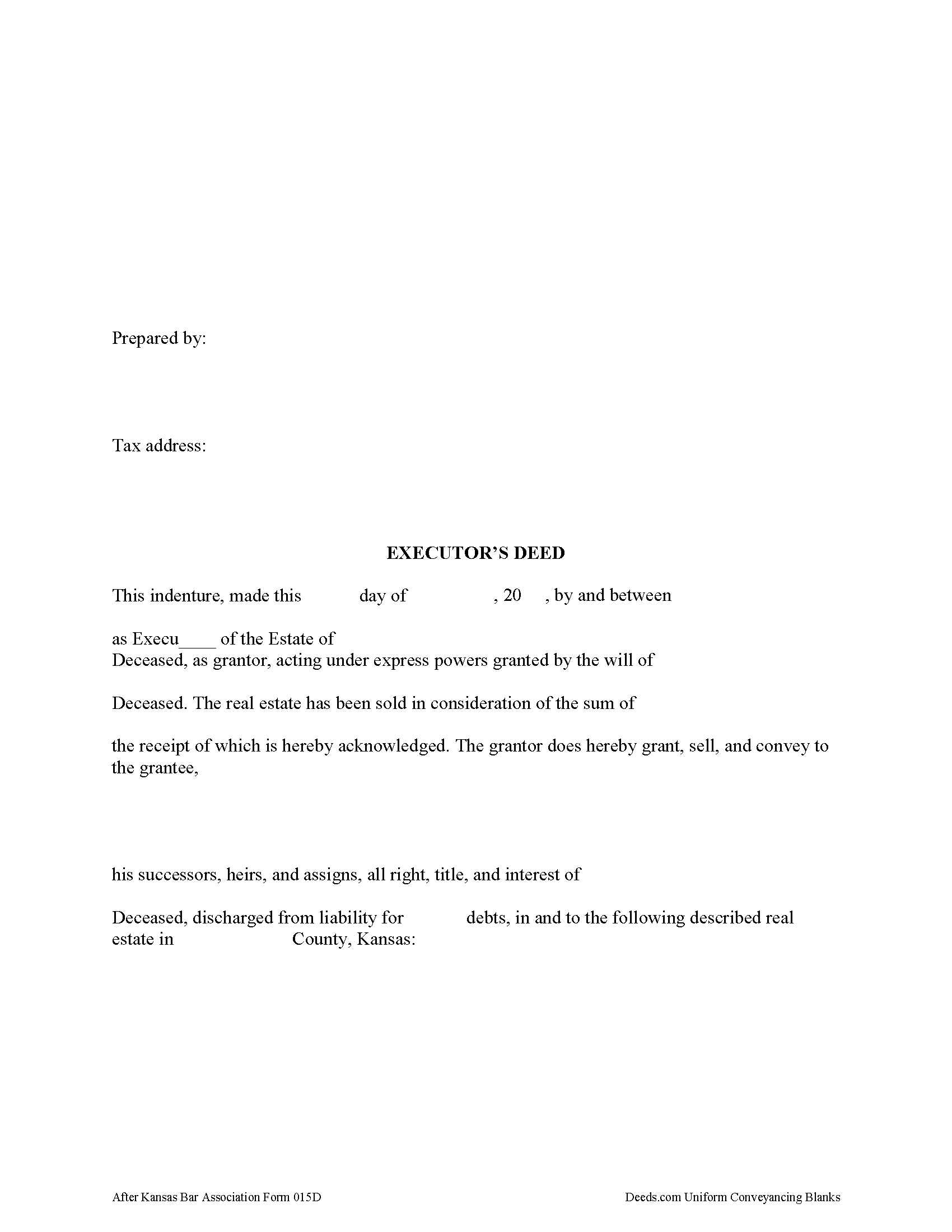

Johnson County Executor Deed with Power of Sale Form

Johnson County Executor Deed with Power of Sale Form

Fill in the blank form formatted to comply with all recording and content requirements.

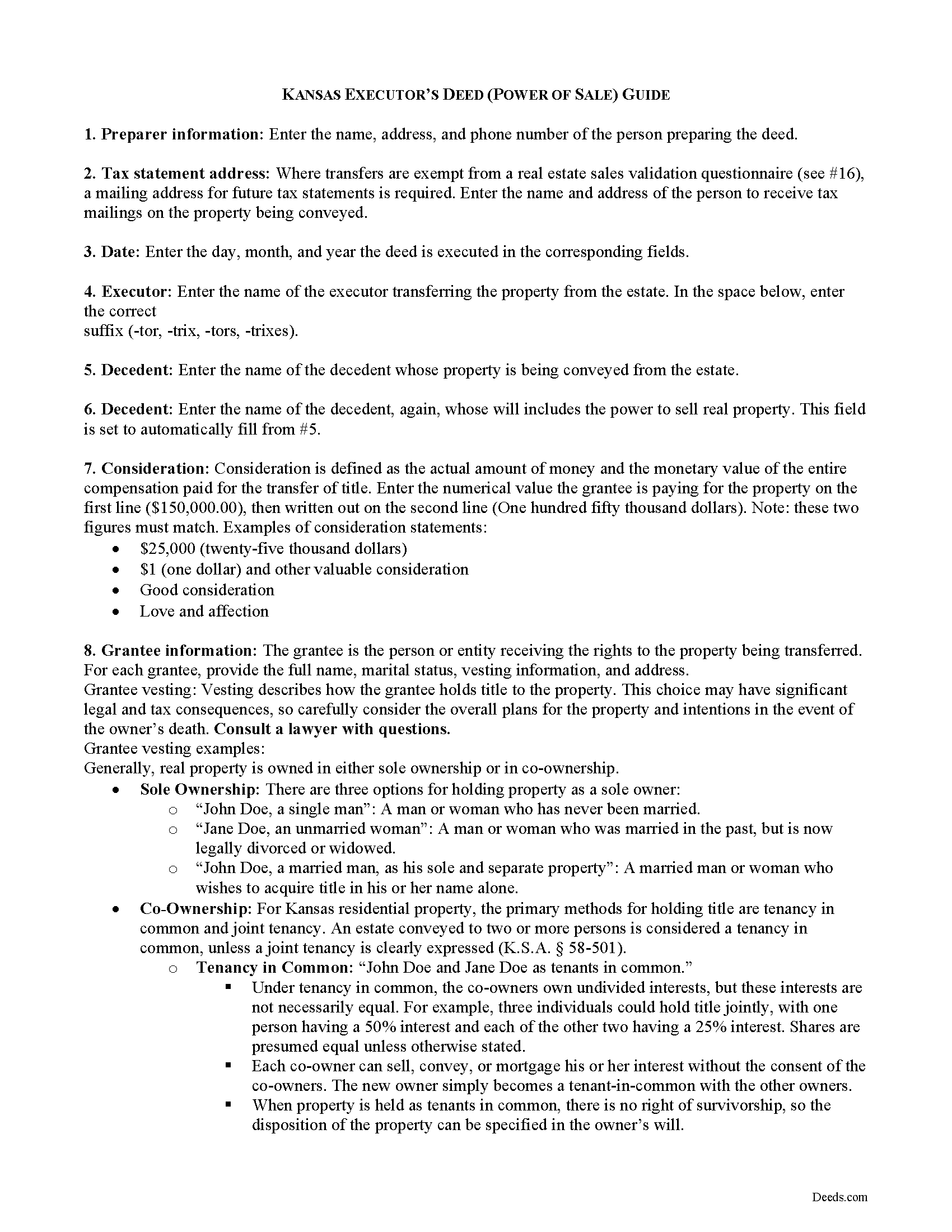

Johnson County Executor Deed with Power of Sale Guide

Line by line guide explaining every blank on the form.

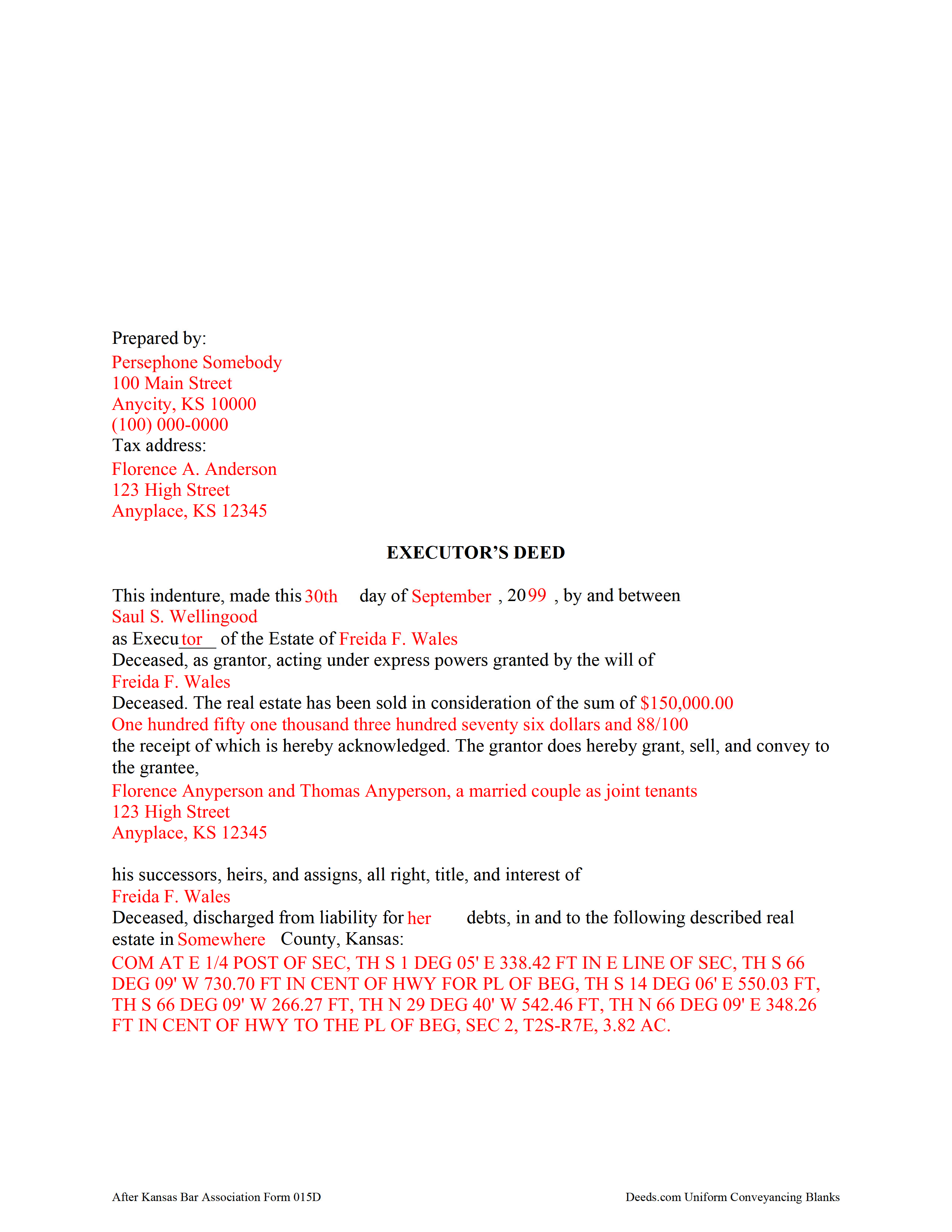

Johnson County Completed Example of the Executor Deed with Power of Sale Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Johnson County documents included at no extra charge:

Where to Record Your Documents

Records and Tax Administration

Olathe, Kansas 66061

Hours: 8:00am-5:00pm M-F

Phone: (913) 715-0775

Recording Tips for Johnson County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Clearview City

- De Soto

- Edgerton

- Gardner

- Leawood

- Lenexa

- Mission

- New Century

- Olathe

- Overland Park

- Prairie Village

- Shawnee

- Shawnee Mission

- Spring Hill

- Stilwell

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (913) 715-0775 for current fees.

Questions answered? Let's get started!

When the decedent dies testate (with a will), naming a personal representative (PR) of his or her estate, the PR is called an executor. An executor may need to sell the decedent's real property to raise money to pay the estate's debts or for other reasons in the best interest of the estate.

An order for sale is required before an executor can transfer real property, unless the decedent's will includes a power of sale.

Use an executor's deed with power of sale after the district court has issued an order for sale to convey real property from the estate. In addition to meeting all state and local standards for conveyances of real property, the deed includes a recitation of facts concerning the executor, the decedent, the order for sale, and the subject property being transferred. The executor signs the completed form in the presence of a notary public prior to recording.

Supplemental documentation may be required, depending on the nature of the transfer. Consult a lawyer with questions about estate administration in Kansas.

(Kansas Executor Deed with POS Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Executor Deed with Power of Sale meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Executor Deed with Power of Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Donna O.

March 6th, 2020

Quick and easy to use. I was able to download the Transfer on Death Deed form to my computer so that I can read through and fill them out at a later time. That made it convenient and "no pressure". The complimentary guide and completed example that came with the form was also very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda G.

April 1st, 2022

So far have only done the download, will come back with further review at a later date.

Thank you!

James M.

November 23rd, 2020

Clear and easy instructions! Prompt notices of steps and status. Great job! I wish all counties in all states were this easy!

Thank you for your feedback. We really appreciate it. Have a great day!

JOSE E.

March 19th, 2019

Thanks

Thank you!

Melody M.

March 27th, 2023

Thank you Deeds.com for making our Quit Deed process easy and efficient. The instructions and example forms are a must! Excellent value for the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Edward L.

March 6th, 2019

Excellent web site with just the right documents. Filled a very important need in less tha 2 minutes time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles S.

February 14th, 2025

very happy with guidance and responses - thank you - not finished yet but confident

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Patrick N.

August 15th, 2019

I was very satisfied with your service. Prompt, and thorough. Price was reasonable. Will use your service again when needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary B.

February 8th, 2023

Your information was orderly and very clear and helpful. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret D.

October 7th, 2020

They deliver!

Thank you!

Darlene D.

June 21st, 2019

A little confusing to try to save your docouments and how to process them but once figured out easy to do.

Thank you!

Anita C.

November 3rd, 2021

I found this site when looking for help filing a quitclaim deed to change my property deed to my married name. I received the correct forms, an example filled out, and a guide specific to my state. I have already submitted it for review to my county assessor's office (they were extremely helpful also) and it looks as if it should sail through. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Khadija K.

March 2nd, 2023

Great Service. Not only the required form, but also the state guidelines. Thank you for making it easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Monty H.

November 6th, 2019

Perfection. The filled-out form was especially helpful and I appreciate not having to share personal/financial information over the Internet, as required by so many other legal form service providers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerry V.

March 9th, 2021

Easy to use, fast and reliable. love deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!