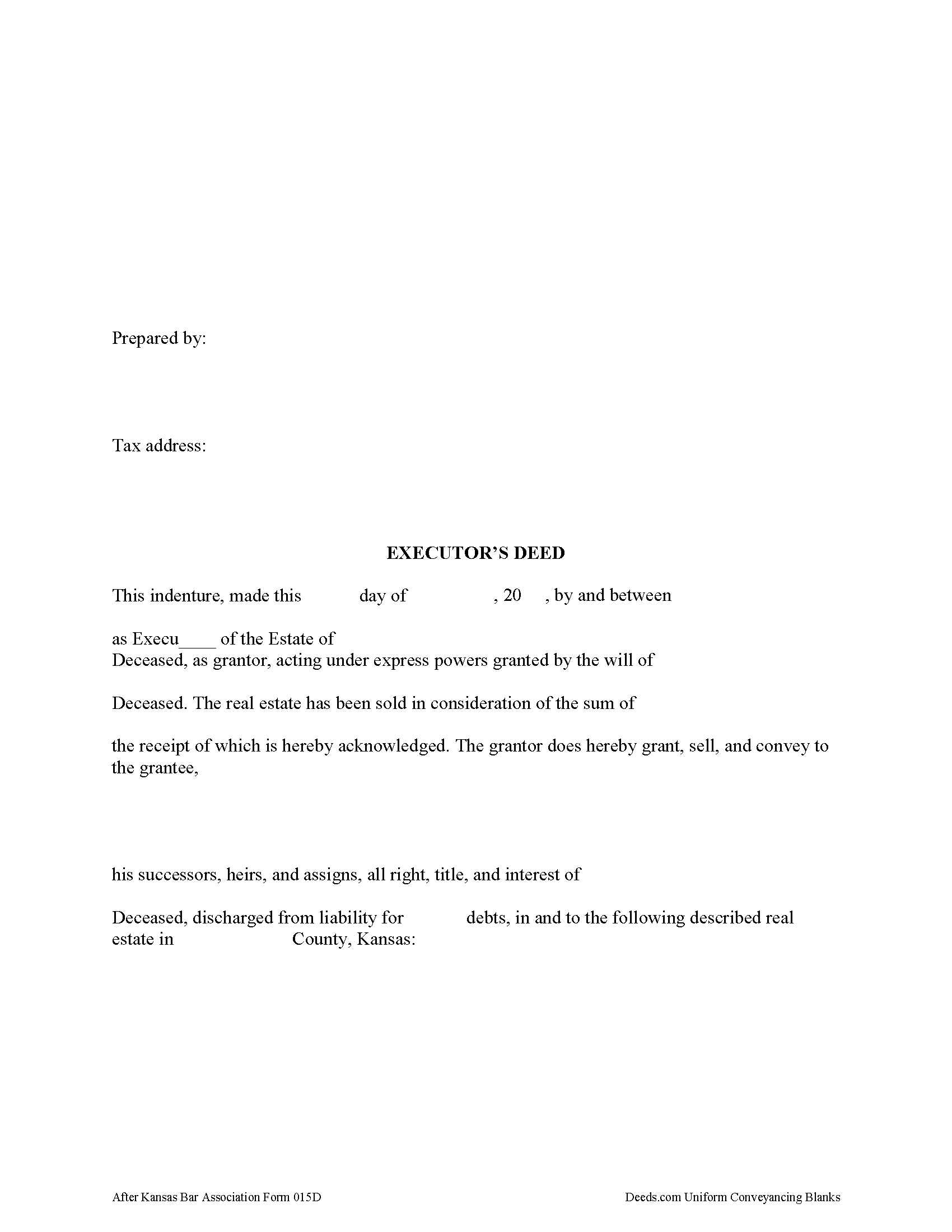

Dickinson County Executor Deed with Power of Sale Form

Dickinson County Executor Deed with Power of Sale Form

Fill in the blank form formatted to comply with all recording and content requirements.

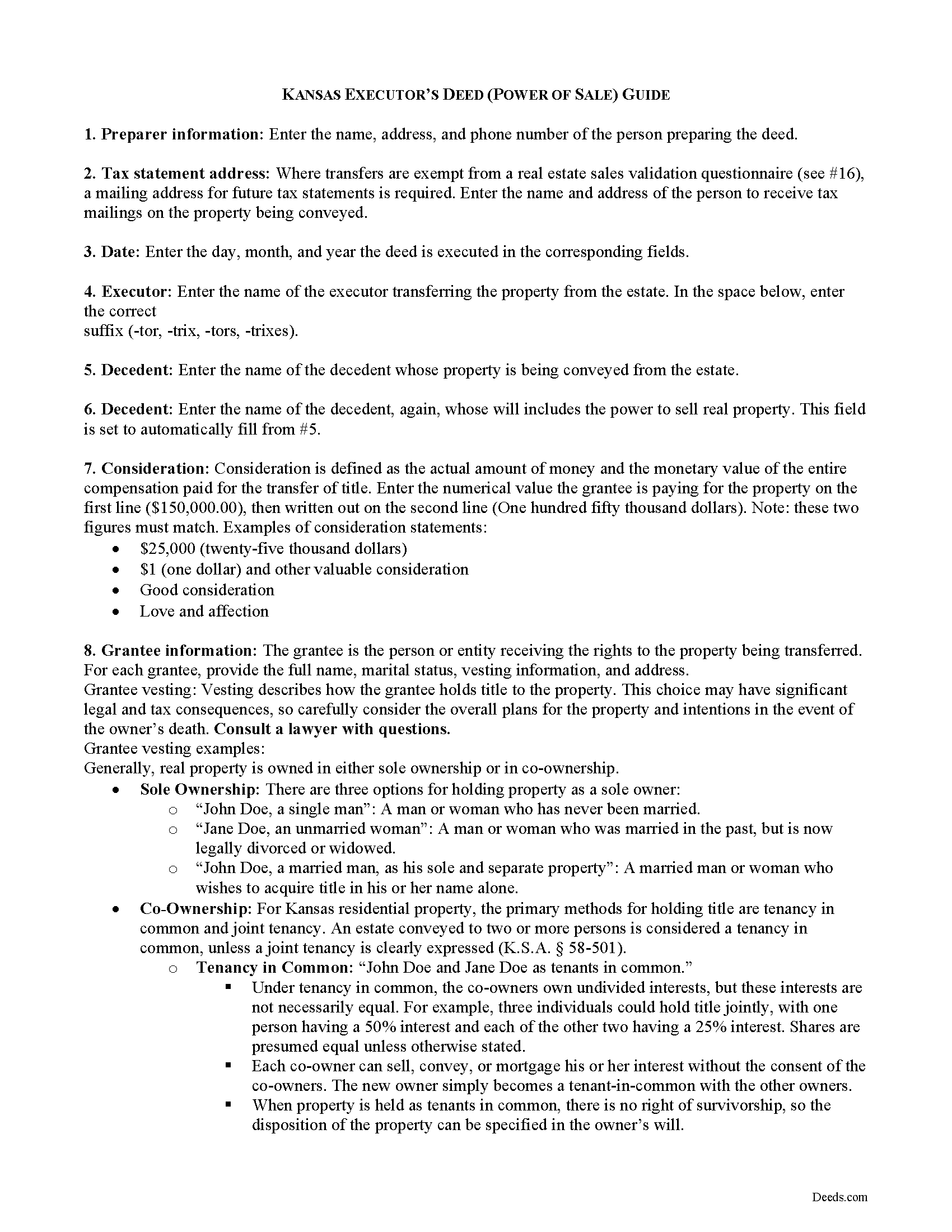

Dickinson County Executor Deed with Power of Sale Guide

Line by line guide explaining every blank on the form.

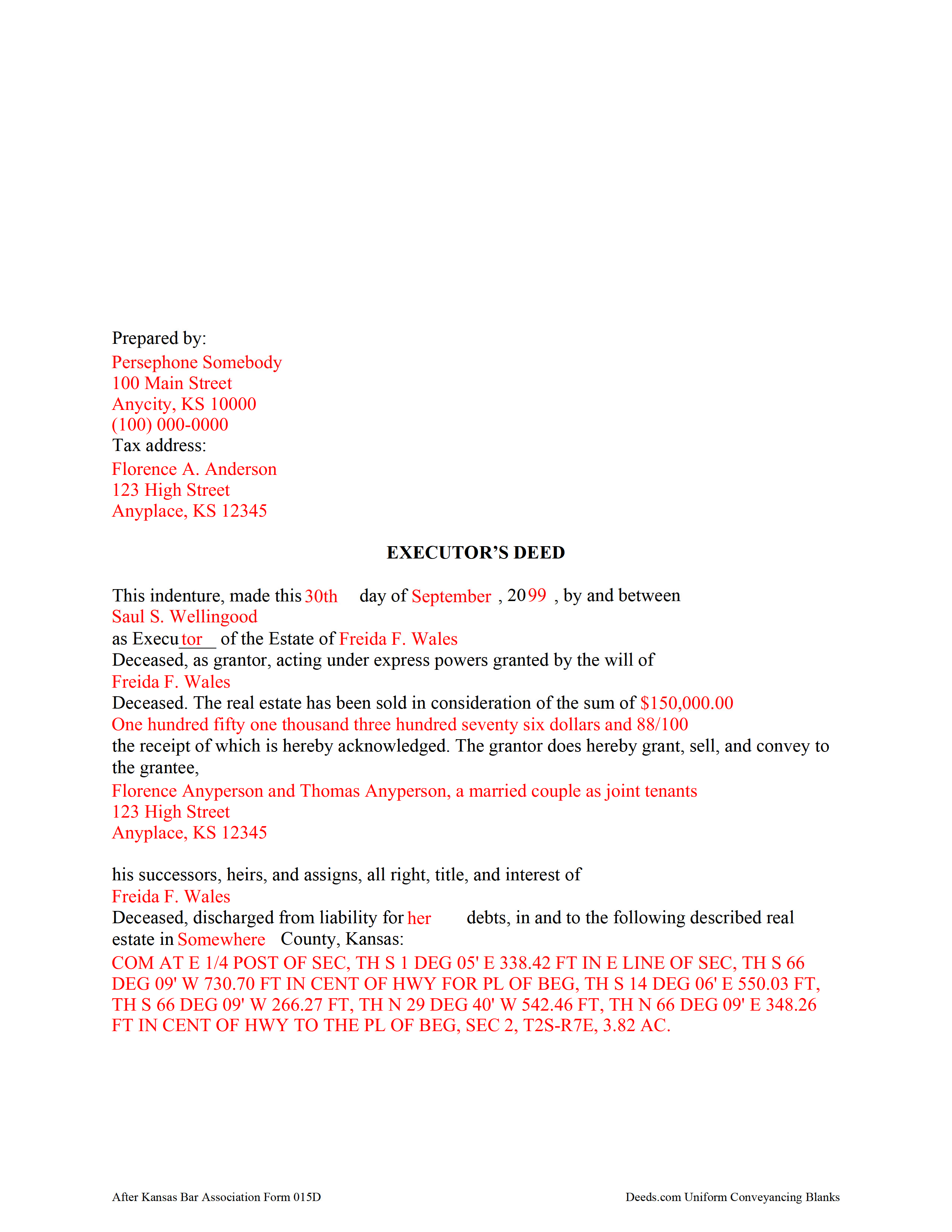

Dickinson County Completed Example of the Executor Deed with Power of Sale Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Dickinson County documents included at no extra charge:

Where to Record Your Documents

Dickinson County Register of Deeds

Abilene, Kansas 67410

Hours: 8:00am-5:00pm M-F

Phone: (785) 263-3073

Recording Tips for Dickinson County:

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Dickinson County

Properties in any of these areas use Dickinson County forms:

- Abilene

- Chapman

- Enterprise

- Herington

- Hope

- Solomon

- Talmage

- Woodbine

Hours, fees, requirements, and more for Dickinson County

How do I get my forms?

Forms are available for immediate download after payment. The Dickinson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dickinson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dickinson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dickinson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dickinson County?

Recording fees in Dickinson County vary. Contact the recorder's office at (785) 263-3073 for current fees.

Questions answered? Let's get started!

When the decedent dies testate (with a will), naming a personal representative (PR) of his or her estate, the PR is called an executor. An executor may need to sell the decedent's real property to raise money to pay the estate's debts or for other reasons in the best interest of the estate.

An order for sale is required before an executor can transfer real property, unless the decedent's will includes a power of sale.

Use an executor's deed with power of sale after the district court has issued an order for sale to convey real property from the estate. In addition to meeting all state and local standards for conveyances of real property, the deed includes a recitation of facts concerning the executor, the decedent, the order for sale, and the subject property being transferred. The executor signs the completed form in the presence of a notary public prior to recording.

Supplemental documentation may be required, depending on the nature of the transfer. Consult a lawyer with questions about estate administration in Kansas.

(Kansas Executor Deed with POS Package includes form, guidelines, and completed example)

Important: Your property must be located in Dickinson County to use these forms. Documents should be recorded at the office below.

This Executor Deed with Power of Sale meets all recording requirements specific to Dickinson County.

Our Promise

The documents you receive here will meet, or exceed, the Dickinson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dickinson County Executor Deed with Power of Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Monte J.

June 28th, 2019

Very helpful.

Thank you!

Melinda P.

January 4th, 2020

I received my documents immediately! Thats was a huge relief!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathie C.

August 13th, 2024

This was the first time I have used Deeds.com and I must say that I am extremely impressed. The person that handled my packages was amazing and extremely helpful. I am recommending that our firm starts using Deeds.com and we do a lot of e-recordings. Thank you so much for making this a great experience and for all of your efforts in making it so great!!!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Charlotte F.

September 2nd, 2020

Great follow up and consideration

Thank you for your feedback. We really appreciate it. Have a great day!

Beverly M.

January 5th, 2019

GREAT FORMS. THANK YOU.

Thank you!

DEBORAH H.

January 22nd, 2024

This is my fourth try, and I hope my form is complete and acceptable.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

sean m.

April 28th, 2021

Wow everything I need in one place... what a concept. thanks Deeds.com for the deeds, the guides and the transfer certificate all included for a great price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marie A.

February 12th, 2019

Easy to download, helpful information and forms quick when you need them. Thank you Deeds.com.

Thank you Marie!

Deborah P.

June 7th, 2021

Very good information. Easy access and easy to download. All the forms needed for TOD to be notarized and recorded with the county office. Much better than working with a Trust and the expense of lawyers, especially when several parties are involved and the owner of said property knows exactly to whom the property should go. Having forms and instructions available for the public to have their wishes recorded and confirmed makes handling final planning much easier and prevents family members from having the unnecessary task of going through court to solve property distribution issues. Thank you for this site and the forms you provide. I will recommend Deeds.com to those I know who are making final plans.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol M.

April 26th, 2021

Very user friendly. Glad I found your site.

Thank you!

John V.

June 17th, 2020

getting the proper forms was easy--filling them out, not so much

Thank you!

Feng T.

November 11th, 2021

Professional product, with clear instructions that gave me high confidence in the accuracy my document. The sample form was super useful. I highly recommend and will reuse Deed.com

Thank you for your feedback. We really appreciate it. Have a great day!

Michael A.

November 14th, 2020

Customer service was poor. I felt like I had to debate the representative to provide guidance and assistance. They acted as though I knew the process, the documents involved, etc. At the same time, they asked me to confirm which documents or at least pages needed to be filed. I was leaning of Deeds.com for their expertise.

Thank you!

Bobby Y.

June 7th, 2024

I like the content and the availability to conduct valuable business online

Thank you!

RUTH A.

November 8th, 2024

I truly appreciate the service that you have for the customers. This very convenient and easy to follow. Thank you very much for this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.