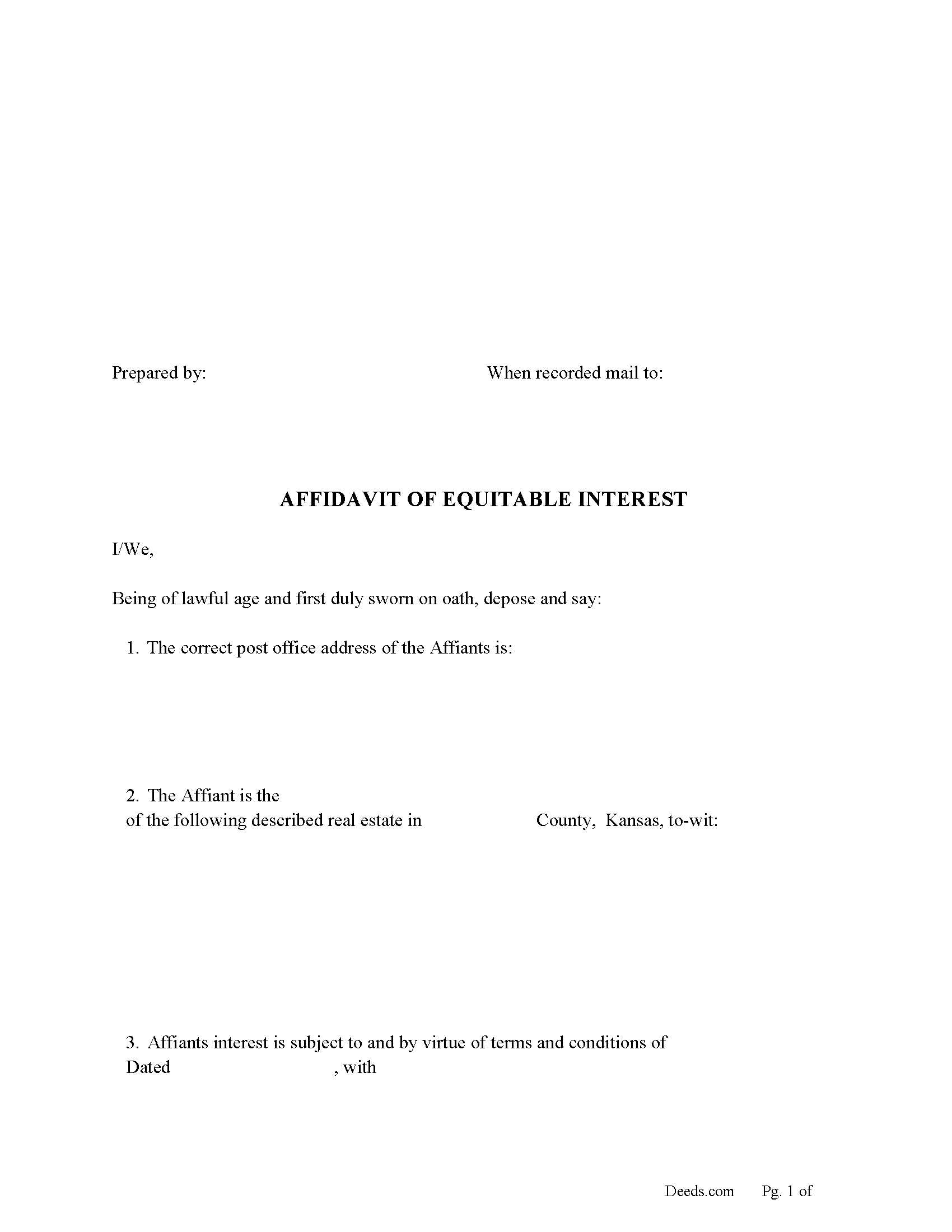

Smith County Affidavit for Equitable Interest Form

Smith County Affidavit for Equitable Interest Form

Fill in the blank Affidavit for Equitable Interest form formatted to comply with all Kansas recording and content requirements.

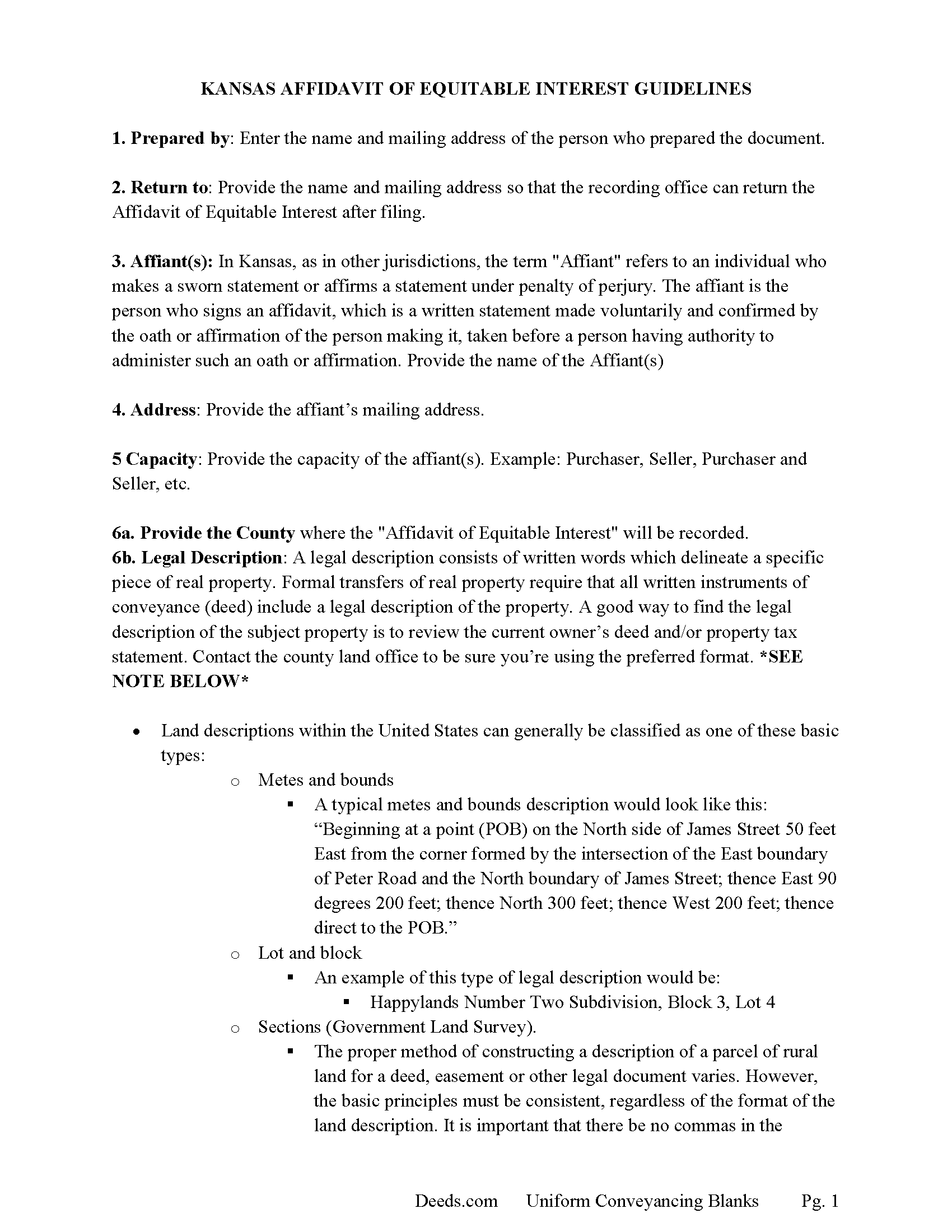

Smith County Affidavit for Equitable Interest Guide

Line by line guide explaining every blank on the Affidavit for Equitable Interest form.

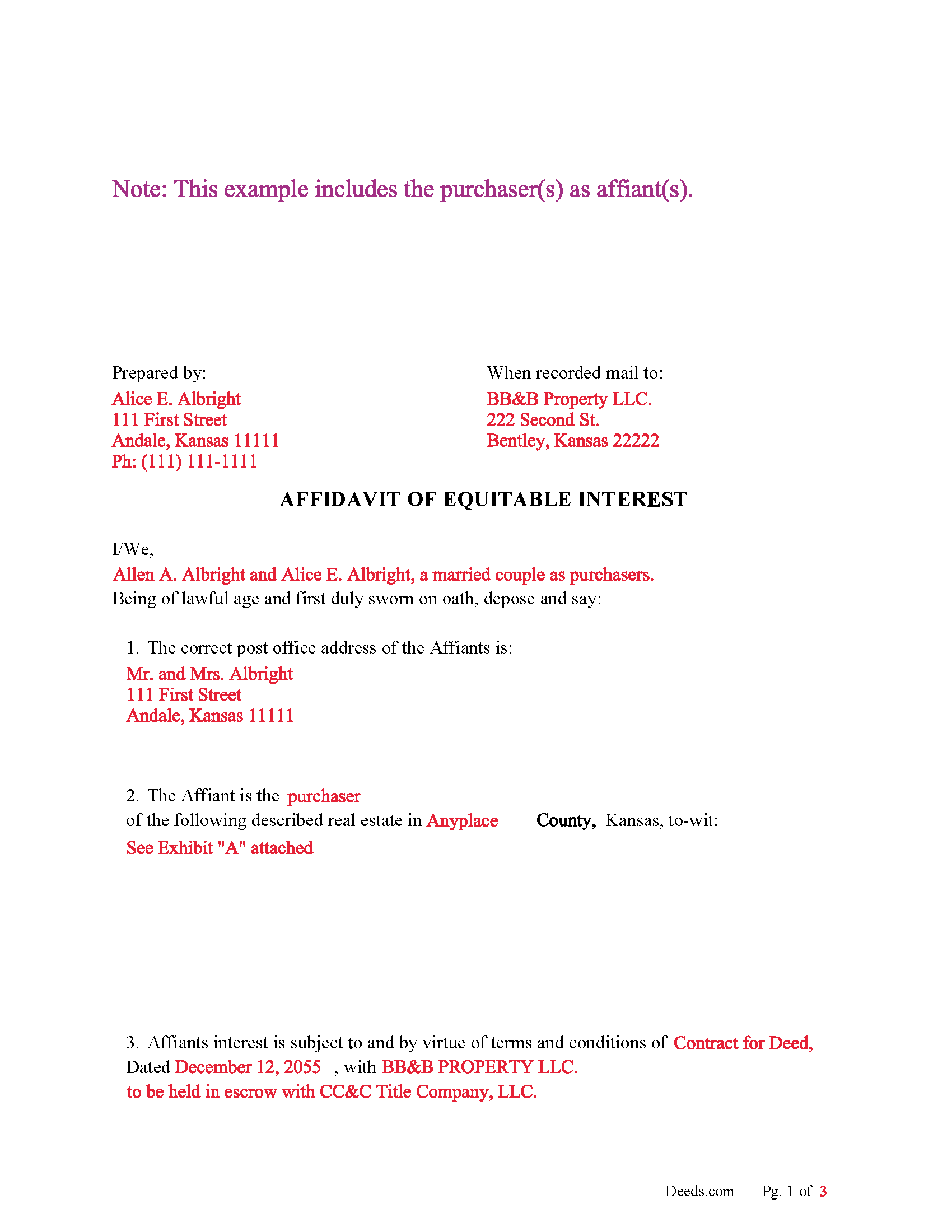

Smith County Completed Example of the Affidavit for Equitable Interest Document

Example of a properly completed Kansas Affidavit for Equitable Interest document for reference.

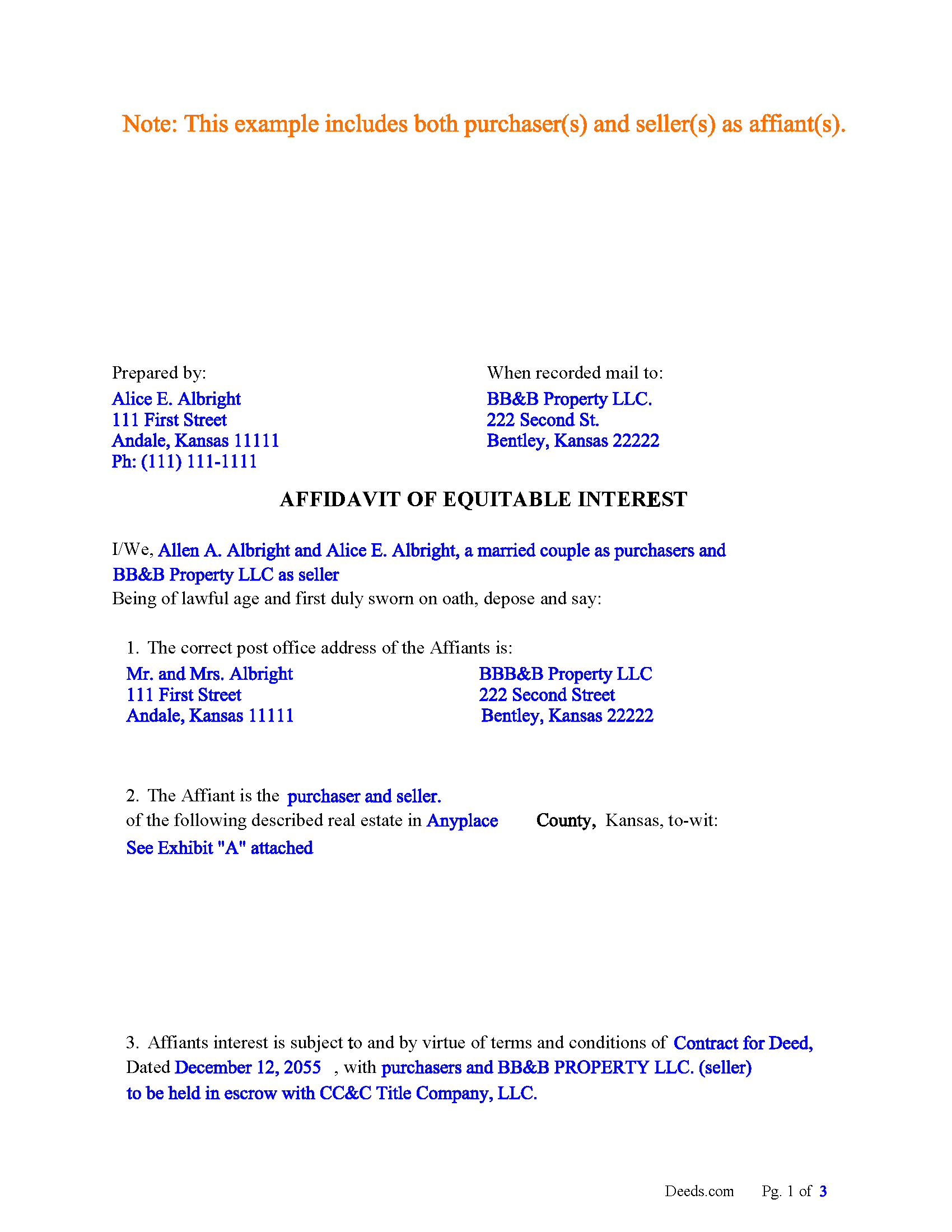

Smith County Completed Example of the Affidavit for Equitable Interest Document

Example of a properly completed Kansas Affidavit for Equitable Interest document for reference.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Register of Deeds

Smith Center, Kansas 66967

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (785) 282-5160

Recording Tips for Smith County:

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Athol

- Cedar

- Gaylord

- Kensington

- Lebanon

- Smith Center

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (785) 282-5160 for current fees.

Questions answered? Let's get started!

In Kansas, as in other jurisdictions, an "Affidavit of Equitable Interest" is a legal document used in real estate transactions to declare the equitable interest of a party in a property. Equitable interest is a type of interest in real estate that indicates a beneficial interest in the property and may arise from a contract, such as a contract for deed, purchase agreement, etc. even though the legal title has not yet been transferred. An affidavit of this type can be filed by either party to the contract, and is often filed by purchasers alone.

Here's a breakdown of what an Affidavit of Equitable Interest typically involves:

1. Declaration of Interest: The affidavit is a sworn statement declaring that the affiant (the person making the affidavit) has an equitable interest in a specific piece of real estate. This interest usually stems from a contractual agreement, like a contract for deed, lease-purchase agreement, or an agreement for deed.

2. Use in Real Estate Transactions: This affidavit is often used in situations where a party needs to prove their interest in a property, but the legal title has not been transferred to them. It can be important in cases where the property is subject to a dispute, or the affiant needs to demonstrate their interest for purposes of a lawsuit, financing, or dealing with government agencies.

3. Details Included: The affidavit will typically include the affiant's name, the description of the property in question, and the nature of the affiant’s equitable interest. It should also detail the circumstances under which the equitable interest was acquired, such as the terms of a contract.

4. Execution and Notarization: As with other affidavits, the Affidavit of Equitable Interest must be signed by the affiant in the presence of a notary public. The notary will acknowledge the signing as a free and voluntary act.

5. Recording: This affidavit may/should be recorded with the county recorder’s office where the property is located. Recording the affidavit can serve as public notice of the affiant's interest in the property, which can be important for protecting that interest.

6. Legal Effect: While an Affidavit of Equitable Interest declares a person's interest in a property, it doesn't grant legal ownership. The legal title remains with the current owner until it's formally transferred.

79-1437c. Real estate sales validation questionnaires;

required to accompany transfers of title; retention time; use of information. No deed or instrument providing for the transfer of title to real estate or affidavit of equitable interest in real estate shall be recorded in the office of the register of deeds unless such deed, instrument or affidavit shall be accompanied by a real estate sales validation questionnaire completed by the grantor or grantee or the agent of such grantor or grantee concerning the property transferred.

(Kansas Affidavit for Equitable Interest Package includes form, guidelines, completed example and sales validation questionnaire) For use in Kansas only.

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Affidavit for Equitable Interest meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Affidavit for Equitable Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Jeff R.

December 10th, 2020

Easy process to receive service. thank you

Thank you!

Ronald L.

January 21st, 2021

There is not enough room on the form to describe my property which was taken directly from the previous deed. Other than that worked as expected.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael K.

April 2nd, 2021

I haven't used them yet. So far so good.

Thank you!

Rocio G.

December 8th, 2020

Better than in person service, I recommend this service 100%.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry L.

September 18th, 2023

Easy, quick and responsive for recording purposes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

GERALD P.

September 19th, 2019

Product is as advertised. Most beneficial is including detailed instructions and examples. Most other options did not include instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia A.

December 13th, 2022

This service was a godsend since I am currently disabled.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richelle B.

August 10th, 2020

Thanks!

Thank you!

Dina O.

December 29th, 2023

easy to use and efficient i like that they give you an example to compare your work to

We are motivated by your feedback to continue delivering excellence. Thank you!

Thomas C.

July 31st, 2021

This platform made electronic filing of a lien easy and quick. I was able to accomplish everything from my laptop and phone, and the fees were reasonable. I would recommend deeds.com for efiling property related documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lorie S.

April 24th, 2024

It was available to download immediately

Thank you!

Christine P.

April 19th, 2020

Great service! Just what I needed and a bunch of informative extras too. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rita M.

January 12th, 2019

Forget what I just wrote! I found it. Thank You! This is a very convenient service.

That's great to hear Rita, thanks for following up.

James B.

July 31st, 2019

Your website is very easy to use. No problem downloading the forms.

Thank you!

Deanna K.

June 28th, 2021

Great service. Prompt and great communication tools. Affordably priced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!