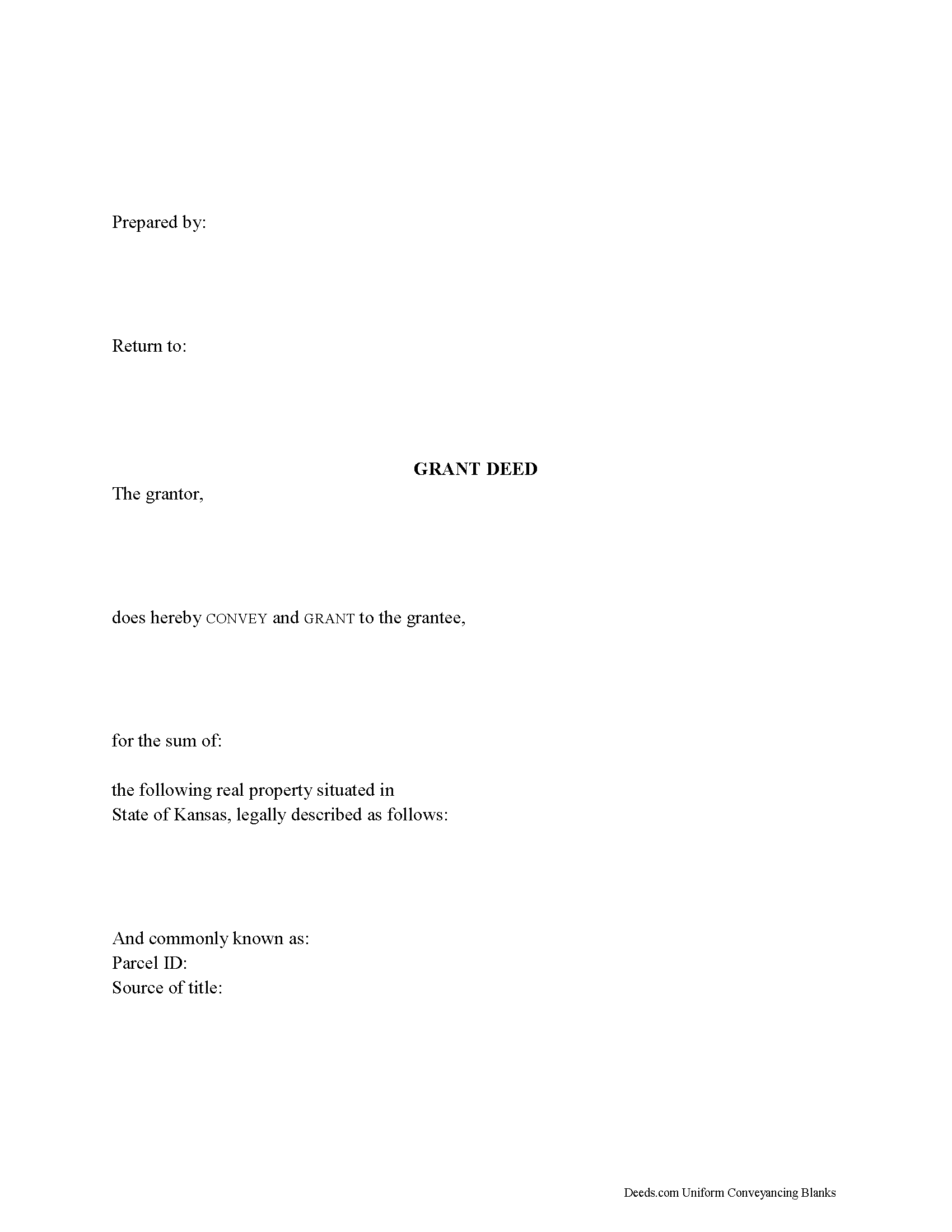

Labette County Grant Deed Form

Labette County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

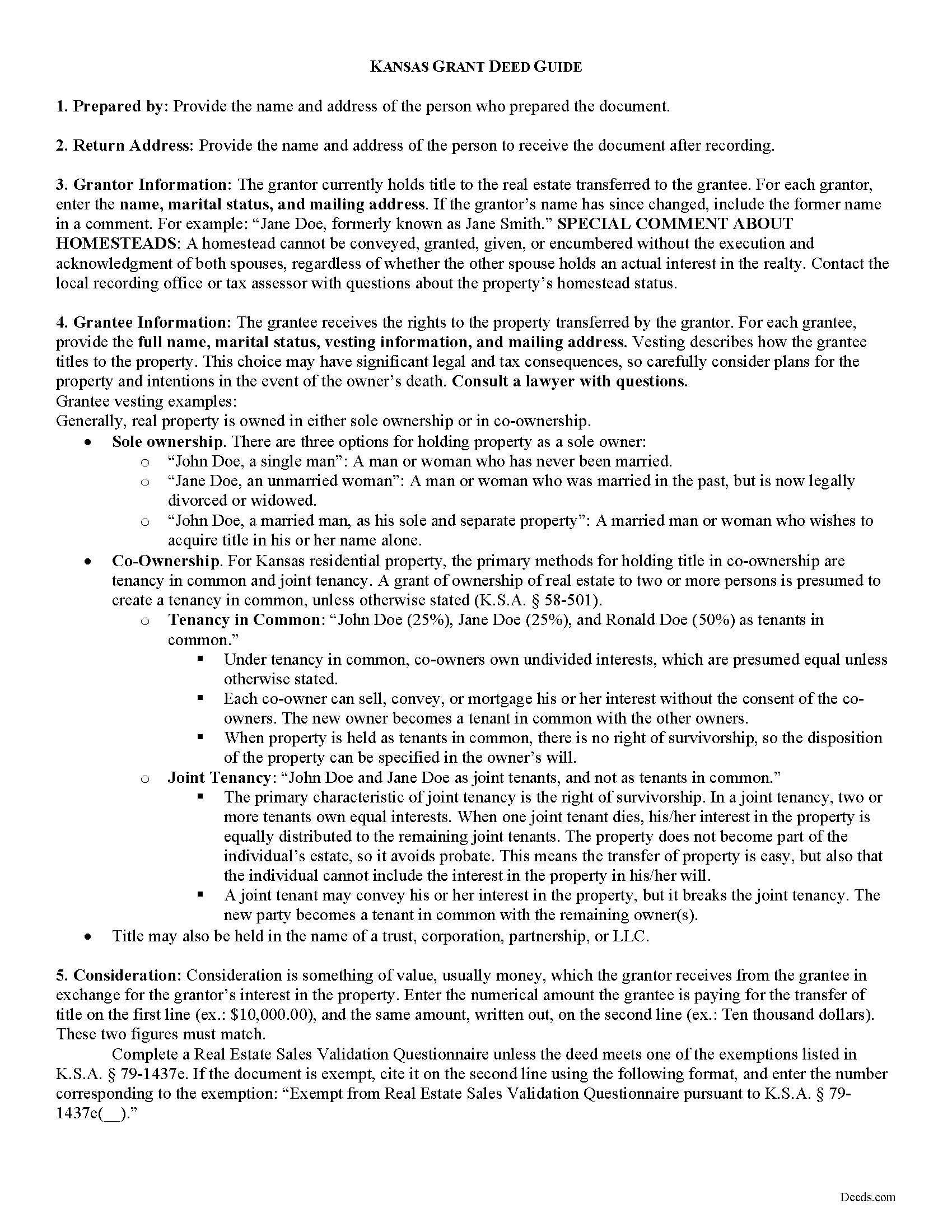

Labette County Grant Deed Guide

Line by line guide explaining every blank on the form.

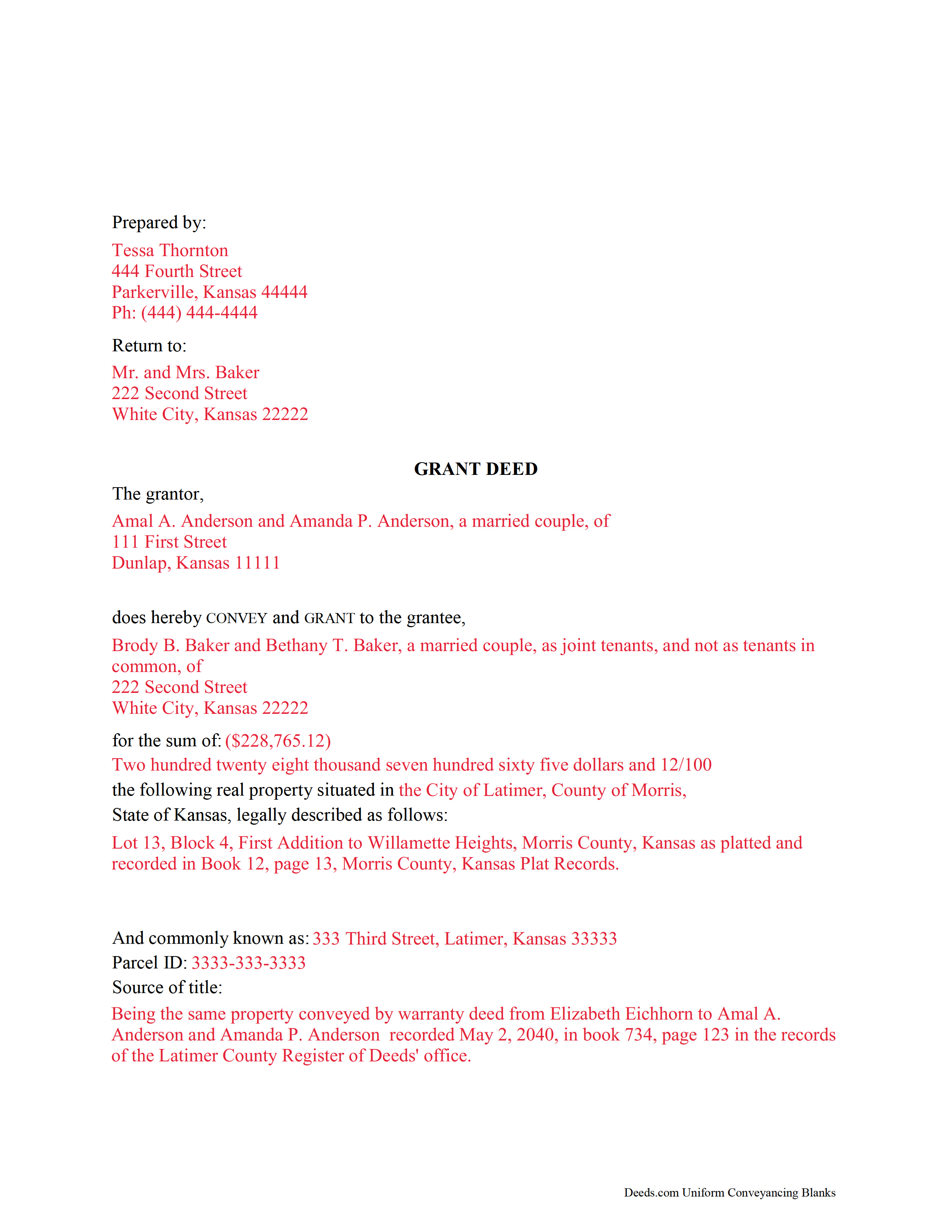

Labette County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Labette County documents included at no extra charge:

Where to Record Your Documents

Labette County Register of Deeds

Oswego, Kansas 67356

Hours: 8:00 to 5:00 M-F

Phone: (620) 795-2138

Recording Tips for Labette County:

- Both spouses typically need to sign if property is jointly owned

- Ask about their eRecording option for future transactions

- Recording fees may differ from what's posted online - verify current rates

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Labette County

Properties in any of these areas use Labette County forms:

- Altamont

- Bartlett

- Chetopa

- Dennis

- Edna

- Mound Valley

- Oswego

- Parsons

Hours, fees, requirements, and more for Labette County

How do I get my forms?

Forms are available for immediate download after payment. The Labette County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Labette County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Labette County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Labette County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Labette County?

Recording fees in Labette County vary. Contact the recorder's office at (620) 795-2138 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Kansas are governed by Chapter 58, Section 22 of the Kansas Statutes, but the statutes do not specifically address grant deeds.

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). A recorded grant deed imparts notice of this transfer to all persons, including subsequent purchasers or mortgagees (K.S.A. 58-2222).

Within the deed are covenants, or guarantees, that the grantor has not previously sold the real property interest now being conveyed to the grantee, and that the property is being conveyed to the grantee without any liens or encumbrances, except for those specifically disclosed in the deed. Grant deeds do not generally require the grantor to defend title claims.

A lawful grant deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Kansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless otherwise stated (K.S.A. 58-501).

Include the complete legal description for the subject property, as well as its physical (street) address or common name and the derivation of title. Additionally, the form must meet state and local standards for recorded documents.

All deeds must be signed by the grantor, or by the party's lawful agent or attorney, and may be acknowledged or proved and certified in the manner prescribed by the Uniform Law on Notarial Acts (K.S.A. 58-2209).

The State Property Valuation Department requires a Real Estate Sales Validation Questionnaire with each deed unless it meets one of the exemptions provided in K.S.A. 79-1437e. Include the amount of consideration exchanged on the form (K.S.A. 79-1437g).

Submit the deed and any required supplemental documents for recording in the county where the property is located. In most cases, the deed will be returned to the grantee after recording. The register of deeds will forward the information to the county clerk, who will update records for mailing tax statements (K.S.A. 58-2221). Record the deed in the appropriate county to provide notice to third parties (K.S.A. 58-2223).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about limited warranty deeds or for any other issues related to the transfer of real property in Kansas.

(Kansas Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Labette County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Labette County.

Our Promise

The documents you receive here will meet, or exceed, the Labette County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Labette County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Beverly R.

February 2nd, 2022

This was a wonderful experience, easy fast and convenient. Thank you for all your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracey M.

August 9th, 2022

Using Deeds.com was unbelievably quick and easy to file a deed restriction with our local county office. From uploading the initial file to deeds.com, to having a fully recorded document was right on one hour - and all from the comfort of my home. I found your service was easy to use and your staff were very quick in responding to my filing. I will definitely use and recommend deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine S.

December 19th, 2019

Description of document could have been better

Thank you!

Shelly J.

May 23rd, 2022

There's nothing to say except it couldn't be easier.

Thank you for your feedback. We really appreciate it. Have a great day!

ronald s.

April 27th, 2021

easy to use site, directions well laid out

Thank you for your feedback. We really appreciate it. Have a great day!

Kathy-Louise A.

February 9th, 2025

I found the process of downloading and completing the documents very user friendly. Thank you for the Declare Value instructions. It was easy to follow, though a sample of the declaration form would be very useful. I didn't know how to list my "capacity" so I left it blank so the recorder could advise me. Otherwise, thank you so much for being available for people who are capable of completing simple legal tasks without the expense of a lawyer. Thank you, thank you, thank you!!!

Your appreciative words mean the world to us. Thank you.

Sandra C.

December 8th, 2022

Not sure whether the two forms I printed will be helpful or not. Will find out when I go to a place for completion and to be notorized.

Thank you!

Katherine D.

August 22nd, 2022

Once I found your site it was very easy to understand, order and copy the forms. It is very helpful that you included an example of a completed form. Thank you. This form helps hundreds of seniors avoid lawyers, probate and the fear of losing their homes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda S.

March 8th, 2019

I am quite pleased with this website. I was able to complete my task with relative ease thanks to all the help these forms provided .The example forms really helped me to navigate the process. I would recommend this service highly.

Thank you Linda, we really appreciate your feedback.

Margaret M.

October 28th, 2019

Great job with these forms. Super easy and up to date, a rare find online these days. Thank you.

Thank you!

Ben G.

September 21st, 2020

Faster AND less expensive than recording in person. Will be using again (and not just because of COVID).

Thank you!

Nancy A.

April 24th, 2024

This is an excellent resource. I was surprised because the price is so low I thought the products might be inferior. Not only were were the requested documents high quality, additional unrequested documents were added to my order that I didn't realize I would need until I read them. I especially appreciate that all the documents were specific to my county. I highly recommend using deeds.com.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

David W.

March 10th, 2021

Thanks to all of you. You provide a great service! Dave in Ca.

Thank you for your feedback. We really appreciate it. Have a great day!

Alex Q.

July 26th, 2023

The best people to work with! Thank you for all you do. We send documents from all states to Deeds.com to record for us. They are professional, keep us updated and always notify us if there is an issue with one of our documents prior to sending to recording and that saves us money and time! Thank you!!

Thanks for the kind words Alex. We appreciate you!

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!