Johnson County Correction Deed Form

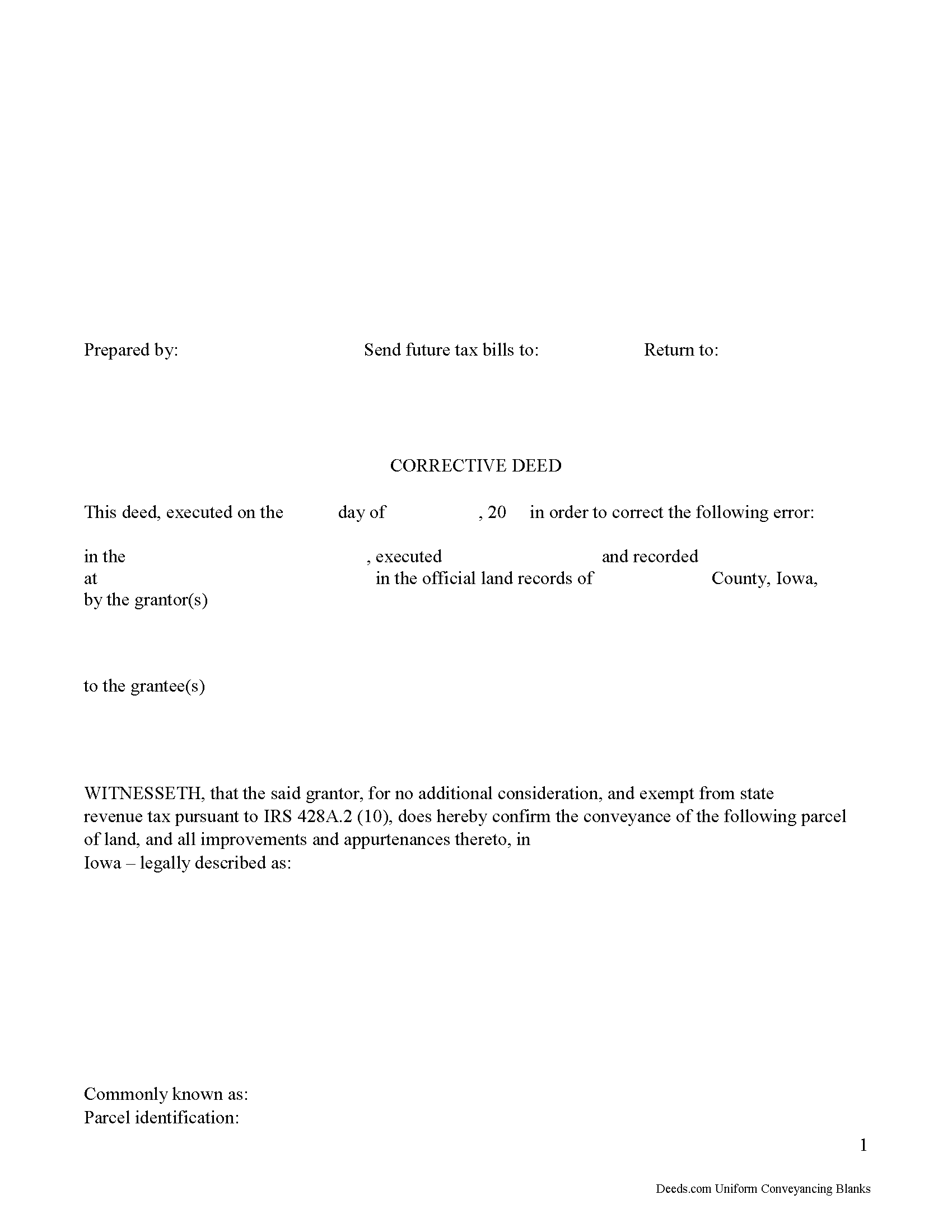

Johnson County Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

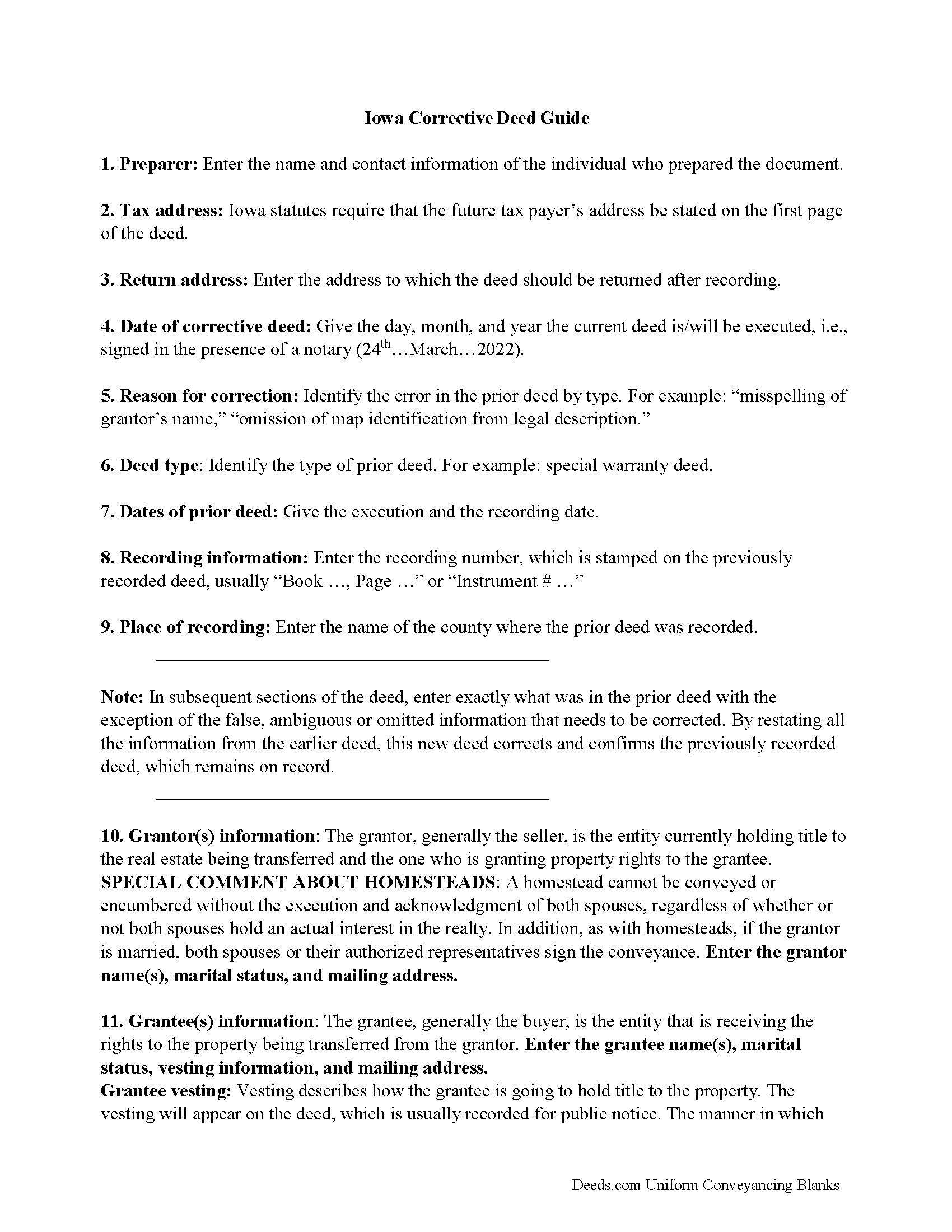

Johnson County Corrective Deed Guide

Line by line guide explaining every blank on the form.

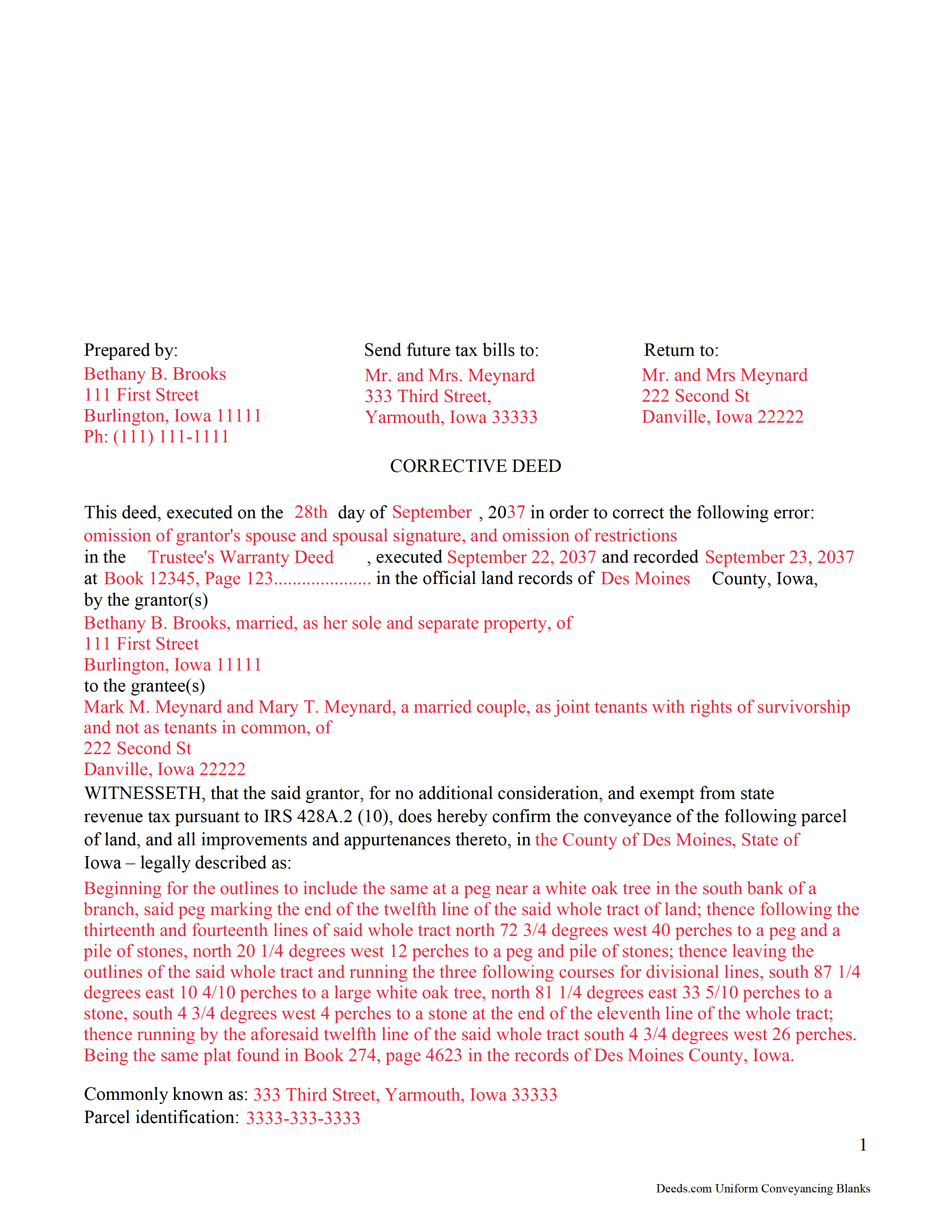

Johnson County Completed Example of the Corrective Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Recorder

Iowa City, Iowa 52240

Hours: 8:00 am - 5:00 pm Monday through Friday

Phone: (319) 356-6093

Recording Tips for Johnson County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Make copies of your documents before recording - keep originals safe

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Coralville

- Hills

- Iowa City

- Lone Tree

- North Liberty

- Oakdale

- Oxford

- Solon

- Swisher

- Tiffin

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (319) 356-6093 for current fees.

Questions answered? Let's get started!

In Iowa, use a correction deed to amend a previously recorded deed that contains a minor error.

A corrective deed is, in effect, an explanation and correction of an error in a prior instrument. As such, it passes no title and, except for the corrected item, reiterates and confirms the prior conveyance. It should be executed from the original grantor to the original grantee, and it needs to be recorded in order to be legally valid.

The correction deed must reference the original conveyance by type of error, date of execution and recording, as well as by recording number and location. Beyond that, it restates the information given in the prior deed, which remains on record and receives a cross-reference to the corrective instrument.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title, changing the vesting information or the legal description of the property, may require a new deed of conveyance instead of a correction deed.

Correction deeds are exempt from state revenue tax pursuant to IRS 428A.2 (10) that exempts "deeds which, without additional consideration, confirm, correct, modify, or supplement a deed previously recorded." The exemption needs to be identified on the deed itself, or the declaration of value form must be submitted with the deed.

(Iowa Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Karen P.

May 6th, 2020

Quick and easy.

Thank you!

Robert S.

July 22nd, 2020

Process was easy to follow and worked as advertised. Thought the price was a little high.

Thank you!

JAMES E.

November 22nd, 2020

Easy to use and excellent software.

Thank you!

Rick R.

February 5th, 2021

So far excellent service - I made a boo boo on the deed - no problem they made the change before they sent it off to be recorded. I will never drive to the Recorder's office again.

Thank you!

Harry S.

March 30th, 2021

This is my first time using the service. Wow! How efficient and effortless! Keep up the good work!

Thank you!

Edward M.

October 3rd, 2022

Thank you very much Very satisfied

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela W.

April 11th, 2019

Signing up was easy and the form was amazing. The ability to type on it (I am on a MAC) was beyond my expectations, the ability to save a blank, save my two documents, save the instructions and sample was excellent. The documents are in the mail and we are hopefully they will be approved. Blessings,

Thank you for your feedback. We really appreciate it. Have a great day!

Debra B.

April 14th, 2020

I was very glad to have this option for filing a form as it would have taken 4 days due to offices being closed to the public during the COVID 19 epidemic. I found the process to be fairly simple and I was able to file the document within 24 hours.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah D.

June 1st, 2023

What I thought was gonna be a long drawn out tedious process was literally 10min tops... The help was quick and a load off. Thanks y'all.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda D.

April 27th, 2019

It was quick & easy so thank you!

Thank you Linda.

Angela T.

June 21st, 2019

I love this website .. it has been very helpful in so many ways.. thank you so much..

Thank you!

Therese L.

September 20th, 2019

Good instructions and example

Thank you!

Fernando C.

April 13th, 2019

I was able to get what I needed!! Easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SueAnn V.

July 22nd, 2021

Thanks so much for the TOD Beneficiary Deed with the explanation, supplementary forms and great example! I just filed it today for the state of Colorado, in my county and it was accepted by the Clerk/Recorder. I really appreciate the thorough work that Deeds.com does. I definitely will use this site again and also recommend it to family and friends. Thanks again.

Thank you for your feedback. We really appreciate it. Have a great day!

Mike F.

April 15th, 2023

The explanation sheet and example was very handy.

Thank you!