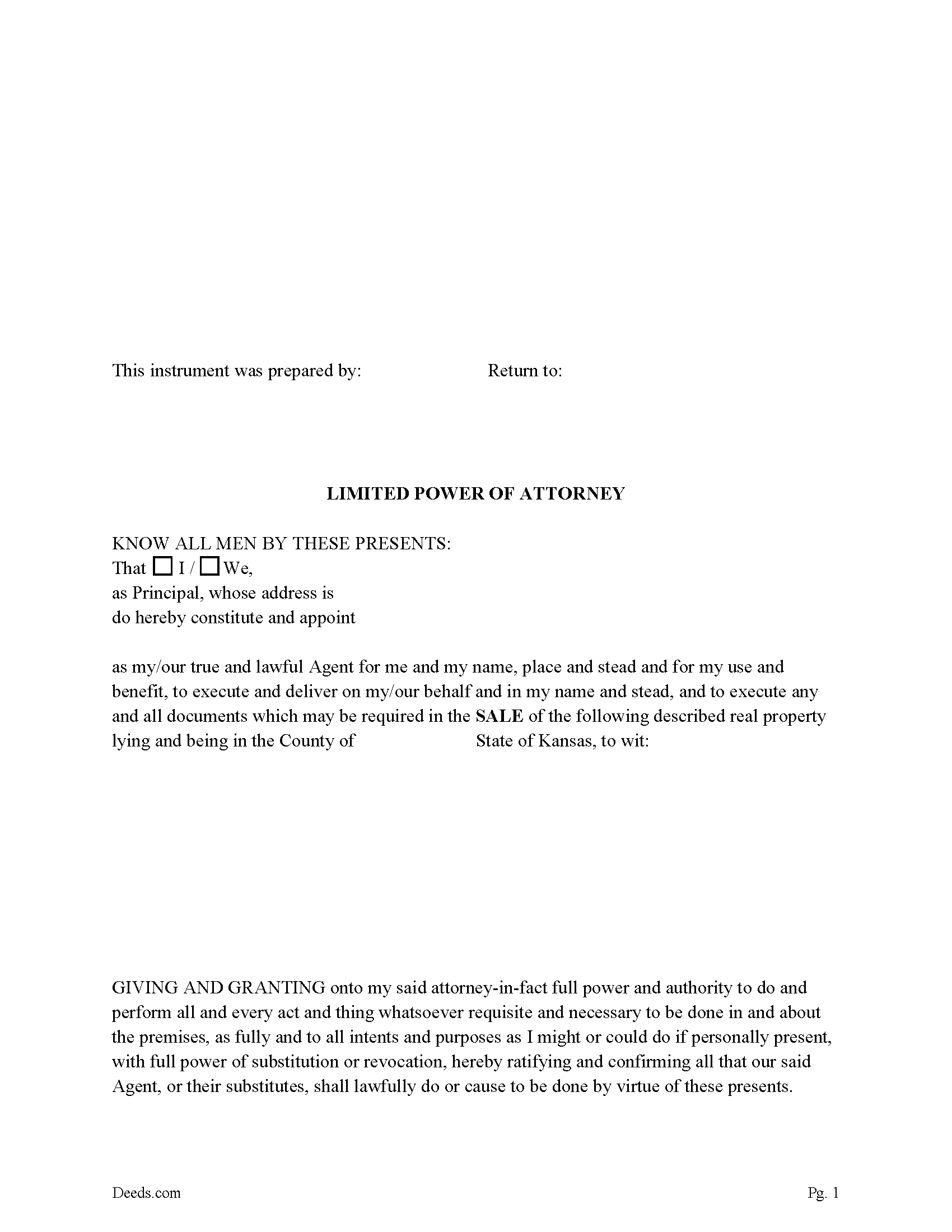

Rice County Limited Power of Attorney for Sale Form

Rice County Limited Power of Attorney for Sale Form

Fill in the blank Limited Power of Attorney for Sale form formatted to comply with all Kansas recording and content requirements.

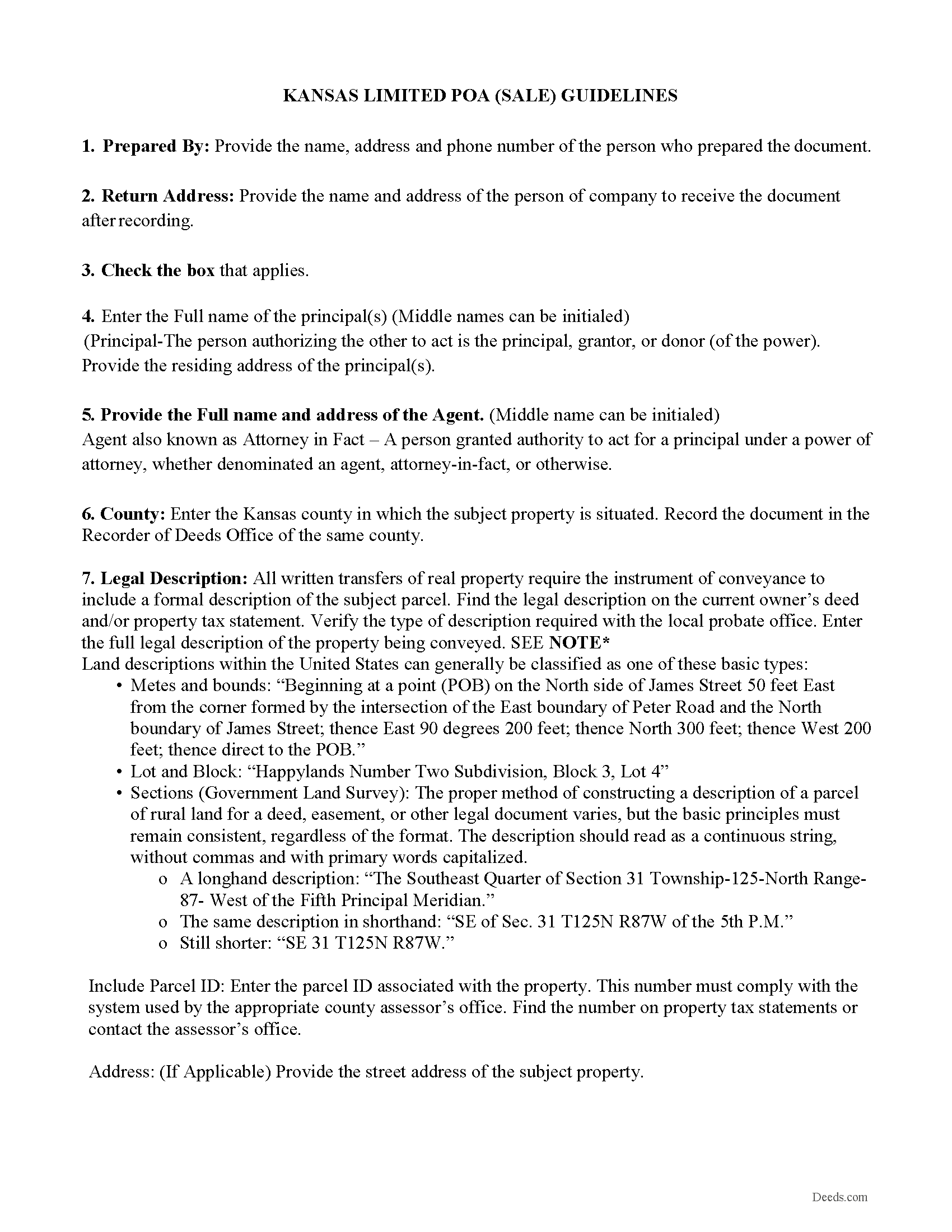

Rice County Limited Power of Attorney for Sale Guide

Line by line guide explaining every blank on the Limited Power of Attorney for Sale form.

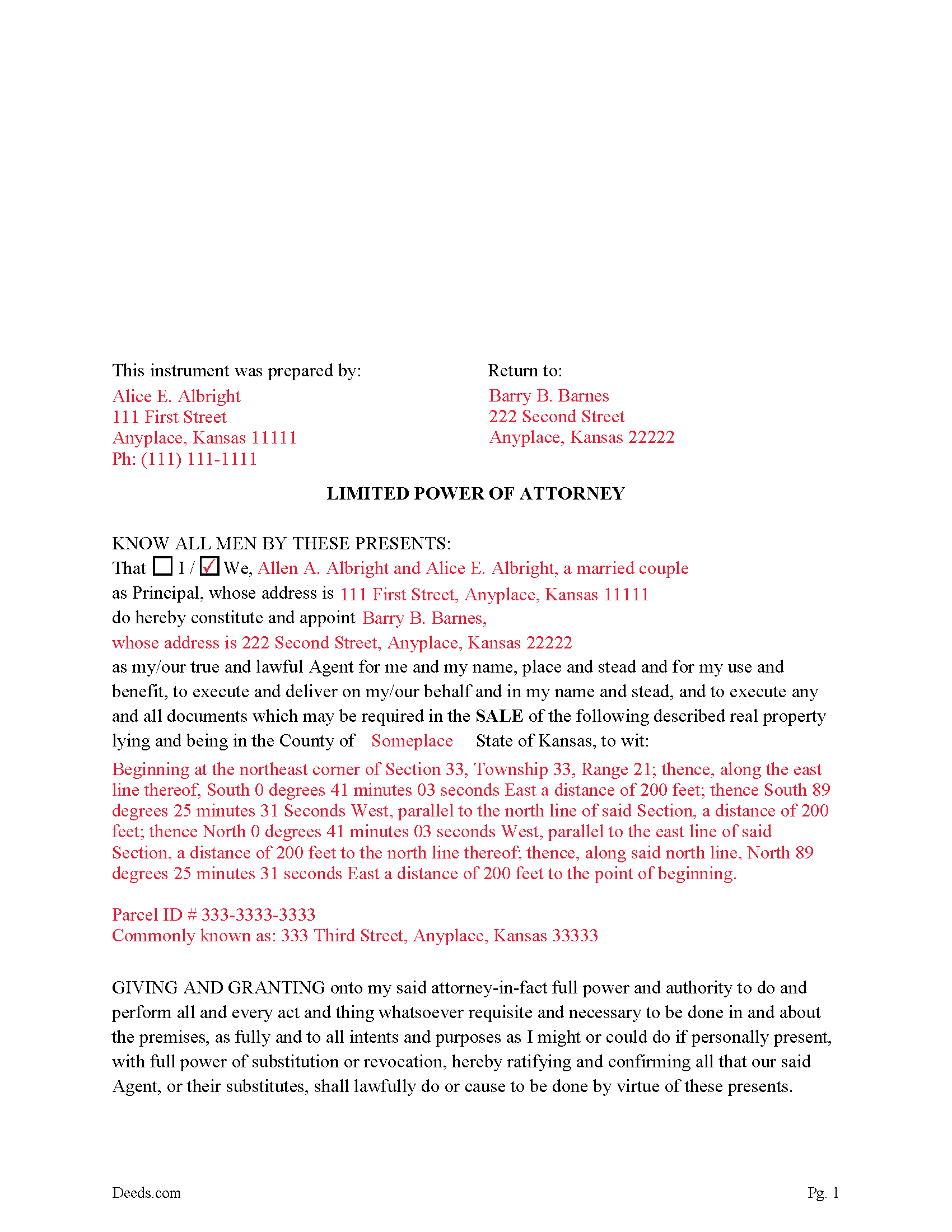

Rice County Completed Example of the Limited Power of Attorney for Sale Document

Example of a properly completed Kansas Limited Power of Attorney for Sale document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Rice County documents included at no extra charge:

Where to Record Your Documents

Rice County Register of Deeds

Lyons, Kansas 67554

Hours: 8:00am-5:00pm M-F

Phone: (620) 257-2931

Recording Tips for Rice County:

- Make copies of your documents before recording - keep originals safe

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

- Have the property address and parcel number ready

Cities and Jurisdictions in Rice County

Properties in any of these areas use Rice County forms:

- Alden

- Bushton

- Chase

- Geneseo

- Little River

- Lyons

- Raymond

- Sterling

Hours, fees, requirements, and more for Rice County

How do I get my forms?

Forms are available for immediate download after payment. The Rice County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rice County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rice County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rice County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rice County?

Recording fees in Rice County vary. Contact the recorder's office at (620) 257-2931 for current fees.

Questions answered? Let's get started!

In Kansas, a Limited Power of Attorney (LPOA) for the sale of real estate is a legal document that grants a designated person (the agent or attorney-in-fact) the authority to handle specific matters related to the sale of real property on behalf of the principal (the person granting the power). This power can include signing documents, handling transactions, and making decisions related to the sale. However, the statutes and legal requirements can be complex and are subject to change, so it's important to consult a legal professional for the most current and applicable advice.

General guidelines regarding a Limited Power of Attorney for real estate in Kansas:

Written Document: The power of attorney must be in writing. It should clearly state the principal's name, the agent's name, and the specific powers granted.

Durability: This document shall continue in effect during any subsequent disability, incompetency, or incapacity of the principal in accordance with the provisions of K.S.A. 58-650, et al.,

Acknowledgment: The document typically needs to be signed by the principal and should be notarized. This is particularly important for real estate transactions, as a notarized document is usually required for recording the deed or other documents in county records.

Specificity: Since it is a limited power of attorney, the document should specify exactly what real estate is involved and what powers the agent has regarding the sale of that property. This can include the power to negotiate and accept offers, execute documents, and handle closing procedures.

Recording: In many cases, the power of attorney document must be recorded with the county recorder’s office in the county where the property is located, especially if it will be used for executing deeds or other documents that will be recorded.

Effective and Termination: It is intended that this power of attorney is to become effective immediately upon execution and terminates upon the completion of the sale of the property.

Legal Capacity: The principal must be of sound mind and have the legal capacity to execute the power of attorney at the time it is signed.

Compliance with Other Laws: Ensure that the document complies with other relevant Kansas laws and any specific requirements of the county where the property is located.

(Kansas Limited POA for Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Rice County to use these forms. Documents should be recorded at the office below.

This Limited Power of Attorney for Sale meets all recording requirements specific to Rice County.

Our Promise

The documents you receive here will meet, or exceed, the Rice County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rice County Limited Power of Attorney for Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Kyle K.

May 3rd, 2022

Deeds is extremely helpful and cost effective for small and large businesses. Saves me time to do more valuable tasks.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie R.

December 16th, 2020

Seamless and prompt service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia C.

December 29th, 2021

Deeds.com saved me time and research by offering a beneficiary deed and full instructions for filling it out. My home will now pass directly to my only son without probate. This form and other complimentary forms was an excellent value.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly M.

May 20th, 2019

Great service once again from Deeds.com. I will be using them again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Frank S.

March 28th, 2025

ALL THE DEED DOCUMENTS ARE ALL EXCELLENT AND ADDITIONAL DOCUMENTS REGARDING COMPLETING THE DOCUMENTS!!! EXCELLENT!!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Michelle D.

March 4th, 2019

Very professional service, they were timely and proficient with answers and sending in the documents that I requested. Will work with them again in the future

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy B.

July 22nd, 2021

Very user-friendly. Looks like everything I needed in one place. Great job.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sarjit K.

August 30th, 2023

excellent

Thank you!

Tiffany P.

May 7th, 2019

Very quick and gave me exactly what I needed! I would have had to go down to the courts and take off work to get this info otherwise.

Thank you for your feedback. We really appreciate it. Have a great day!

Anita A.

February 10th, 2019

No review provided.

Thank you!

Spencer A.

January 25th, 2019

Deeds.com made it so easy to file my paper work with the county. It saved me half a days travel and cost me about a tank of gas. This service was well worth the saved travel time and energy. I would highly recommend this service to other individuals. The other companies I spoke with only service law firms, title companies & banks etc. Thanks deed.com, I'll be back and will refer all my friends too.

Thank you so much Spencer, we really appreciate your feedback!

Terri L.

January 31st, 2022

Great Tool! Very easy to complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

heather i.

December 5th, 2022

I don't pay very close attention to what I'm doing all the time which leads to mistakes. Deeds.com was helpful in correcting my error and getting me on my way.

Thank you!

Carol W.

March 14th, 2021

The only reason for the low review was I could not find the form that I needed.

Sorry to hear that we did not have what you needed. We hope you found it somewhere. Have a wonderful day.

James W.

February 27th, 2021

We were able to find deceased parents' deed.

Thank you!