Franklin County Transfer on Death Affidavit Form

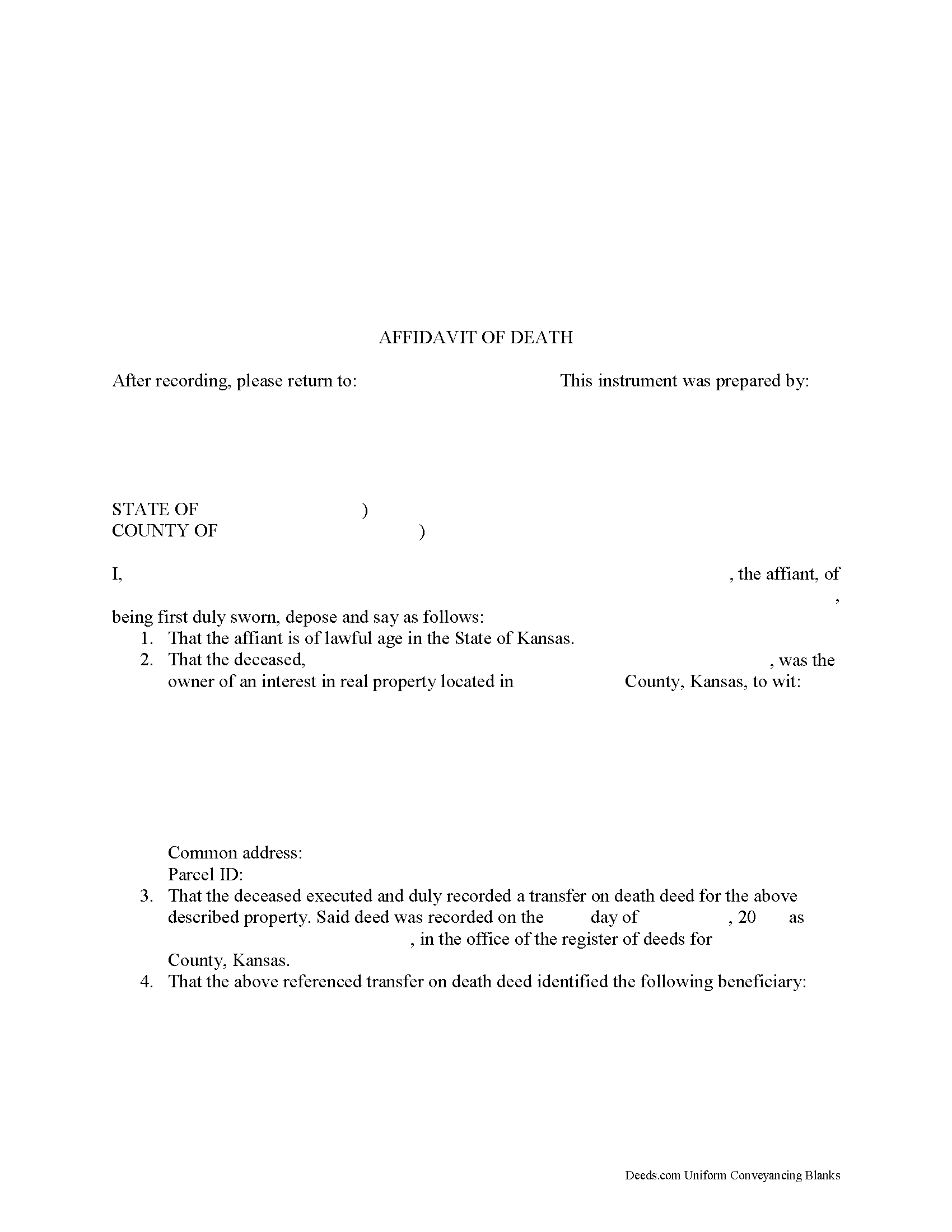

Franklin County Transfer on Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

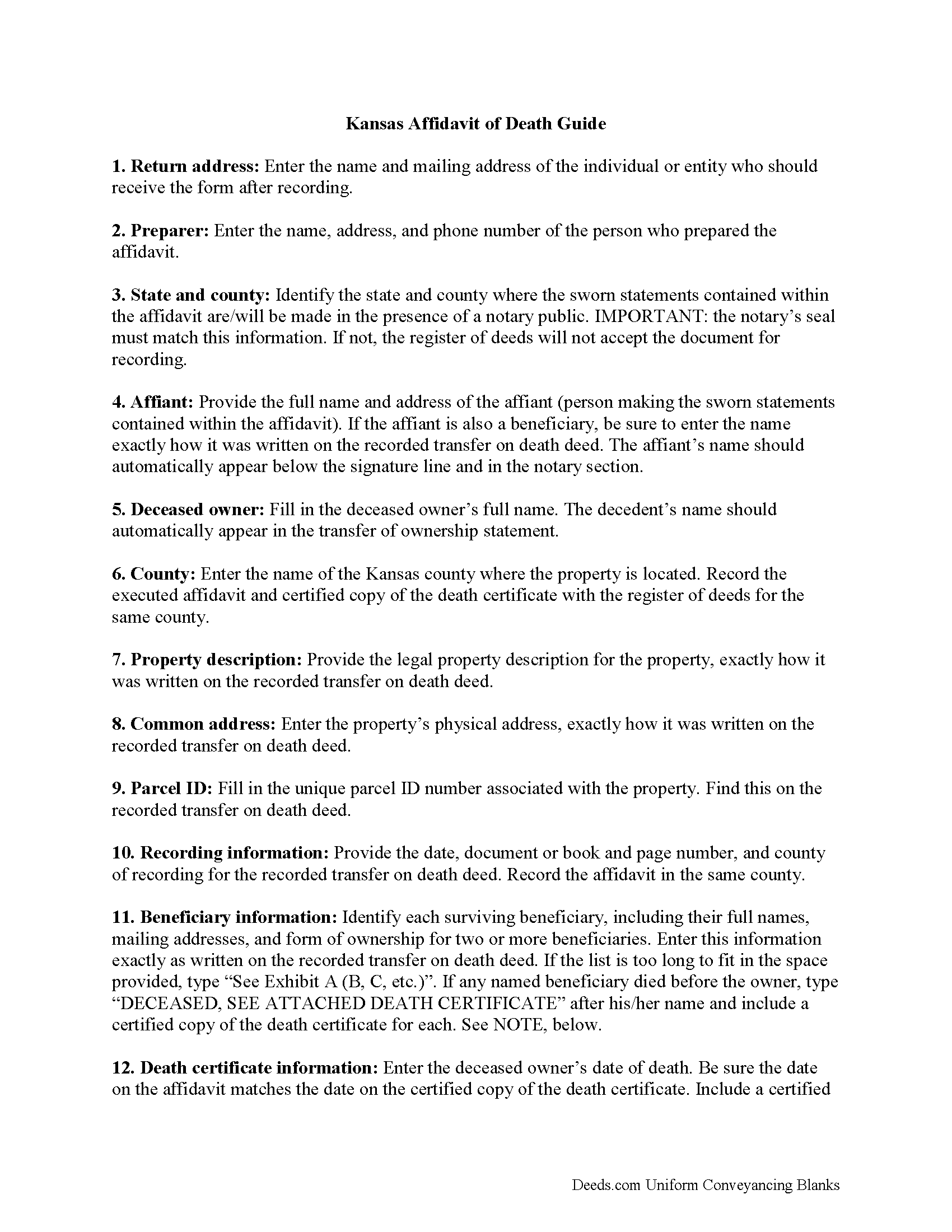

Franklin County Transfer on Death Affidavit Guide

Line by line guide explaining every blank on the form.

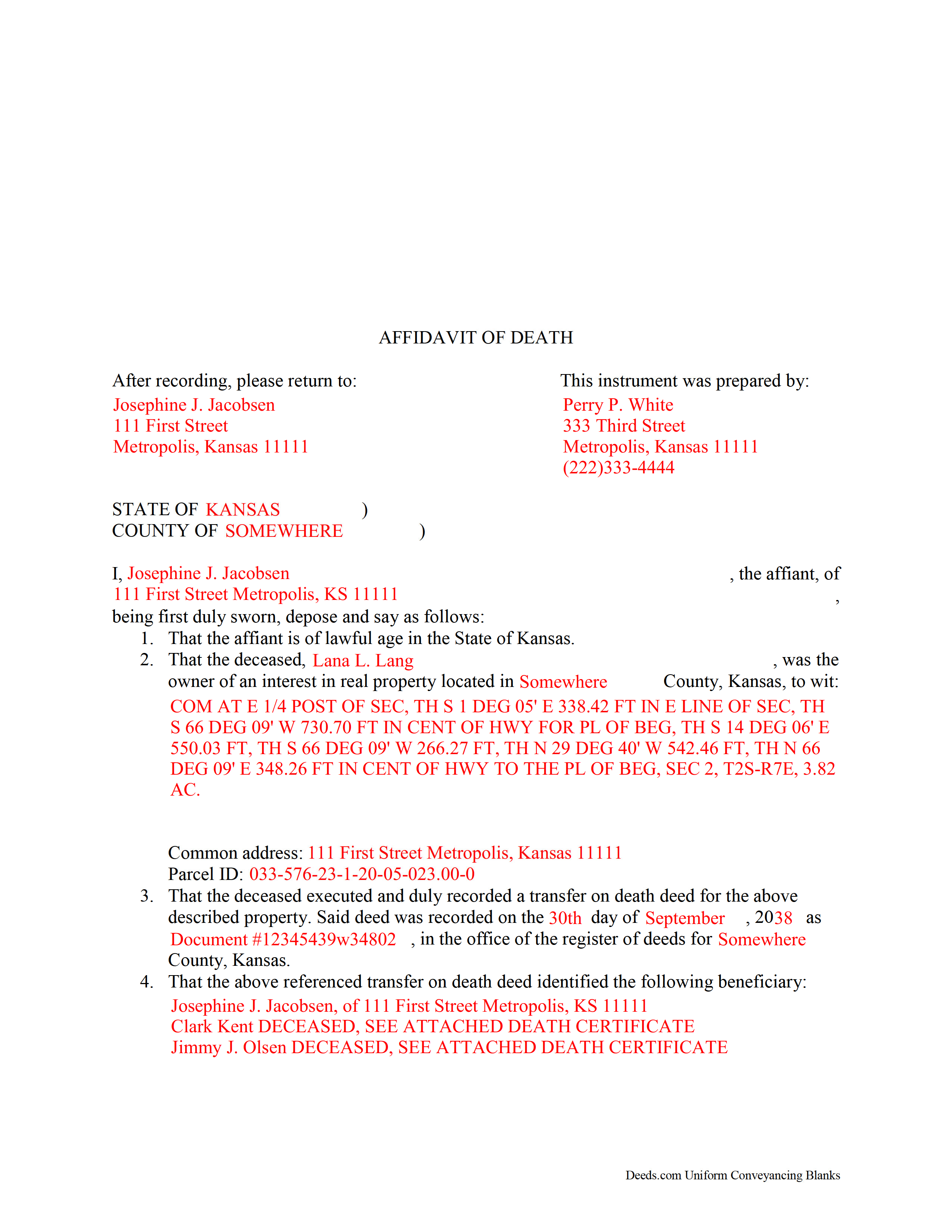

Franklin County Completed Example of the Transfer on Death Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Register of Deeds

Ottawa, Kansas 66067

Hours: Mon - Fri 8:00am to 4:30pm / Recording until 4:00pm

Phone: (785) 229-3440

Recording Tips for Franklin County:

- Avoid the last business day of the month when possible

- Make copies of your documents before recording - keep originals safe

- Have the property address and parcel number ready

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Lane

- Ottawa

- Pomona

- Princeton

- Rantoul

- Richmond

- Wellsville

- Williamsburg

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (785) 229-3440 for current fees.

Questions answered? Let's get started!

Using a Kansas Affidavit of Death to Complete a Transfer on Death

In Kansas, the county assessor's office initiates the transfer of real property rights under a transfer on death deed. There are several steps to take, however, before that can happen.

When the property owner dies, an individual with personal knowledge of the intended transfer, whether the named beneficiary or someone else, makes the sworn statements contained within an affidavit of death. The affidavit, along with an official copy of the deceased owner's death certificate, is filed for record with the register of deeds for the county where the land is located.

The register of deeds then forwards the details to the county assessor's office, where they match the information on the affidavit with the deed records. After the assessor's office verifies the details, they begin the process to transfer the previous owner's rights to the beneficiary.

(Kansas Transfer on Death Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Affidavit meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Transfer on Death Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Cynthia B.

July 21st, 2023

So simple to e-record my two documents. The communication was fast and very helpful. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Lee C.

February 10th, 2021

Quick, easy and reasonably priced.

Thank you!

JUDITH G.

April 22nd, 2022

So far, so good! I appreciate a no-hassle website.

Thank you!

Lorraine F.

October 9th, 2024

I followed the instructions to download the form for my Mac, typed in the legal description of the real property but the space provided for it would not expand so I just typed the form into Word as a document. While I appreciate having the form to work with it would have been a breeze if it worked properly.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Kathleen Z.

April 22nd, 2019

Very simple. By creating the deed and filing it myself, I am saving a legal fee of $300!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharla B.

November 25th, 2019

Was very helpful it helped me find out everything I needed for the deed.

Thank you!

Carol S.

May 7th, 2022

Needed a Quit Claim Deed and am so happy I went to Deeds.com. Completed my forms - they looked professional and had no problem submitting them to Assessor's office. PERFECT!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Desiree D.

April 10th, 2024

This service is so good, quick, reasonably priced! I would use Deeds.com again!

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!

Miljana K.

January 20th, 2019

I was on several sites but this was the easiest and cost effective. No bait and switch like on several sites where you get a "free trial" and then they started billing you monthly for legal services. Excellent.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia M.

August 19th, 2019

Very easy site to navigate and very helpful information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura J.

April 6th, 2021

Very satisfied. Highly recommend!

Thank you!

Karen L.

October 8th, 2021

My card was charged twice in error, I contacted deeds.com and within minutes, the error was corrected! Fast service, thank you deed.com

Thank you!

Natalie F.

April 13th, 2020

So convenient and easy to use! Will definitely recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gretchen D.

January 7th, 2019

Quick and easy process to get the documents, and helpful to see the example filled out.

Thank you for your feedback Gretchen, we really appreciate it. Have a great day!