Smith County Executor Deed Form

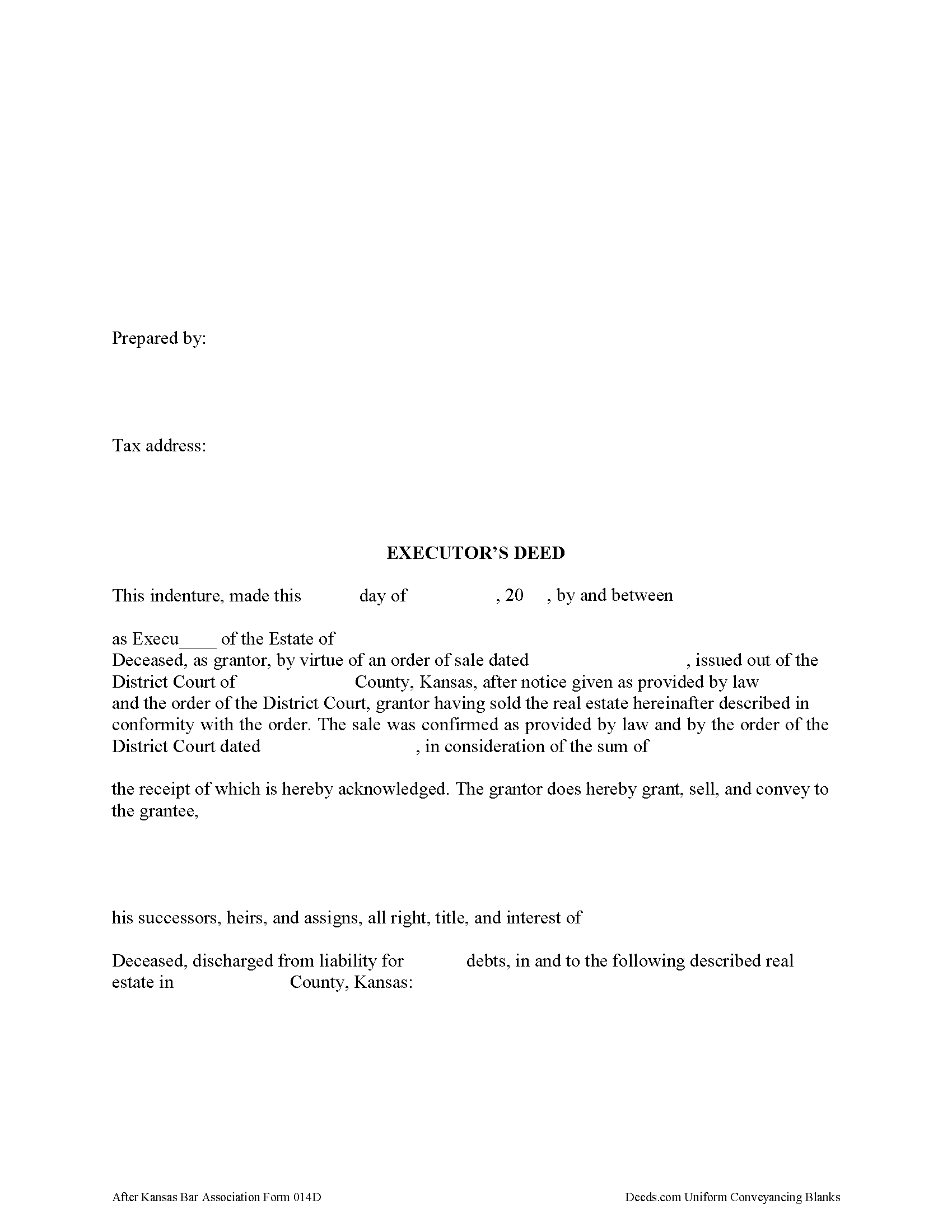

Smith County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

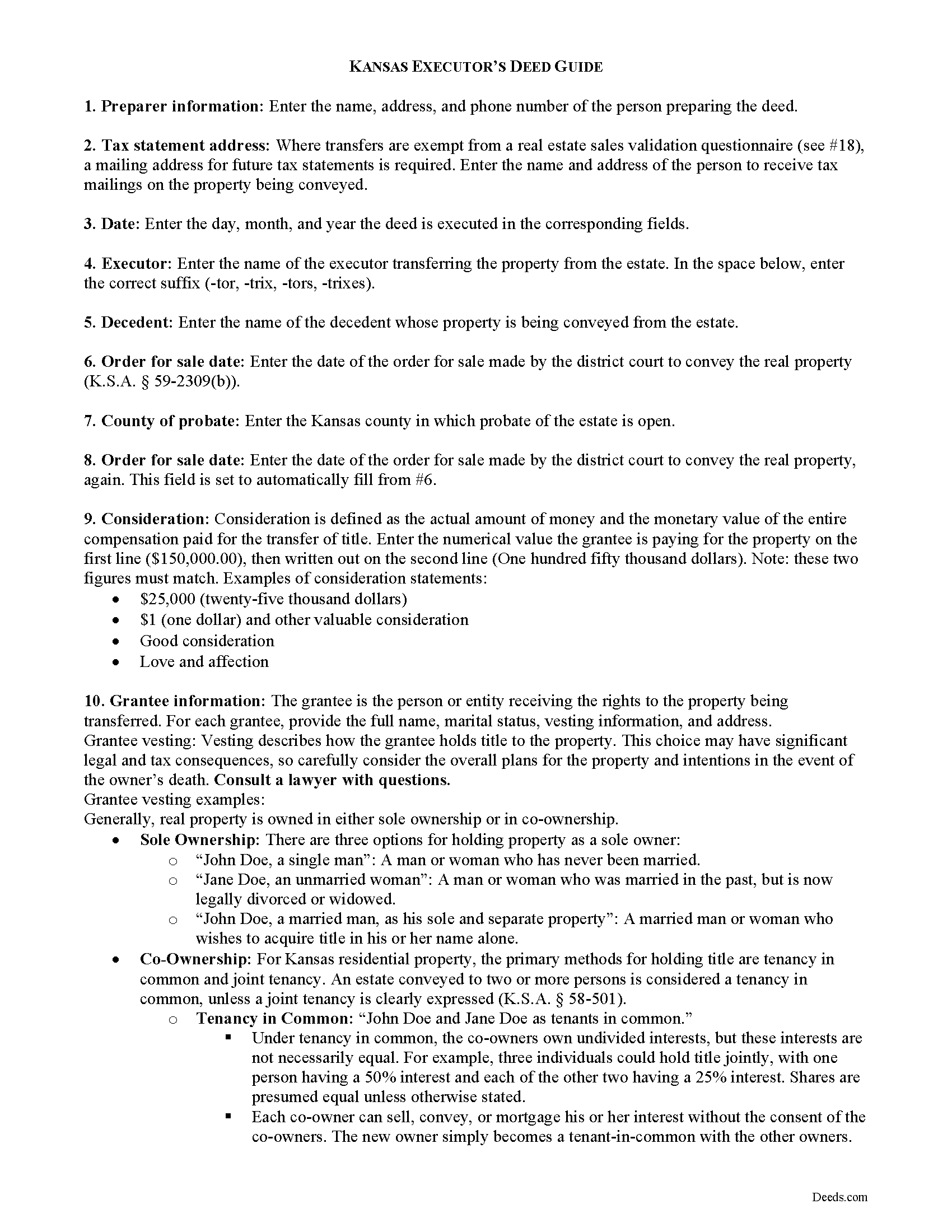

Smith County Executor Deed Guide

Line by line guide explaining every blank on the form.

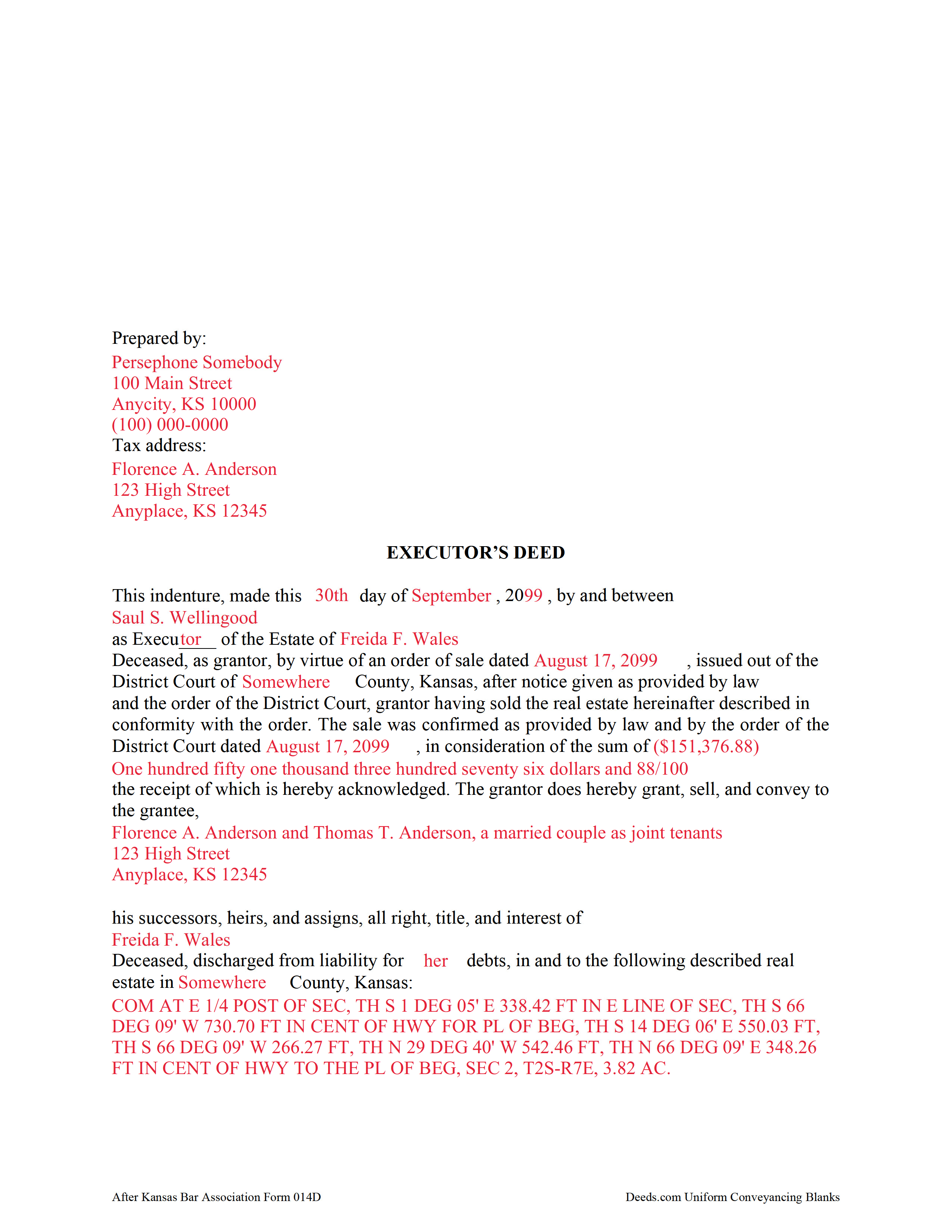

Smith County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Register of Deeds

Smith Center, Kansas 66967

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (785) 282-5160

Recording Tips for Smith County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Athol

- Cedar

- Gaylord

- Kensington

- Lebanon

- Smith Center

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (785) 282-5160 for current fees.

Questions answered? Let's get started!

When the decedent dies testate (with a will) naming a personal representative (PR) of his or her estate, the PR is called an executor. An executor may need to sell the decedent's real property to raise money to pay the estate's debts or for other reasons in the best interest of the estate.

If the decedent's will includes a power of sale, a simple executor's deed may be used to convey real property from the estate. The deed requires a recitation of facts concerning the executor, the decedent, and the subject property being transferred, and must be signed in the presence of a notary public and is subject to requirements for conveyances of real property in Kansas.

Supplemental documentation, such as a real estate sales validation questionnaire, may be required, depending on the transfer. Consult a lawyer with questions about estate administration in Kansas.

(Kansas Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Julie S.

May 2nd, 2020

I am really impressed by this website. Not only is it affordable, but they give a detailed description, instructions, and an example to follow. Also there are additional forms included. And it's State, even county, specific. They do not require a subscription either as you can just order what you want. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John Z.

November 5th, 2021

Very easy to use. Straight forward. Am glad I found the tools to process an important document of property ownership. Thanks much. Will recommend to friends and family.

Thank you!

ronnie y.

May 8th, 2019

nice to get everything I need for the county that the property is located.

Thank you for your feedback. We really appreciate it. Have a great day!

Christina A G.

December 19th, 2020

It was easy to locate, purchase, and download the documents I needed on the Deeds.com website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles C.

July 8th, 2021

Easy to use. Good price. I like that it came with instructions and an example.

Thank you for your feedback. We really appreciate it. Have a great day!

Douglas T.

August 9th, 2021

Deeds.com supplied me with forms I needed immediately.

Thank you!

George R.

July 28th, 2020

One of the most satisfactory and easy to use websites I have come across. Being able to record documents in the court records without having to pay an atty $500 per hour and accomplish the recording in about 24 hours instead of days and even weeks i s invaluable. Worked perfectly.

Thank you!

Linda Munguia N.

May 29th, 2021

Easy process. Appreciated the detailed instructions for filing.

Thank you!

Elizabeth K.

November 25th, 2023

I found what I needed easily.

We are delighted to have been of service. Thank you for the positive review!

Doug C.

November 20th, 2020

Great Job guys! I would not even have thought to look for this service. The county recorder's office and kiosks are all closed because of covid. I was directed to you because of a referral on the county site. I wish I had known you had forms available as well. I searched for a day to find the appropriate form.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia D.

January 22nd, 2019

It worked great- I had a little trouble at first with the site, figuring out where to do what, but the form was much better than the one we purchased at Staples, loved being able to fill out with the computer. We did need the other form as per the screen prior to ordering but couldn't figure out which one. The ladies at the recorders were great too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joe D.

June 15th, 2019

Complete coverage of deeds, laws, etc.

Thank you!

TOM S.

July 21st, 2019

Itwas easy to locate the necessary forms I needed and download worked great.

Thank you!

FELISA J.

December 18th, 2019

I liked the ease of locating the document I needed and the sample document was extremely helpful. I would have liked the acknowledgement to be on the same page as the rest of the document. It costs for each page recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Remon W.

January 26th, 2021

Excellent and fast service. I will be using this site as needed in the future.

Thank you Remon, we appreciate you.