Osage County Trustee Deed Form

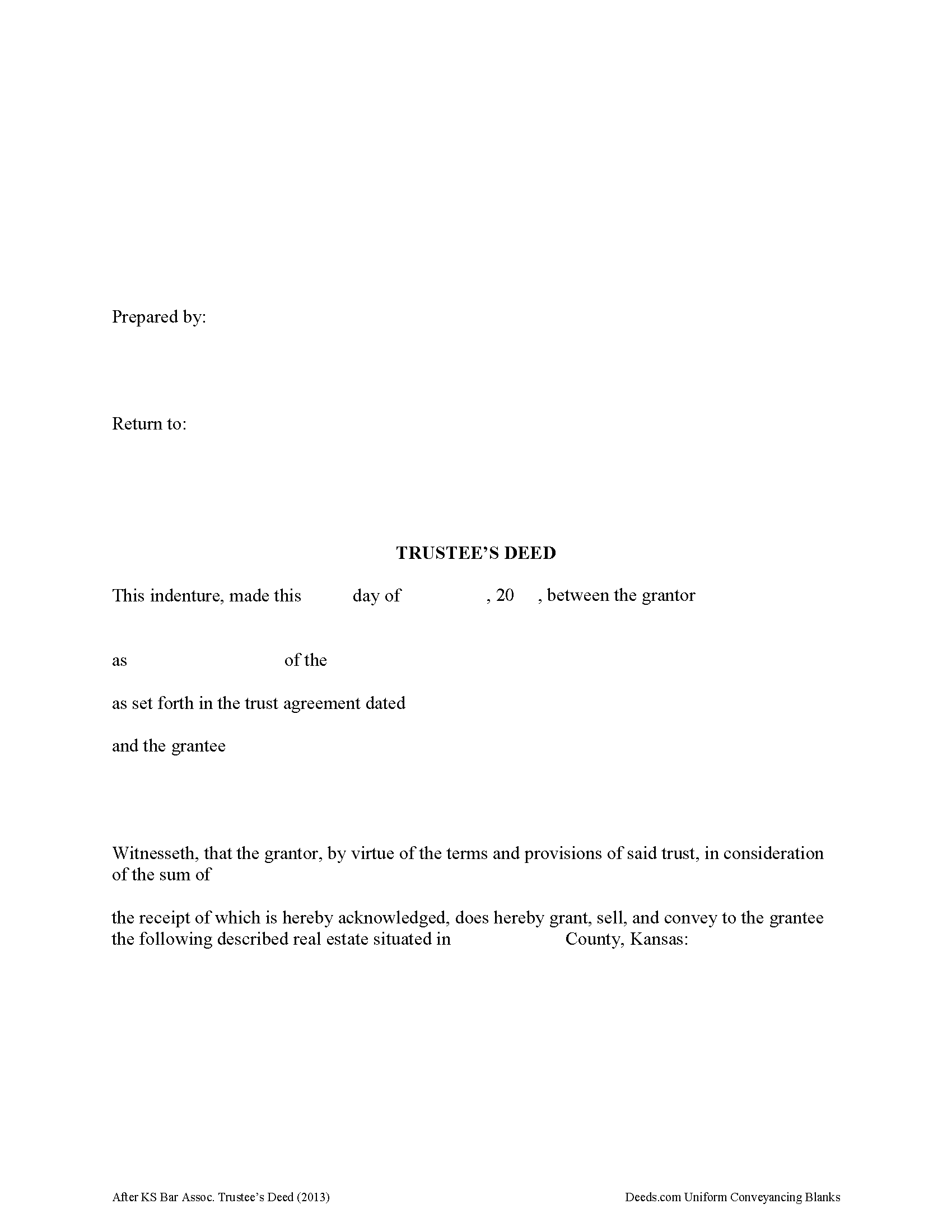

Osage County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

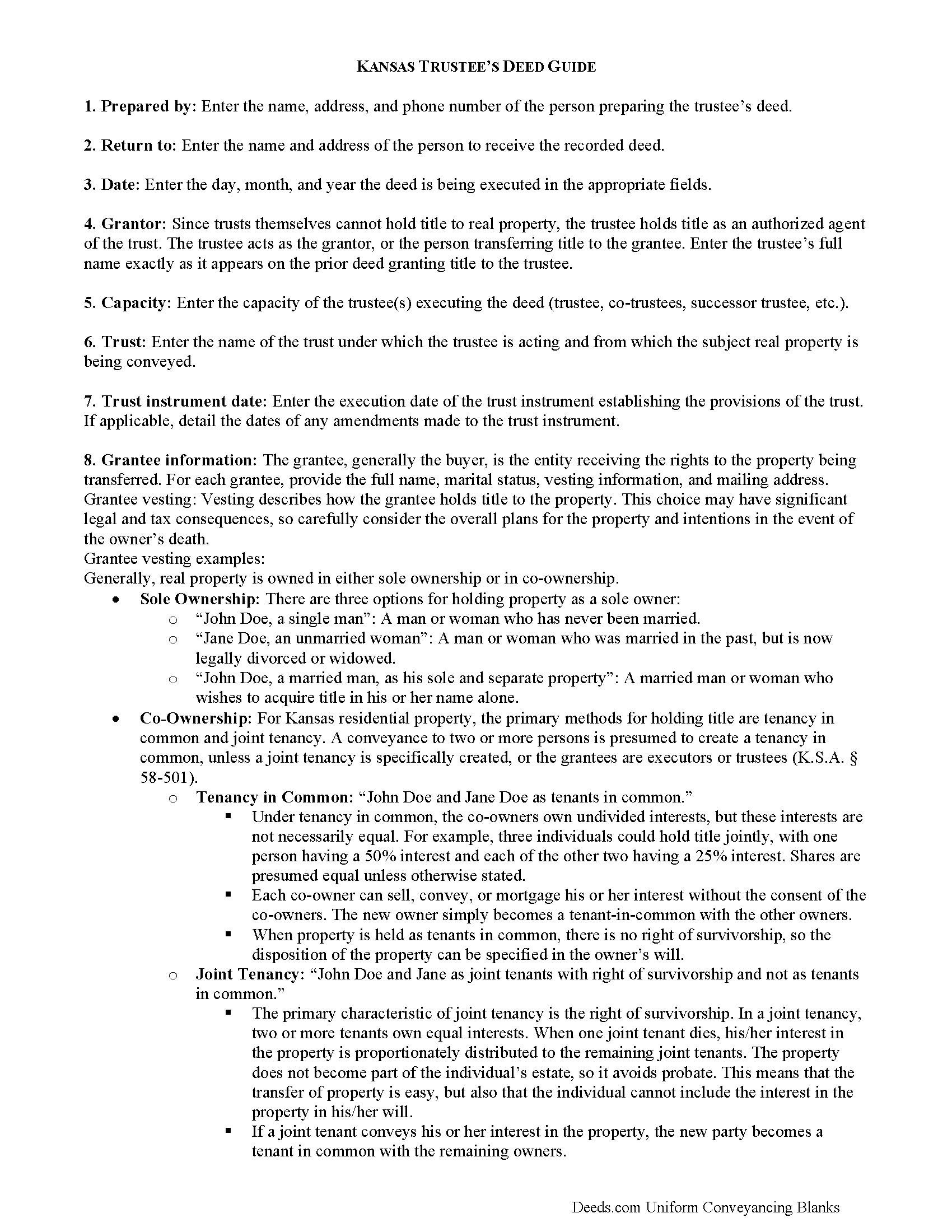

Osage County Trustee Deed Guide

Line by line guide explaining every blank on the form.

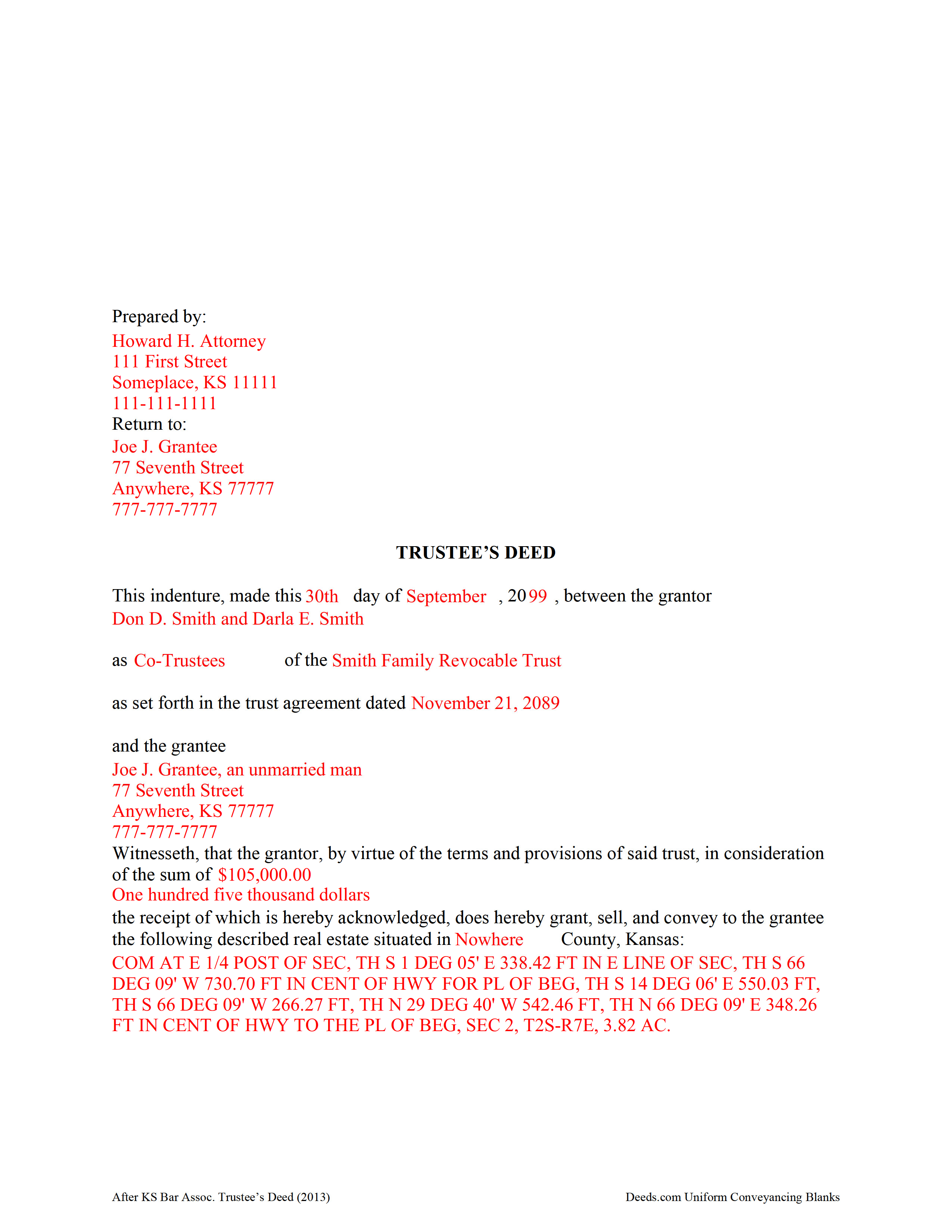

Osage County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Osage County documents included at no extra charge:

Where to Record Your Documents

Osage County Register of Deeds

Lyndon, Kansas 66451

Hours: 8:00 to 5:00 Mon-Fri / Recording until 3:30

Phone: (785) 828-4523

Recording Tips for Osage County:

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Osage County

Properties in any of these areas use Osage County forms:

- Burlingame

- Carbondale

- Lyndon

- Melvern

- Osage City

- Overbrook

- Quenemo

- Scranton

- Vassar

Hours, fees, requirements, and more for Osage County

How do I get my forms?

Forms are available for immediate download after payment. The Osage County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Osage County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Osage County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Osage County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Osage County?

Recording fees in Osage County vary. Contact the recorder's office at (785) 828-4523 for current fees.

Questions answered? Let's get started!

A trustee's deed is used in trust administration to convey real property from a trust. Unlike other real estate deeds, which are named for the type of warranties of title they contain, the trustee's deed is named for the person executing the document.

The trustee is the fiduciary appointed in the trust instrument to represent a trust. Since the trust as an entity cannot hold title to real property, property is transferred to the trust in the name of the trustee-as-representative. The settlor is the person executing the trust instrument and funding the trust with assets.

In a trustee's deed, then, the trustee is the grantor conveying title to the grantee. In Kansas, the trustee's deed is a special warranty deed containing covenants that the grantor defends the title against claims by, through, or under the grantor and grantor's heirs. Further, the deed warrants that the grantor is lawfully seized of the property, has the right to convey the property, and that the property is free from encumbrances, other than those which may be listed in the form. The warranty is limited in that the grantor does not warrant title against those claiming a right, interest, or title that arose prior to, or separate from, the grantor's interest in the property.

Apart from the information above, the trustee's deed's granting clause references the name and date of the trust under which the trustee is acting, as well as the role of the trustee (co-trustee, successor trustee, etc.). The deed requires all the necessary information for documents affecting real property in the state of Kansas, including a recitation of the legal description of the real estate.

The Kansas trustee's deed form also carries a certification that the grantor is the duly appointed, qualified, and acting trustee of the trust, with a reference to the article or section from the trust instrument where the trustee is granted the authority to convey trust property. Further, the deed certifies that the trust is in full force and effect and has not been amended or revoked. These statements are also found in a certification of trust, a document that a trustee may need to furnish, depending on the transaction taking place.

All acting trustees need to sign the deed in the presence of a notary public before submitting the deed for recording in the county in which the real property is located.

(Kansas Trustee Deed Package includes form, guidelines, and completed example)

As each situation is unique, contact a lawyer for guidance.

Important: Your property must be located in Osage County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Osage County.

Our Promise

The documents you receive here will meet, or exceed, the Osage County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Osage County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Robert L.

February 24th, 2021

Very easy to use and I had no issues submitting my deed.

Thank you!

Lori A.

February 14th, 2023

It was quick and easy. A little expensive but convient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda Munguia N.

May 29th, 2021

Easy process. Appreciated the detailed instructions for filing.

Thank you!

Norman K.

August 13th, 2021

Easy to use, would like to convert to a Word doc though

Thank you!

Gail W.

September 19th, 2019

Deeds.com had the forms I needed, along with completed examples. Fast download. Easy to use site. Thanks!

Thank you!

Ardith T.

May 18th, 2020

Very clear and complete. Good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dianne J.

January 23rd, 2021

Thought we would just do a quit claim to remove a name on a deed but after read your instruction and all that is needed we decided to meet with a lawyer. Appreciate all the info that you supplied.

Glad to hear that Dianne. We always recommend seeking the advice of a professional if you are not completely sure of what you are doing. Have a great day!

Audrey A.

August 19th, 2019

Great!

Thank you!

Daniel W.

April 18th, 2020

They are amazing. So fast and friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca H.

May 22nd, 2021

I thought the forms were reasonably priced, the instructions included in the packet were thorough, and the examples helpful. Thank you for the additional CDR forms too. I contacted the Recorder's office via email with a question and Jennifer Bowser answered promptly. Job well done! However, when I delivered the deed and Real Property Transfer Declaration to the Clerk's office in Lafayette, the clerk was unfamiliar with the Declaration document being submitted and it took some time to convince her to submit the form without charging the recording fee. She even tried to phone the recorder's office for clarification, but no one answered. There then was an additional form at that office that I had to complete called Recording Request/Transmittal Form. I would suggest including that form with instructions in your on-line packet to speed up the process when a Deed is delivered to the County Clerk's satellite office. I do not expect every clerk to know all the particulars of recording requirements but a little knowledge wouldn't hurt.

Thank you for your feedback. We really appreciate it. Have a great day!

DEBBY G.

January 12th, 2023

I was so confused on how to complete the form. But I followed the instructions and used the example and got it done.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert W.

February 22nd, 2020

With the guide everything went great

Thank you!

Charles B.

December 14th, 2019

Excellent andeasy to navigate website for non-lawyers. Needed some forms for a specific county in a specific state, and Deeds.com took me right there, where I downloaded the forms and a guide on how to fill them out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda I.

August 16th, 2023

So far so good. It was reasonably easy to download and complete the form using information found in my closing paperwork. I haven't yet had my form notarized but plan to do so this week and submit the packet to my county auditor.

Thank you for your feedback. We really appreciate it. Have a great day!

Shari W.

July 30th, 2020

Fast and easy. Great service. Thanks.

Thank you!