County Conditional Lien Waiver upon Progress Payment Form

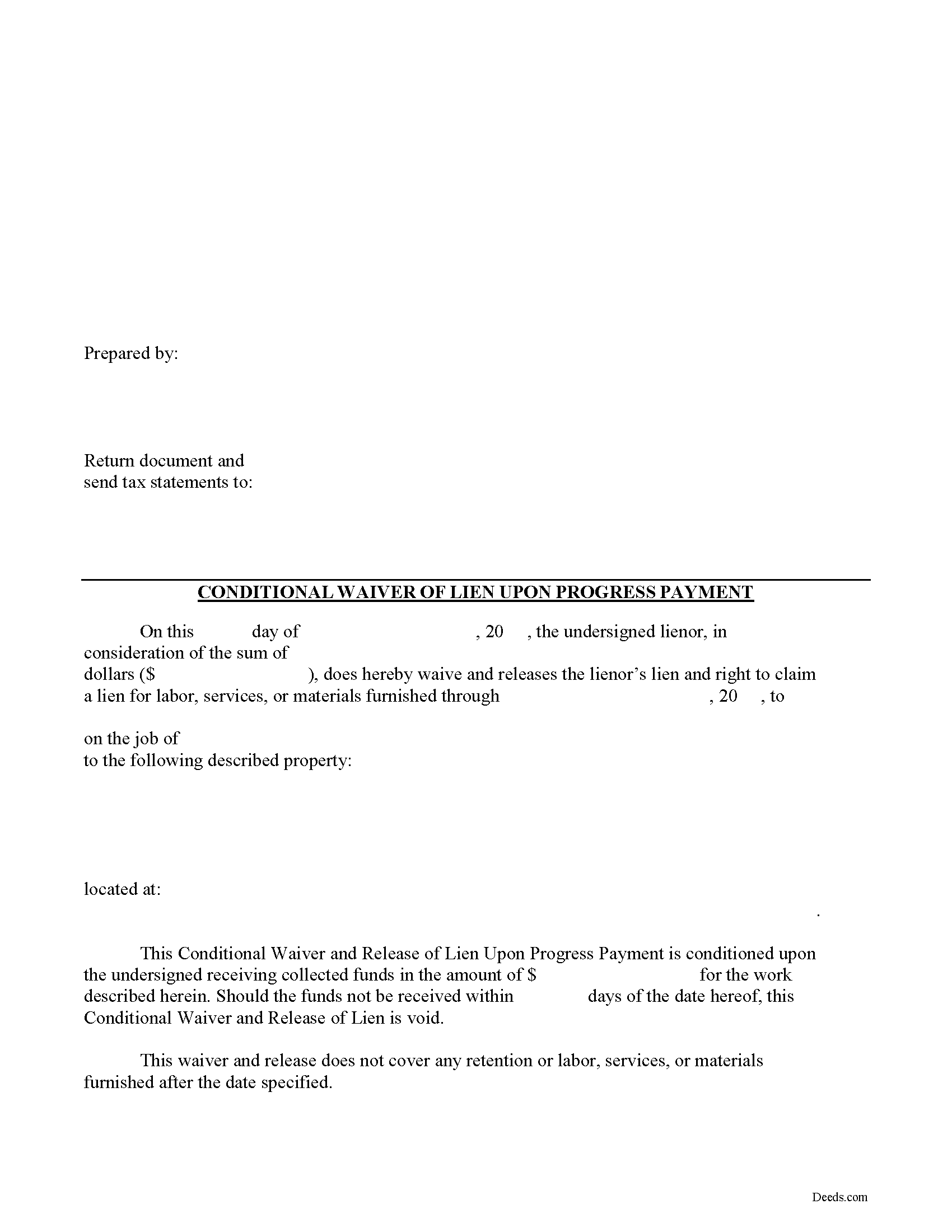

Fill in the blank Conditional Lien Waiver upon Progress Payment form formatted to comply with all Iowa recording and content requirements.

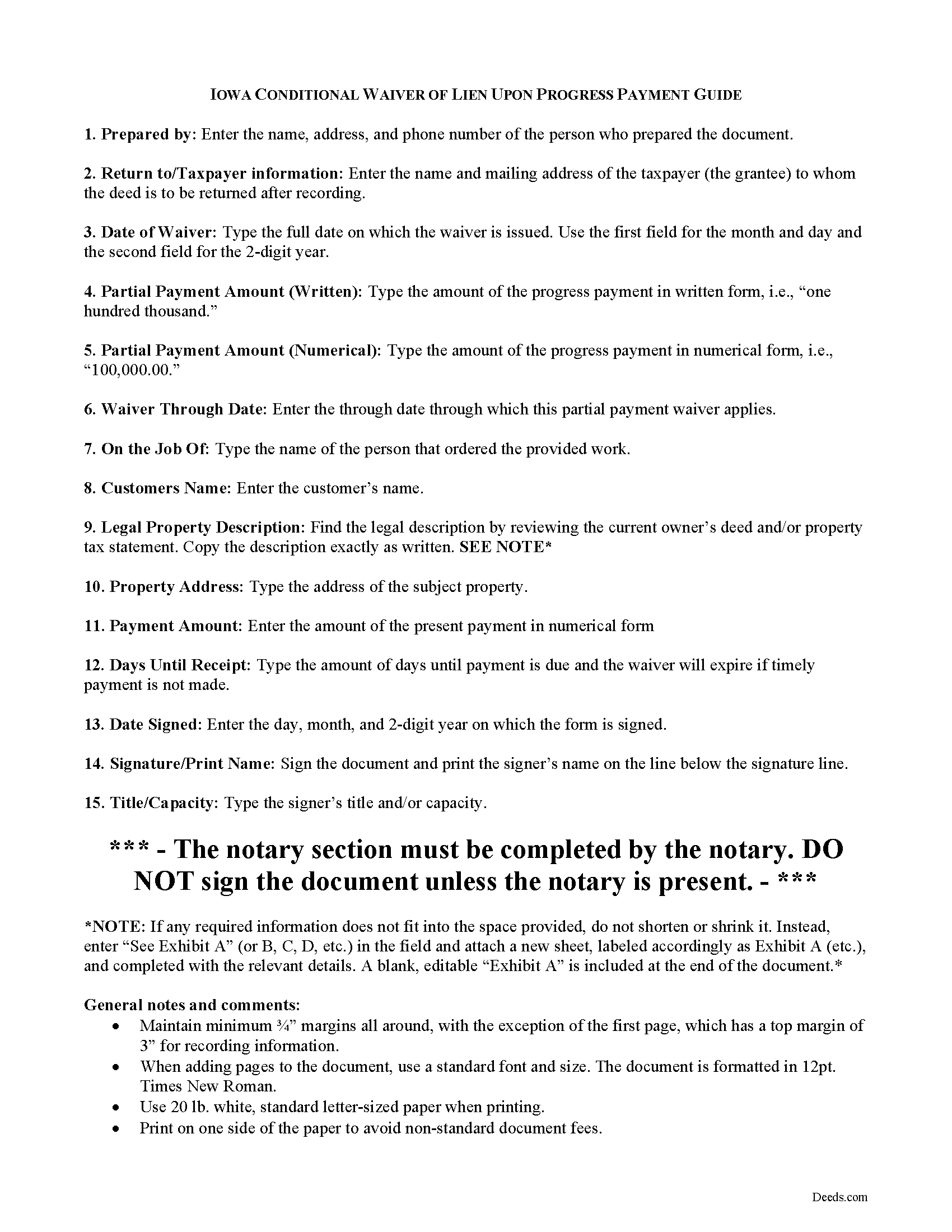

Hancock County Conditional Lien Waiver upon Progress Payment Guide

Line by line guide explaining every blank on the Conditional Lien Waiver upon Progress Payment form.

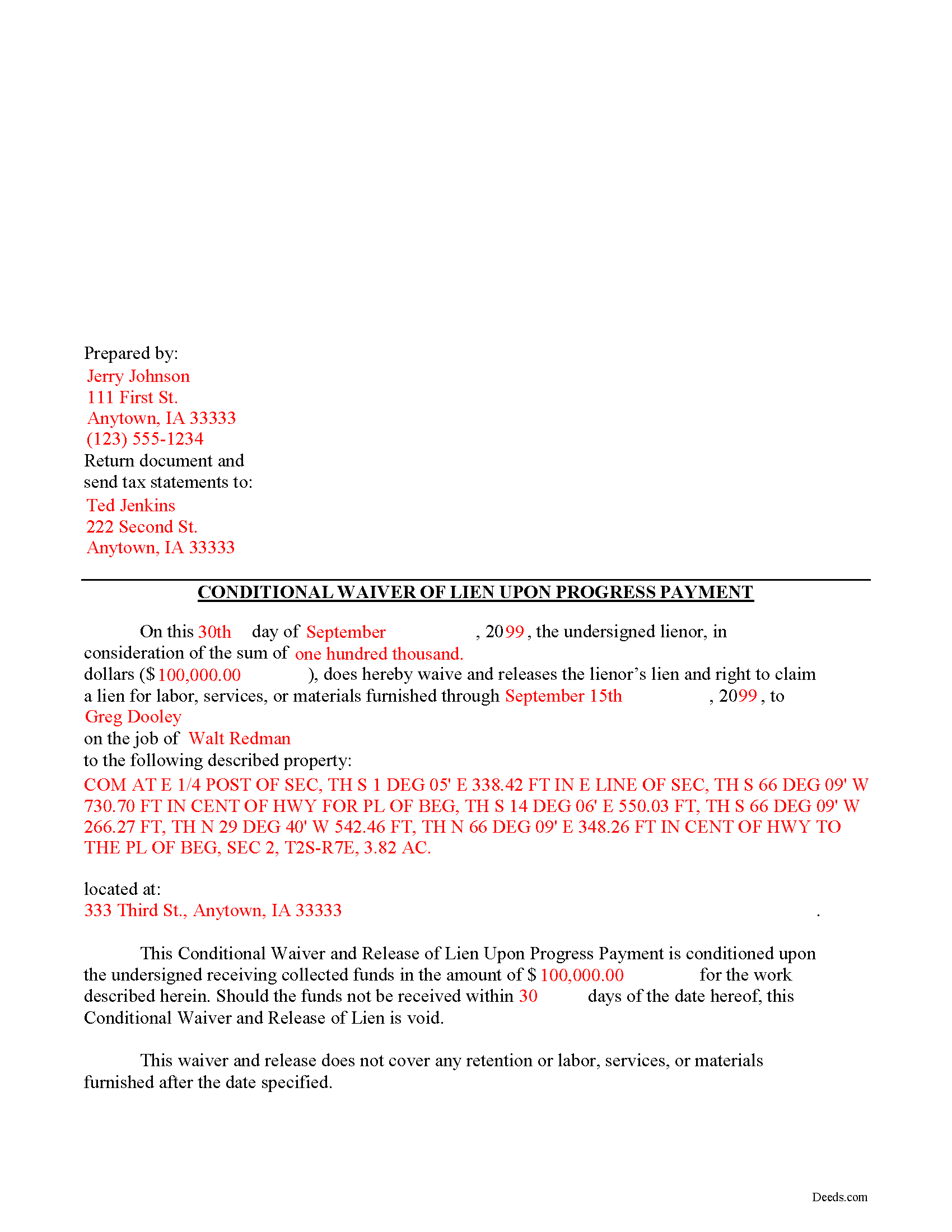

Hancock County Completed Example of the Conditional Lien Waiver upon Progress Payment Document

Example of a properly completed Iowa Conditional Lien Waiver upon Progress Payment document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Hancock County documents included at no extra charge:

Where to Record Your Documents

Hancock County Recorder

Garner, Iowa 50438-0070

Hours: 8:00 to 4:00 Monday through Friday

Phone: (641) 923-2464

Recording Tips for Hancock County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Hancock County

Properties in any of these areas use Hancock County forms:

- Britt

- Corwith

- Crystal Lake

- Garner

- Goodell

- Kanawha

- Klemme

- Woden

Hours, fees, requirements, and more for Hancock County

How do I get my forms?

Forms are available for immediate download after payment. The Hancock County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hancock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hancock County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hancock County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hancock County?

Recording fees in Hancock County vary. Contact the recorder's office at (641) 923-2464 for current fees.

Questions answered? Let's get started!

Mechanic's liens are governed under Chapter 572 of Iowa Code. A waiver is a conscious relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay. In Iowa, there are no statutory forms for waivers although according to the principles of contract law, the parties may agree to such modifications in writing.

Generally, waivers come in four varieties: conditional or unconditional, and based on a partial/progress or final payment. Conditional waivers only become effective after the responsible party's check clears the bank on which it was drawn, and provide more protection for the claimants. Unconditional waivers go into effect immediately, tend to favor the owners' interests, and should only be used after payment is confirmed. Waiving lien rights after a partial payment allows the claimant to retain some lien rights, but to release others based on the amount paid on the overall balance due. Waivers upon final payments remove the claimant's eligibility to place a lien because they state that the account is paid in full.

Regardless of the nature, waivers must identify the parties, the location of the project, relevant dates, and payments.

Partial waivers are used to waive a lien for up to the partial or progress payment amount. A conditional waiver means the waiver is conditioned upon the claimant receiving the amount due. Use the partial conditional waiver when the owner makes less than the full or final payment and the payment method does not guarantee receipt of the money (such as a check that hasn't cleared yet).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to property owners or anything else with regard to mechanic's liens.

Important: Your property must be located in Hancock County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver upon Progress Payment meets all recording requirements specific to Hancock County.

Our Promise

The documents you receive here will meet, or exceed, the Hancock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hancock County Conditional Lien Waiver upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Peggy L.

November 16th, 2020

Exactly what I needed and so nice to not have to pay a lawyer

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L.

March 3rd, 2019

Perfect timely service! Will use again!

Thank you!

Larry H.

March 29th, 2019

Wow! So easy and such a cost savings. Thanks

Thanks Larry, we appreciate your feedback.

Ed C.

June 16th, 2025

I purchased the DIY quitclaim deed forms for Florida and couldn’t be happier. The forms were clear, professional, and easy to follow. I had everything filled out and recorded without a single issue. Worth every penny — the site is great, and the forms are exactly what I needed. Highly recommend!

Thanks so much, Ed! We’re thrilled to hear that the Florida quitclaim deed forms worked perfectly for you and that the recording process went smoothly. We appreciate your trust and recommendation!

Patrick R.

August 25th, 2023

I was satisfied and would refer this website to others.

Thank you for your feedback. We really appreciate it. Have a great day!

Conrad N.

November 1st, 2021

It worked well for me.

Thank you!

Terry M.

January 8th, 2020

Very responsive. I was notified very quickly if the deed I was looking for was available.

Thank you!

Darren G.

December 10th, 2021

Your beneficiary deed sample contains a error of the LDPS designation. I copied the designation of LPDS instead of the correct designation

Thank you for your feedback. We really appreciate it. Have a great day!

Diana T.

July 15th, 2022

Very helpful Got information and form I wanted.

Thank you for your feedback. We really appreciate it. Have a great day!

Gerry V.

March 9th, 2021

Easy to use, fast and reliable. love deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Seth T.

January 8th, 2019

THE BEST WEBSITE I HAVE EVER SEEN FOR LEGAL DOCUMENTS!!! THANKS

Thanks Seth, we appreciate your feedback.

victor h.

February 26th, 2022

Easy to use and just what I was looking for

Thank you!

Barbara C.

February 27th, 2020

Excellent site; easy to use

Thank you!

Dean P.

October 6th, 2021

Very fast, efficient, and convenient - thanks Deeds.com! I would recommend this service to everyone needing to record documents, especially out-of-state customers such as myself.

Thank you for your feedback. We really appreciate it. Have a great day!

james e.

August 23rd, 2022

Would be nice if these things downloaded with the type of document rather than a number

Thank you for your feedback. We really appreciate it. Have a great day!