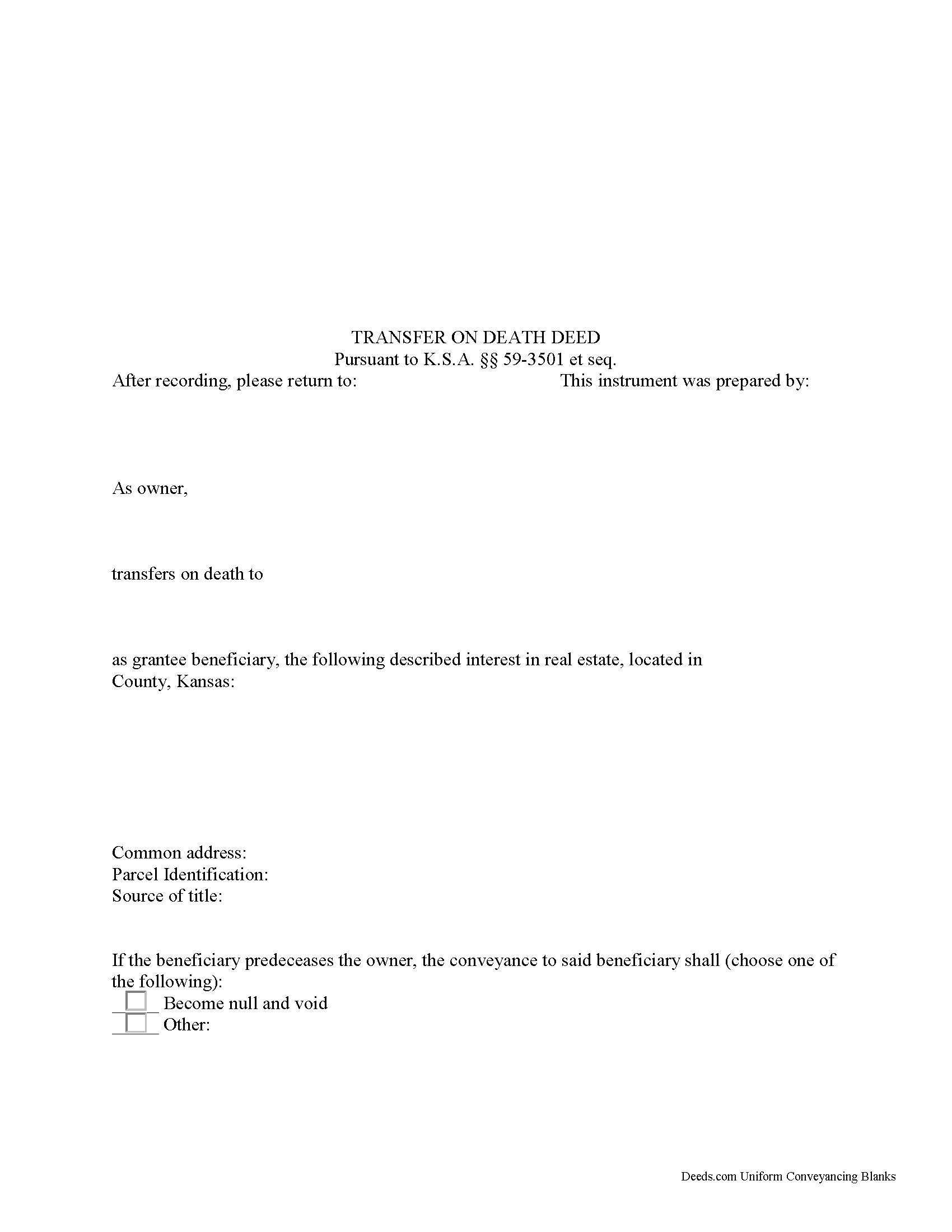

Rawlins County Transfer on Death Deed Form

Rawlins County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

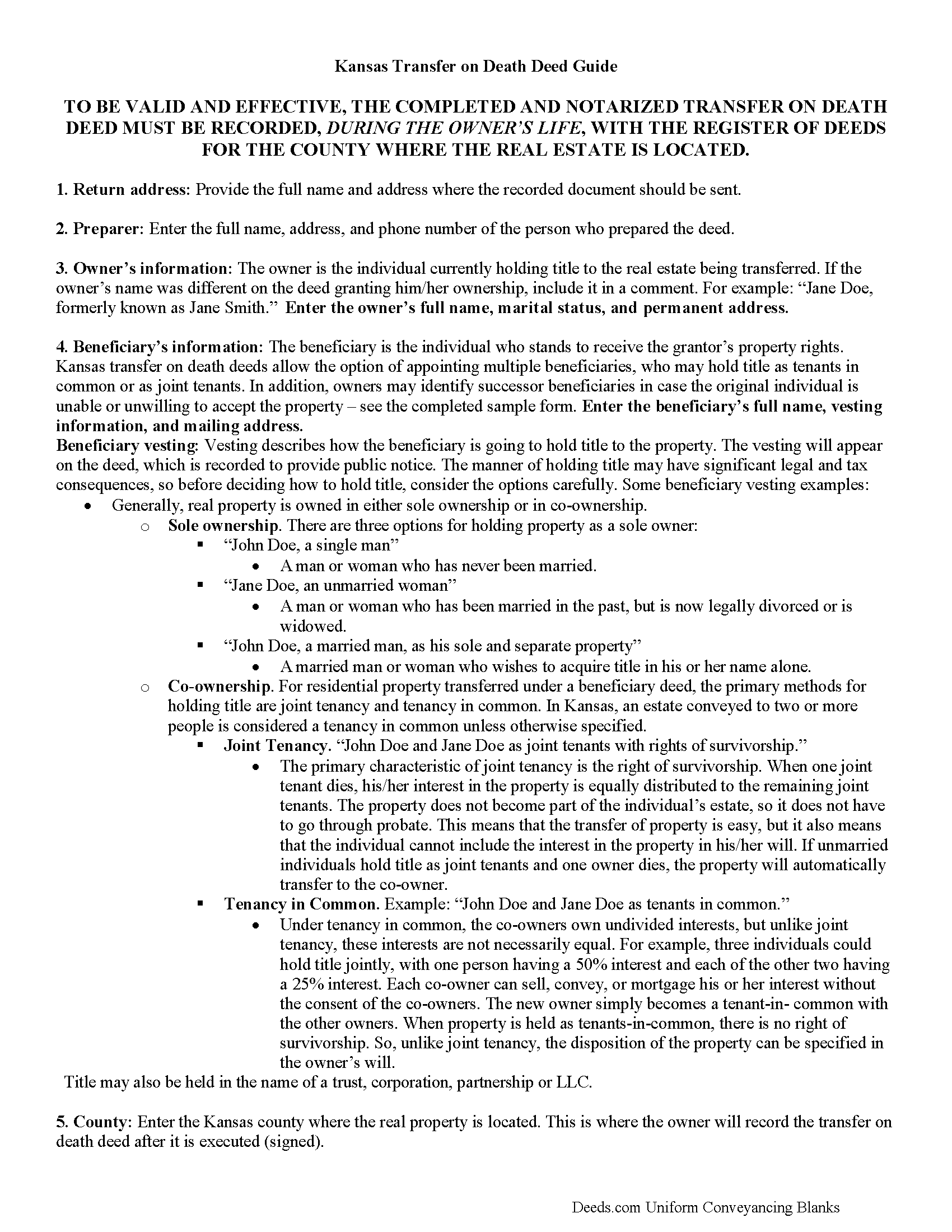

Rawlins County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

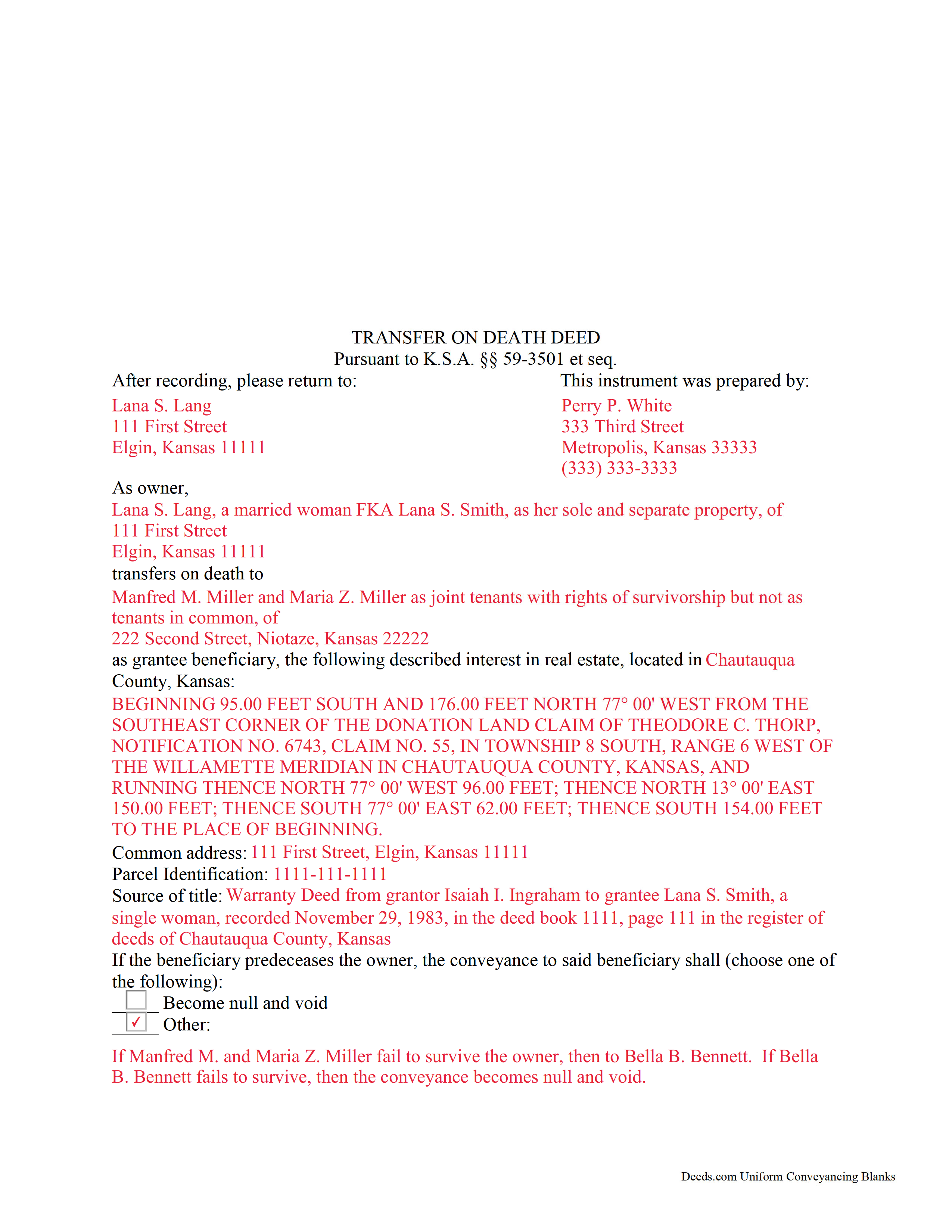

Rawlins County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Rawlins County documents included at no extra charge:

Where to Record Your Documents

Rawlins County Register of Deeds

Atwood, Kansas 67730

Hours: 9:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (785) 626-3172

Recording Tips for Rawlins County:

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Rawlins County

Properties in any of these areas use Rawlins County forms:

- Atwood

- Herndon

- Ludell

- Mc Donald

Hours, fees, requirements, and more for Rawlins County

How do I get my forms?

Forms are available for immediate download after payment. The Rawlins County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rawlins County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rawlins County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rawlins County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rawlins County?

Recording fees in Rawlins County vary. Contact the recorder's office at (785) 626-3172 for current fees.

Questions answered? Let's get started!

Kansas enacted its statutory transfer on death deeds in 1997. These nontestamentary, nonprobate conveyances are governed by K.S.A. 59-3501 (2012) et seq. Nontestamentary means that the transfer is not included in or affected by the owner's last will and testament. Nonprobate means that the property's change in title occurs outside the probate process.

Transfer on death deeds, when lawfully executed and RECORDED DURING THE OWNER'S LIFE, convey a land owner's interest in a specific piece of real property to a designated beneficiary after the owner dies. Until death, the owner retains absolute rights to and control over the property, including entering into agreements to rent, mortgage, or sell the property outright.

The deeds do not require any consideration from the beneficiary, nor do they demand that the beneficiary receive notice about his/her/their potential future interest in real estate. The owner may also change, revoke, or otherwise modify the terms of the transfer. In addition, the statute explains that a "subsequent transfer-on-death beneficiary designation revokes all prior designations of grantee beneficiary or beneficiaries by such record owner for such interest in real estate" (K.S.A. 59-3503(b)).

As with a transfer on death deed, all revocations or other changes to a recorded transfer on death deed may be made "at any time prior to the death of the record owner, by executing, acknowledging and recording in the office of the register of deeds in the county where the real estate is located an instrument describing the interest revoking the designation. The signature, consent or agreement of or notice to the grantee beneficiary or beneficiaries is not required" (K.S.A. 59-3503(a)).

Beneficiaries should be aware, however, that they take "the record owner's interest in the real estate at death subject to all conveyances, assignments, contracts, mortgages, liens and security pledges made by the record owner or to which the record owner was subject during the record owner's lifetime, including . . . claims of the state of Kansas for medical assistance, as defined in K.S.A. 39-702" (K.S.A. 59-3504(b)).

Overall, transfer on death deeds offer a flexible and useful tool to owners of Kansas real estate. Even so, there are benefits and drawbacks to this method of estate planning. Because each situation is unique, contact an attorney with specific questions or for complex situations.

(Kansas Transfer on Death Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Rawlins County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Rawlins County.

Our Promise

The documents you receive here will meet, or exceed, the Rawlins County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rawlins County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

linda l.

August 10th, 2020

I was very impressed with the Mineral Deed form, especially with the instructions to fill it out AND a copy of a completed for to compare against. This definitely saved me money for an attorney. The one thing I don't understand, though, is why I could not save the completed Deed to my hard drive. I did have to change a few things after the fact and I had to re-type the entire page to make the corrections. If not for this, I would definitely rate the forms and instructions as a 5 star.

Thank you for your feedback. We really appreciate it. Have a great day!

Leon S.

June 26th, 2023

I am happy that I found Deeds.com. It provided me with all the information I needed to prepare a quit claim deed, and at a reasonable cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jesse K.

October 30th, 2020

Very simple to use website for remote recording of documents. I will definately use this platform for future recordings.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

January 25th, 2022

I needed a quitclaim deed to transfer ownership of a home. An attorney wanted $400.00 to file the deed. I downloaded a blank deed for my area from deeds.com. I received it instantly. (Small fee) it came with instructions and a template. I filled it out and submitted it to the County Clerks office.it was simple and I saved a lot of money. There may be other forms you need, check with whoever you are submitting the deed. You'll have additional fees, but that is up to the municipality in which you reside. It will be helpful if you have the latest deed on file. It was much easier than I thought. This is an easy website to navigate through and it is 100% legitimate. I recommend Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

fran g.

April 25th, 2021

To hard for me. But with that being said it's a great option for most people.

Thank you!

Donald S.

July 7th, 2020

Good

Thank you!

Michael W.

August 27th, 2021

This was really easy and very helpful. Thanks,

Thank you!

Dana H.

September 8th, 2021

Thanks for making this process a seamless one! I love Deeds.com and will recommend it to others!

Thank you for your feedback. We really appreciate it. Have a great day!

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Robert K.

June 13th, 2021

Very user friendly - I found the affidavit I needed right away together with the guide to filling it out.

Thank you!

Gary K.

July 26th, 2019

Easy to use site. Good job, it works with no stress.

Thank you!

Hinz H.

May 28th, 2020

Prompt accurate service

Thank you!

Michael W.

February 8th, 2025

Wonderful service.

Thank you!

Lynette D.

July 29th, 2020

I planned to use an attorney for this process but deeds.com made it so easy I was able to do it myself and I saved $330 in the process. I really appreciated the instructions and example provided on the site.

Thank you for your feedback. We really appreciate it. Have a great day!

Nicolette C.

March 3rd, 2025

Deeds.com was a wealth of information and easy to navigate through the myriad of forms to choose from. During a time of family tragedy, this site was a valuable resource to complete necessary paperwork and ensure assets were in proper names and titles.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.