Dickinson County Mineral Deed with Quitclaim Covenants Form

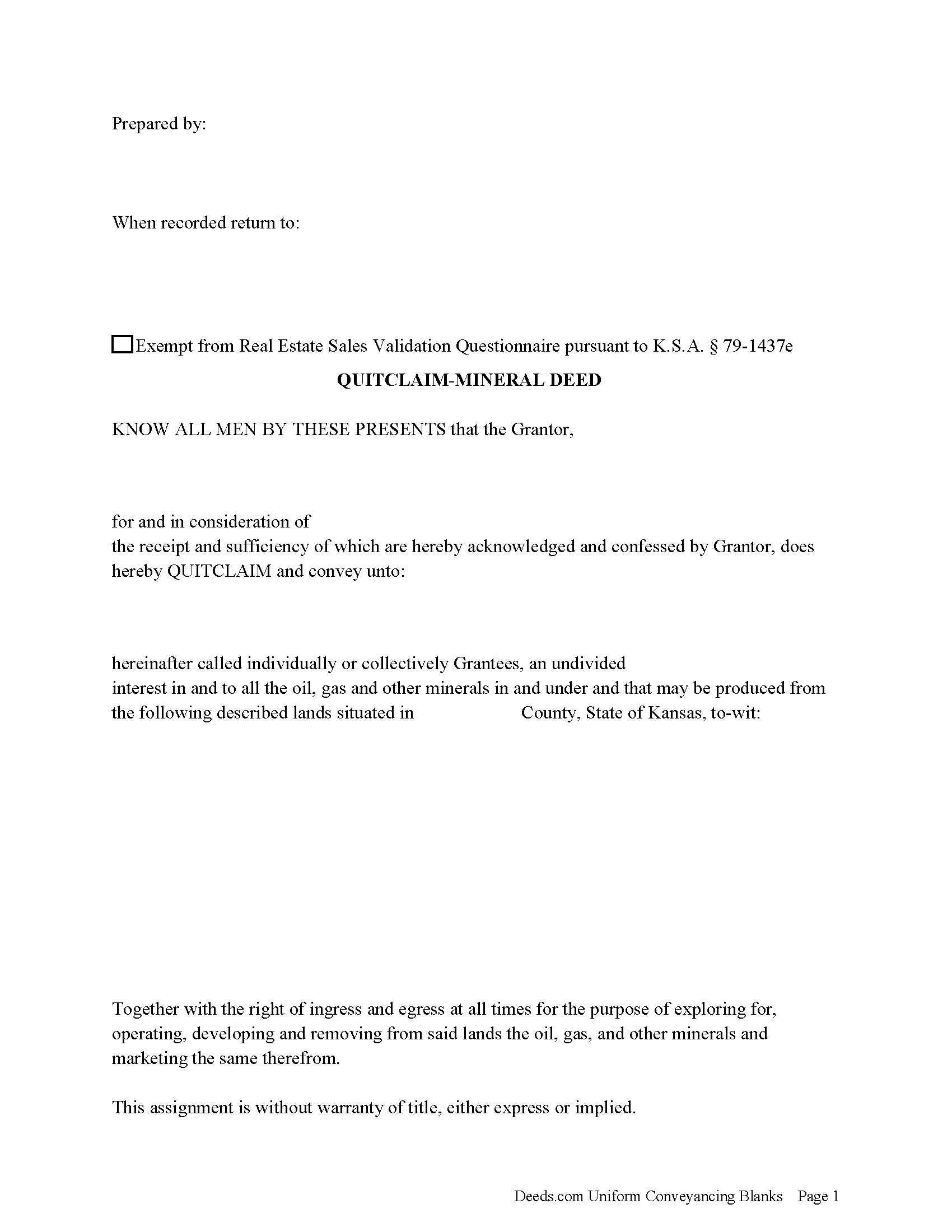

Dickinson County Mineral Deed with Quitclaim Covenants Form

Fill in the blank Mineral Deed with Quitclaim Covenants form formatted to comply with all Kansas recording and content requirements.

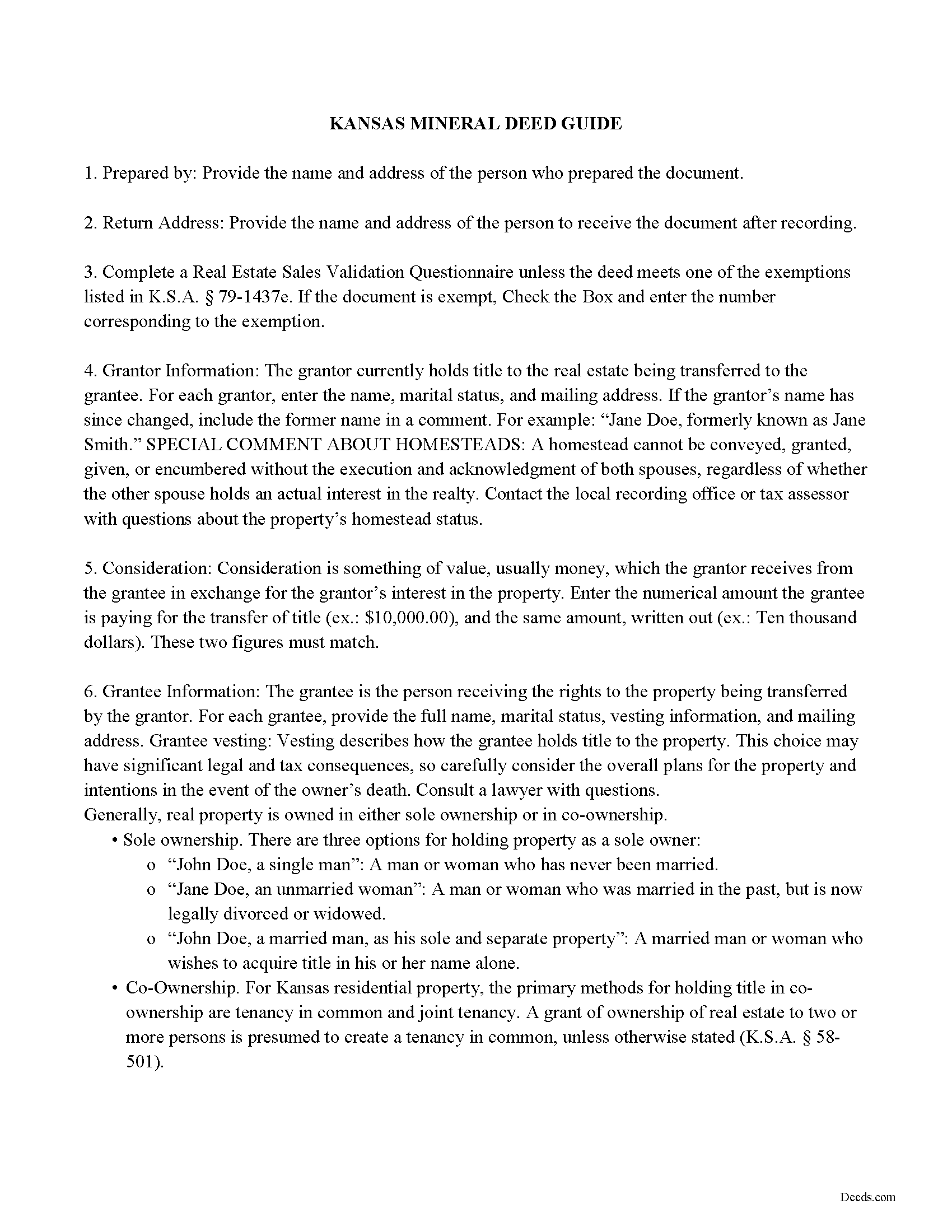

Dickinson County Mineral Deed with Quitclaim Covenants Guide

Line by line guide explaining every blank on the Mineral Deed with Quitclaim Covenants form.

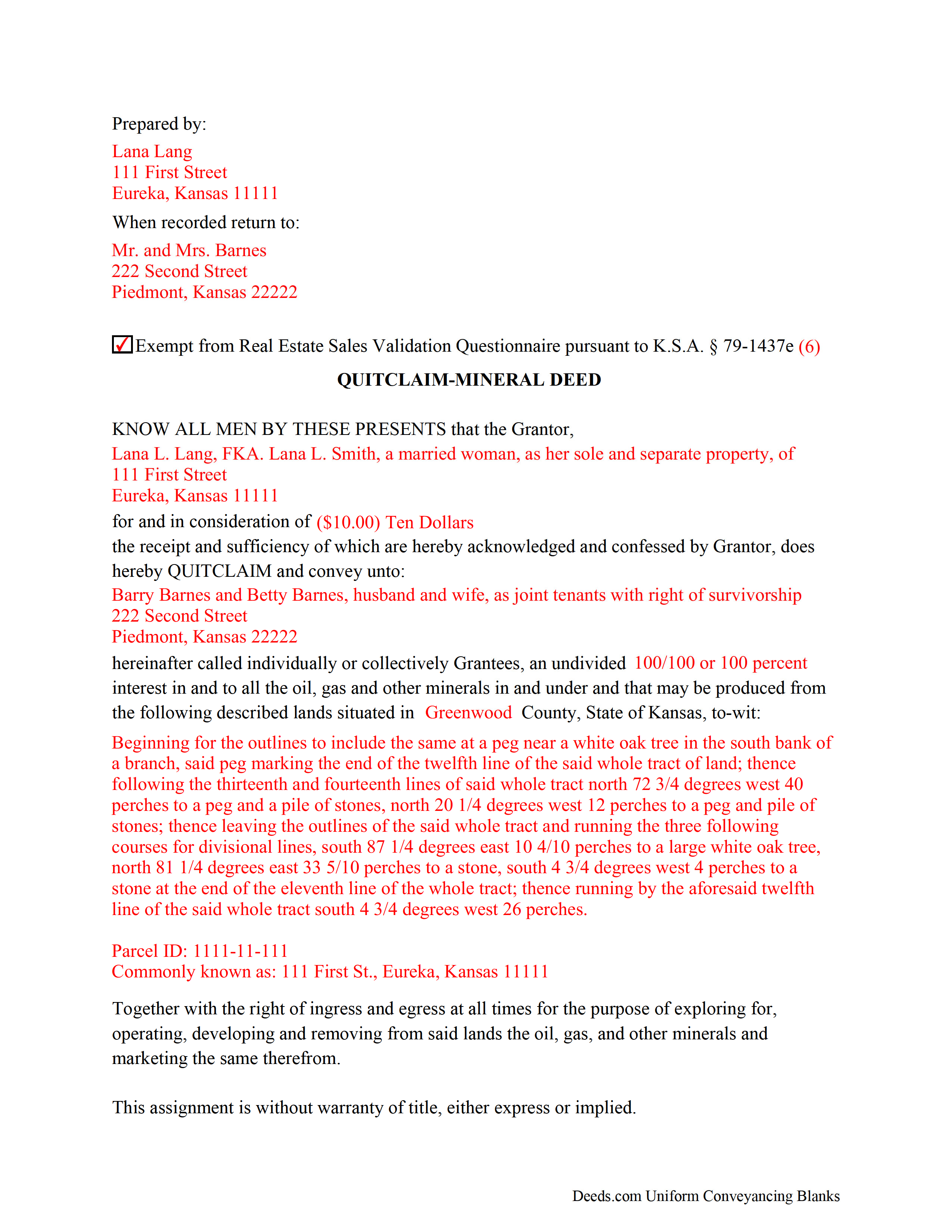

Dickinson County Completed Example of the Mineral Deed with Quitclaim Covenants Document

Example of a properly completed Kansas Mineral Deed with Quitclaim Covenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Dickinson County documents included at no extra charge:

Where to Record Your Documents

Dickinson County Register of Deeds

Abilene, Kansas 67410

Hours: 8:00am-5:00pm M-F

Phone: (785) 263-3073

Recording Tips for Dickinson County:

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Dickinson County

Properties in any of these areas use Dickinson County forms:

- Abilene

- Chapman

- Enterprise

- Herington

- Hope

- Solomon

- Talmage

- Woodbine

Hours, fees, requirements, and more for Dickinson County

How do I get my forms?

Forms are available for immediate download after payment. The Dickinson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dickinson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dickinson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dickinson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dickinson County?

Recording fees in Dickinson County vary. Contact the recorder's office at (785) 263-3073 for current fees.

Questions answered? Let's get started!

The General Mineral Deed in Kansas Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. Resolution often involves the holder(s) of the mineral rights, quit-claiming any rights he/she/they have or might have in the subject property.

Use of this document can have a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Kansas Mineral Deed with Quitclaim Package includes form, guidelines, and completed example)

Important: Your property must be located in Dickinson County to use these forms. Documents should be recorded at the office below.

This Mineral Deed with Quitclaim Covenants meets all recording requirements specific to Dickinson County.

Our Promise

The documents you receive here will meet, or exceed, the Dickinson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dickinson County Mineral Deed with Quitclaim Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Glenda W.

April 22nd, 2021

It is a very helpful and awesome website. I was so glad to hear about it. It is very convenient and saves money as well. I'm sure I will be using it again in the future. Thumbs up to deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy C.

January 15th, 2021

Simple and easy to download. After reading the instructions/sample pages I did still have some questions regarding the beneficiary deed for the state of MO.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anna C.

February 9th, 2021

It was more detailed than the forms on other website, plus cheaper. I do not have date it was recorded in 2000 but did have date of warranty deed. Will that be ok with Recorder? Also did not want to date it today till I know when and where the Recorders office is located.

Thank you for your feedback. We really appreciate it. Have a great day!

Eleanor W.

October 30th, 2023

This link thankfully saved us much time and expense with positive correct completion of the forms needed and verifyed with the county office where to be filed.

Your kind words have lifted our spirits! Thank you for sharing your positive experience.

William C.

February 23rd, 2020

Excellent, easy to use. Technically accurate in all information offered.

Thank you!

Patricia D.

January 5th, 2019

I looked around for forms and came to this site. I had to do 15 deeds and this form was very useful to completing that. Very impressed. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

William J. T.

July 9th, 2019

Satisfied with downloaded documents.

Thank you!

Debra B.

April 14th, 2020

I was very glad to have this option for filing a form as it would have taken 4 days due to offices being closed to the public during the COVID 19 epidemic. I found the process to be fairly simple and I was able to file the document within 24 hours.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna C.

April 1st, 2022

Easy to use.

Thank you!

Scott D.

March 31st, 2025

I am very satisfied with the quality of the product I ordered. I have done similar property transfers/recording in the past on my own but paying for the forms and guidance is well worth it. The AI question area is extremely helpful. The example for the forms is perfect (as it has to be). I will absolutely use Deeds.com in the future for any related property needs. A+

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ellen D.

November 25th, 2019

Fantastic service! The forms were available to download instantly and they were perfect for my situation. Easy to use on my older computer. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Ann M.

February 11th, 2022

I was extremely pleased with how easy this process was, and how quickly my document was recorded. I will definitely use this again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rhonda L.

May 27th, 2020

This was one of the most simple but efficient process. Walked me thru every step. Total process was less than 2 weeks.

Thank you!

Shantu S.

December 1st, 2022

Easy to follow directions and complete the Deed.

Thank you!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.