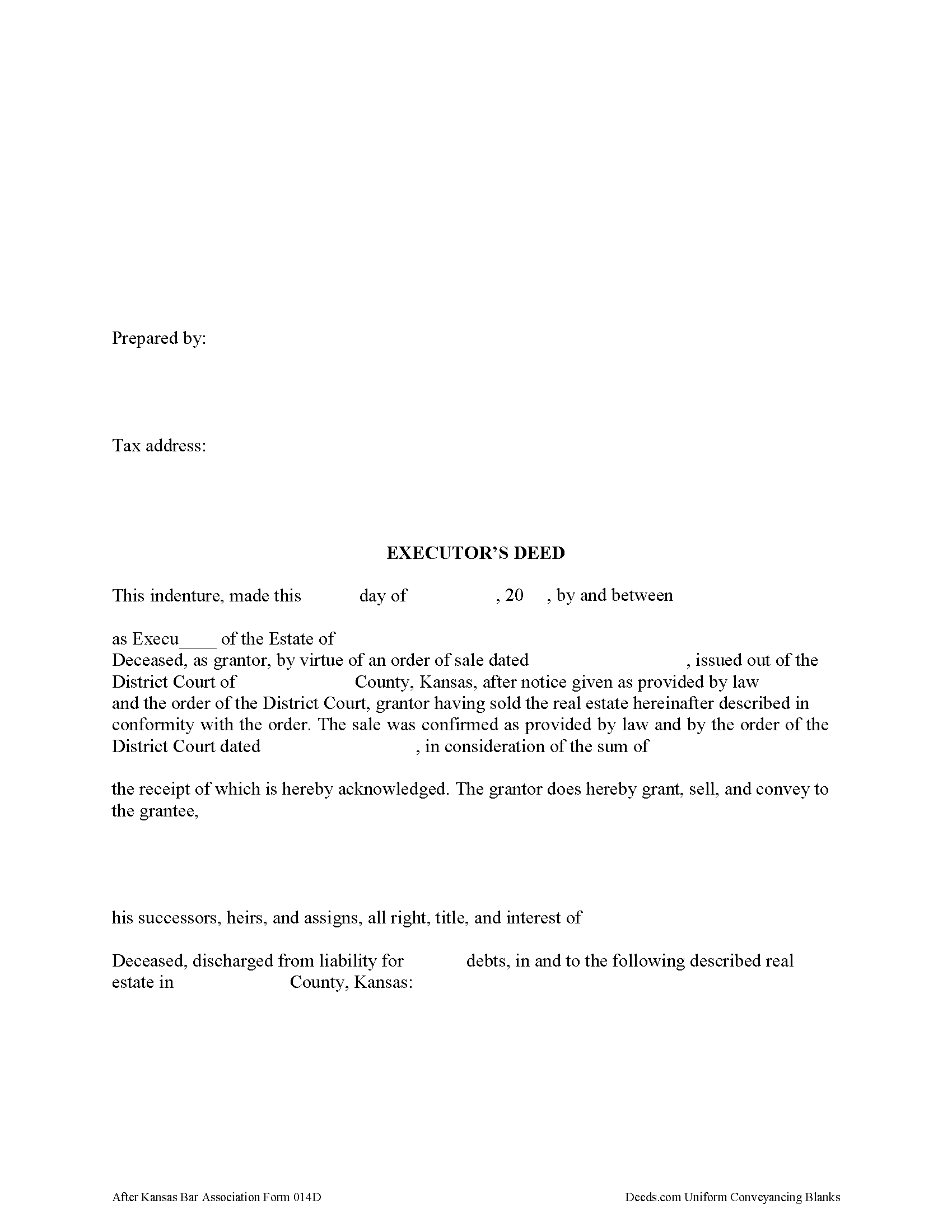

Rice County Executor Deed Form

Rice County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

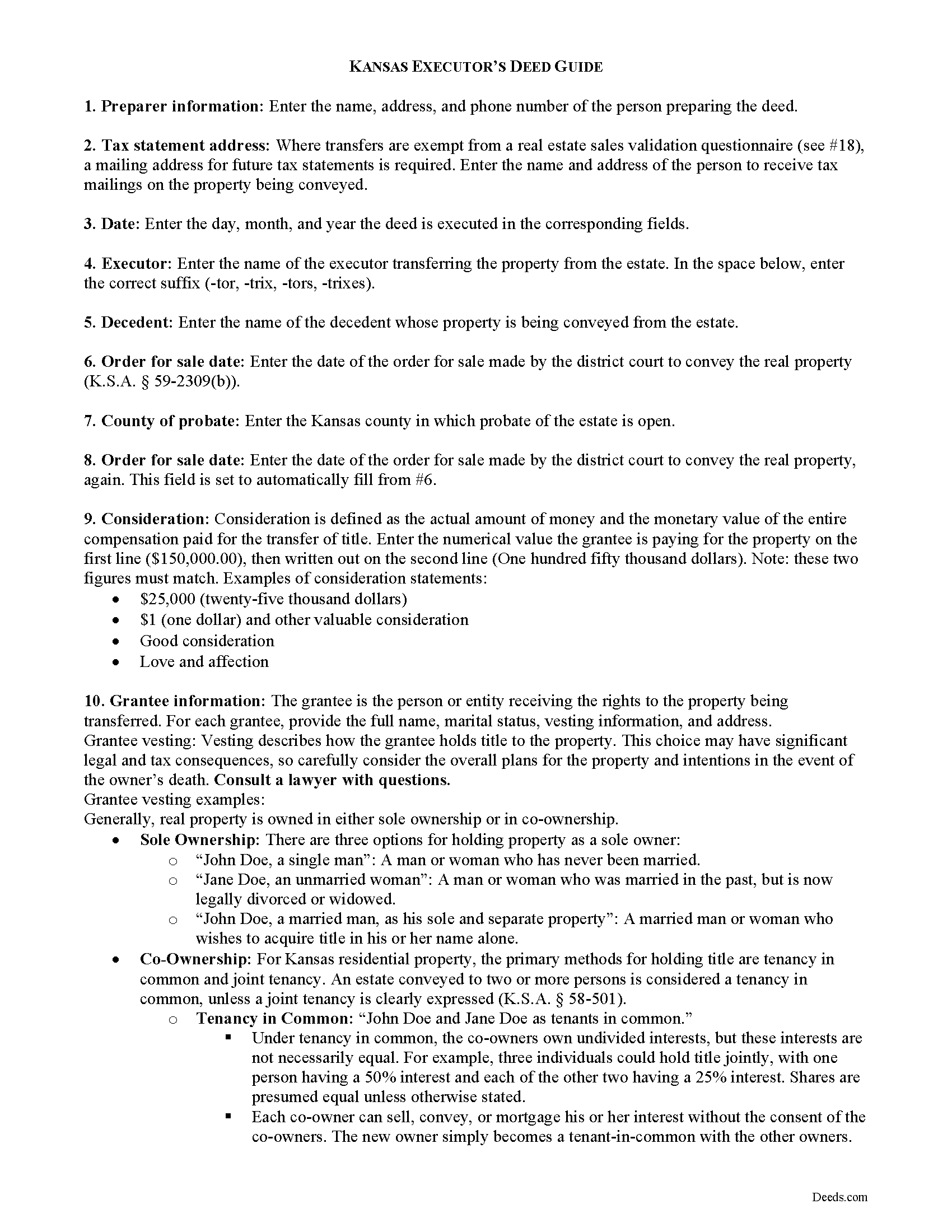

Rice County Executor Deed Guide

Line by line guide explaining every blank on the form.

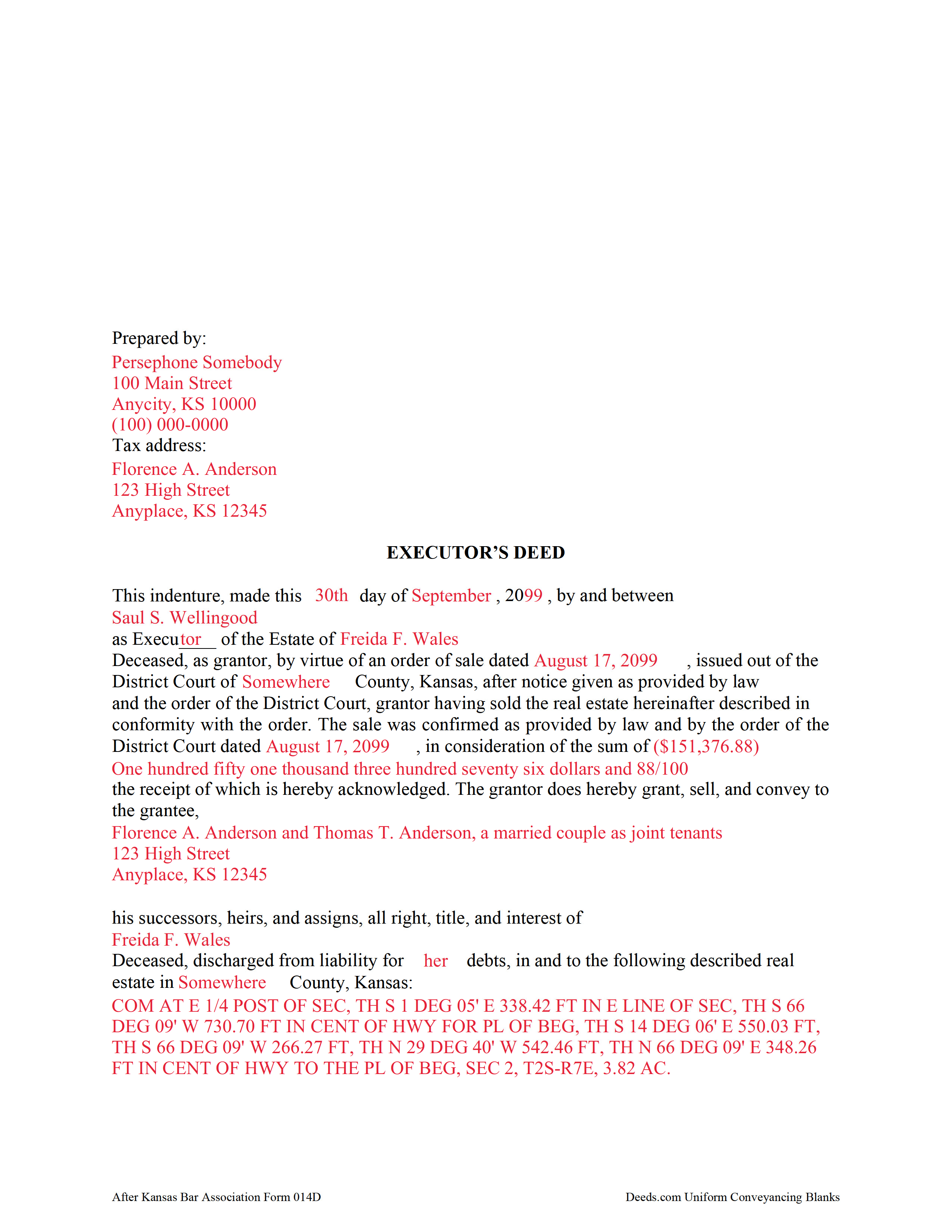

Rice County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Rice County documents included at no extra charge:

Where to Record Your Documents

Rice County Register of Deeds

Lyons, Kansas 67554

Hours: 8:00am-5:00pm M-F

Phone: (620) 257-2931

Recording Tips for Rice County:

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Rice County

Properties in any of these areas use Rice County forms:

- Alden

- Bushton

- Chase

- Geneseo

- Little River

- Lyons

- Raymond

- Sterling

Hours, fees, requirements, and more for Rice County

How do I get my forms?

Forms are available for immediate download after payment. The Rice County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rice County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rice County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rice County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rice County?

Recording fees in Rice County vary. Contact the recorder's office at (620) 257-2931 for current fees.

Questions answered? Let's get started!

When the decedent dies testate (with a will) naming a personal representative (PR) of his or her estate, the PR is called an executor. An executor may need to sell the decedent's real property to raise money to pay the estate's debts or for other reasons in the best interest of the estate.

If the decedent's will includes a power of sale, a simple executor's deed may be used to convey real property from the estate. The deed requires a recitation of facts concerning the executor, the decedent, and the subject property being transferred, and must be signed in the presence of a notary public and is subject to requirements for conveyances of real property in Kansas.

Supplemental documentation, such as a real estate sales validation questionnaire, may be required, depending on the transfer. Consult a lawyer with questions about estate administration in Kansas.

(Kansas Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Rice County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Rice County.

Our Promise

The documents you receive here will meet, or exceed, the Rice County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rice County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Jennifer H.

February 25th, 2021

Price is too expensive.

Thank you for your feedback Jennifer.

Margaret A.

April 30th, 2021

Thank for the help. Needed that disclaimer to avoid filing a full ITR tax return to get an L-9

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robson A.

June 15th, 2021

Very easy & efficient to use! I would have had to drive an hour to the county office. So glad this worked instead! You should advertise more....if I hadn't done research I would never have known about your service.

Thank you!

susanne y.

July 13th, 2020

wonderful service, docs recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

Evan W.

February 2nd, 2021

Quick service. Thank you

Thank you!

Marjorie D.

November 1st, 2021

The process was easy and efficient. I will definitely be using this service!

Thank you for your feedback. We really appreciate it. Have a great day!

Kelly H.

November 30th, 2020

This site was very fast and easy to use, highly recommend it.

Thank you for your feedback. We really appreciate it. Have a great day!

Maree W.

August 5th, 2022

I am so impress with the forms that is needed for your state. It makes your task so easy and no worries. This was a big help in taking care of business. Thank you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine S.

February 27th, 2019

Very good site! I found everything I needed right here on Deeds.com. Excellent quality forms, easy access, perfect delivery, reasonable price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia S.

August 3rd, 2022

The forms was easy to use and the guides was helpful

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura J.

April 6th, 2021

Very satisfied. Highly recommend!

Thank you!

wendy w.

October 19th, 2022

Excellent

Thank you!

Kathryn S.

September 16th, 2024

So quick. So easy. Worth every penny!

Thank you for your feedback. We really appreciate it. Have a great day!

Pauletta C.

February 12th, 2022

worked like a charm

Thank you!

Jacqueline J.

May 12th, 2020

Unable to use.

Sorry to hear that Jacqueline.