Kearny County Grant Deed Form

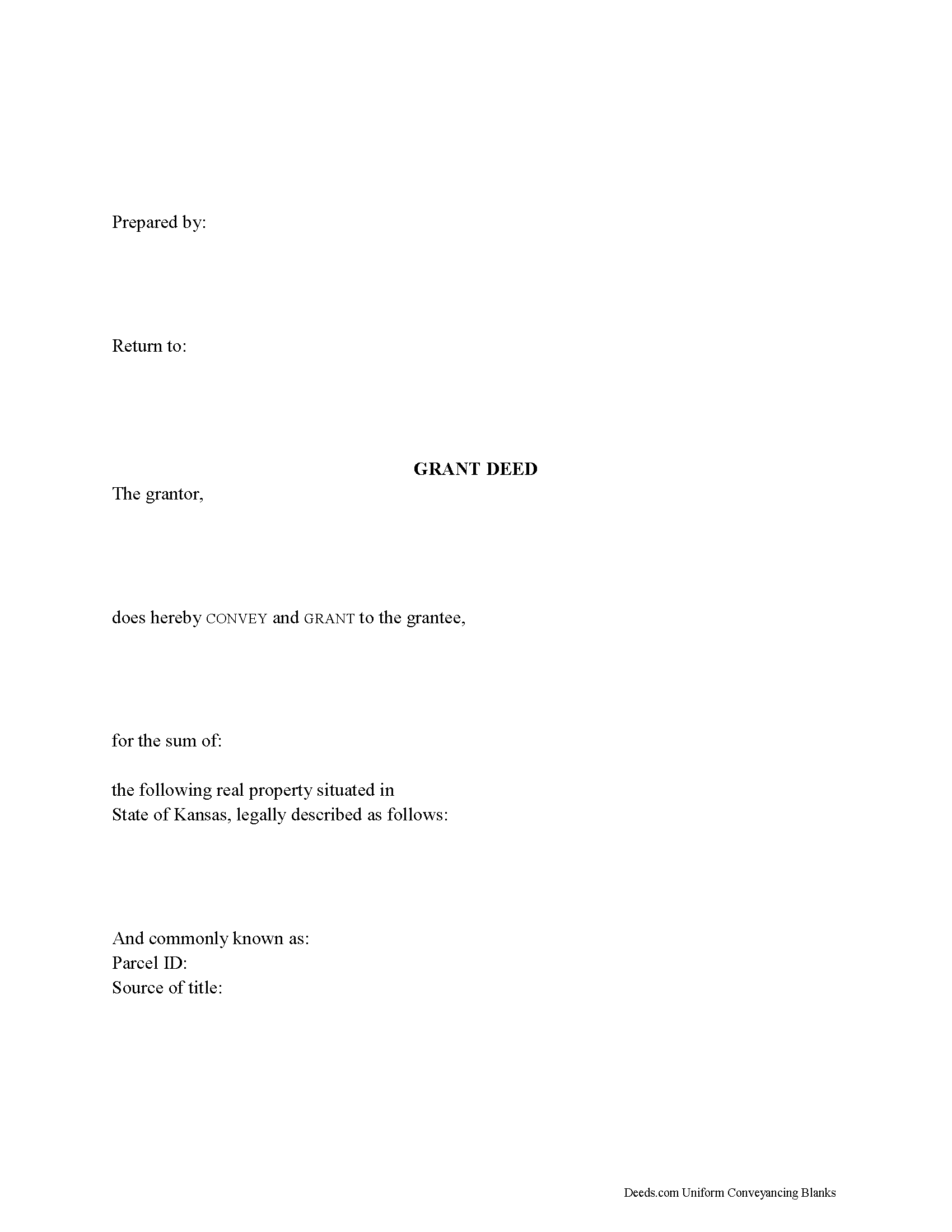

Kearny County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

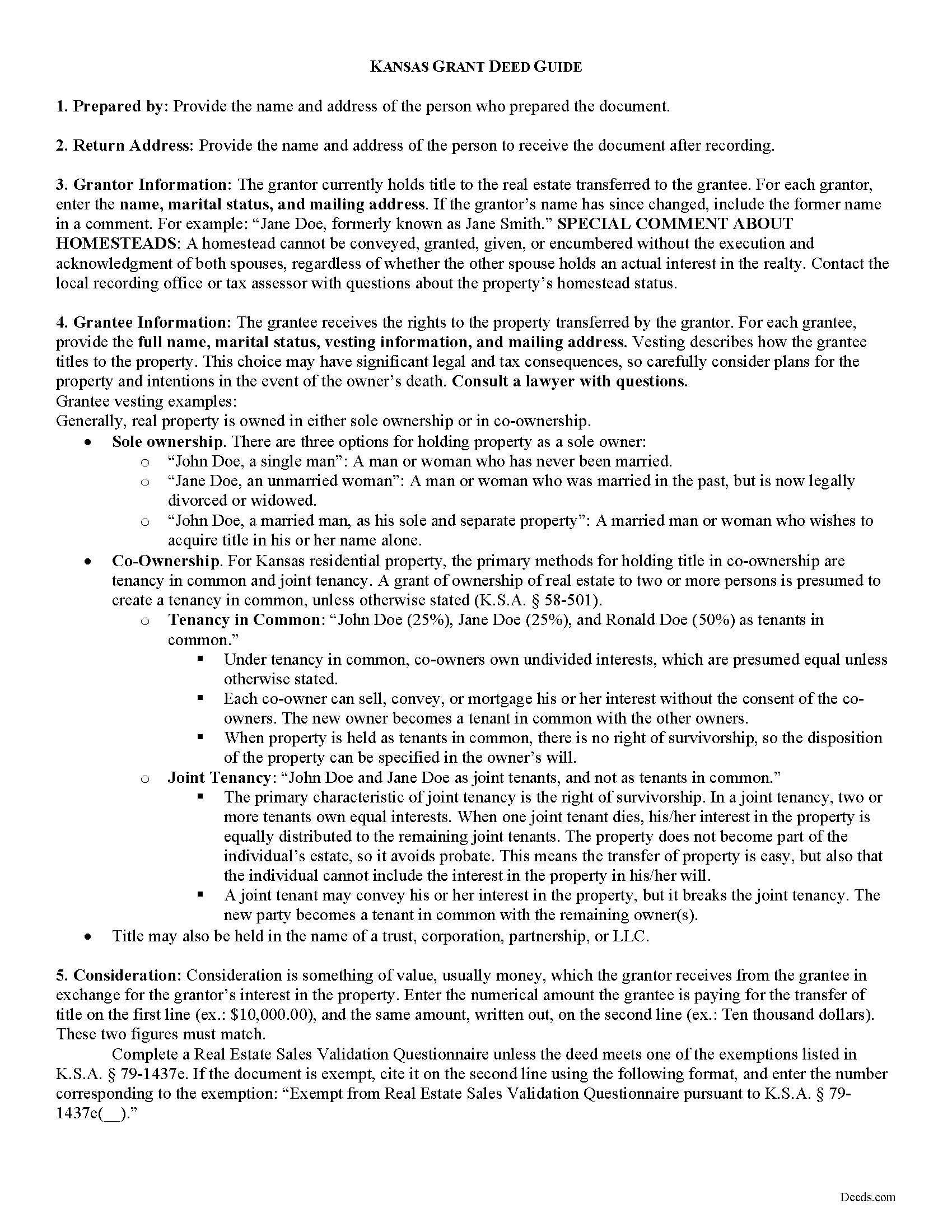

Kearny County Grant Deed Guide

Line by line guide explaining every blank on the form.

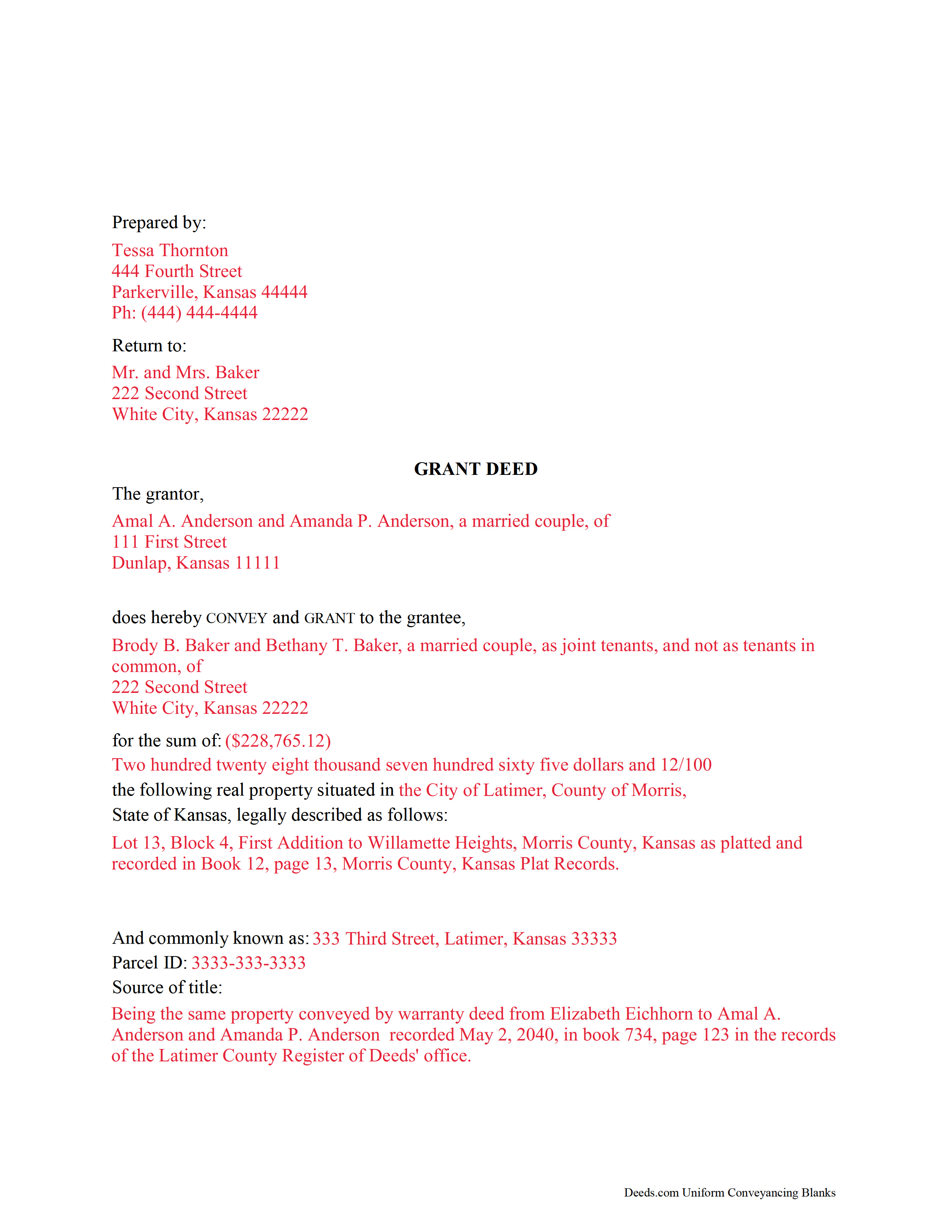

Kearny County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Kearny County documents included at no extra charge:

Where to Record Your Documents

Kearny County Register of Deeds

Lakin, Kansas 67860

Hours: 8:00am-5:00pm M-F

Phone: (620) 355-6241

Recording Tips for Kearny County:

- Check that your notary's commission hasn't expired

- Ask about their eRecording option for future transactions

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Kearny County

Properties in any of these areas use Kearny County forms:

- Deerfield

- Lakin

Hours, fees, requirements, and more for Kearny County

How do I get my forms?

Forms are available for immediate download after payment. The Kearny County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kearny County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kearny County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kearny County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kearny County?

Recording fees in Kearny County vary. Contact the recorder's office at (620) 355-6241 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Kansas are governed by Chapter 58, Section 22 of the Kansas Statutes, but the statutes do not specifically address grant deeds.

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). A recorded grant deed imparts notice of this transfer to all persons, including subsequent purchasers or mortgagees (K.S.A. 58-2222).

Within the deed are covenants, or guarantees, that the grantor has not previously sold the real property interest now being conveyed to the grantee, and that the property is being conveyed to the grantee without any liens or encumbrances, except for those specifically disclosed in the deed. Grant deeds do not generally require the grantor to defend title claims.

A lawful grant deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Kansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless otherwise stated (K.S.A. 58-501).

Include the complete legal description for the subject property, as well as its physical (street) address or common name and the derivation of title. Additionally, the form must meet state and local standards for recorded documents.

All deeds must be signed by the grantor, or by the party's lawful agent or attorney, and may be acknowledged or proved and certified in the manner prescribed by the Uniform Law on Notarial Acts (K.S.A. 58-2209).

The State Property Valuation Department requires a Real Estate Sales Validation Questionnaire with each deed unless it meets one of the exemptions provided in K.S.A. 79-1437e. Include the amount of consideration exchanged on the form (K.S.A. 79-1437g).

Submit the deed and any required supplemental documents for recording in the county where the property is located. In most cases, the deed will be returned to the grantee after recording. The register of deeds will forward the information to the county clerk, who will update records for mailing tax statements (K.S.A. 58-2221). Record the deed in the appropriate county to provide notice to third parties (K.S.A. 58-2223).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about limited warranty deeds or for any other issues related to the transfer of real property in Kansas.

(Kansas Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Kearny County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Kearny County.

Our Promise

The documents you receive here will meet, or exceed, the Kearny County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kearny County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Gary M.

April 18th, 2020

Death of JT form was excellent. You have the best documents out there. I wish I could have read the sample just so I knew my information was entered correctly. Real problem is County wants a bar code on documents to get recorded. Now? Need four deed forms so the expense starts to be prohibitive. I would rather pay more and get multiple access.

Thank you for your feedback. We really appreciate it. Have a great day!

Dean B.

September 17th, 2020

I needed to cut and paste my phone number with the dashes in order to use this website with my iPhone

Thank you!

JoAnn S.

July 31st, 2021

Easy to process orders.

Thank you!

Tamara H.

May 11th, 2023

Absolutely awesome! Quick, easy and efficient. I will definitely be using again!

Thank you Tamara. We really appreciate you taking the time to leave your comments. Have an amazing day!

Juston P.

August 24th, 2022

The service provided was exactly what I needed. The downloadable deed and supporting documents allowed me to move forward with the days project. Everything I needed to file my documents from two states away and at two in the morning! I highly recommend this site. I found it to be the easiest, most expedient and cost effective method to get up to date legal forms for filing land deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alan S.

April 28th, 2020

Great job! Fast and easy. Terrific communications.

Thank you!

Elizabeth B.

February 3rd, 2020

Excellent product! Easy to fill out, complete directions. I highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ed S.

October 1st, 2021

This is the first time that I have used this service. An employee at the Clerk and Register office in Arizona suggested that I try Deeds.com to find the form I needed and the county office could not provide. I am a licensed Realtor in Colorado with a 43-year career and this service has not been necessary in my own state but it was extremely helpful in finding a form in Arizona. Five star rating for the very user-friendly website!

Thank you for your feedback. We really appreciate it. Have a great day!

Norman K.

March 2nd, 2021

It wasn't really what I needed I read and read and read and read and I thought I was to do with for filing for probate or probate executor but instead it was for the property if you are executor and but it wasn't very clear on that so it didn't work for me so I was kind of wasted money

Sorry to hear that Norman. We've gone ahead and canceled your order and payment.

David D.

September 20th, 2022

Two thumbs up!

Thank you!

Mary L.

March 25th, 2023

Super easy, fast recording time. 100% recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anita M.

March 10th, 2019

This was a very easy process to find the correct documents and download them. The price was also reasonable.

Thank you for your feedback. We really appreciate it. Have a great day!

Bonnie C.

July 28th, 2021

Easy and convenient. Was nice to have just a one time charge without a so-called anual fee/membership. Will use again if needed. May update review after "all is said and done."

Thank you!

Kari G.

July 15th, 2021

The service was prompt and attentive to my questions. I would've just appreciated a heads up that I also needed to contact the county directly (and provide contact info) to receive a certified copy of the document (Notice of Commencement) in order to submit the certified copy to the Building Department. This was an extra step that I haven't had to complete before using another eRecording service. Even if this extra step is a result of the county's system. I would still have expected a head's up (since there wasn't any info regarding this on the county's site for eRecording).

Thank you for your feedback. We really appreciate it. Have a great day!

Lucus S.

May 19th, 2022

I tried to do it myself by copying an old deed and ended up with a bunch of headaches (expensive ones) wish I would have used these documents first. Live and learn.

Thank you!