Hamilton County Transfer on Death Deed Form

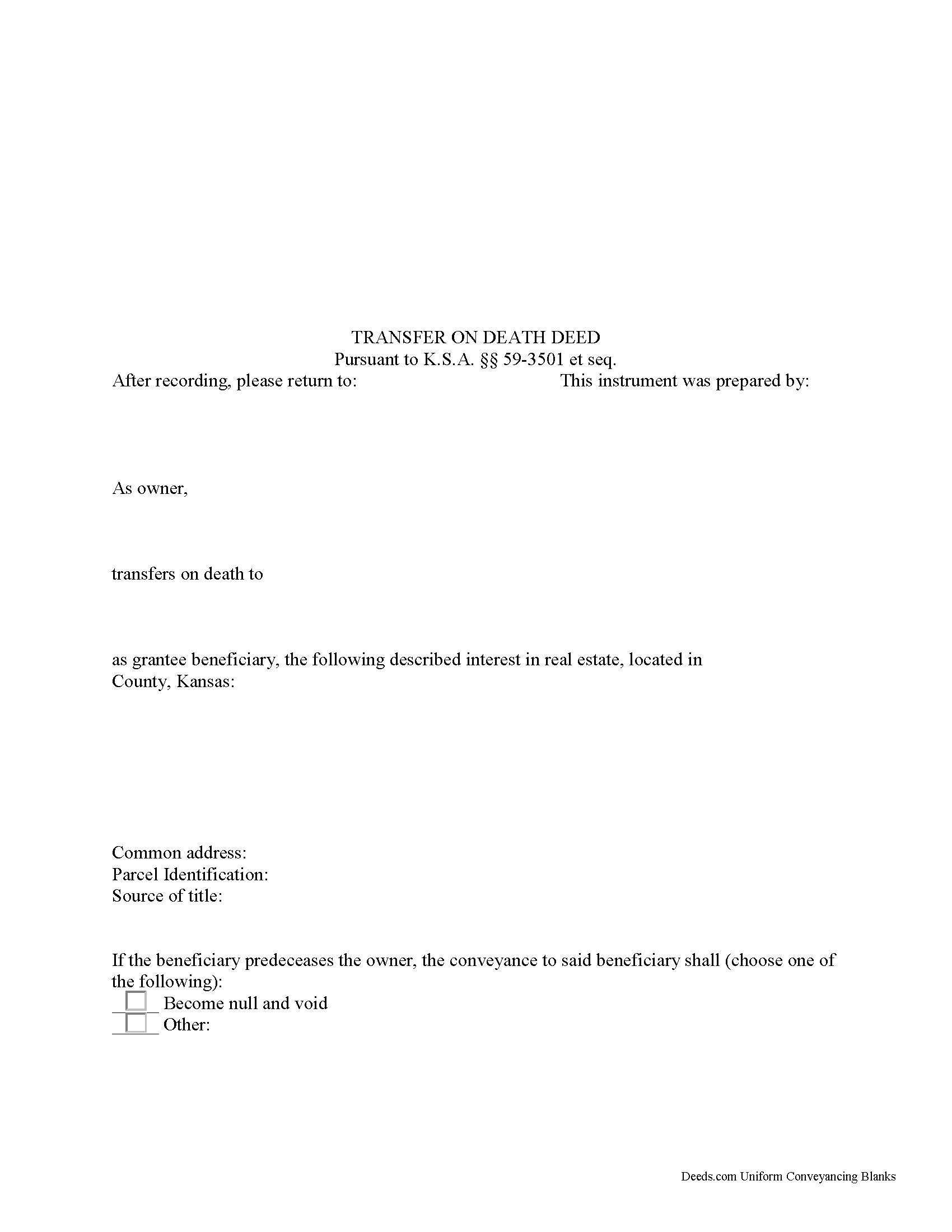

Hamilton County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

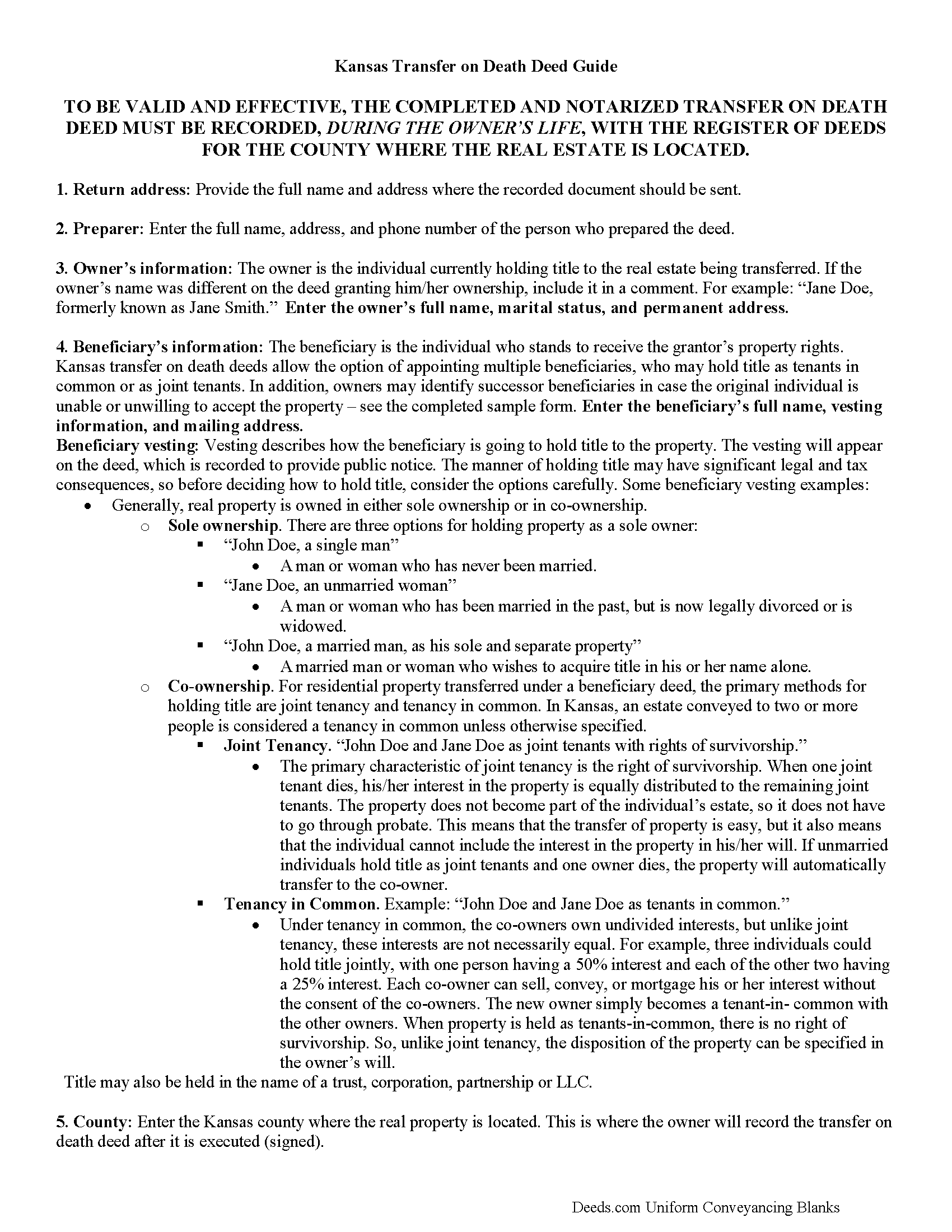

Hamilton County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

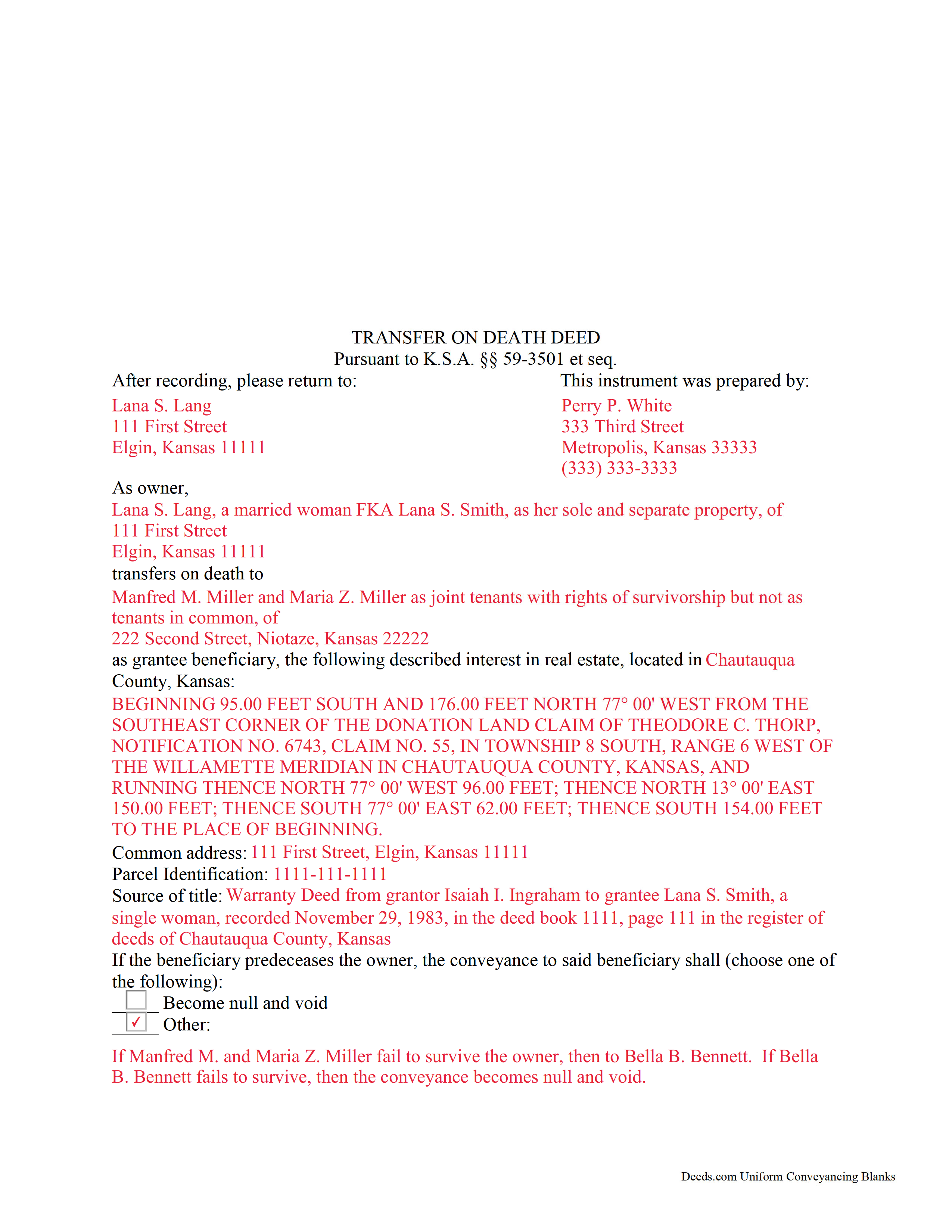

Hamilton County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Hamilton County documents included at no extra charge:

Where to Record Your Documents

Hamilton County Register of Deeds

Syracuse, Kansas 67878

Hours: 8:30 to 4:30 M-F

Phone: (620) 384-6925

Recording Tips for Hamilton County:

- Bring your driver's license or state-issued photo ID

- Avoid the last business day of the month when possible

- Have the property address and parcel number ready

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Hamilton County

Properties in any of these areas use Hamilton County forms:

- Coolidge

- Kendall

- Syracuse

Hours, fees, requirements, and more for Hamilton County

How do I get my forms?

Forms are available for immediate download after payment. The Hamilton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hamilton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hamilton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hamilton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hamilton County?

Recording fees in Hamilton County vary. Contact the recorder's office at (620) 384-6925 for current fees.

Questions answered? Let's get started!

Kansas enacted its statutory transfer on death deeds in 1997. These nontestamentary, nonprobate conveyances are governed by K.S.A. 59-3501 (2012) et seq. Nontestamentary means that the transfer is not included in or affected by the owner's last will and testament. Nonprobate means that the property's change in title occurs outside the probate process.

Transfer on death deeds, when lawfully executed and RECORDED DURING THE OWNER'S LIFE, convey a land owner's interest in a specific piece of real property to a designated beneficiary after the owner dies. Until death, the owner retains absolute rights to and control over the property, including entering into agreements to rent, mortgage, or sell the property outright.

The deeds do not require any consideration from the beneficiary, nor do they demand that the beneficiary receive notice about his/her/their potential future interest in real estate. The owner may also change, revoke, or otherwise modify the terms of the transfer. In addition, the statute explains that a "subsequent transfer-on-death beneficiary designation revokes all prior designations of grantee beneficiary or beneficiaries by such record owner for such interest in real estate" (K.S.A. 59-3503(b)).

As with a transfer on death deed, all revocations or other changes to a recorded transfer on death deed may be made "at any time prior to the death of the record owner, by executing, acknowledging and recording in the office of the register of deeds in the county where the real estate is located an instrument describing the interest revoking the designation. The signature, consent or agreement of or notice to the grantee beneficiary or beneficiaries is not required" (K.S.A. 59-3503(a)).

Beneficiaries should be aware, however, that they take "the record owner's interest in the real estate at death subject to all conveyances, assignments, contracts, mortgages, liens and security pledges made by the record owner or to which the record owner was subject during the record owner's lifetime, including . . . claims of the state of Kansas for medical assistance, as defined in K.S.A. 39-702" (K.S.A. 59-3504(b)).

Overall, transfer on death deeds offer a flexible and useful tool to owners of Kansas real estate. Even so, there are benefits and drawbacks to this method of estate planning. Because each situation is unique, contact an attorney with specific questions or for complex situations.

(Kansas Transfer on Death Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hamilton County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Hamilton County.

Our Promise

The documents you receive here will meet, or exceed, the Hamilton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hamilton County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Dave W.

April 14th, 2020

Hello, The instructions were clear and easy to navigate. Thanks, Dr. Dave Wayne

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terralynn J.

July 18th, 2019

I was very pleased to find ONLINE, Deed Revision Document(s) and their explanation. I ordered these document Forms, downloaded them and Printed them. Now, I will be able to fill them out in the privacy of my home. Instructions were also included, how to file this new Deed, after I complete it and have it Notarized. This has saved me time and emotional stress following the death of my husband. THANK YOU.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy S.

June 12th, 2021

The Quit Claim form was submitted, accepted, and processed by Davidson County with no hiccups. Recommended service!

Thank you!

NATALIE A.

January 6th, 2021

The form was very easy to use and the sample tool you had was very helpful. the only problem i had was saving the document and then trying to find it later. I finally was able to figure out how to save it. but i still cannot find the saved document on my computer. Luckily i printed it before i closed it and did not need to make any changes.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

January 11th, 2019

I downloaded the gift deed and I can not type my info onto it what am I doing wrong. Please advise

Sounds like you may be trying to complete the form in your browser. The document needs to be downloaded and saved to you computer, then opened in Adobe.

Alana G.

March 26th, 2021

I was very pleased. It was the form I needed. I was getting discouraged by companies that wanted me to sign up for monthly payments just to get the one form I needed. I prefer your system of paying for what I get. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine W.

January 24th, 2019

I was impressed by the completeness of the package of forms PLUS instructions. Particularly helpful is the filled in sample, which enables you to see what a correct, completed deed ought to look like.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chanda C.

June 2nd, 2020

It's going well so far!

Thank you!

Chrystal L.

February 25th, 2023

Excellent! Follow the prompts for easy access. Forms readily available. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ROBERET D.

November 18th, 2021

after a poor start was able to get to the forms page and find what I was looking for and every thing worked good. Just getting to the right area was a struggle but we made thanks Bob

Thank you for your feedback. We really appreciate it. Have a great day!

MARIA G.

July 5th, 2021

I tried 3 local attorneys and got no where , wrong information, to busy and another one was very rude. One said he'd do it then didn't. I was so stressed and tried a different online form company advertising an in person attorney within hours. They did call back but gave me the wrong answer. I needed a form used in NC and knew about it from the clerk of the court. The deadline was approaching, I looked one more time and found Deeds.com. They have the form and the much need instructions and for less than $30.00. I am so pleased and also relived!

Thank you for your feedback. We really appreciate it. Have a great day!

Connie C.

February 18th, 2021

I thought the process was fairly easy. The price was reasonable. I had a slight problem, some of the words were missing from one page of the documents when I printed it. However, after I saved it to my computer, I was able to print the page in full.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer M.

April 3rd, 2024

Consistent and quick. This site saves me so much time away from my desk. It's a great resource for my small business!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy M.

June 2nd, 2019

I like what I see so far!

Thank you!

Jennie P.

June 25th, 2019

Thank you for the information you sent.

Thank you!