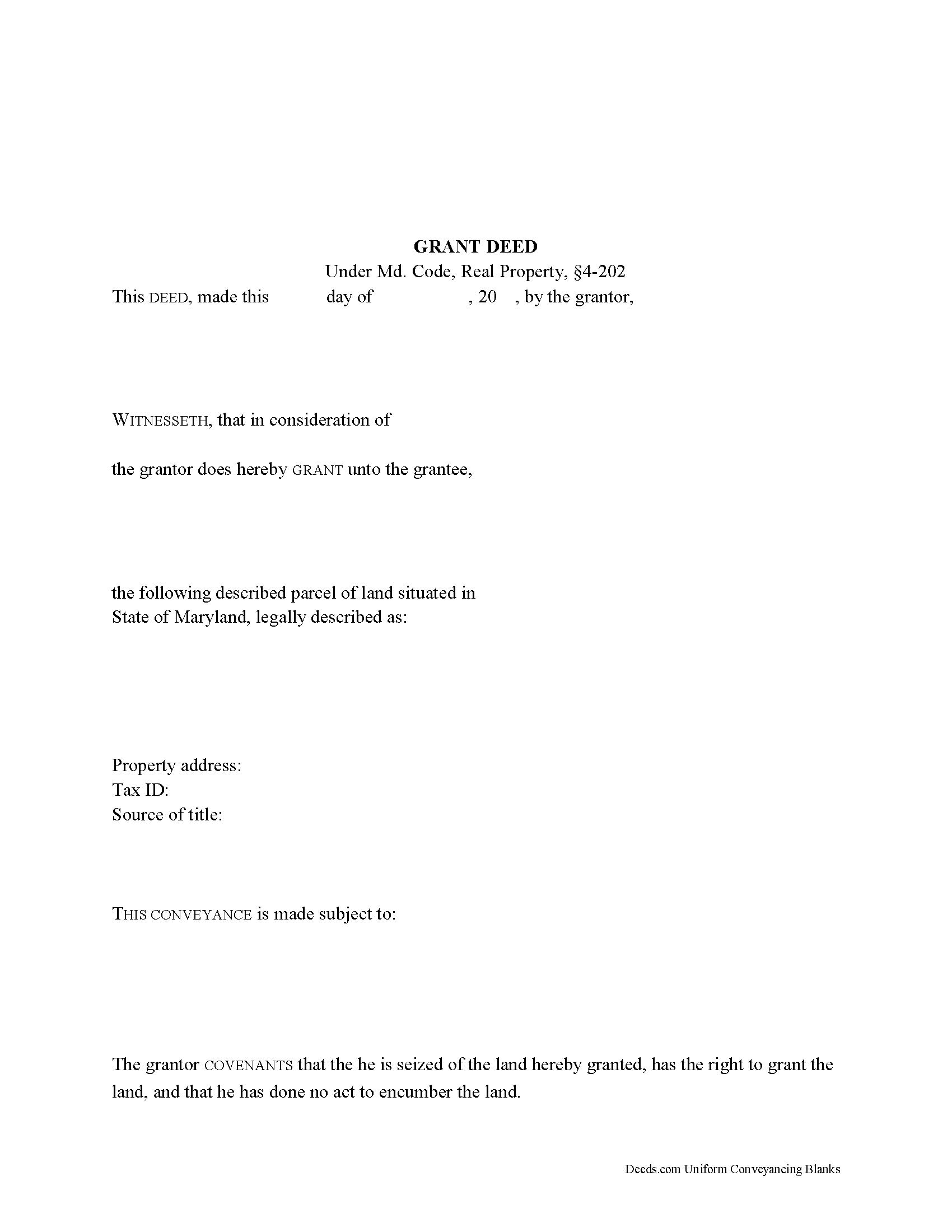

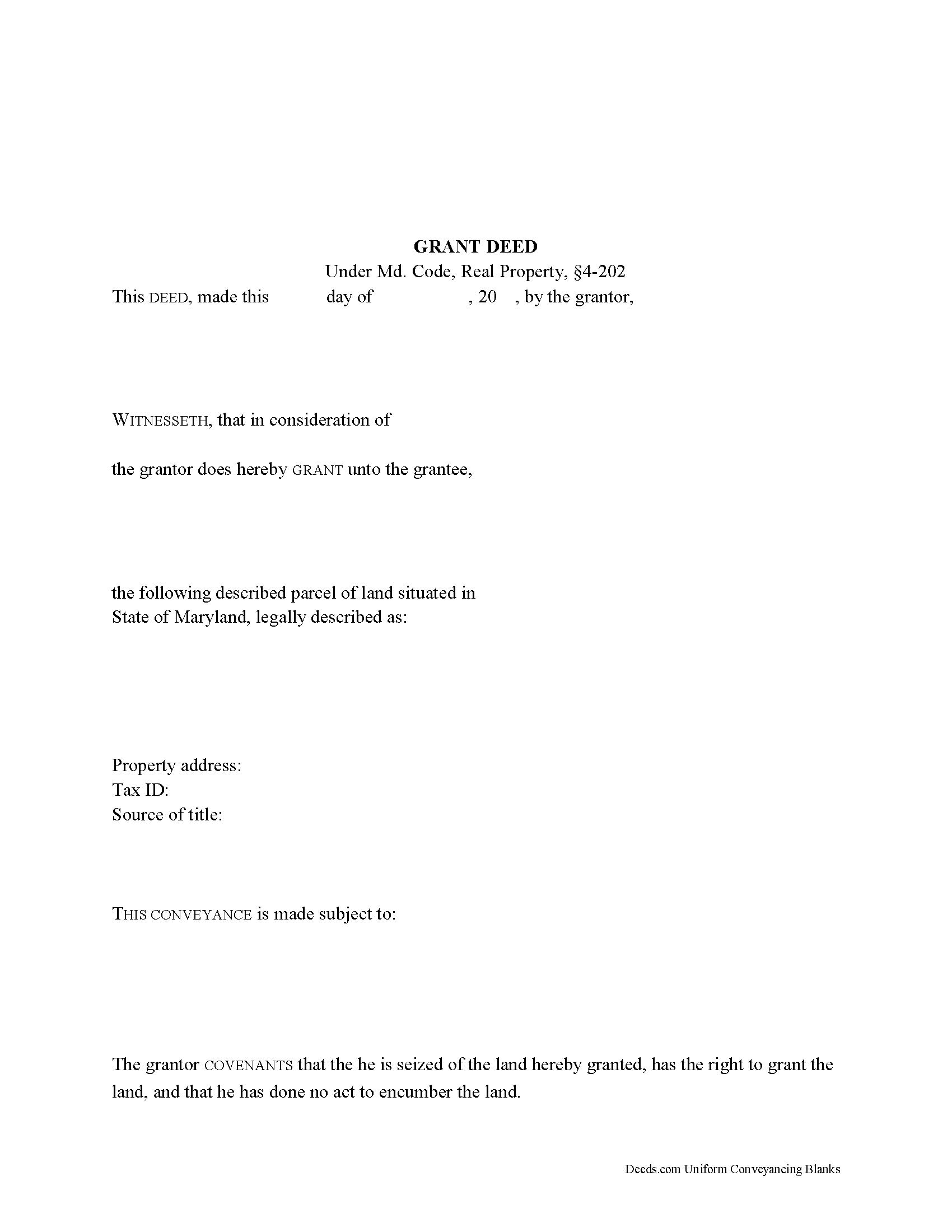

Maryland Grant Deed

County or Independent City Specific Legal Forms Validated as Recently as September 8, 2025

About the Maryland Grant Deed

How to Use This Form

- Select your county or independent city from the list on the left

- Download the county or independent city-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county or independent city recorder's office

What Others Like You Are Saying

“Thanks for your expedite process”

— ANGELIA E.“Top notch service.”

— Thoreson P.“Found this site very easy to navigate and customer service very supportive and quickly answers any q…”

— Anita L.“Excellent service and actually better than expected. Plus if the information is not available you re…”

— Maryanne M.“Thank you so much for making this process seemless. We are very pleased with the service.”

— Sierra S.

Grant deeds are statutory under the Maryland Code, Real Property, section 4-202. By using the word "grant," the grantor (owner) warrants to the grantee (buyer) that at the time of execution of the deed, he is in lawful possession of the land granted by the deed (Md. Code, Real Prop. 2-107) but does not warrant that he will defend title claims [1].

A lawful grant deed identifies the names, addresses, and marital status of each grantor and grantee, and information on how the grantee will hold title. For Maryland residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless expressly stated otherwise (Md. Code, Real Prop. 2-117). In the case of a married couple, a tenancy by the entirety is automatically created (Md. Code, Real Prop. 4-108).

Include the source of title, a complete legal description of the property (Md. Code, Real Prop. 4--101), and a certificate of preparation (Md. Code, Real Prop. 3-104(f)(1)) in the deed. Submit a completed intake sheet along with the deed when recording (Md. Code, Real Prop. 3-104). Other supplemental documents may include an affidavit of residency or whatever else is necessary for the specific transfer. Consult the local recording office with questions.

A transfer tax is imposed on most deeds (Md. Code, Tax Prop. 13-202). Exemptions from the transfer tax can be found at (Md. Code, Tax Prop. 13-207(a)). As a prerequisite to recording, grant deeds must be endorsed with the certificate of the collector of taxes of the county where the property is assessed.

To be recorded, a grant deed must be signed by the grantor, and the signature must be acknowledged. Witnesses are not required for conveyances of real estate in Maryland. The deed must be executed and recorded in order to provide notice of the transfer.

A grant deed should be recorded in the county where the property is located. If the land is in more than one county, the deed should be recorded in all such counties (Md. Code, Real Prop. 3-103). The circuit court in the county where the property is located is responsible for recordings deeds.

In addition to the content requirements set forth by statute, the form must meet all state and local standards for recorded documents. These may vary from county to county, so contact the local recording office with questions.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about grant deeds or transfers of real property in Maryland.

(Maryland GD Package includes form, guidelines, and completed example)

Important: County or Independent City-Specific Forms

Our grant deed forms are specifically formatted for each county or independent city in Maryland.

After selecting your county or independent city, you'll receive forms that meet all local recording requirements, ensuring your documents will be accepted without delays or rejection fees.

How to Use This Form

- Select your county or independent city from the list above

- Download the county or independent city-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county or independent city recorder's office

What Others Like You Are Saying

“Thanks for your expedite process”

— ANGELIA E.“Top notch service.”

— Thoreson P.“Found this site very easy to navigate and customer service very supportive and quickly answers any q…”

— Anita L.“Excellent service and actually better than expected. Plus if the information is not available you re…”

— Maryanne M.“Thank you so much for making this process seemless. We are very pleased with the service.”

— Sierra S.Common Uses for Grant Deed

- Transfer property between family members

- Add or remove names from property titles

- Transfer property into or out of trusts

- Correct errors in previously recorded deeds

- Gift property to others