Download Kansas Certificate of Trust Legal Forms

Kansas Certificate of Trust Overview

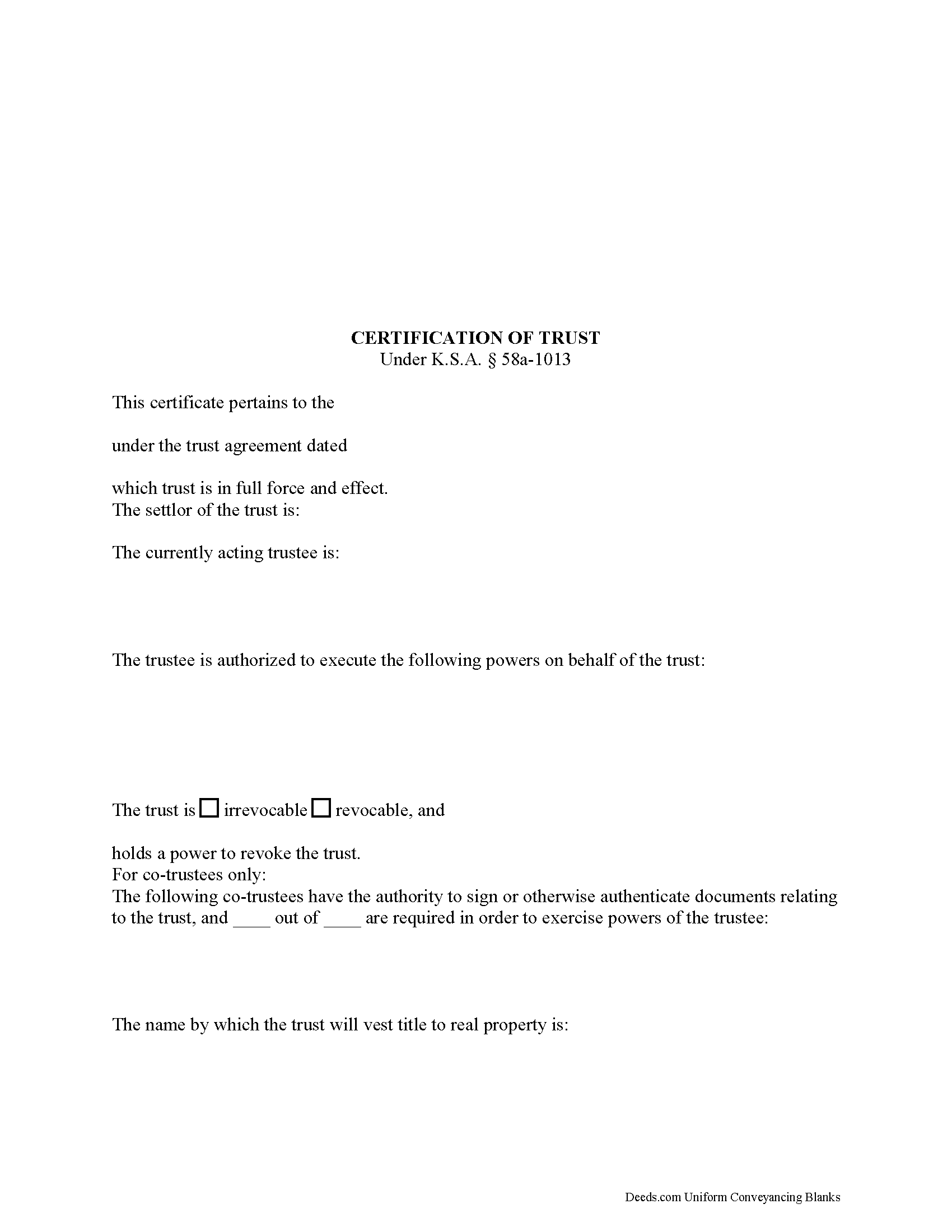

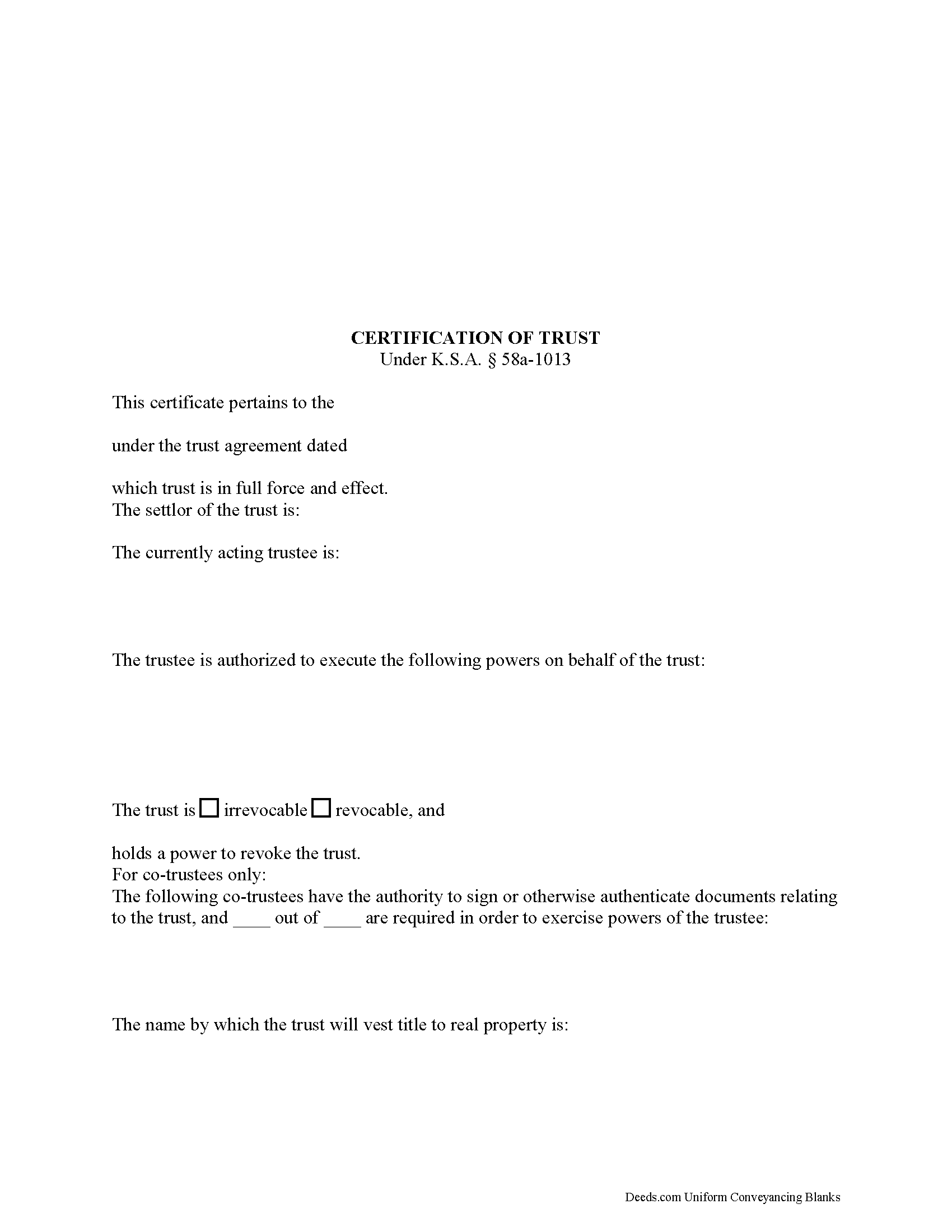

Part of the Kansas Uniform Trust Code, the certification of trust is codified at K.S.A. 58a-1013.

In lieu of the trust instrument, a trustee doing business with a third party who is not a trust beneficiary can provide an acknowledged certification of trust. The certification is an abstract of the trust instrument and contains only information essential to the transaction.

A trust instrument, executed by the trust's settlor, contains the trust provisions. It designates a trustee, or a fiduciary that represents the trust. The trust instrument also identifies the trust beneficiaries, or the person(s) having a present or future interest in the trust (K.S.A. 58a-103(2)(A)).

A certification of trust does not disclose the trust's beneficiaries, or other information a settlor may wish to keep private. In Kansas, only trust instruments pertaining to "the state, or any county, municipality, political or governmental subdivision, or governmental agency of the state as the beneficiary" are required to be recorded (K.S.A. 58-2431, 2).

The document certifies, first and foremost, the existence of the trust and the trustee's authority to represent the trust. The certification also states the name, date, and type (revocable or irrevocable) of trust and provides the identity of the trust's settlor, or the person who established the trust and is funding the trust with assets, as well as the name of any person able to revoke the trust, if applicable.

In addition, the certification details the powers that the trustee has been granted relevant to the transaction at hand. For trusts with more than one trustee, the document identifies all trustees who may authorize documents relating to the trust and whether all or less than all is required to authenticate trust documents. Finally, the certification should include the manner of taking title to trust property.

All Kansas documents affecting real property require a legal description. If using the document in conjunction with a trustee's deed, the certification should contain the legal description of the subject real property.

A recipient of a certification of trust can request copies of excerpts from the original trust instrument and later amendments which designate the trustee and confer the power to act in the pending transaction, but may assume without inquiry the existence of the facts contained in the certification (K.S.A. 58a-1013(e),(f). Requesting the entire trust instrument in addition to the certification or excerpts opens the recipient to certain liabilities in court.

Consult a lawyer for guidance and with any questions relating to trusts or certifications of trust, as each situation is unique.

(Kansas Certificate of Trust Package includes form, guidelines, and completed example)