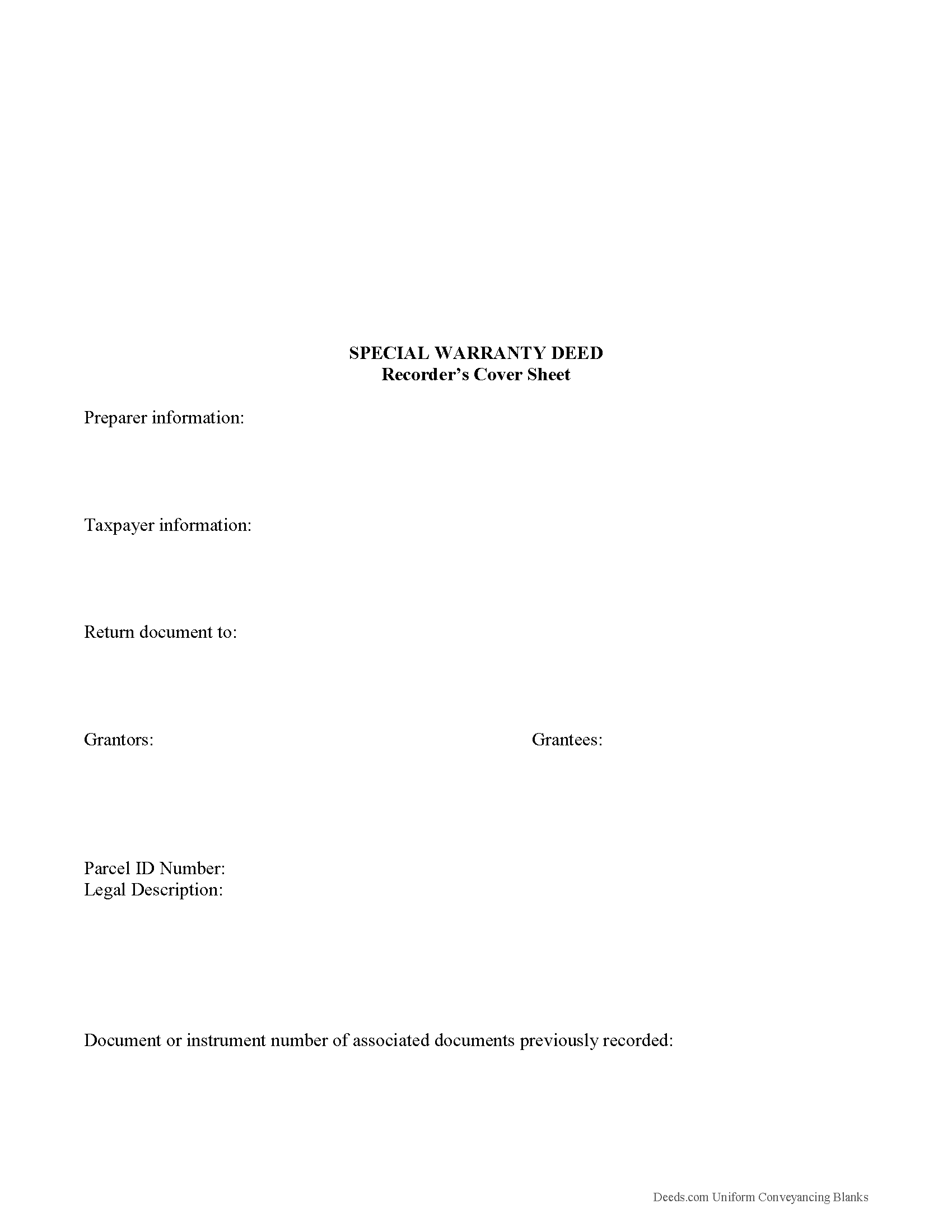

Taylor County Special Warranty Deed Form

Taylor County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

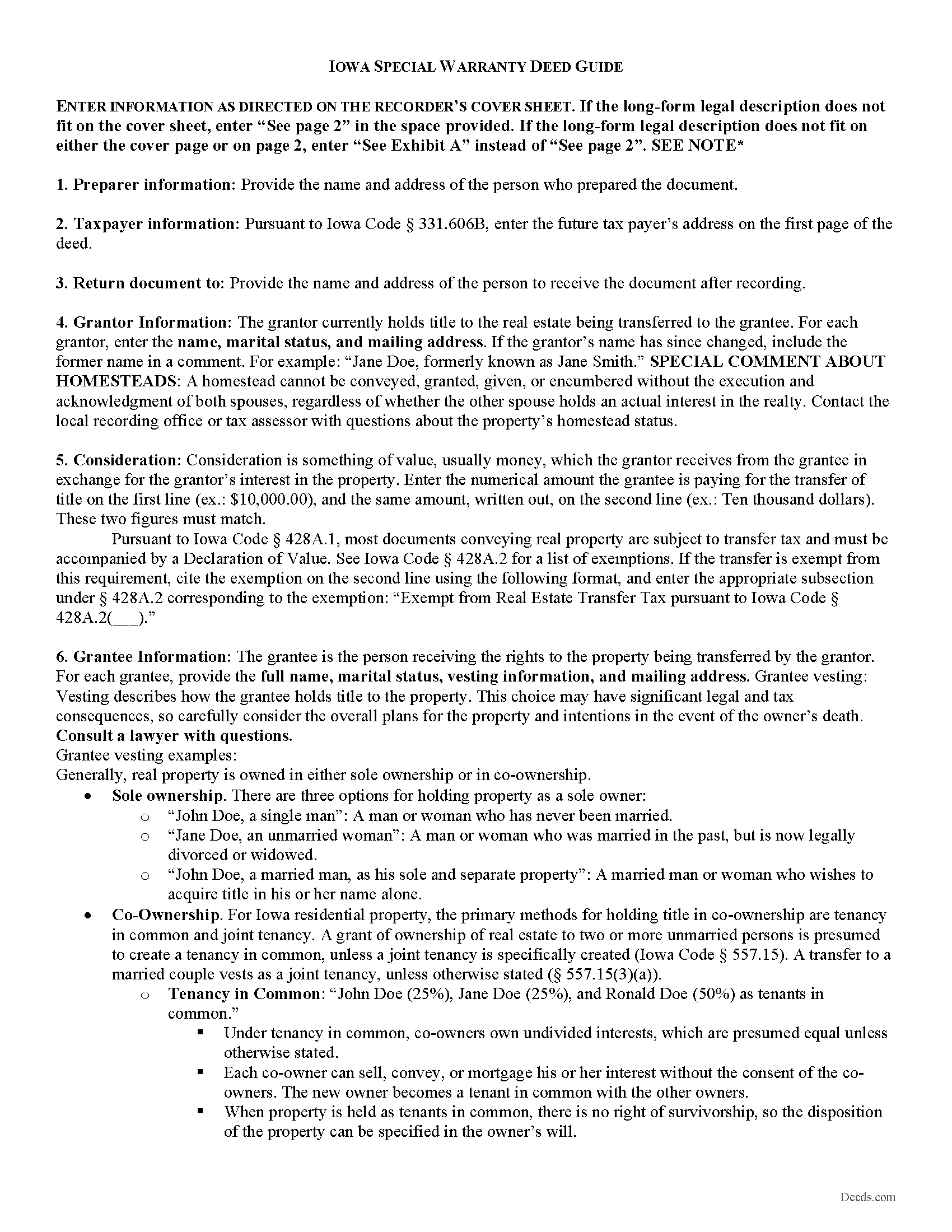

Taylor County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

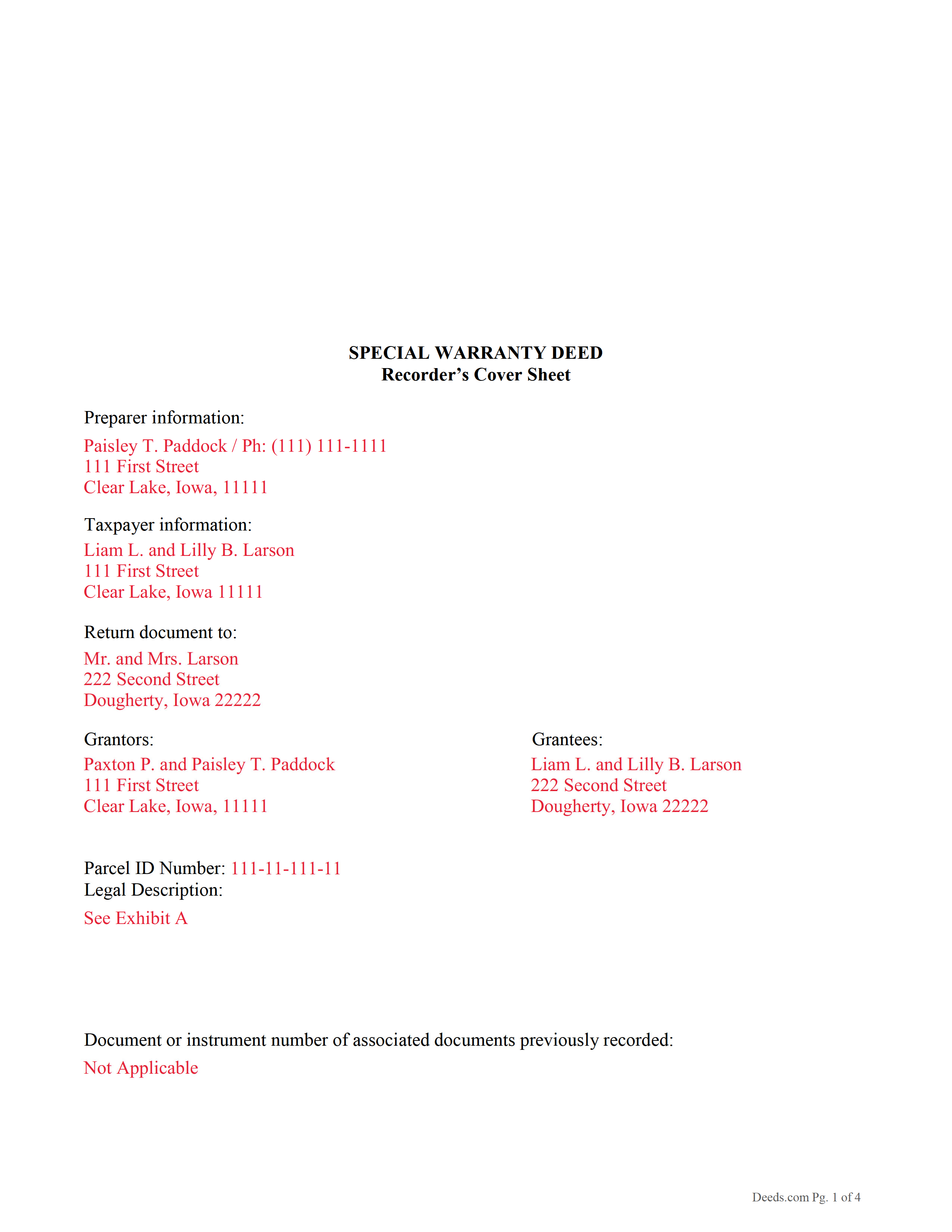

Taylor County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Taylor County documents included at no extra charge:

Where to Record Your Documents

Taylor County Recorder

Bedford, Iowa 50833

Hours: 8:00am to 4:30pm.M-F

Phone: (712) 523-2275

Recording Tips for Taylor County:

- Ask if they accept credit cards - many offices are cash/check only

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Taylor County

Properties in any of these areas use Taylor County forms:

- Bedford

- Blockton

- Clearfield

- Gravity

- Lenox

- New Market

- Sharpsburg

Hours, fees, requirements, and more for Taylor County

How do I get my forms?

Forms are available for immediate download after payment. The Taylor County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Taylor County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Taylor County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Taylor County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Taylor County?

Recording fees in Taylor County vary. Contact the recorder's office at (712) 523-2275 for current fees.

Questions answered? Let's get started!

A special warranty deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). This type of deed provides more liability protection for the grantor, and less protection for the buyer. In a special warranty deed, the grantor warrants against defects in the title during his or her ownership, and that he or she is authorized to sell it, but does not guarantee freedom from claims on the title originating before the grantor owned the property. Because of this risk, special warranty deeds are less common for residential real estate transactions. Instead, these types of deeds are typically used for foreclosed bank-owned properties and commercial properties that have changed ownership several times.

A lawful deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Iowa residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy is specifically created (Iowa Code 557.15). A transfer to a married couple vests as a joint tenancy, unless otherwise stated (Iowa Code 557.15(3)(a)).

As with any conveyance of real estate, a special warranty deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Finally, the deed must meet all state and local standards for recorded documents.

The grantor must sign the completed deed in front of a notary. The acknowledgment (notary section), whether made within the State of Iowa, outside the state, outside the United States, or under federal authority, should comply with the provisions of chapter 9b of the Iowa Statutes. Once acknowledged, file it in the recorder's office in the county where the property is located.

Include all relevant documents, affidavits, forms, and fees along with the deed for recording. Most deeds require a separate Real Estate Transfer Groundwater Hazard Statement (Iowa Code Section 558.69). Consult the local recording office to confirm which supplemental materials are necessary for the specific transaction.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with any questions about special warranty deeds, or for any other issues related to the transfer of real property in Iowa.

(Iowa Special Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Taylor County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Taylor County.

Our Promise

The documents you receive here will meet, or exceed, the Taylor County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Taylor County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Ben C.

December 8th, 2024

Easy and Quick,Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca G.

May 25th, 2022

Very user friendly. Forms professional and acceptable to state applicable to. Appreciate the sample & instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Lana J.

March 4th, 2022

Very easy to use and the forms were perfectly formatted. Great value and service!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ROBERET D.

November 18th, 2021

after a poor start was able to get to the forms page and find what I was looking for and every thing worked good. Just getting to the right area was a struggle but we made thanks Bob

Thank you for your feedback. We really appreciate it. Have a great day!

Charles W.

July 7th, 2019

I was vey pleased with this service. It offered all of the necessary step by step information guides for completing the forms. Again, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jared D.

April 29th, 2020

Yes it was awsome experience,thank you

Thank you!

Lucille F.

December 9th, 2019

Instructions very detailed and clear.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa W.

May 25th, 2022

The easiest thing to use ever. Amazing and extremely prompt support. They get the job done with all the information you might need

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra R.

August 17th, 2021

So easy to follow when preparing a deed. The example places given helped to know how to correctly fill out the form! Very easy! I will use deeds.com again! Thank you!

Thank you!

Marlene S.

May 22nd, 2019

This service seems simple and reasonably priced. The deed I requested was not available, and they let me know immediately and refunded the fee. I would try to use this service again, if I had need.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank H.

September 22nd, 2022

Form and instructions were useful. But I suggest creating a form for transferring a deed pursuant to a trust. The existing form is based on a will going through probate so it doesn't fit the trust situation in some respects.

Thank you for your feedback. We really appreciate it. Have a great day!

Joshua P.

July 27th, 2022

Easy fill in the blanks form. Just FYI make sure you have a copy of whatever deed you are changing and the tax records. You will want the language to be identical.

Thank you for your feedback. We really appreciate it. Have a great day!

Jenifer L.

January 2nd, 2019

I'm an attorney. I see youve mixed up the terms "grantor" and "grantee" and their respective rights in this version. Anyone using it like this might have title troubles down the line.

Thank you for your feedback Jenifer, we have flagged the document for review.

Garrett R.

May 24th, 2022

I am a real estate attorney in CA. These Wyoming model deeds look too basic and barely adequate: no usual name and address at the top for tax statements and who recorded it. Some old fashioned legalese that only obfuscates. I won't use them. Your background info was good though.

Thank you for your feedback. We really appreciate it. Have a great day!

Jean T.

January 3rd, 2024

It's wonderful that these forms are easily accessible!

Thank you for your feedback. We really appreciate it. Have a great day!