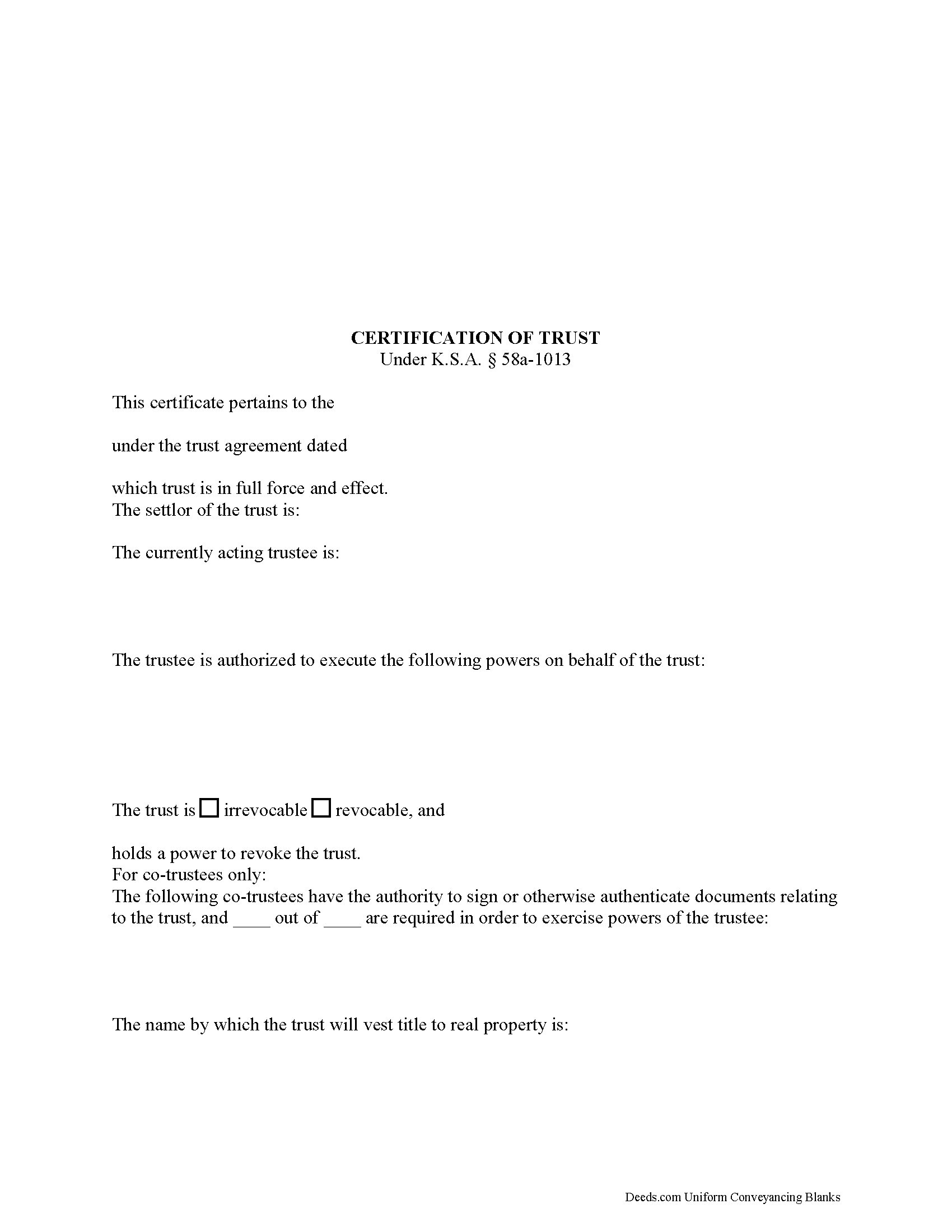

Decatur County Certificate of Trust Form

Decatur County Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Decatur County Certificate of Trust Form

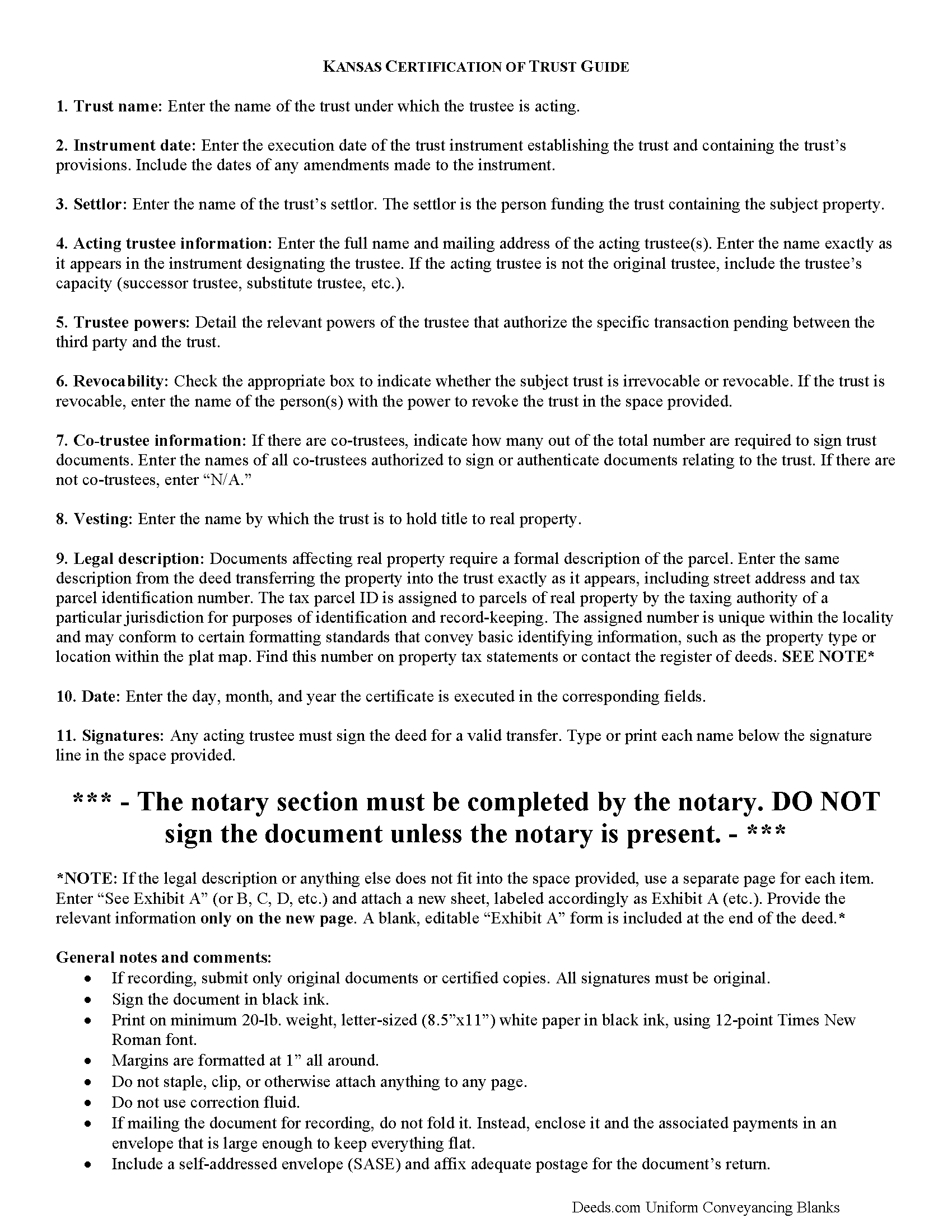

Line by line guide explaining every blank on the form.

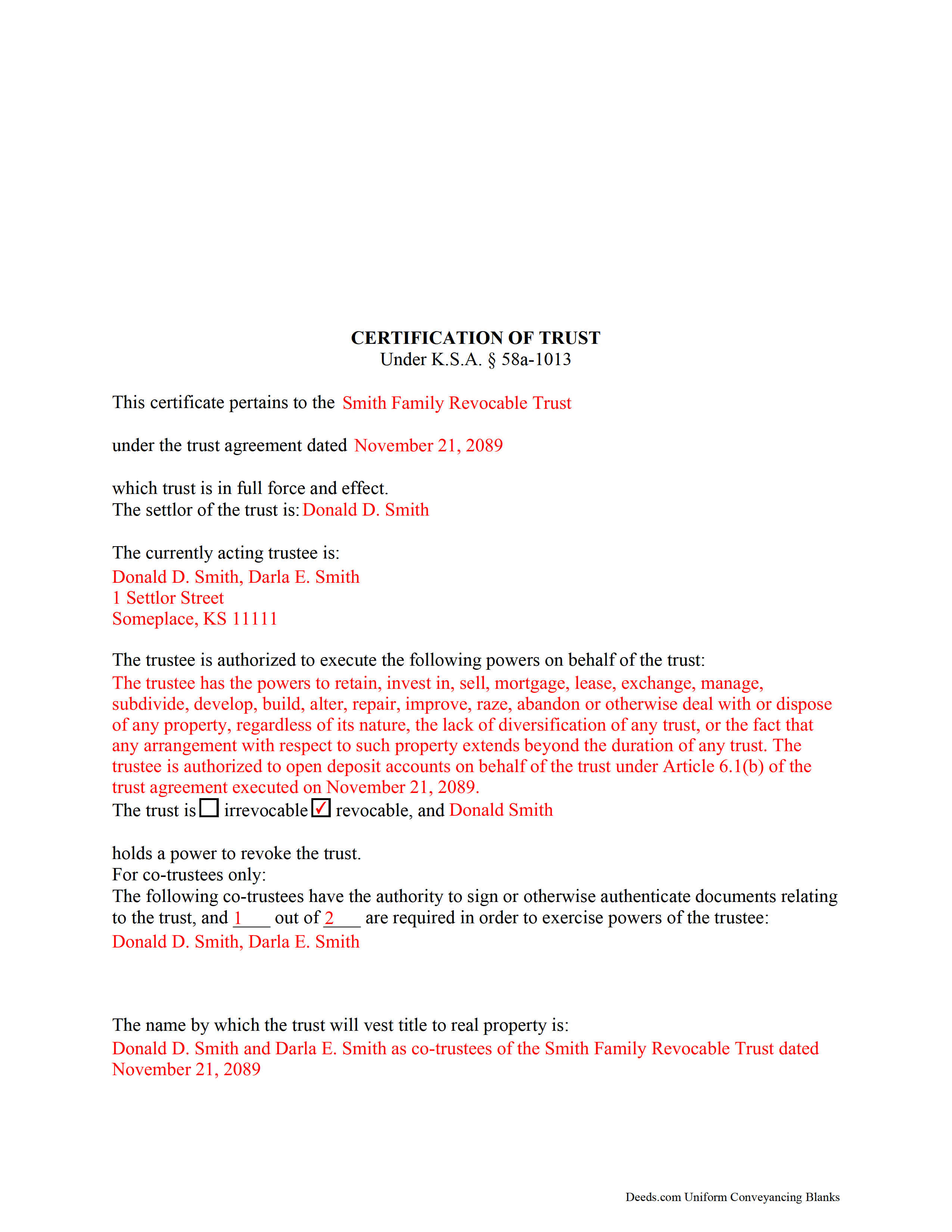

Decatur County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Decatur County documents included at no extra charge:

Where to Record Your Documents

Decatur County Register of Deeds

Oberlin, Kansas 67749

Hours: 8-12, 1-5

Phone: (785) 475-8105

Recording Tips for Decatur County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Decatur County

Properties in any of these areas use Decatur County forms:

- Dresden

- Jennings

- Norcatur

- Oberlin

Hours, fees, requirements, and more for Decatur County

How do I get my forms?

Forms are available for immediate download after payment. The Decatur County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Decatur County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Decatur County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Decatur County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Decatur County?

Recording fees in Decatur County vary. Contact the recorder's office at (785) 475-8105 for current fees.

Questions answered? Let's get started!

Part of the Kansas Uniform Trust Code, the certification of trust is codified at K.S.A. 58a-1013.

In lieu of the trust instrument, a trustee doing business with a third party who is not a trust beneficiary can provide an acknowledged certification of trust. The certification is an abstract of the trust instrument and contains only information essential to the transaction.

A trust instrument, executed by the trust's settlor, contains the trust provisions. It designates a trustee, or a fiduciary that represents the trust. The trust instrument also identifies the trust beneficiaries, or the person(s) having a present or future interest in the trust (K.S.A. 58a-103(2)(A)).

A certification of trust does not disclose the trust's beneficiaries, or other information a settlor may wish to keep private. In Kansas, only trust instruments pertaining to "the state, or any county, municipality, political or governmental subdivision, or governmental agency of the state as the beneficiary" are required to be recorded (K.S.A. 58-2431, 2).

The document certifies, first and foremost, the existence of the trust and the trustee's authority to represent the trust. The certification also states the name, date, and type (revocable or irrevocable) of trust and provides the identity of the trust's settlor, or the person who established the trust and is funding the trust with assets, as well as the name of any person able to revoke the trust, if applicable.

In addition, the certification details the powers that the trustee has been granted relevant to the transaction at hand. For trusts with more than one trustee, the document identifies all trustees who may authorize documents relating to the trust and whether all or less than all is required to authenticate trust documents. Finally, the certification should include the manner of taking title to trust property.

All Kansas documents affecting real property require a legal description. If using the document in conjunction with a trustee's deed, the certification should contain the legal description of the subject real property.

A recipient of a certification of trust can request copies of excerpts from the original trust instrument and later amendments which designate the trustee and confer the power to act in the pending transaction, but may assume without inquiry the existence of the facts contained in the certification (K.S.A. 58a-1013(e),(f). Requesting the entire trust instrument in addition to the certification or excerpts opens the recipient to certain liabilities in court.

Consult a lawyer for guidance and with any questions relating to trusts or certifications of trust, as each situation is unique.

(Kansas Certificate of Trust Package includes form, guidelines, and completed example)

Important: Your property must be located in Decatur County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Decatur County.

Our Promise

The documents you receive here will meet, or exceed, the Decatur County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Decatur County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Jeffrey G.

January 10th, 2022

We had a one-time-only recording to make in the District of Columbia. We could not have e-filed the document without the assistance Deeds.com! The service they provided was wonderful.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry H.

March 29th, 2019

Wow! So easy and such a cost savings. Thanks

Thanks Larry, we appreciate your feedback.

Jennifer C.

January 8th, 2021

Fast turnaround. Very much appreciated!

Thank you!

Michael R.

August 25th, 2025

A suggestion: Include instructions on how to add your spouse to the deed, rather than transferring completely to a third party

Thank you for your thoughtful feedback. Adding a spouse to a deed is a common need, and suggestions like yours help us identify where additional guidance would be useful. We’ll take this into consideration as we continue improving our resources.

Bea Lou H.

December 2nd, 2022

easy access and easy to find what I was looking for. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Terry C.

July 29th, 2021

It is a difficult challenge -- trying to take the needless jargon out of legal transactions so ordinary citizens can manage their affairs. Deeds.com hasn't solved all the problems, but has made a super effort to help us achieve self-sufficiency.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles B.

December 14th, 2019

Excellent andeasy to navigate website for non-lawyers. Needed some forms for a specific county in a specific state, and Deeds.com took me right there, where I downloaded the forms and a guide on how to fill them out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jenifer L.

January 2nd, 2019

I'm an attorney. I see youve mixed up the terms "grantor" and "grantee" and their respective rights in this version. Anyone using it like this might have title troubles down the line.

Thank you for your feedback Jenifer, we have flagged the document for review.

Gina B.

March 30th, 2023

This website is reliable and informative. So glad I can across this website. They provide a wide range of documents that are always provided on the recording county website. Thanks!

Thank you!

Gary S.

January 9th, 2022

Easy to use. Very helpful

Thank you!

Richard S.

February 11th, 2021

Nicely done. Smooooth

Thank you for your feedback. We really appreciate it. Have a great day!

Mikel R.

February 16th, 2021

Definitely recommend. Superb customer service. Well worth the money! Thanks again!

Thank you for your feedback. We really appreciate it. Have a great day!

Z. L.

October 20th, 2021

I appreciate a service that can reach any county in Texas to file deed distribution deeds. It is convenient, time and money saving for our clients and takes the headache out of estate administration. Thanks.

Thank you!

Karen D.

July 17th, 2020

Awesome,thorough, and fast.

Thank you!

Deborah P.

June 7th, 2021

Very good information. Easy access and easy to download. All the forms needed for TOD to be notarized and recorded with the county office. Much better than working with a Trust and the expense of lawyers, especially when several parties are involved and the owner of said property knows exactly to whom the property should go. Having forms and instructions available for the public to have their wishes recorded and confirmed makes handling final planning much easier and prevents family members from having the unnecessary task of going through court to solve property distribution issues. Thank you for this site and the forms you provide. I will recommend Deeds.com to those I know who are making final plans.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!