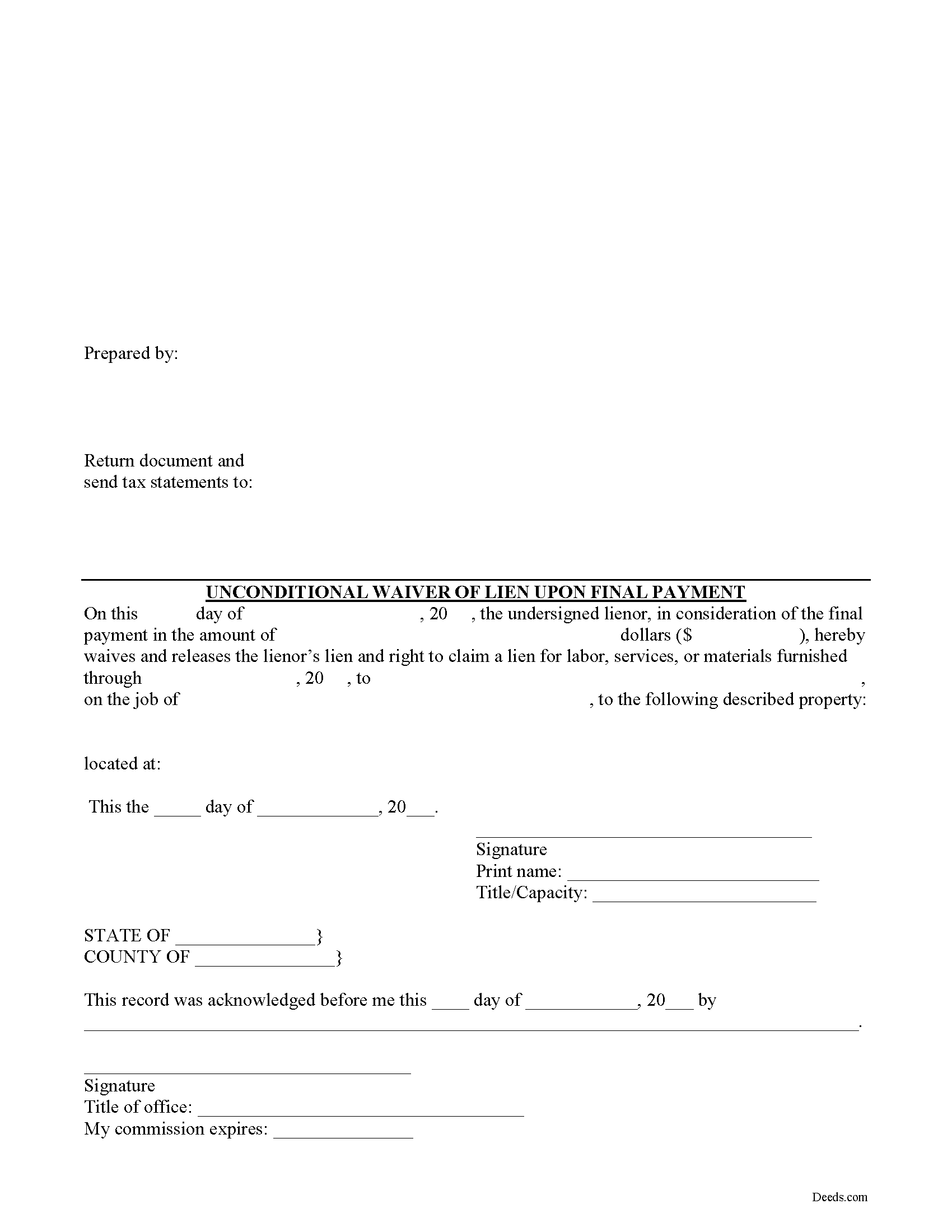

Jefferson County Unconditional Waiver on Final Payment Form

Jefferson County Unconditional Waiver on Final Payment Form

Fill in the blank Unconditional Waiver on Final Payment form formatted to comply with all Iowa recording and content requirements.

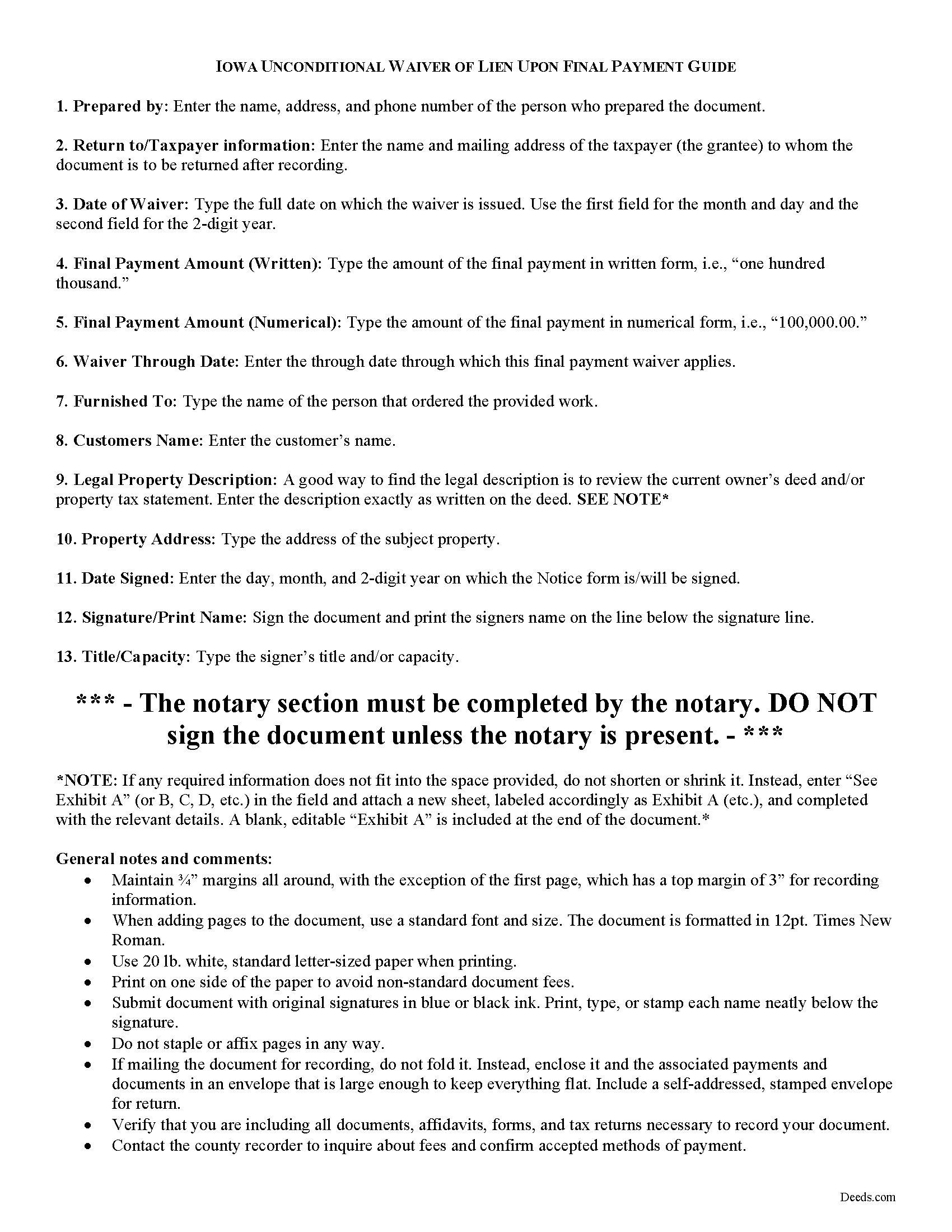

Jefferson County Unconditional Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

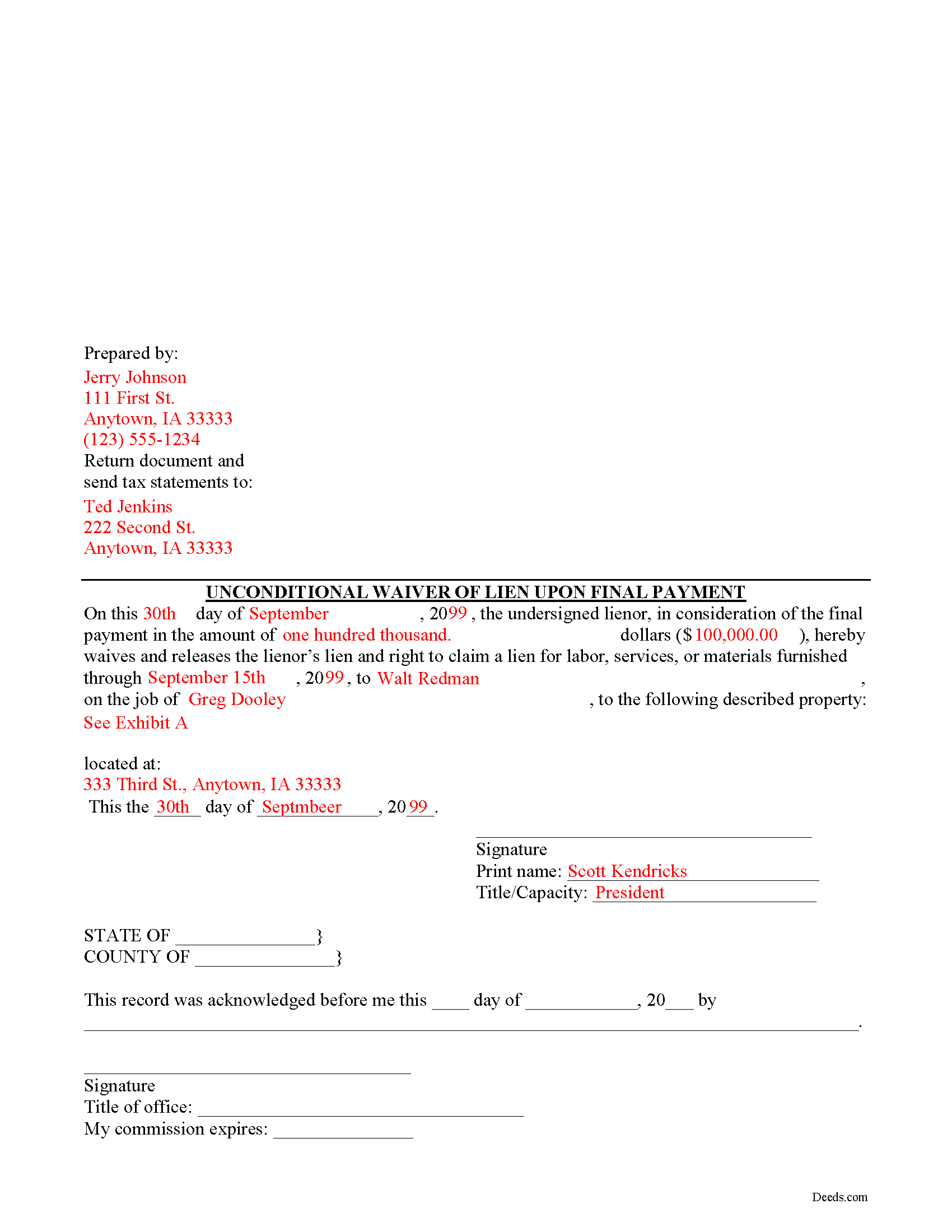

Jefferson County Completed Example of the Unconditional Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Jefferson County documents included at no extra charge:

Where to Record Your Documents

Jefferson County Recorder

Fairfield, Iowa 52556-2820

Hours: 8:00am to 4:30pm M-F

Phone: (641) 472-4331

Recording Tips for Jefferson County:

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Jefferson County

Properties in any of these areas use Jefferson County forms:

- Batavia

- Fairfield

- Libertyville

- Lockridge

- Packwood

Hours, fees, requirements, and more for Jefferson County

How do I get my forms?

Forms are available for immediate download after payment. The Jefferson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jefferson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jefferson County?

Recording fees in Jefferson County vary. Contact the recorder's office at (641) 472-4331 for current fees.

Questions answered? Let's get started!

Mechanic's liens are governed under Chapter 572 of Iowa Code. A waiver is a conscious relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay. In Iowa, there are no statutory forms for waivers although according to the principles of contract law, the parties may agree to such modifications in writing.

Generally, waivers come in four varieties: conditional or unconditional, and based on a partial/progress or final payment. Conditional waivers only become effective after the responsible party's check clears the bank on which it was drawn, and provide more protection for the claimants. Unconditional waivers go into effect immediately, tend to favor the owners' interests, and should only be used after payment is confirmed. Waiving lien rights after a partial payment allows the claimant to retain some lien rights, but to release others based on the amount paid on the overall balance due. Waivers upon final payments remove the claimant's eligibility to place a lien because they state that the account is paid in full.

Regardless of the nature, waivers must identify the parties, the location of the project, relevant dates, and payments.

Use the final unconditional waiver when a full and final payment is made and collectability of the amount due amount is not an issue. The unconditional waiver should only be granted when payment is made through a verified method. The waiver is effective up to the full amount due and the claimant waives any lien rights without condition.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to property owners or anything else with regard to mechanic's liens.

Important: Your property must be located in Jefferson County to use these forms. Documents should be recorded at the office below.

This Unconditional Waiver on Final Payment meets all recording requirements specific to Jefferson County.

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Unconditional Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Jim H.

August 13th, 2020

Well written form, and the guidance document and example supplied were very helpful.

Thank you!

Moving Forward V.

October 13th, 2023

Great Service!

Thank you!

Beverly D.

January 12th, 2021

Thank You, Job well done. So nice not to have to leave house and drive all over to record these documents. Very satisfied.

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth-Wayne L.

August 20th, 2020

1) I was very pleased when the staff mentioned your service since the three referenced on the Recorder's website all wanted HUGE Account set-up and maintenance fees AND BIG fees per recording, and yours has no set-up fee AND nominal per-recording fee; 2) My (few) recordings will be NON-LAND Related, summary or entire record(s) of Administrative (Procedures Act) records, Other than the Border width and Cover Sheet, do you anticipate any other special requirements for such recording(s)? NOTE: I just sent one by Snail Mail, and they just informed me that due to the GERMIPHOBIA 'Pandemic' the ONLY open and record Snail Mail ONCE A MONTH On the first of each chmonth!

Thank you!

kevin d.

April 19th, 2022

the quitclaim form worked well with the Nevada Recorders office. Tried other vendors, theirs were rejected.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John B.

January 23rd, 2019

Forms are as advertised and easy to access.

Thank you for your feedback. We really appreciate it. Have a great day!

James W.

June 10th, 2019

It turned out that I was able to search for what I needed on the local county website, which is what your site suggested be tried. I was impressed with your honesty and practical instructions for searches your site gave. I'm pretty sure I'll be back.

Thank you for your feedback James. Glad to hear we were able to steer you in the right direction.

Norma C.

September 4th, 2019

Great service and process for recording deeds quickly and easily. Also impressed with prompt replies to messages providing clear and specific instructions/guidance.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jann H.

July 18th, 2019

Was helpful information

Thank you!

Betty B.

February 10th, 2022

Thank you . I appreciate your assistance Once again thanks

Thank you!

Zina J.

October 30th, 2019

Deeds.com supplied exactly what I needed to complete a quitclaim. Deeds.com saved me $180, supplied the necessary forms, and a sample page to use as a guide. I recommend Deeds.com.

Thank you!

Mary W.

June 25th, 2020

Easy to access and good instructions. Where to mail would be the only thing I would add.

Thank you for your feedback. We really appreciate it. Have a great day!

DOYCE F.

September 25th, 2019

Very helpful.Thank you

Thank you!

Fernando C.

August 2nd, 2020

I was happy with my purchase. I honestly received more than I expected . I recommend you expand to offer more forms such as Living Will.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARK S.

March 17th, 2020

Forms seem direct, simple, not what a "big firm" might have, appear sufficient to do the job -- safety in following at least the basics

Thank you!