Campbell County Mortgage and Promissory Note Form

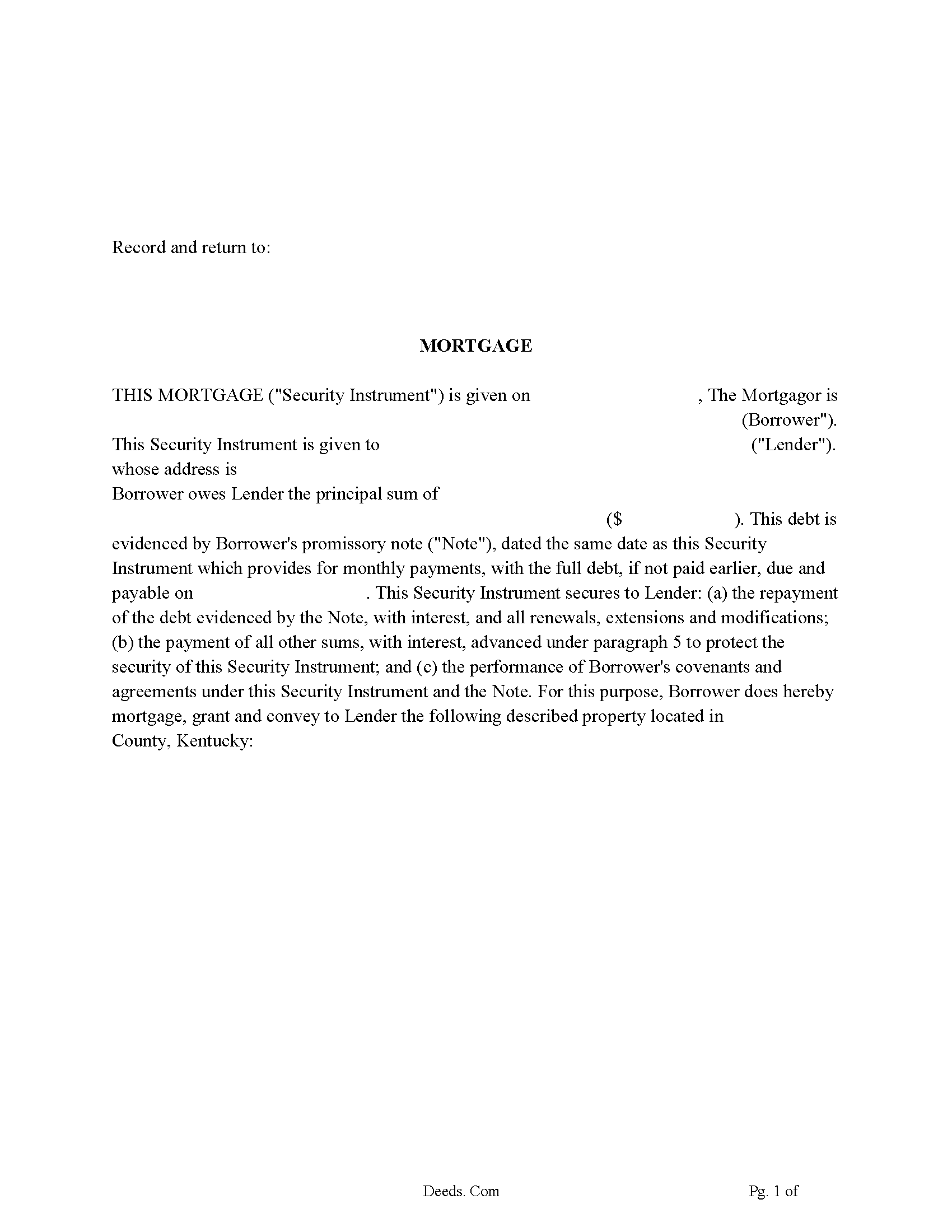

Campbell County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Campbell County Mortgage Guidelines

Line by line guide explaining every blank on the form.

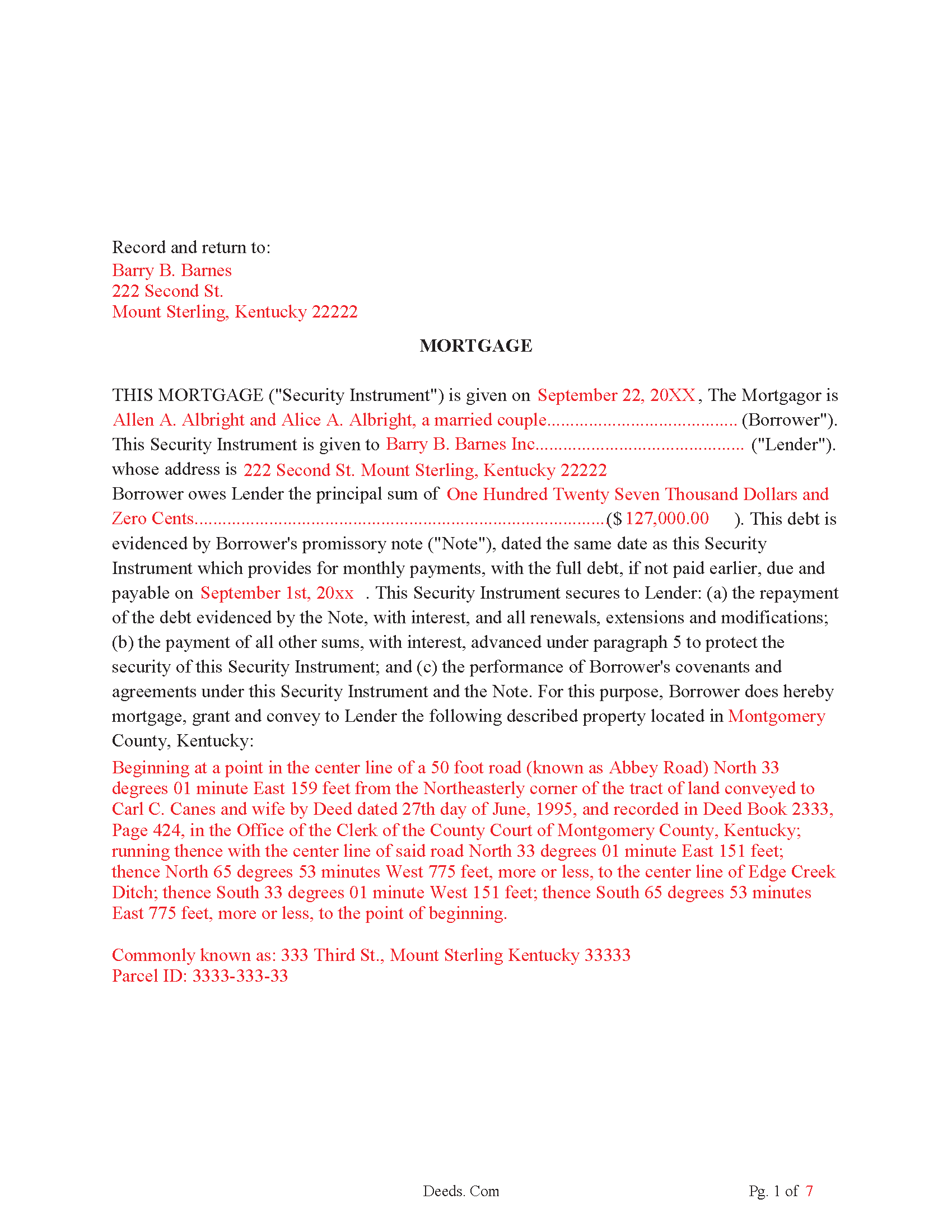

Campbell County Completed Example of the Mortgage Form

Example of a properly completed form for reference.

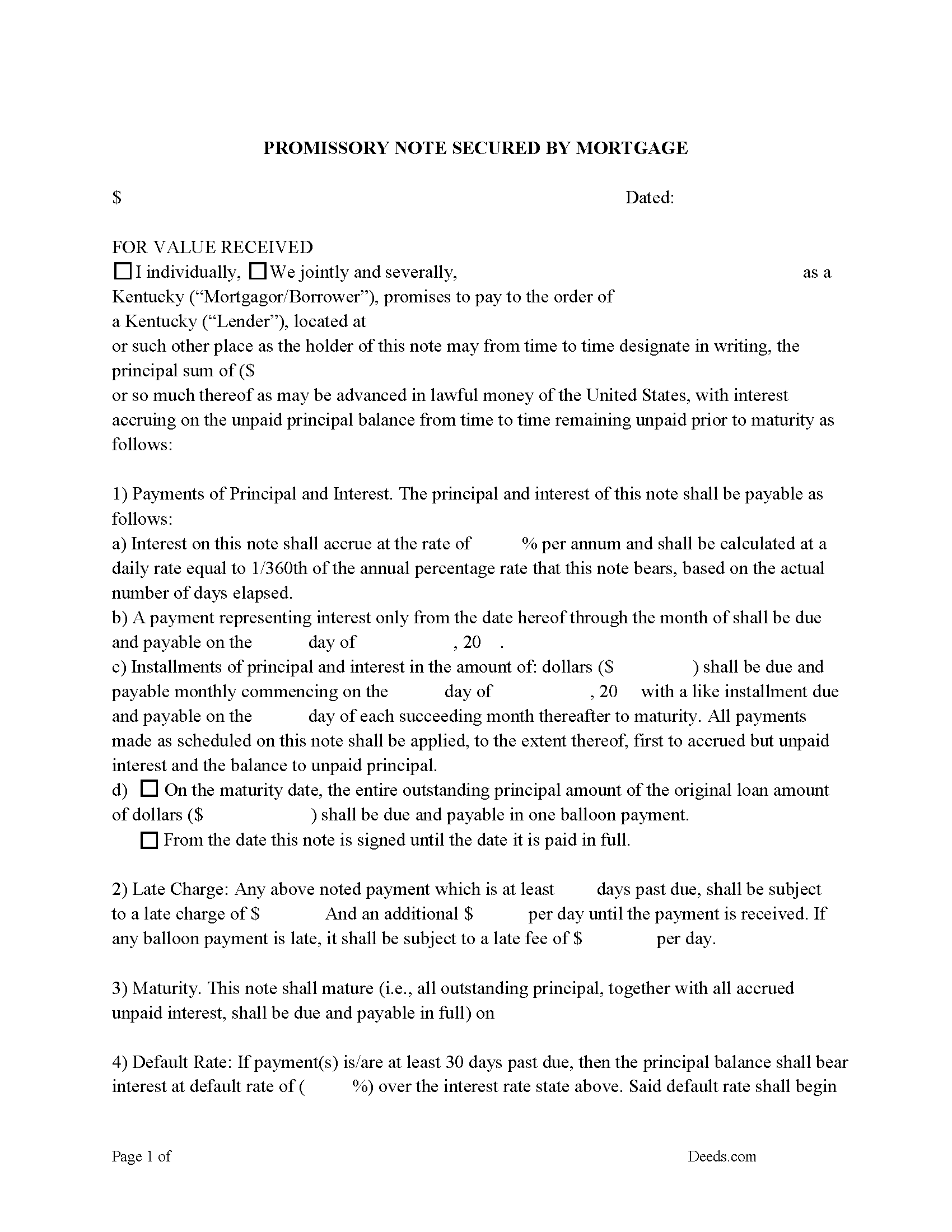

Campbell County Promissory Note Form

Note that is secured by the Mortgage Deed. Can be used for traditional installments or balloon payment.

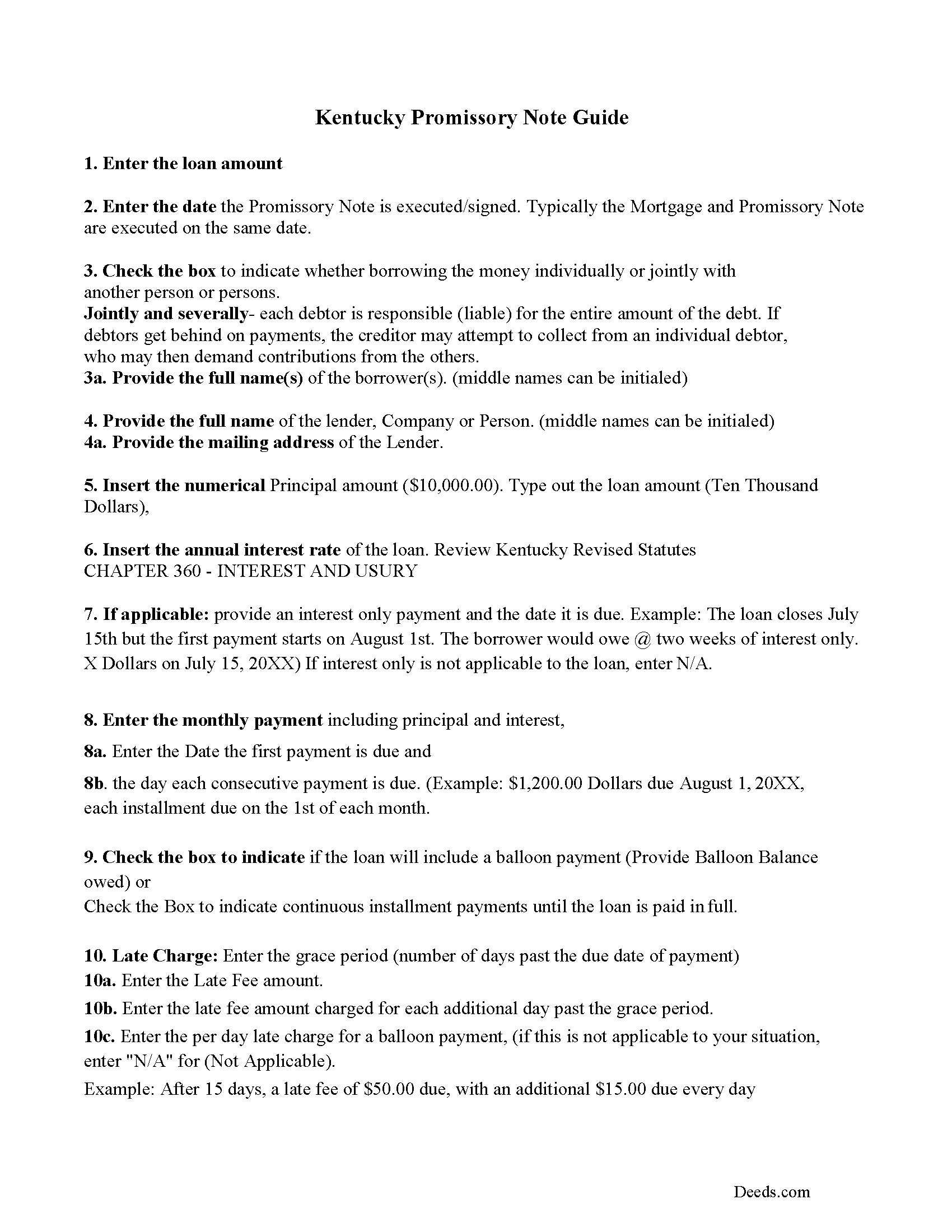

Campbell County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

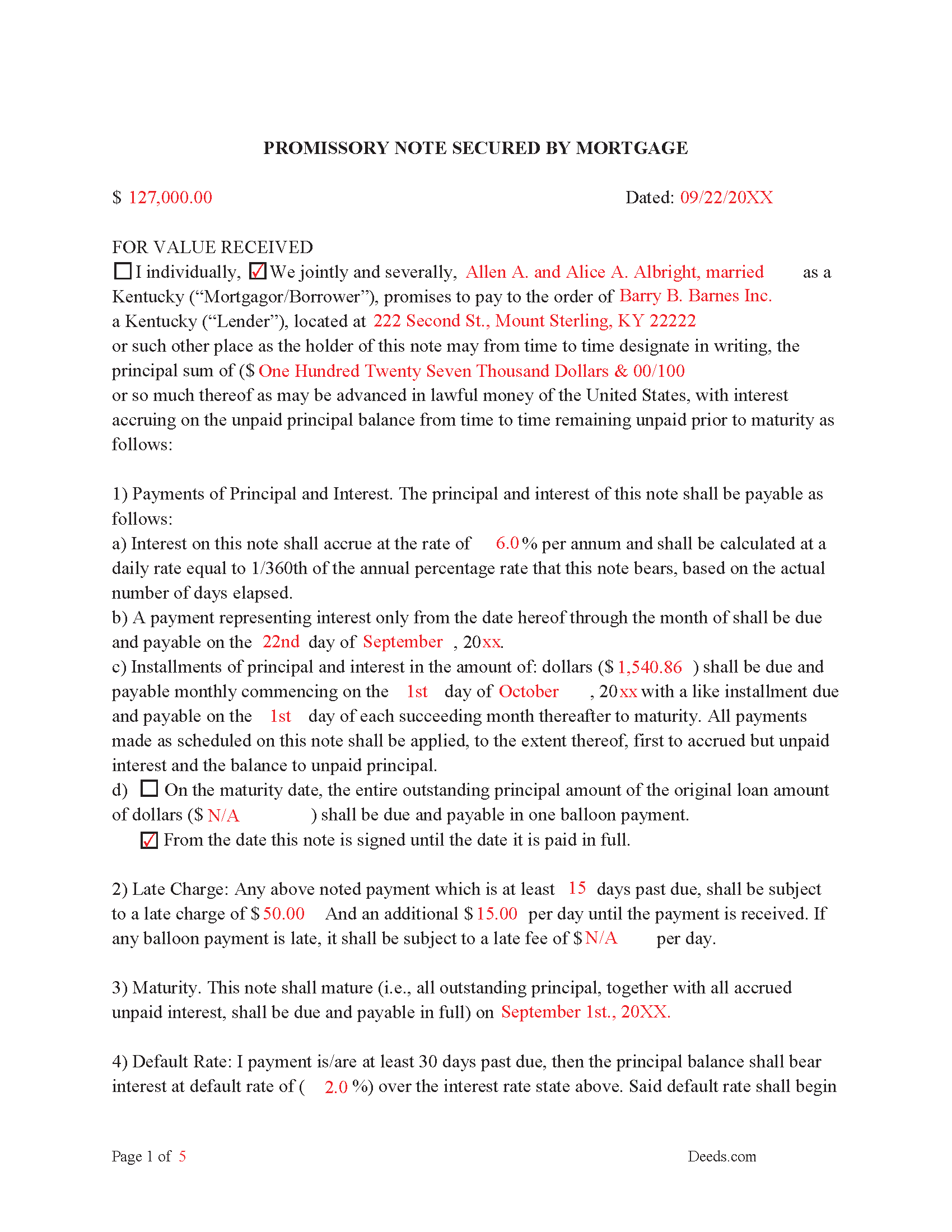

Campbell County Completed Example of the Promissory Note

This Kentucky Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

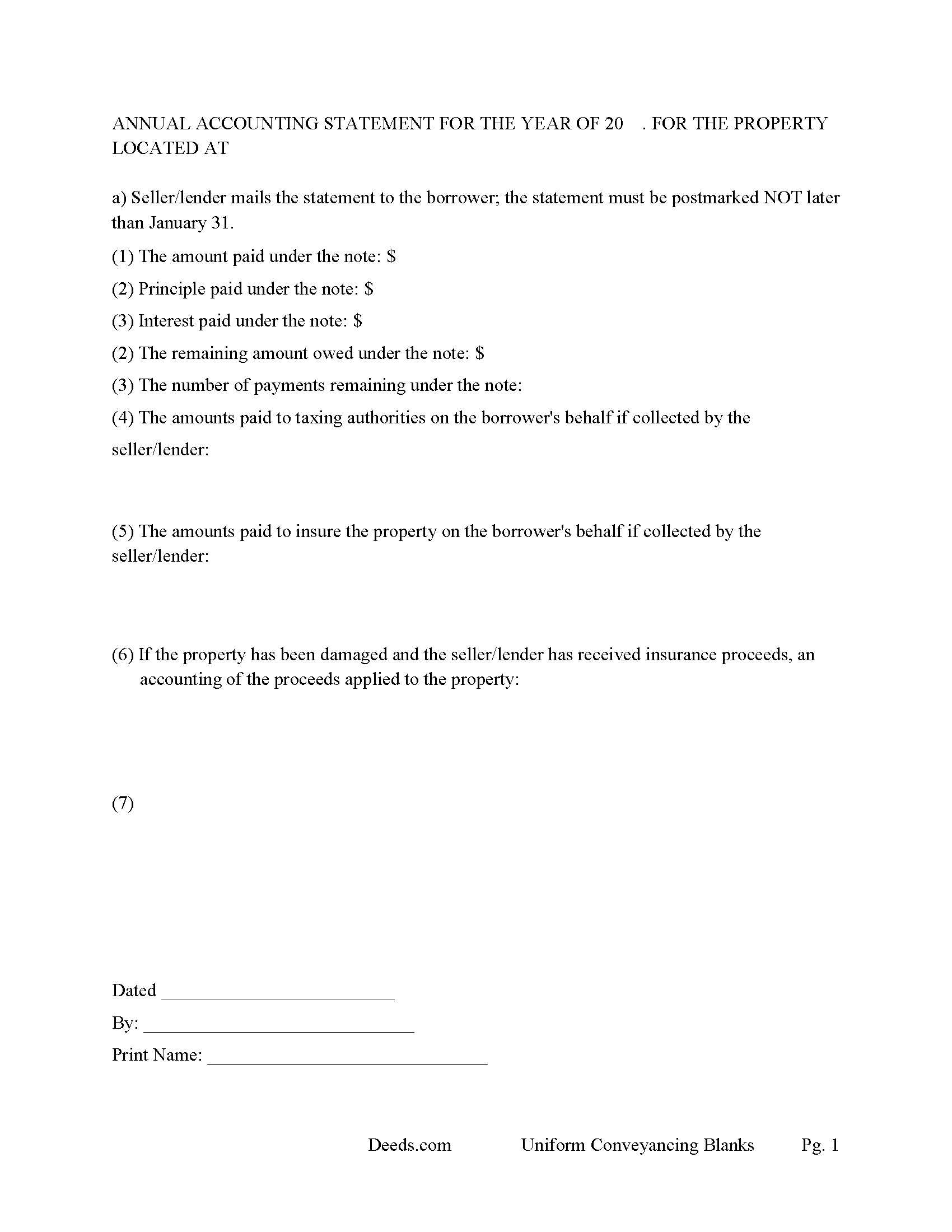

Campbell County Annual Accounting Statement Form

Use for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Campbell County documents included at no extra charge:

Where to Record Your Documents

Campbell County Clerk

Newport, Kentucky 41071

Hours: 8:30 to 4:00 M-F; Sat 9:00 to 12:00

Phone: (859) 292-3845

Recording Tips for Campbell County:

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- Ask about their eRecording option for future transactions

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Campbell County

Properties in any of these areas use Campbell County forms:

- Alexandria

- Bellevue

- California

- Dayton

- Fort Thomas

- Melbourne

- Newport

- Silver Grove

Hours, fees, requirements, and more for Campbell County

How do I get my forms?

Forms are available for immediate download after payment. The Campbell County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Campbell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Campbell County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Campbell County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Campbell County?

Recording fees in Campbell County vary. Contact the recorder's office at (859) 292-3845 for current fees.

Questions answered? Let's get started!

Kentucky Mortgage and Promissory Note

This is a Kentucky Mortgage given to secure a debt on real property. This form can be used to finance a house, rental property (up to 4 units) or Condominium. This form secures repayment of a debt, with interest. evidenced by a Promissory Note. A Mortgage with strong default clauses can be beneficial when selling and/or financing a property.

Mortgage Form that meets the following requirements.

MORTGAGE - This document must have the following: first party and their mailing address (KRS 382.335 & KRS 382.430), second party and their mailing address (KRS 382.110), amount of the mortgage (KRS 382.330), maturity date (KRS 382.330), legal description of the property (Common Law and OAG 81.100), preparation statement (KRS 382.335), and a return mail address (KRS 382.335 & KRS 382.240). The document must be signed by the mortgagor and notarized.

KRS 382.335

Provides that virtually all documents filed in land records contain the author's name, address and signature.

382.430 Instrument constituting lien to name person liable for taxes thereon.

(1) No mortgage, conveyance, or other instrument or writing constituting a lien or other security for any note or other evidence of indebtedness shall be received for record by any county clerk unless such mortgage, conveyance, or other writing gives the address of the person or the address of the principal place of business of the corporation owning or holding the note or other evidence of indebtedness, or liable for the payment of taxes thereon.

(2) Should there be an assignment of such note or other evidence of indebtedness, of record in the clerk's office, the assignment shall state the address of the assignee. Unless any assignment is made of record, the original holder or owner shall be liable for taxes as though no assignment had been made.

(3) For the purposes of this chapter, a mortgage that has been recorded with any county clerk shall not be deemed invalid or ineffective as constructive notice for failure to include the county of residence in the mortgagee's address.

382.110 Recording of deeds and mortgages -- Place of recording -- Use of certified copies of original records -- Contents of deed.

(1) All deeds, mortgages and other instruments required by law to be recorded to be effectual against purchasers without notice, or creditors, shall be recorded in the county clerk's office of the county in which the property conveyed, or the greater part thereof, is located.

(2) No county clerk or deputy county clerk shall admit to record any deed of conveyance of any interest in real property equal to or greater than a life estate, unless the deed plainly specifies and refers to the next immediate source from which the grantor derived title to the property or the interest conveyed therein.

(3) An authentic photocopy of any original record may be certified, as a true, complete, unaltered copy of the original record on file by the official public custodian of the record. A certified copy of a document certified by the official public custodian of that document may be submitted for filing in any other filing officer's jurisdiction as though it were the original record. However, no county clerk or deputy county clerk shall accept for filing any original document or certified copy of any document unless the original document and its certified copy conforms to all statutory requirements for filing the document under KRS Chapter 382. The provisions of this subsection shall apply only to a record generated and filed in Kentucky, and only if the certified copy thereof is to be utilized in Kentucky. If the record is a foreign record or a Kentucky record to be filed or utilized in a foreign jurisdiction, then this subsection shall not apply and applicable federal, Kentucky, or foreign law shall apply.

(4) If the source of title is a deed or other recorded writing, the deed offered for record shall refer to the former deed or writing, and give the office, book and page where recorded, and the date thereof. If the property or interest therein is obtained by inheritance or in any other way than by recorded instrument of writing, the deed offered for record shall state clearly and accurately how and from whom the title thereto was obtained by the grantor.

(5) If the title to the property or interest conveyed is obtained from two (2) or more sources, the deed offered for record shall plainly specify and refer to each of the sources in the manner provided in subsections (2) and (4), and shall show which part of the property, or interest therein, was obtained from each of the sources.

(6) No grantor shall lodge for record, and no county clerk or deputy shall receive and permit to be lodged for record, any deed that does not comply with the provisions of this section.

(7) No clerk or deputy clerk shall be liable to the fine imposed by subsection (1) of KRS 382.990 because of any erroneous or false references in any such deed, nor because of the omission of a reference required by law where it does not appear on the face of such deed that the title to the property or interest conveyed was obtained from more than one (1) source.

(8) This section does not apply to deeds made by any court commissioner, sheriff or by any officer of court in pursuance of his duty as such officer, nor to any deed or

instrument made and acknowledged before March 20, 1928. No deed shall be invalid because it is lodged contrary to the provisions of this section.

382.330 Instrument not to be recorded unless date of maturity shown -- Exception.

No county clerk shall record a deed or deed of trust or mortgage covering real property by which the payment of any indebtedness is secured unless the deed or deed of trust or mortgage states the date and the maturity of the obligations thereby secured which have been already issued or which are to be issued forthwith. In the case of obligations due on demand, the requirement of stating the maturity thereof shall be satisfied by stating that such obligations are "due on demand."

382.335 Certain information to be included in instruments in order for them to be recorded.

(1) No county clerk shall receive or permit the recording of any instrument by which the title to real estate or personal property, or any interest therein or lien thereon, is conveyed, granted, encumbered, assigned, or otherwise disposed of; nor receive any instrument or permit any instrument, provided by law, to be recorded as evidence of title to real estate, unless the instrument has endorsed on it, a printed, typewritten, or stamped statement showing the name and address of the individual who prepared the instrument, and the statement is signed by the individual. The person who prepared the instrument may execute his or her signature by affixing a facsimile of his or her signature on the instrument. This subsection shall not apply to any instrument executed or acknowledged prior to July 1, 1962.

(2) No county clerk shall receive or permit the recording of any instrument by which the title to real estate or any interest therein is conveyed, granted, assigned, or otherwise disposed of unless the instrument contains the mailing address of the grantee or assignee. This subsection shall not apply to any instrument executed or acknowledged prior to July 1, 1970.

(3) This section shall not apply to wills or to statutory liens in favor of the Commonwealth.

(4) No county clerk shall receive, or permit the recording of, any instrument by which real estate, or any interest therein, is conveyed, granted, assigned, transferred, or otherwise disposed of unless the instrument complies with the official indexing system of the county. The indexing system shall have been in place for at least twenty-four (24) months prior to July 15, 1994 or shall be implemented for the purpose of allowing computerized searching for the instruments of record of the county clerk. If a county clerk requires a parcel identification number on an instrument before recording, the clerk shall provide a computer terminal, at no charge to the public, for use in finding the parcel identification number. The county clerk may make reasonable rules about the use of the computer terminal, requests for a parcel identification number, or both.

(5) The receipt for record and recording of any instrument by the county clerk without compliance with the provisions of this section shall not prevent the record of filing of the instrument from becoming notice as otherwise provided by law, nor impair the admissibility of the record as evidence.

382.240 Delivery of recorded instruments -- Destruction of unclaimed instruments.

Each instrument that is recorded shall be delivered to the party entitled thereto. The county clerk shall require prepayment of postage for delivery of said instruments at the time they are left for record in his office. If the county clerk is unable to locate the parties entitled thereto, he shall retain the instruments for at least two (2) years. The clerk may then destroy the instruments provided that he shall first make the following announcement by public notice in the newspaper of the largest circulation in the county: "Legal instruments which have been filed for record in the (name of county) county clerk's office and which have been in the custody of the clerk for over two (2) years must be claimed by the persons entitled thereto within thirty (30) days, or they shall be destroyed." The date of the notice and the name of the clerk shall be appended to the notice. Thirty (30) days after the appearance of the public notice, the county clerk may destroy the instruments.

KENTUCKY PROMISSORY NOTE SECURED BY MORTGAGE

Promissory Note guided by Kentucky Law, includes the option of accepting installment loan payments or a balloon payment, Balloon payments are often used to cash out when selling and financing a property. Example: 5 years of payments, followed by a balloon payment of $$$. Late payments and default rates are charged to protect Lender(s). The Borrower in this note has the option of paying the loan off early, with no penalty.

(Kentucky Mortgage Package includes forms, guidelines, and completed examples)

Important: Your property must be located in Campbell County to use these forms. Documents should be recorded at the office below.

This Mortgage and Promissory Note meets all recording requirements specific to Campbell County.

Our Promise

The documents you receive here will meet, or exceed, the Campbell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Campbell County Mortgage and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Kimberly S.

July 21st, 2022

Worked very well. Seamless process with helpful directions.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

June 19th, 2019

Deeds.com had what I needed at the time that I needed it. Thank you very much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Valerie C.

May 1st, 2022

Thanks

Thank you!

Steve R.

April 28th, 2023

Quick, clean, easy. A hat trick.

Thank you!

ian a.

September 28th, 2022

Your website advertising was somewhat deceptive regarding doing a quitclaim on a name change. "If you are transferring the property to yourself under your new name, all you have to do is update the deed from your former name to your current one." This made this sound easy. But when I downloaded the material for my state, expecting to find an example, there was no example of how to do a name change quitclaim deed! I therefore had to figure this out myself. You might have provided a warning about certain uses that were not covered in the material so that people know ahead of time that the use they needed to know about wasn't covered in the material.

Thank you for your feedback. We really appreciate it. Have a great day!

John H.

September 16th, 2022

Response was timely, even though unsuccessful in locating a requested deed. Deeds very courteously and professionally cancelled my order and cancelled its charge to my credit card.

Thank you for your feedback. We really appreciate it. Have a great day!

Kendall B.

September 24th, 2019

Good

Thank you!

Don M.

February 17th, 2023

The process was easy going. The process is one thing, the results another. I have attempting to resolve this matter, of claiming sole ownership of the property for several YEARS. I lost my Bride of 65 years in 2015. A lawyer I hired failed in his attempt, so I'm waiting to see the actual results. I also have two parcels in New Mexico under the same situation, so if this is successful, I'll gladly be back. Thank You so very much. Don Martin

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kay C.

November 16th, 2020

that worked great I like to see what I'm filling out and the extra info is really helpful..

Thank you!

Roger A.

November 2nd, 2023

Easy peasy to use! It's great to have the guide for completing the form and an example of a completed form.

It was a pleasure serving you. Thank you for the positive feedback!

Kimberley H.

July 14th, 2021

This was crazy easy to do...such a fantastic service! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Douglas A.

September 10th, 2020

So far so good once we got the initial problems worked out.

Thank you!

Jacqueline B.

August 23rd, 2021

The service was very clear and direct. I was able to get everything I need right now. Your website is set up well. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth R.

October 12th, 2021

Thank you. After searching for the correct forms and instructions on my county website, and finding nothing, I was very pleased with the Pinal County, AZ, acceptable forms and instructions I was able to download at a very reasonable cost from Deeds.com.

Thank you!

John K.

June 21st, 2023

Very pleased. Responsive staff and fast recordation.

Thank you for the kind words John. Our staff appreciates you and your feedback. Have an amazing day!