Talbot County Quitclaim Deed Form

Talbot County Quitclaim Deed Form

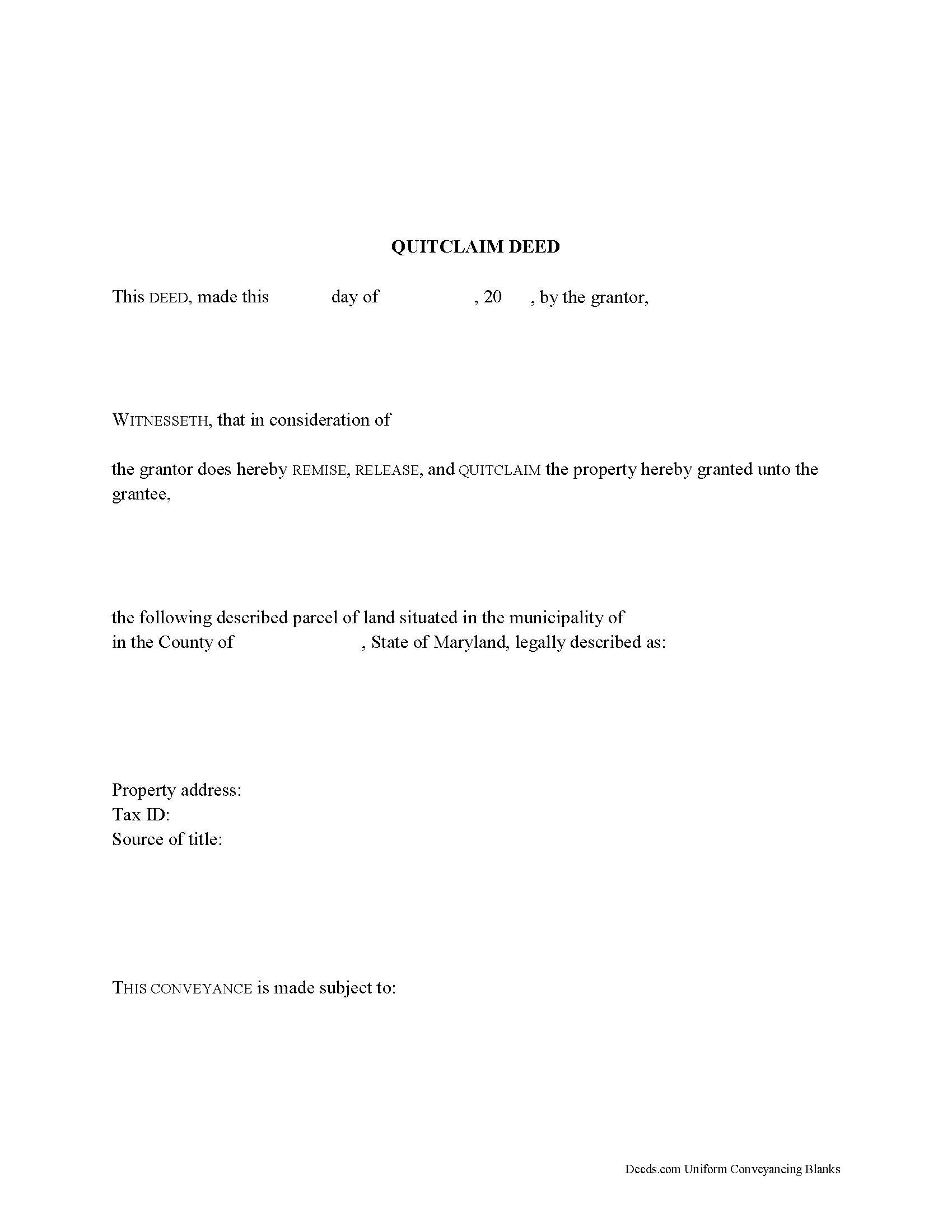

Fill in the blank Quitclaim Deed form formatted to comply with all Maryland recording and content requirements.

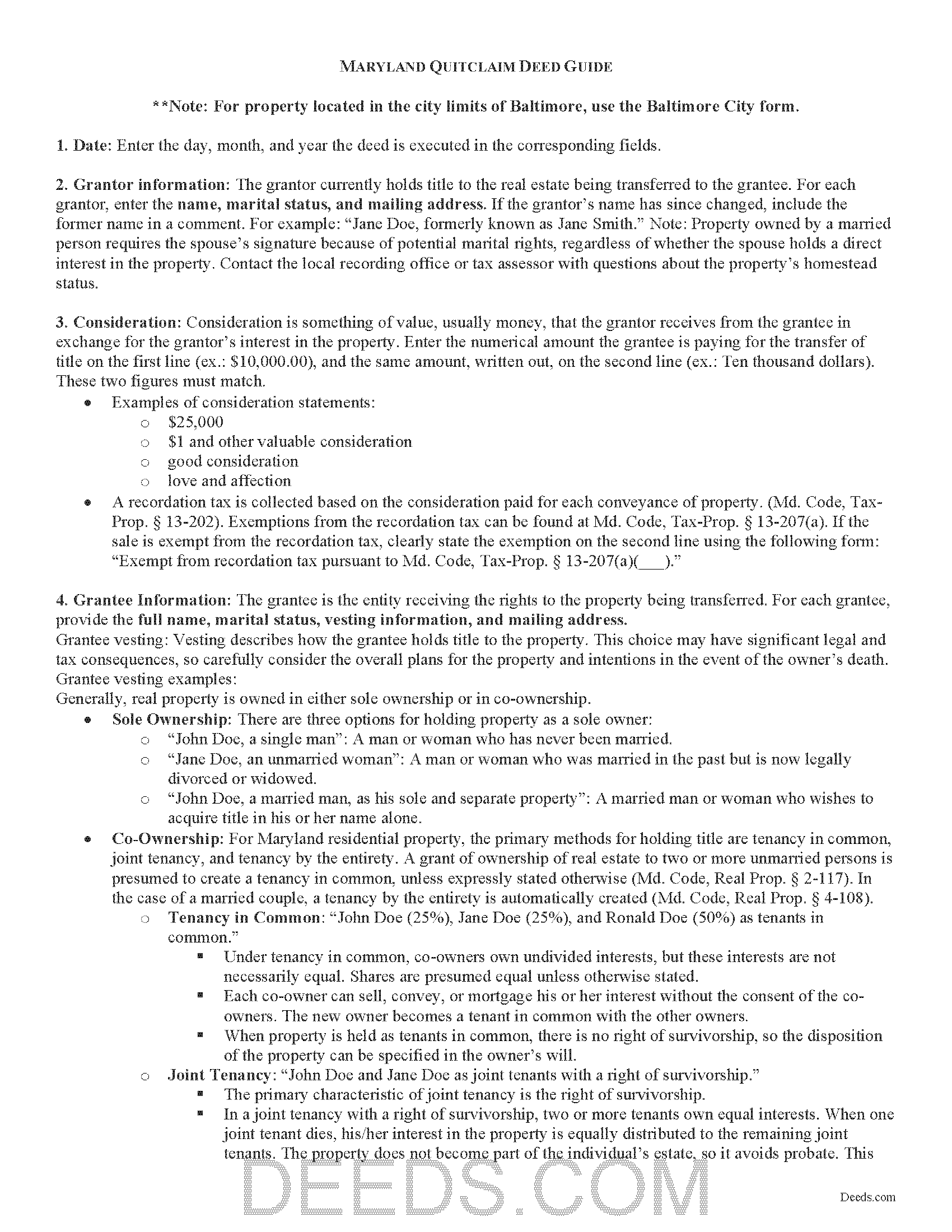

Talbot County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

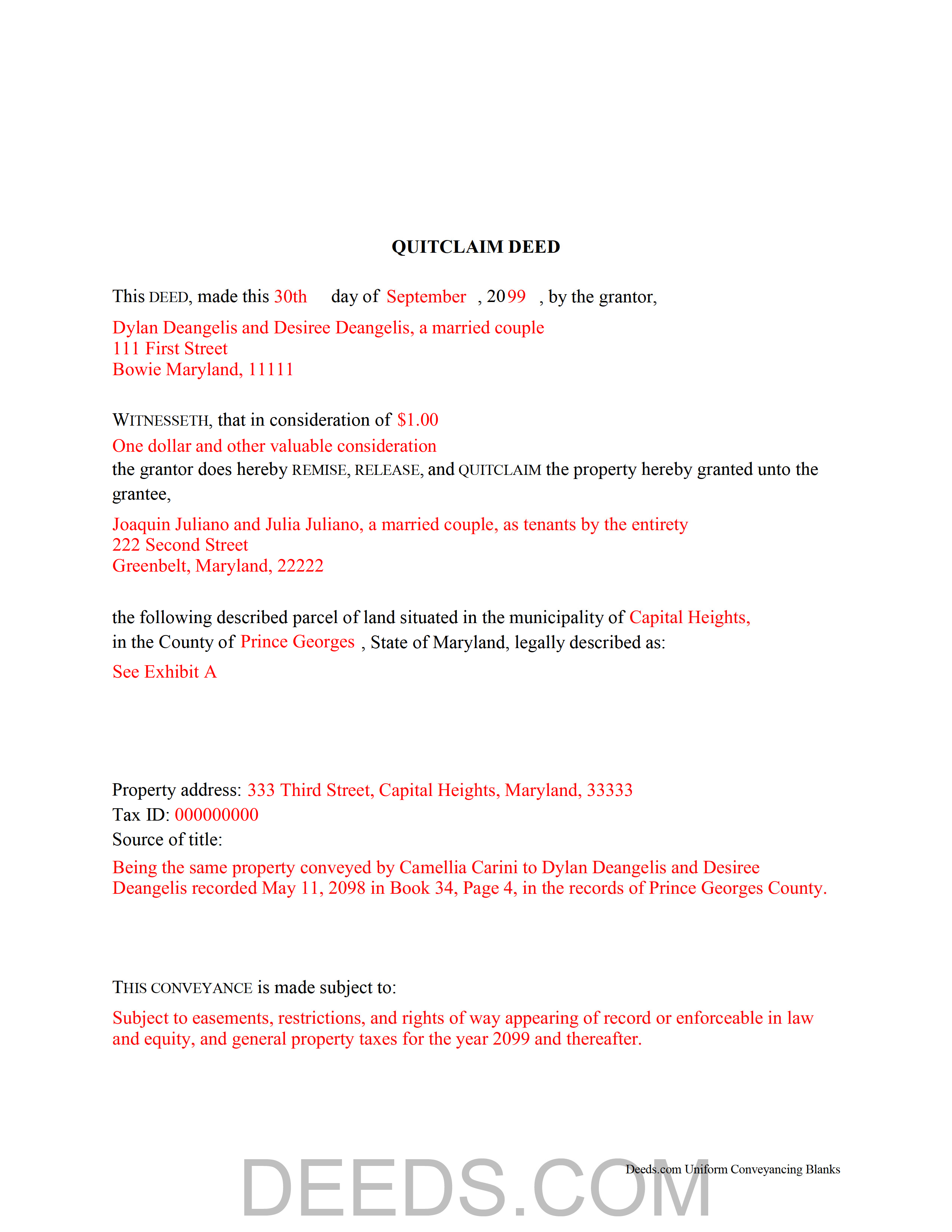

Talbot County Completed Example of the Quitclaim Deed Document

Example of a properly completed Maryland Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Additional Maryland and Talbot County documents included at no extra charge:

Where to Record Your Documents

Circuit Court Clerk

Address:

Courthouse - 11 North Washington St, Suite 16

Easton, Maryland 21601

Hours: 8:30 to 4:30 Monday through Friday

Phone: 410-822-2611

Recording Tips for Talbot County:

- Bring your driver's license or state-issued photo ID

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Talbot County

Properties in any of these areas use Talbot County forms:

- Bozman

- Claiborne

- Cordova

- Easton

- Mcdaniel

- Neavitt

- Newcomb

- Oxford

- Royal Oak

- Saint Michaels

- Sherwood

- Tilghman

- Trappe

- Wittman

- Wye Mills

How do I get my forms?

Forms are available for immediate download after payment. The Talbot County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Talbot County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Talbot County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Talbot County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Talbot County?

Recording fees in Talbot County vary. Contact the recorder's office at 410-822-2611 for current fees.

Have other questions? Contact our support team

Although not defined in the statutes, Maryland accepts quitclaim deeds to transfer the rights, title, and interest in real estate, if any, from the grantor (owner) to the grantee (buyer), with no protections for the grantee. There may be potential unknown claims or restrictions on the title, and the buyer must accept the risk that the grantor may not have complete ownership of the property.

A lawful quitclaim deed identifies the name, address, and marital status of each grantor and grantee. State law requires that all recorded documents contain information on how the grantee will hold title. For Maryland residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless expressly stated otherwise (Md. Code, Real Prop. 2-117). In the case of a married couple, a tenancy by the entirety is automatically created (Md. Code, Real Prop. 4-108).

State the source of title and a complete legal description of the property (Md. Code, Real Prop. 4--101). Give a certificate of preparation (Md. Code, Real Prop. 3-104(f)(1)) in the deed. Quitclaim deeds must be accompanied by a completed intake sheet when submitting for recordation (Md. Code, Real Prop. 3-104). Other required documents may include an affidavit of residency, and/or Maryland Form MW 506 NRS for non-resident sale of property. Contact the local recording office with questions about supporting materials.

A transfer tax is imposed on most deeds (Md. Code, Tax-Prop. 13-202). Find exemptions from the transfer tax at Md. Code, Tax-Prop. 13-207(a). As a prerequisite to recording, quitclaim deeds must be endorsed with the certificate of the collector of taxes of the county where the property is assessed.

Quitclaim deeds must be signed by the grantor in the presence of a notary public. Witnesses are not required for conveyances of real estate in Maryland. In addition to the content requirements set forth by statute, the form must meet all state and local standards for recorded documents. These may vary from county to county, so contact the local recording office with questions.

Record the executed deed in the circuit court for county where the property is located in order to provide notice of the transfer. If the subject land is in more than one county, record the deed (or a certified copy) in all such counties (Md. Code, Real Prop. 3-103).

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about quitclaim deeds or transfers of real property in Maryland.

(Maryland QCD Package includes form, guidelines, and completed example)

Important: Your property must be located in Talbot County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Talbot County.

Our Promise

The documents you receive here will meet, or exceed, the Talbot County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Talbot County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4569 Reviews )

Niranjan C.

August 24th, 2021

Whole process was very easy and quick. Forms were easy to fill, examples were quite appropriate. Recommended.

Thank you!

Lori G.

May 21st, 2020

thank you for all your help and patience. I would highly recommend Deeds.com to everyone. Sincerely, Lori G.

Thank you!

Danny A.

January 10th, 2021

This app is a fast and convenient way to download documents you need.

Thank you!

Barbara J.

October 7th, 2023

Process was simple and fast. Awaiting response form agency. I’m happy to have found deeds.com for a speedy service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Irwin C.

August 25th, 2023

For starters, enrolling was as easy as could be. Then, it only took minutes before my entry was formatted and filed. Finally, when I asked a question, I got an answer within a few minutes. Couldn't be happier with service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anne F.

January 27th, 2022

For someone like me that isn't the swiftest on a computer, deeds.com made getting the documents I needed simple and fast. Loved the pages with the explanation and the sample of a completed document. Thank you for your very organized website. Worth every cent I paid.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles B.

November 20th, 2023

The support received was far above expectations.

We are grateful for your feedback and looking forward to serving you again. Thank you!

William P.

June 28th, 2022

VERY difficult to work with. Nice people. But difficult system. Ask for MANY changes. Why dont you do that as a

Sorry to hear of your struggle William. We do hope that you found something more suitable to your needs elsewhere.

Brenn C.

April 11th, 2022

These products would be more useful if they final deed could be copied and pasted into a word document for proper formatting. Because most of the document is protected against selecting and copying, I did not find it useful. I would not purchase again.

Thank you for your feedback. We really appreciate it. Have a great day!

Dennis H.

June 26th, 2019

Thank you for this program. It will help in the future. Dennis Holt

Thank you!

Marlin M.

March 10th, 2025

all round GREAT!

Always great to hear kind words from such a long time customer Marlin, thank you.

Kathy R.

October 8th, 2022

I was very pleased with the quick turn around on a response to my inquiry. Further guidance was direct and I appreciate the professionalism from deeds.com.

Thank you!

Daniel D.

June 3rd, 2019

Easier than I expected. I followed the downloaded examples step by step, and before I knew it, the form was completed correctly and good to go. Thank you, Daniel D.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura S.

April 21st, 2025

Easy to utilize database and instructions!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Melvin M.

June 6th, 2019

loads of forms and instructions....for a good buy...it would help to know where to send the forms after completing them...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!