Smith County Certificate of Trust Forms (Kansas)

Express Checkout

Form Package

Certificate of Trust

State

Kansas

Area

Smith County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Smith County specific forms and documents listed below are included in your immediate download package:

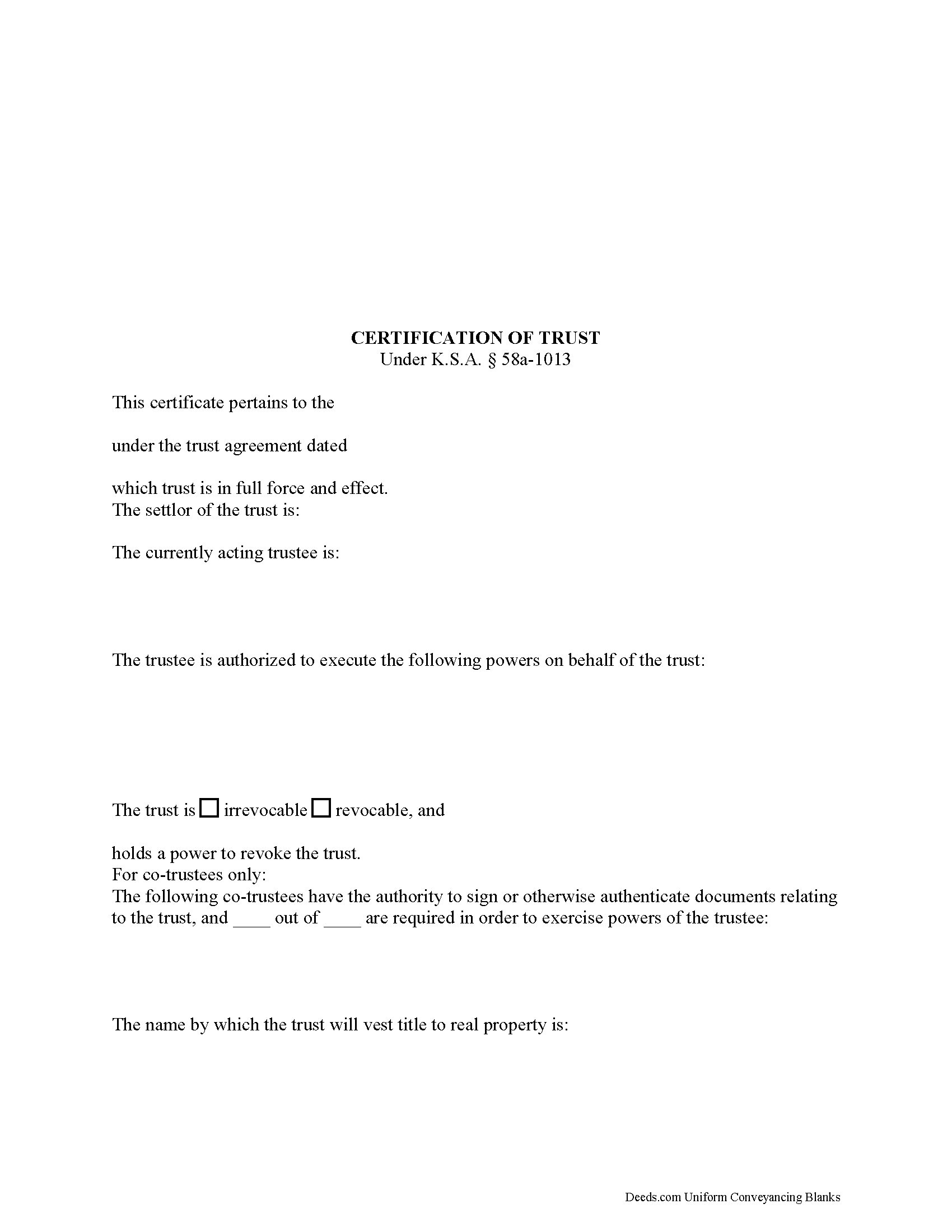

Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 4/4/2024

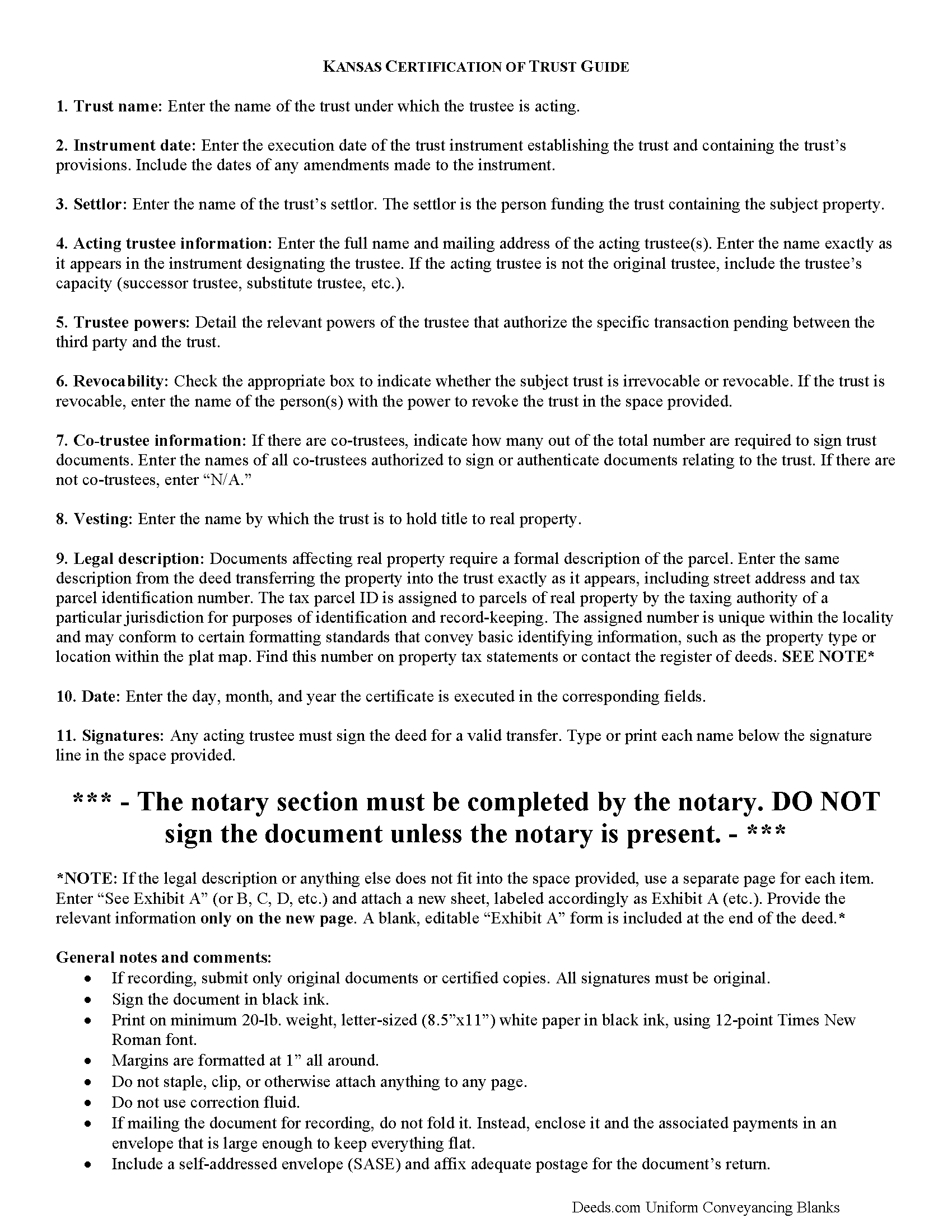

Certificate of Trust Form

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/24/2024

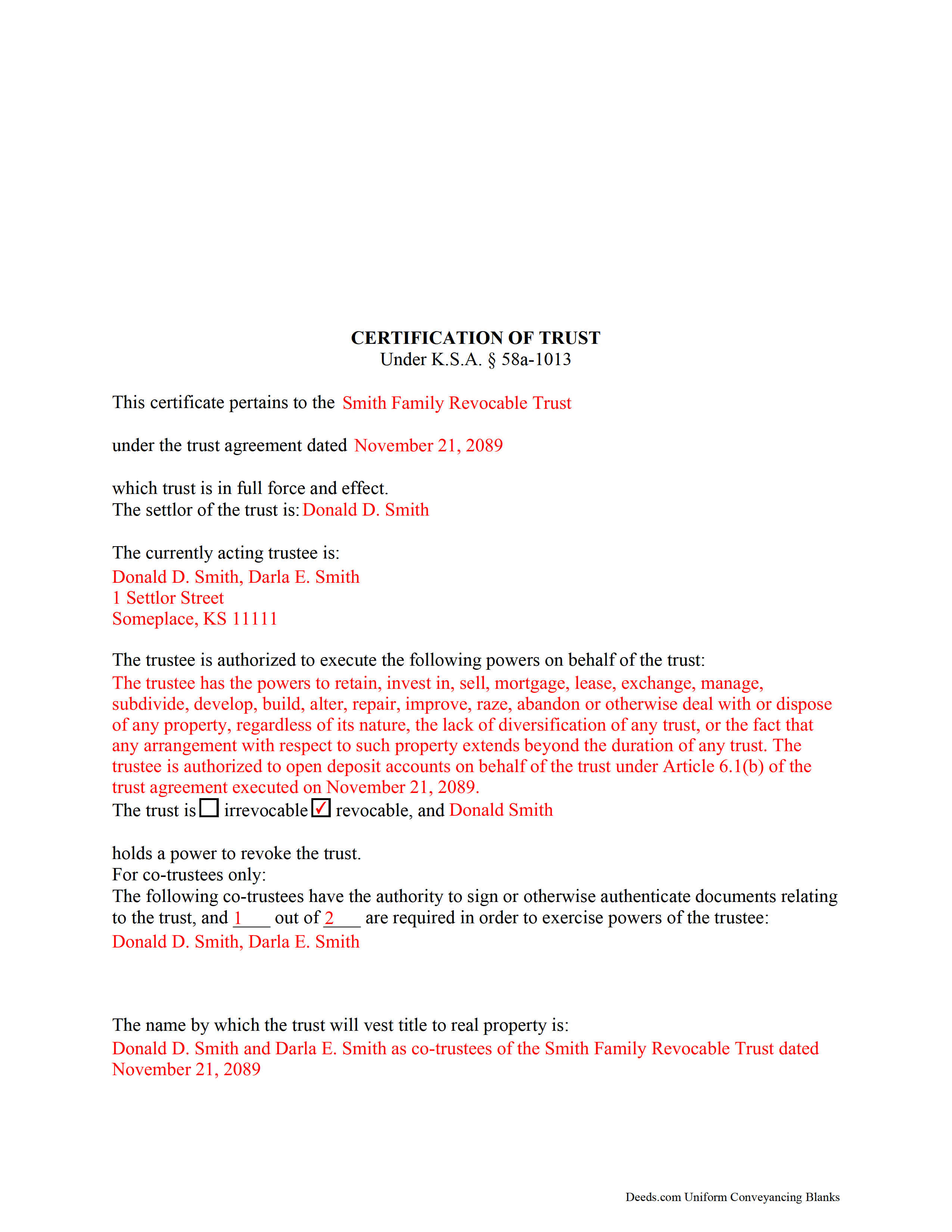

Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

Included document last reviewed/updated 1/31/2024

Included Supplemental Documents

The following Kansas and Smith County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kansas or Smith County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Smith County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Smith County Certificate of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Certificate of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Smith County that you need to transfer you would only need to order our forms once for all of your properties in Smith County.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Certificate of Trust Forms:

- Smith County

Including:

- Athol

- Cedar

- Gaylord

- Kensington

- Lebanon

- Smith Center

What is the Kansas Certificate of Trust

Part of the Kansas Uniform Trust Code, the certification of trust is codified at K.S.A. 58a-1013.

In lieu of the trust instrument, a trustee doing business with a third party who is not a trust beneficiary can provide an acknowledged certification of trust. The certification is an abstract of the trust instrument and contains only information essential to the transaction.

A trust instrument, executed by the trust's settlor, contains the trust provisions. It designates a trustee, or a fiduciary that represents the trust. The trust instrument also identifies the trust beneficiaries, or the person(s) having a present or future interest in the trust (K.S.A. 58a-103(2)(A)).

A certification of trust does not disclose the trust's beneficiaries, or other information a settlor may wish to keep private. In Kansas, only trust instruments pertaining to "the state, or any county, municipality, political or governmental subdivision, or governmental agency of the state as the beneficiary" are required to be recorded (K.S.A. 58-2431, 2).

The document certifies, first and foremost, the existence of the trust and the trustee's authority to represent the trust. The certification also states the name, date, and type (revocable or irrevocable) of trust and provides the identity of the trust's settlor, or the person who established the trust and is funding the trust with assets, as well as the name of any person able to revoke the trust, if applicable.

In addition, the certification details the powers that the trustee has been granted relevant to the transaction at hand. For trusts with more than one trustee, the document identifies all trustees who may authorize documents relating to the trust and whether all or less than all is required to authenticate trust documents. Finally, the certification should include the manner of taking title to trust property.

All Kansas documents affecting real property require a legal description. If using the document in conjunction with a trustee's deed, the certification should contain the legal description of the subject real property.

A recipient of a certification of trust can request copies of excerpts from the original trust instrument and later amendments which designate the trustee and confer the power to act in the pending transaction, but may assume without inquiry the existence of the facts contained in the certification (K.S.A. 58a-1013(e),(f). Requesting the entire trust instrument in addition to the certification or excerpts opens the recipient to certain liabilities in court.

Consult a lawyer for guidance and with any questions relating to trusts or certifications of trust, as each situation is unique.

(Kansas Certificate of Trust Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4323 Reviews)

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Mitchell S.

April 25th, 2024

This service was very helpful, quick, inexpensive and easy to use. Should I ever need it again, I know right where to go.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Rebecca W.

January 24th, 2023

Very easy to find and download.

Thank you!

Tommie G.

March 11th, 2021

I saved 225.00 with this purchase.Make sure you have an updated property description from

your county tax collectors' office.In Bay county,Florida the tax office will email you an updated property description.I attached the email to the the deed.I had to change the date and they accepted a white out and ink correction on your form.

Thank you for your feedback. We really appreciate it. Have a great day!

Carol F.

May 22nd, 2019

Instructions were easy to follow and it was reasonable

Thank you for your feedback. We really appreciate it. Have a great day!

Joy N.

February 22nd, 2024

As a real estate professional, I've had the opportunity to use various legal form providers over the years, but none have matched the quality and user-friendliness of Deeds.com's real estate legal forms.

The forms themselves are comprehensive, up-to-date, and in line with current real estate laws and regulations, which is paramount in our field. The clarity and thoroughness of the documentation ensured that I could complete with confidence, knowing that every detail was covered.

I wholeheartedly recommend their services and look forward to continuing our partnership.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Delsina T.

October 9th, 2020

So helpful. Thank you so much for making this a smooth process.

Thank you!

Colleen B.

September 20th, 2020

Looks good. We will see how it goes.

Thank you!

Robert S.

December 21st, 2018

Were unable to help me because of the recorders office but credited my account promptly

Thank you for your feedback. We really appreciate it. Have a great day!

Dawna M.

June 15th, 2021

Easy to use website and immediate documents appropriate for my area. My only complaint is that the forms had an alignment problem where the fields that were filled in by me did not line up with the template text. I tried to correct it to no avail so I ended up having to retype the entire document. I purchased two templates and both had the same issue.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas F.

February 18th, 2021

Very convenient!

Thank you!

Richard G.

March 17th, 2023

Easy to use. I was able to find out what I needed quickly and was able to download the information necessary.

Thank you!

Dianne W.

July 14th, 2020

Thank you for responding so quickly to my question. I was able to locate the form and get everything downloaded. Once I saw the icon, it was easy peasy!!

Thank you!

Christine B. B.

May 20th, 2019

The Personal Representatives Deed is definitely a helpful document for my files. I find it need just a little tweaking by deeds.com ,

There should be more space for the legal description. I did see in the FAQ's you recommend putting it in the Exhibit and this is what I did. Also I couldn't get the year to be accepted and had to write it in. These are just some minor suggestions, on the whole I was grateful to find this document. Thank you.

Thank you for your feedback. Sorry to hear that you had trouble with the date field, we will have it reviewed.

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.