Smith County Mineral Deed with Quitclaim Covenants Form

Smith County Mineral Deed with Quitclaim Covenants Form

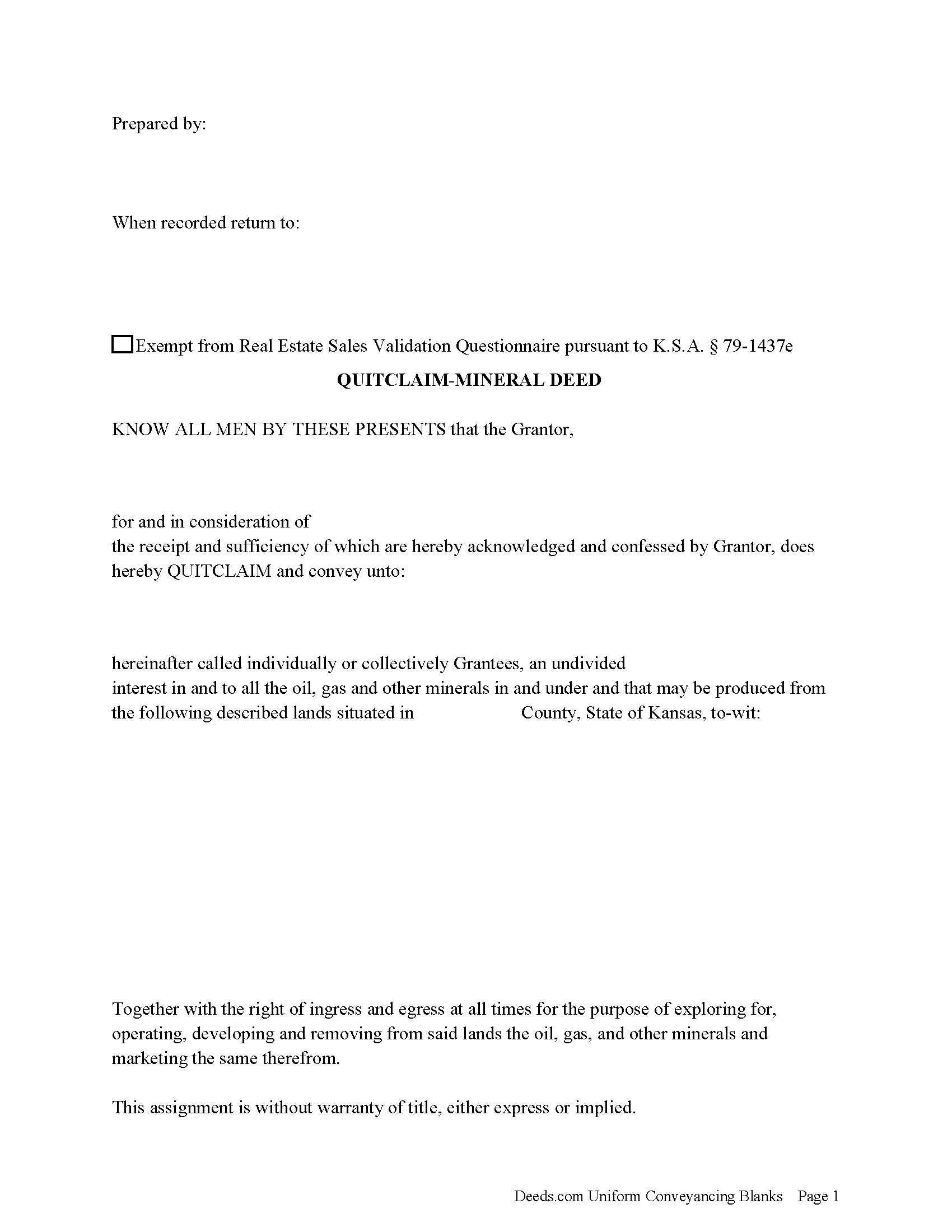

Fill in the blank Mineral Deed with Quitclaim Covenants form formatted to comply with all Kansas recording and content requirements.

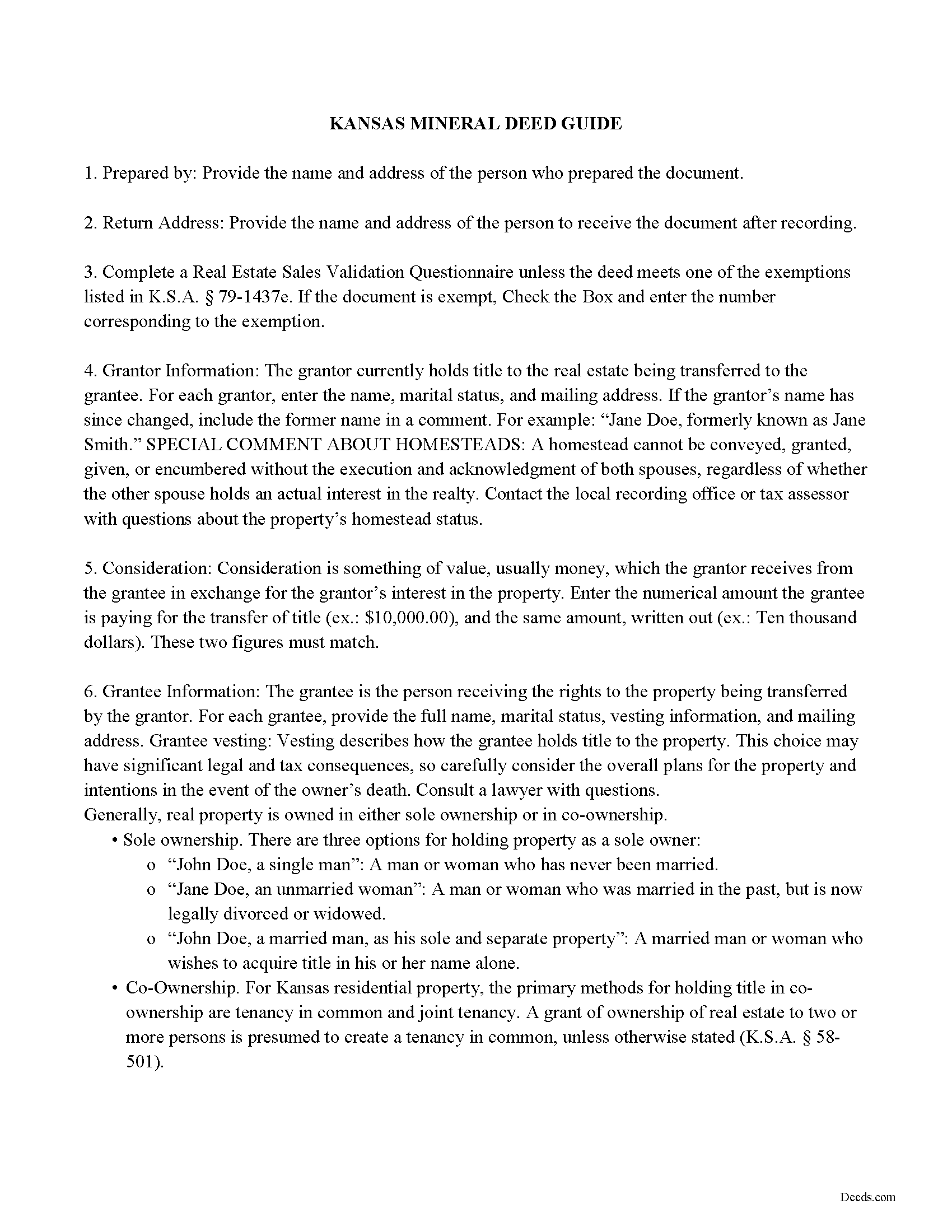

Smith County Mineral Deed with Quitclaim Covenants Guide

Line by line guide explaining every blank on the Mineral Deed with Quitclaim Covenants form.

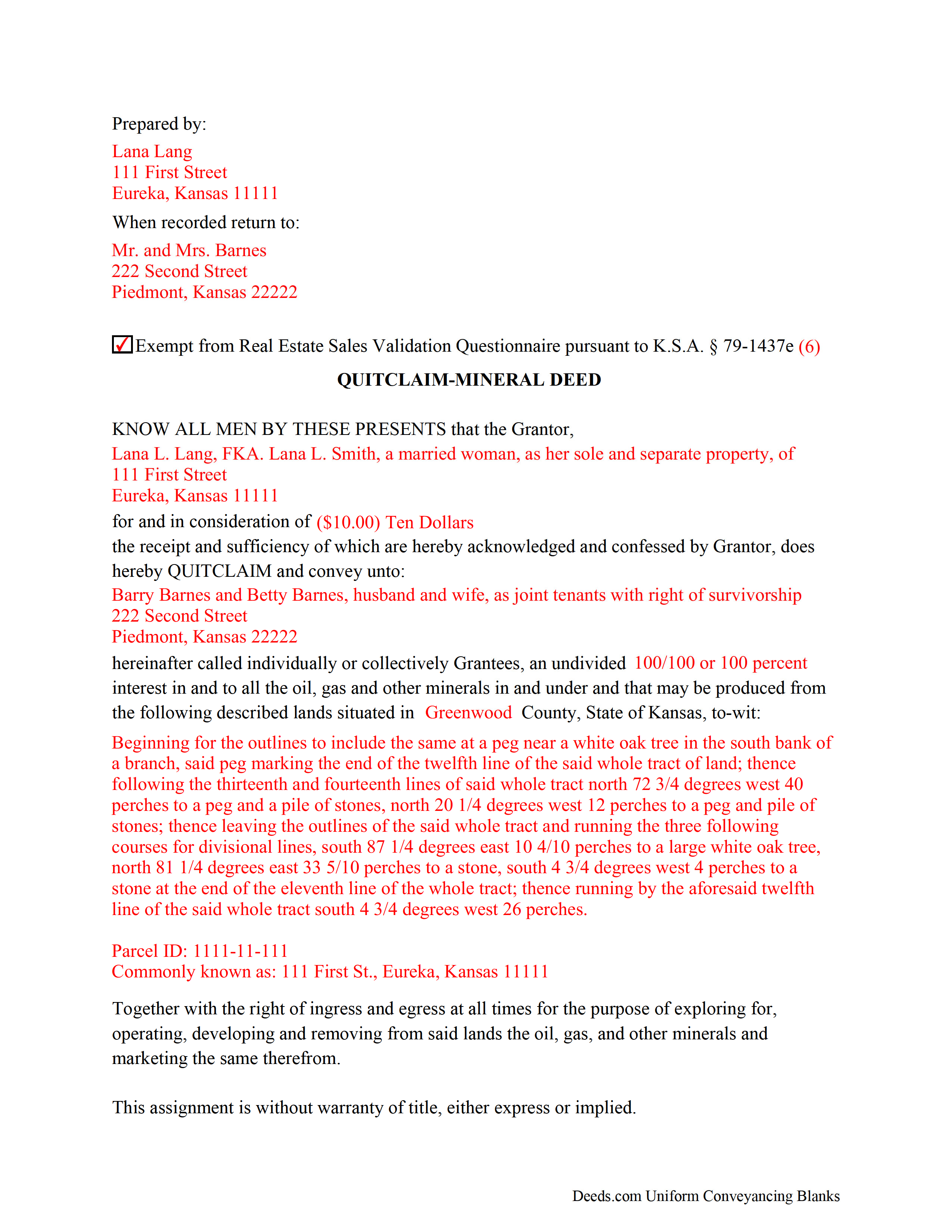

Smith County Completed Example of the Mineral Deed with Quitclaim Covenants Document

Example of a properly completed Kansas Mineral Deed with Quitclaim Covenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Smith County documents included at no extra charge:

Where to Record Your Documents

Smith County Register of Deeds

Smith Center, Kansas 66967

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (785) 282-5160

Recording Tips for Smith County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Smith County

Properties in any of these areas use Smith County forms:

- Athol

- Cedar

- Gaylord

- Kensington

- Lebanon

- Smith Center

Hours, fees, requirements, and more for Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smith County?

Recording fees in Smith County vary. Contact the recorder's office at (785) 282-5160 for current fees.

Questions answered? Let's get started!

The General Mineral Deed in Kansas Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. Resolution often involves the holder(s) of the mineral rights, quit-claiming any rights he/she/they have or might have in the subject property.

Use of this document can have a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Kansas Mineral Deed with Quitclaim Package includes form, guidelines, and completed example)

Important: Your property must be located in Smith County to use these forms. Documents should be recorded at the office below.

This Mineral Deed with Quitclaim Covenants meets all recording requirements specific to Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smith County Mineral Deed with Quitclaim Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

James S.

April 22nd, 2019

easy to use

Thank you James.

William C.

August 28th, 2019

Great service and fast also

Thank you!

GLENN B.

August 21st, 2023

Great affordable quick service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Amanda P.

April 14th, 2021

Quick kind and useful feedback provided related to issues.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wayne S.

March 12th, 2025

The website is quick and easy to navigate and the downloading of forms is a simple process.

Thank you, Wayne! We're thrilled to hear that you found our website quick and easy to navigate. Making the process simple for our customers is our goal! If you ever need anything, we're here to help. Appreciate your support!

Michael S.

May 13th, 2023

I'll give you a review. YOur deeds are way, way, TOO EXPENSIVE Michael Spinks, Attorney

Thank you for your feedback. We're sorry to hear that you're dissatisfied with our pricing.

We take pride in the quality of our products, and our prices reflect the costs involved in sourcing, producing, and ensuring the high standards we've set. It's a balancing act between affordability and maintaining these standards.

We're aware that everyone has a budget to consider, and we're constantly working on optimizing our pricing. However, we won't compromise the quality of our products for the sake of cutting costs. We believe in fair value, and we hope our customers do too.

Glenn M.

July 21st, 2023

Fast, easy, saves money!!!

Thank you!

Pamela J.

January 7th, 2021

The form was short, and explainable.. so that is my feed back on that...but we have not received anything back to actually see if we filled the form out correctly. So I definitely can not say if I'm satisfied with it or not until I know that it is approved. I would recommend Coos County web site for Forms to people. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Sally P.

June 22nd, 2023

I cannot thank the staff at Deeds.com enough for all of their assistance and their quick and their most pleasant responses. They were extremely quick and efficient to help me to file my documents. Thanks for everything and I will definitely be referring folks to your site.

Our team is deeply committed to providing efficient, reliable assistance and it's always rewarding to know we've made a difference for our customers. Your kind words about our quick and pleasant responses are much appreciated and will certainly serve as an extra boost of motivation for our team.

We also sincerely appreciate your intention to refer others to our site. Your trust and confidence in our service means a lot to us, and we're grateful to have you as part of the Deeds.com community.

Julie D S.

January 24th, 2020

thank you for all the forms

Thank you!

Robert B.

March 4th, 2019

Found this sight on the internet looking for information to add my fiance' to the house deed. Looks like the right place to be. Looking forward to getting the forms I need.

Thank you!

David C.

February 7th, 2021

I found it pretty easy to navigate, all worked well. Need a better example of excise tax. Lastly, your link in the email to get to this page doesn't work :)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eddy O.

August 20th, 2022

Your site was very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Wendy S.

January 11th, 2021

Good template that met my needs. Much better than another draft template that I found on another site. Would have been helpful if the template had been provided in a Word format instead of PDF so that I could remove the sections that are not applicable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel R.

December 6th, 2021

Could have had Clerk's certification of mailing form after it is recorded. Not fatal, but I did have to resort to reading the statute as well.

Thank you!