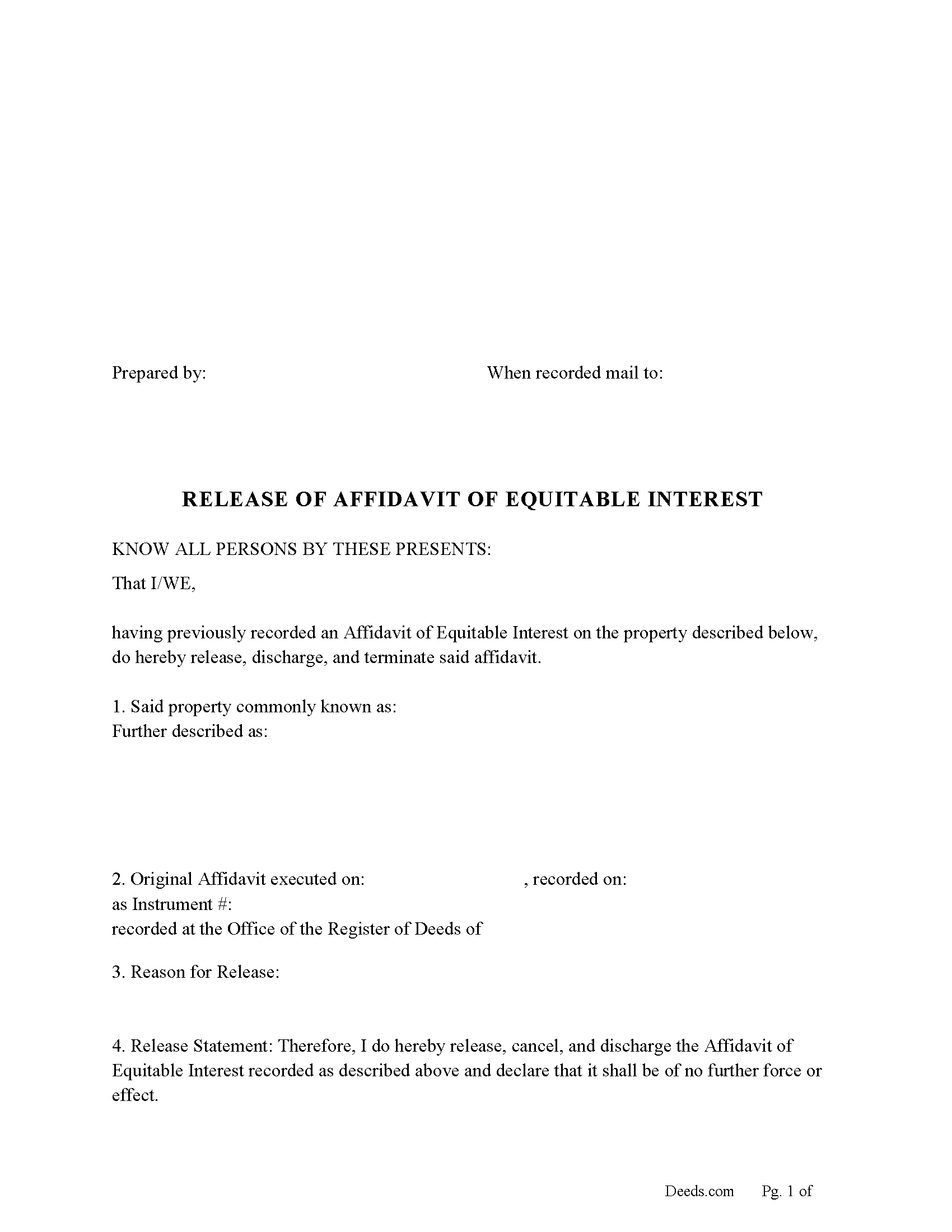

Johnson County Release of Affidavit of Equitable Interest Form

Johnson County Release of Affidavit of Equitable Interest Form

Fill in the blank Release of Affidavit of Equitable Interest form formatted to comply with all Kansas recording and content requirements.

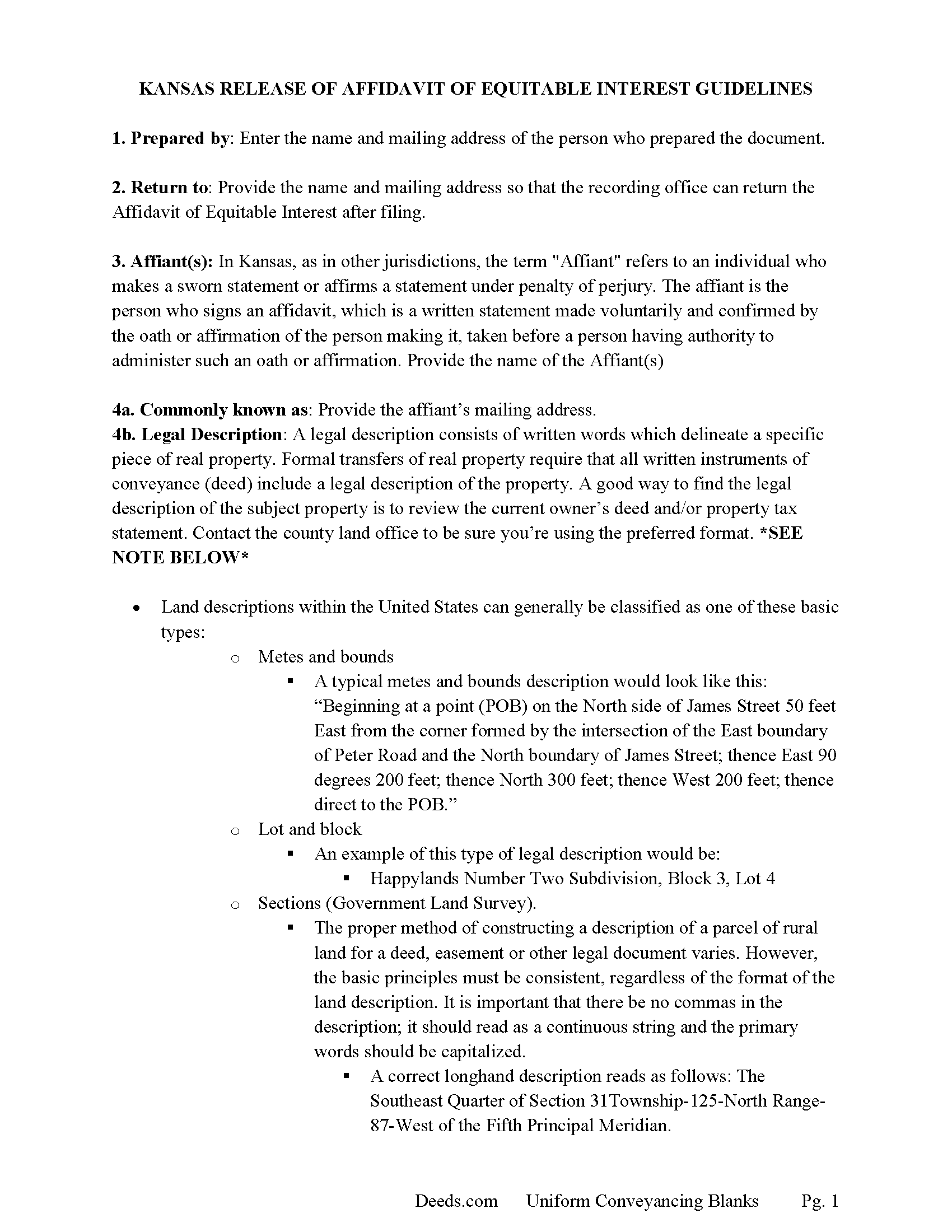

Johnson County Release of Affidavit of Equitable Interest Guide

Line by line guide explaining every blank on the Release of Affidavit of Equitable Interest form.

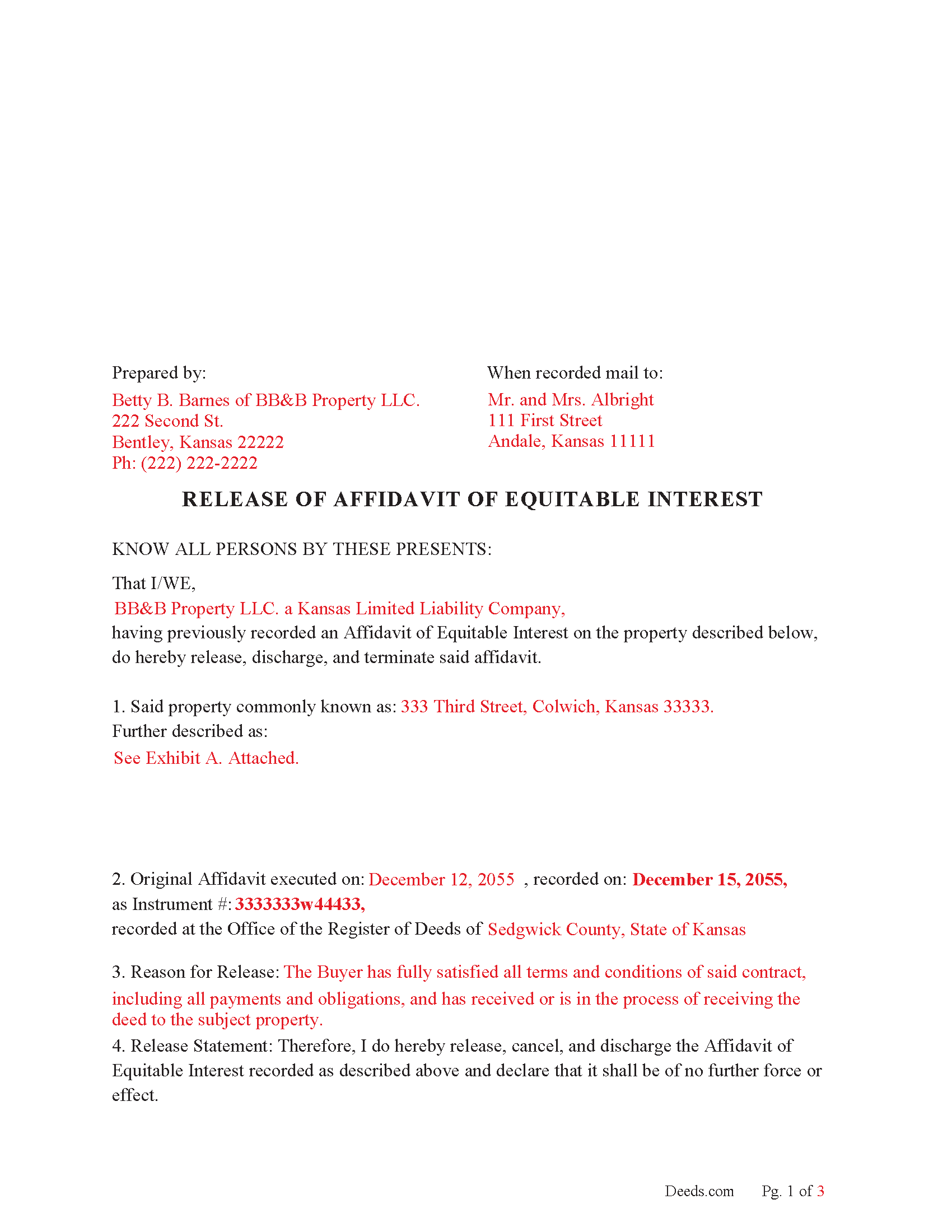

Johnson County Completed Example of the Release of Affidavit of Equitable Interest Document

Example of a properly completed Kansas Release of Affidavit of Equitable Interest document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Johnson County documents included at no extra charge:

Where to Record Your Documents

Records and Tax Administration

Olathe, Kansas 66061

Hours: 8:00am-5:00pm M-F

Phone: (913) 715-0775

Recording Tips for Johnson County:

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Clearview City

- De Soto

- Edgerton

- Gardner

- Leawood

- Lenexa

- Mission

- New Century

- Olathe

- Overland Park

- Prairie Village

- Shawnee

- Shawnee Mission

- Spring Hill

- Stilwell

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (913) 715-0775 for current fees.

Questions answered? Let's get started!

A Release of Affidavit of Equitable Interest is a recorded document used to formally cancel and remove an Affidavit of Equitable Interest from public land records. Its purpose is to clear title, remove encumbrances, or reflect that a buyer’s equitable interest in a property is no longer valid or active.

Here are some common uses for a Release of Affidavit of Equitable Interest in Kansas

1. Contract for Deed Has Been Fully Satisfied

The buyer has completed all payment obligations.

Legal title has been conveyed via deed.

Recording the release helps avoid confusion over any lingering claims.

2. Buyer Defaults on the Contract

The buyer stops making payments or otherwise breaches the contract.

Seller may record a release after giving proper notice (often 15 days as per K.S.A. 58-5202).

Clears title so the seller can resell or refinance the property.

3. Mutual Termination or Cancellation

Both parties agree to cancel the contract for deed.

Buyer relinquishes their equitable interest voluntarily.

Recording the release helps prevent future title disputes.

4. Buyer Has Vacated or Abandoned the Property

If the buyer walks away from the contract/property.

Seller can document the release and proceed with possession or resale.

5. Affidavit Was Filed in Error or No Longer Applicable

For example, the affidavit was mistakenly recorded or based on an unenforceable agreement.

Recording a release corrects the official land records.

6. Court Order or Settlement

A judge may order a release as part of a quiet title action or dispute resolution.

May also follow mediation, divorce, or estate settlement involving the property.

7. Clearing Title for Sale, Refinance, or Transfer

Lenders and title companies often require the release to be recorded before issuing a loan or insurance.

Ensures the property appears free of competing claims in title searches.

Recording the Release of Affidavit of Equitable Interest protects the seller, the buyer, and any third party (like a lender or future purchaser) by ensuring the public land records accurately reflect the current legal and equitable interests in the property.

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Release of Affidavit of Equitable Interest meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Release of Affidavit of Equitable Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Hinz H.

May 28th, 2020

Prompt accurate service

Thank you!

Debra M.

May 29th, 2020

Since the recorder's office is closed, due to Covid, this worked well to submit my Quit Claim Deed. I was a bit confused with the direction and download. But, I think I got her done! We'll see if I get recorded and confirmation is received. I may be back

Thank you for your feedback. We really appreciate it. Have a great day!

Terrill M.

January 10th, 2020

Great forms and information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie B.

December 17th, 2021

Site is SO easy to use. Thank you for such a valuable resource.

Thank you for your feedback. We really appreciate it. Have a great day!

MARCO G.

May 9th, 2019

Very easy to use. Got the emailed documents within minutes.

We appreciate your feedback Marco, thank you.

Delba O.

January 4th, 2021

This was the easiest process ever. Thank you for making this so easy. No hassle, just upload your docs, pay the invoice and done. It didn't even take 2 business days to get my deed recorded. If I ever need to record anything I will definitely use your services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Quaid H.

August 20th, 2019

Just what we needed! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael F.

May 12th, 2021

I'm not too bright and I made a mess of things when I tried to create my own deed. It was lucky that I found the forms here after so many of my personal failures. It's good that the pros know what they are doing.

Such kind words Michael, thank you.

Russell B.

March 15th, 2023

complete package as promised at a very reasonable cost. Easy forms to complete. Thank you. Definitely 5 stars!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Narcedalia G.

December 4th, 2023

Easy to use quick responses with accurate information and great customer service. No need to say more!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Maria W.

July 19th, 2022

Really, the best and easiest service given us to complete a process for recorder office! Thank you!!

Thank you!

Marilyn G.

June 21st, 2020

Easy to follow instructions

Thank you for your feedback. We really appreciate it. Have a great day!

Ruth R.

January 31st, 2020

Very pleased with the service, solved an immediate problem for me and at good price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dana G.

July 22nd, 2021

This service is WONDERUL. I spent 14 years trying to get a deed recorded properly. Deeds.com kept submitting and resubmitting after corrections until it was finally accepted. They did in one day what I couldn't get done in 14 years!

Thank you!

Trent D.

April 17th, 2022

You Guys are Fantastic and the service you all provide. Is PRICELESS!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!