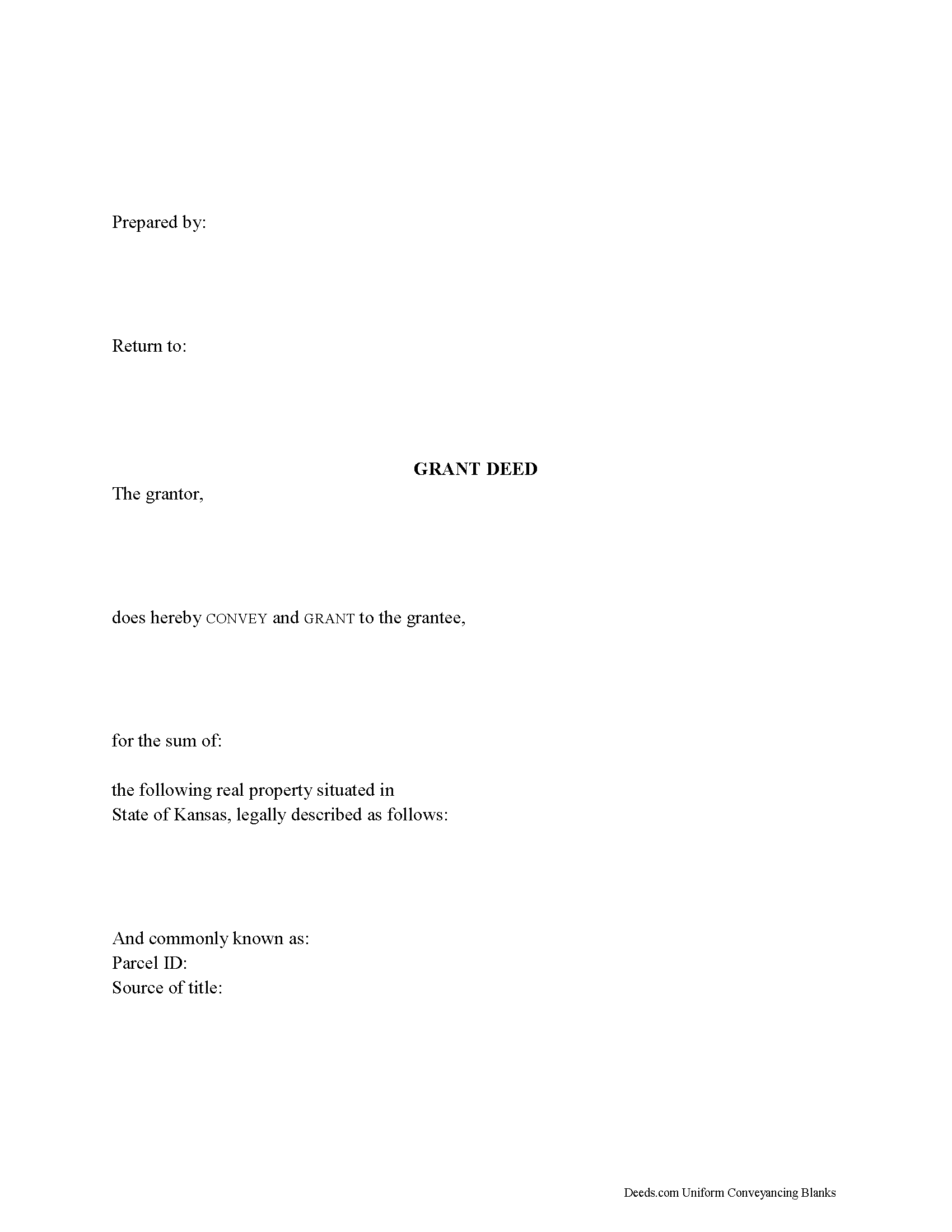

Smith County Grant Deed Form

Smith County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

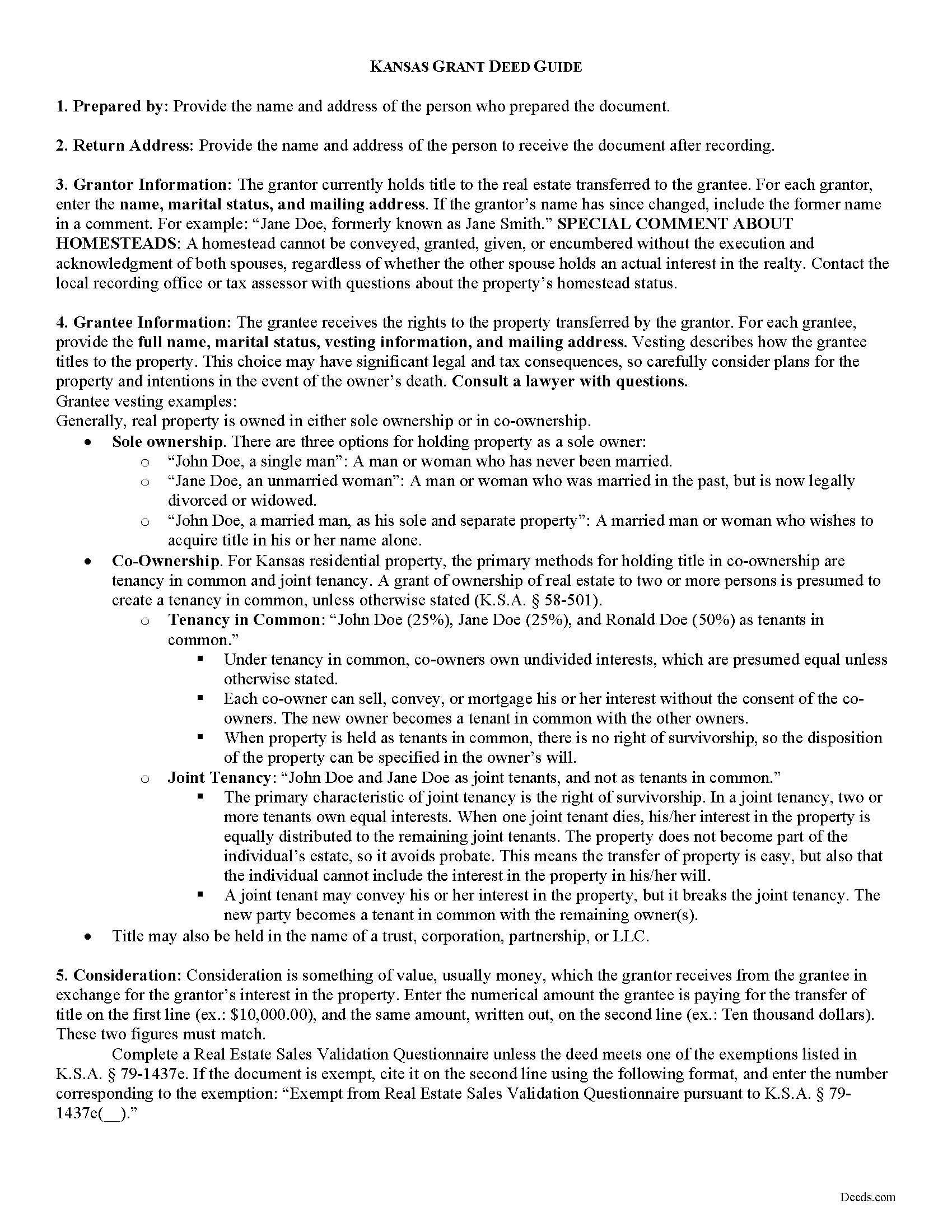

Smith County Grant Deed Guide

Line by line guide explaining every blank on the form.

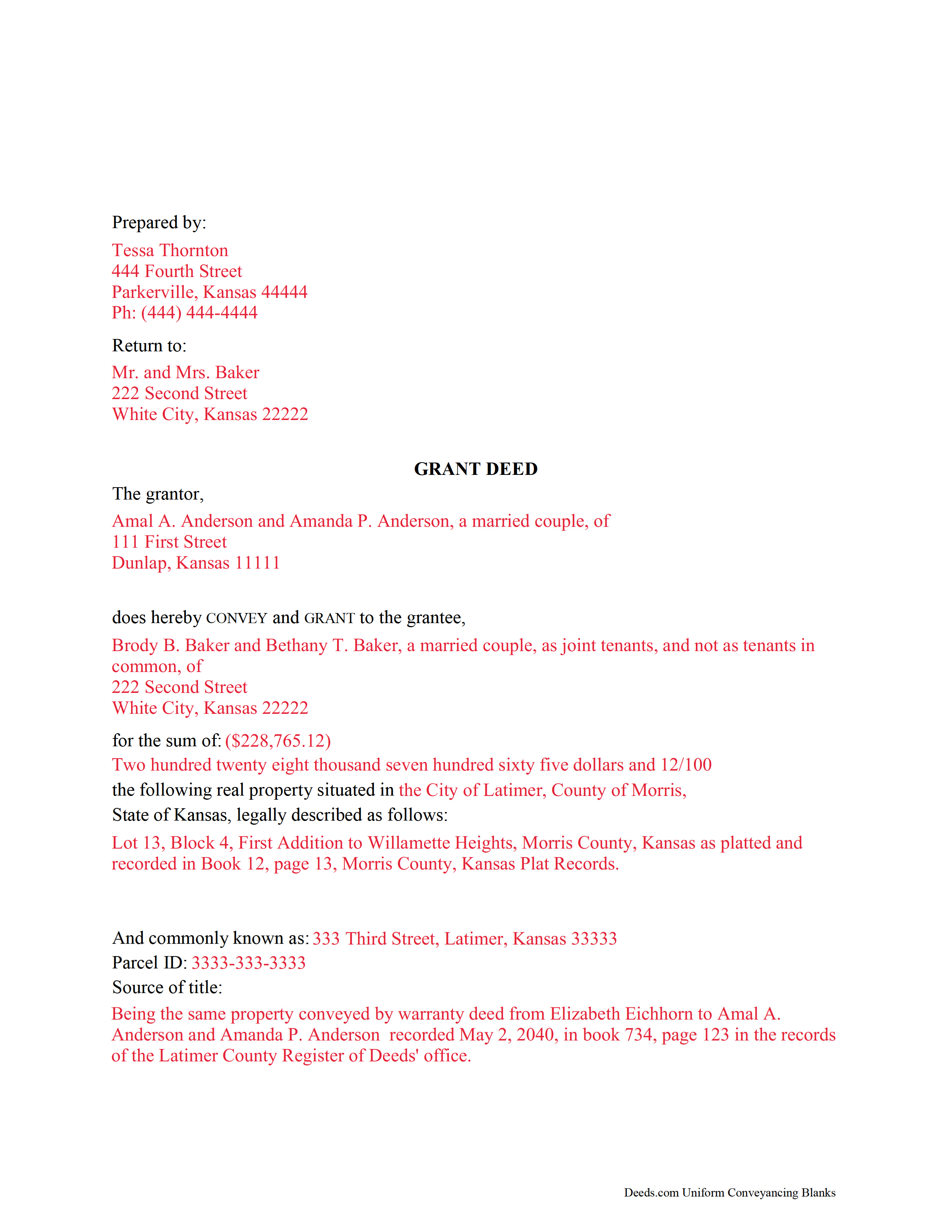

Smith County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Register of Deeds

Smith Center, Kansas 66967

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (785) 282-5160

Recording Tips for Smith County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Athol

- Cedar

- Gaylord

- Kensington

- Lebanon

- Smith Center

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (785) 282-5160 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Kansas are governed by Chapter 58, Section 22 of the Kansas Statutes, but the statutes do not specifically address grant deeds.

A grant deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). A recorded grant deed imparts notice of this transfer to all persons, including subsequent purchasers or mortgagees (K.S.A. 58-2222).

Within the deed are covenants, or guarantees, that the grantor has not previously sold the real property interest now being conveyed to the grantee, and that the property is being conveyed to the grantee without any liens or encumbrances, except for those specifically disclosed in the deed. Grant deeds do not generally require the grantor to defend title claims.

A lawful grant deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Kansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless otherwise stated (K.S.A. 58-501).

Include the complete legal description for the subject property, as well as its physical (street) address or common name and the derivation of title. Additionally, the form must meet state and local standards for recorded documents.

All deeds must be signed by the grantor, or by the party's lawful agent or attorney, and may be acknowledged or proved and certified in the manner prescribed by the Uniform Law on Notarial Acts (K.S.A. 58-2209).

The State Property Valuation Department requires a Real Estate Sales Validation Questionnaire with each deed unless it meets one of the exemptions provided in K.S.A. 79-1437e. Include the amount of consideration exchanged on the form (K.S.A. 79-1437g).

Submit the deed and any required supplemental documents for recording in the county where the property is located. In most cases, the deed will be returned to the grantee after recording. The register of deeds will forward the information to the county clerk, who will update records for mailing tax statements (K.S.A. 58-2221). Record the deed in the appropriate county to provide notice to third parties (K.S.A. 58-2223).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about limited warranty deeds or for any other issues related to the transfer of real property in Kansas.

(Kansas Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Heather A.

January 8th, 2019

quick response to e-mail. the forms are easy to use, fully explained.

Thank you for your feedback Heather, glad we could help.

Thomas R.

June 21st, 2024

First time user. Was pleased with the easy of use and the step-by-step directions provided by the website.

We are motivated by your feedback to continue delivering excellence. Thank you!

Nora B.

April 15th, 2019

VERY NICE SERVICE

Thank you for your feedback. We really appreciate it. Have a great day!

Robin F.

November 9th, 2022

Very Convenient and easy to use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David K.

August 9th, 2021

My 1st trip to your site. I give it a full 5-star rating! Thank you. I'll be back.

Thank you for your feedback. We really appreciate it. Have a great day!

DON O.

December 16th, 2020

needs to be more user friendly

Thank you for your feedback. We really appreciate it. Have a great day!

Terralynn J.

July 18th, 2019

I was very pleased to find ONLINE, Deed Revision Document(s) and their explanation. I ordered these document Forms, downloaded them and Printed them. Now, I will be able to fill them out in the privacy of my home. Instructions were also included, how to file this new Deed, after I complete it and have it Notarized. This has saved me time and emotional stress following the death of my husband. THANK YOU.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Craig H.

August 18th, 2022

Awesome service! It was so quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Anthony J S.

July 30th, 2022

It was nice to find a form to use for leaving my house without having my kids deal with Probate Court. The price was a lot cheaper than paying for a Lawyer to set up a transfer of ownership.

Thank you for your feedback. We really appreciate it. Have a great day!

Dina O.

December 29th, 2023

easy to use and efficient i like that they give you an example to compare your work to

We are motivated by your feedback to continue delivering excellence. Thank you!

Alison L.

February 16th, 2021

Wonderful and easy to use platform. I was using a more complicated platform that wouldn't load half the time. Makes for filing deeds in the pandemic quick and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Keith L.

March 15th, 2019

Great to have a downloadable form, rather than a cloud solution that gives no guarantee of privacy. Appreciated the sample.......but all of that still left me with open issues about how to tweak the form to serve my particular needs......for example: how to ensure that survivor rights were properly characterized; how far back I should go with the "Source" section + how I should layer my own additions to the chain of ownership, etc. Nonetheless, an overall happy experience. Thank you for your help

Thank you for your feedback. We really appreciate it. Have a great day!

Shirley B.

July 9th, 2019

Very convenient, glad I discovered this website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April C.

June 24th, 2020

Great service fast and patience great team their staff kvh was very great part of team .I need it filed the same day . I will recommend them to others

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

January 11th, 2019

I downloaded the gift deed and I can not type my info onto it what am I doing wrong. Please advise

Sounds like you may be trying to complete the form in your browser. The document needs to be downloaded and saved to you computer, then opened in Adobe.