Baltimore County Trustee Deed Form (Maryland)

All Baltimore County specific forms and documents listed below are included in your immediate download package:

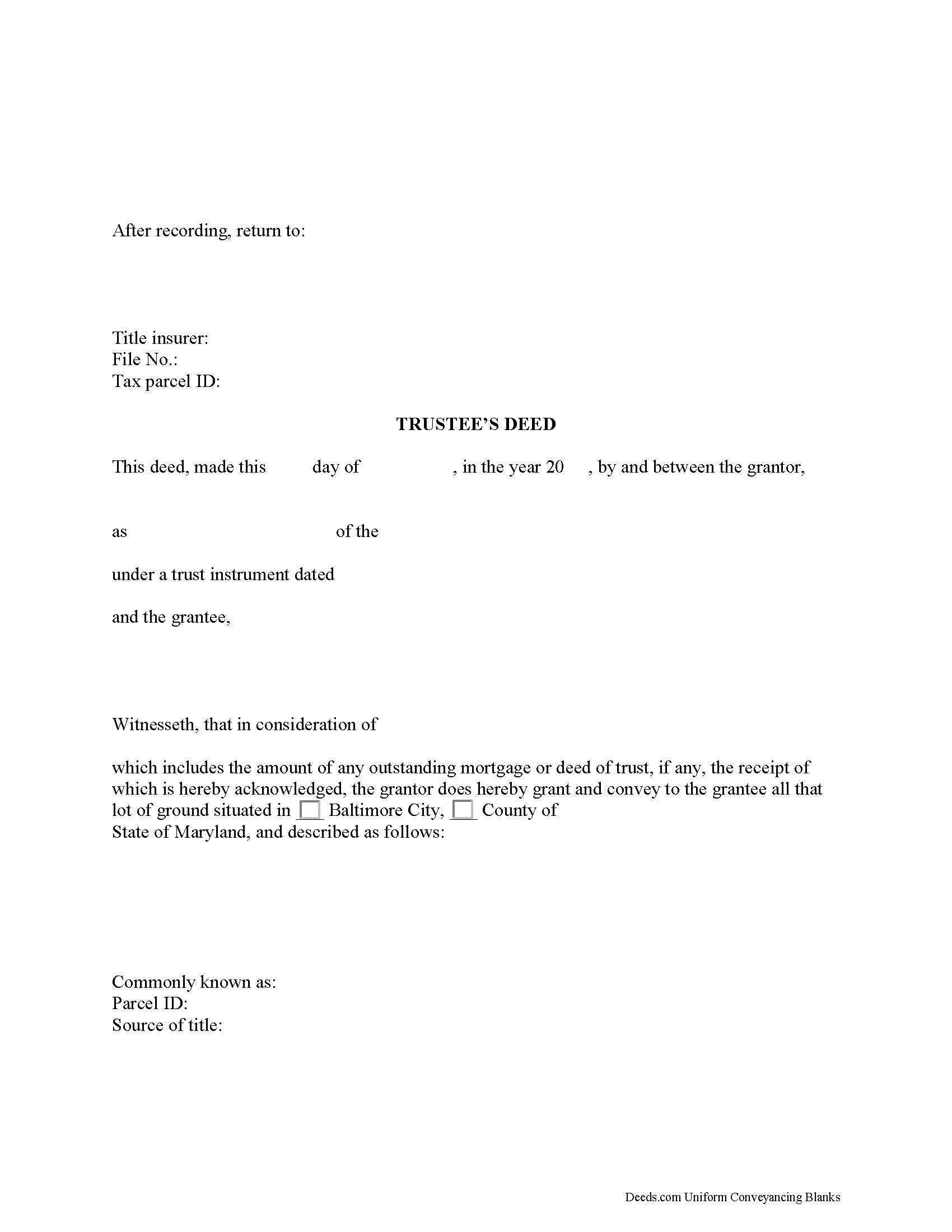

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Baltimore County compliant document last validated/updated 5/22/2025

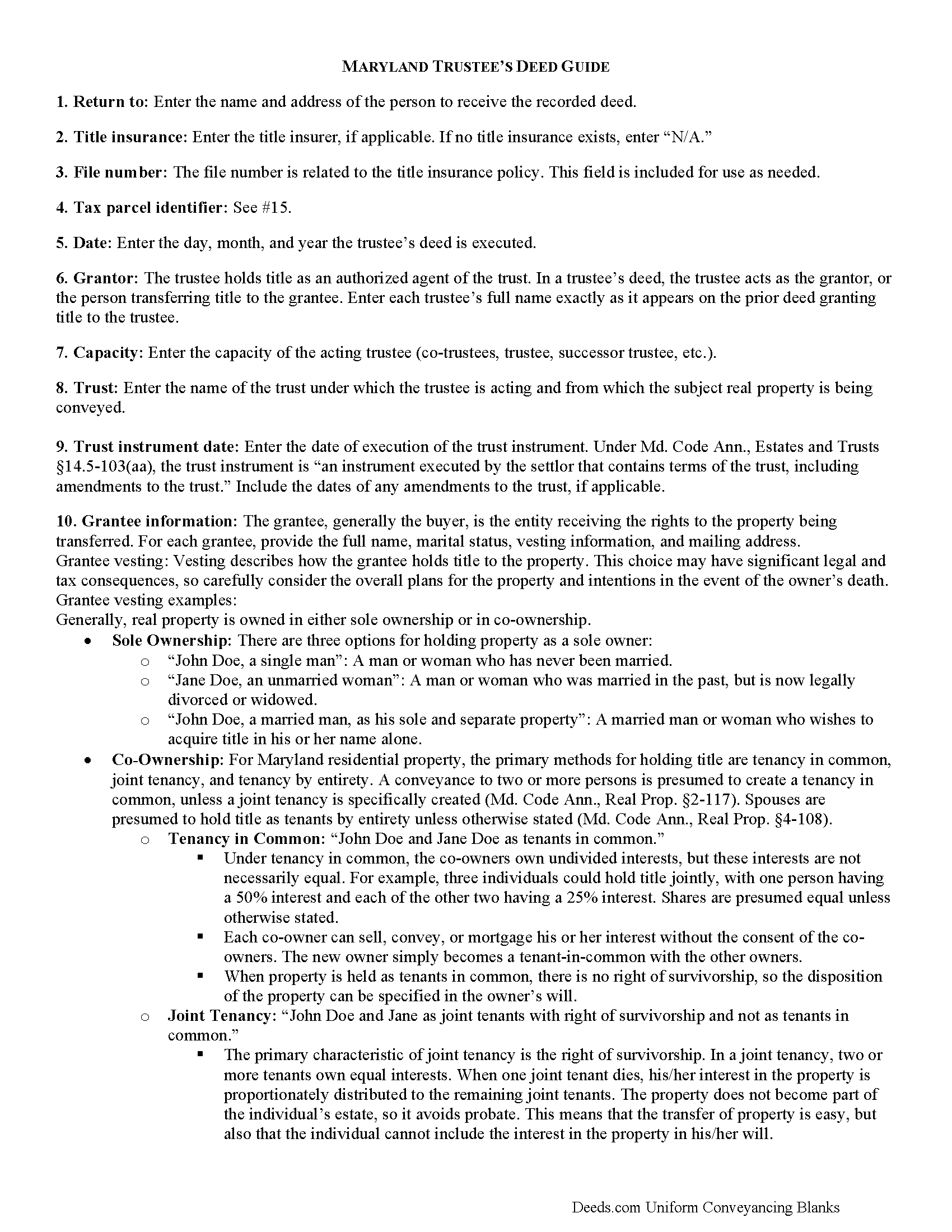

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Baltimore County compliant document last validated/updated 2/28/2025

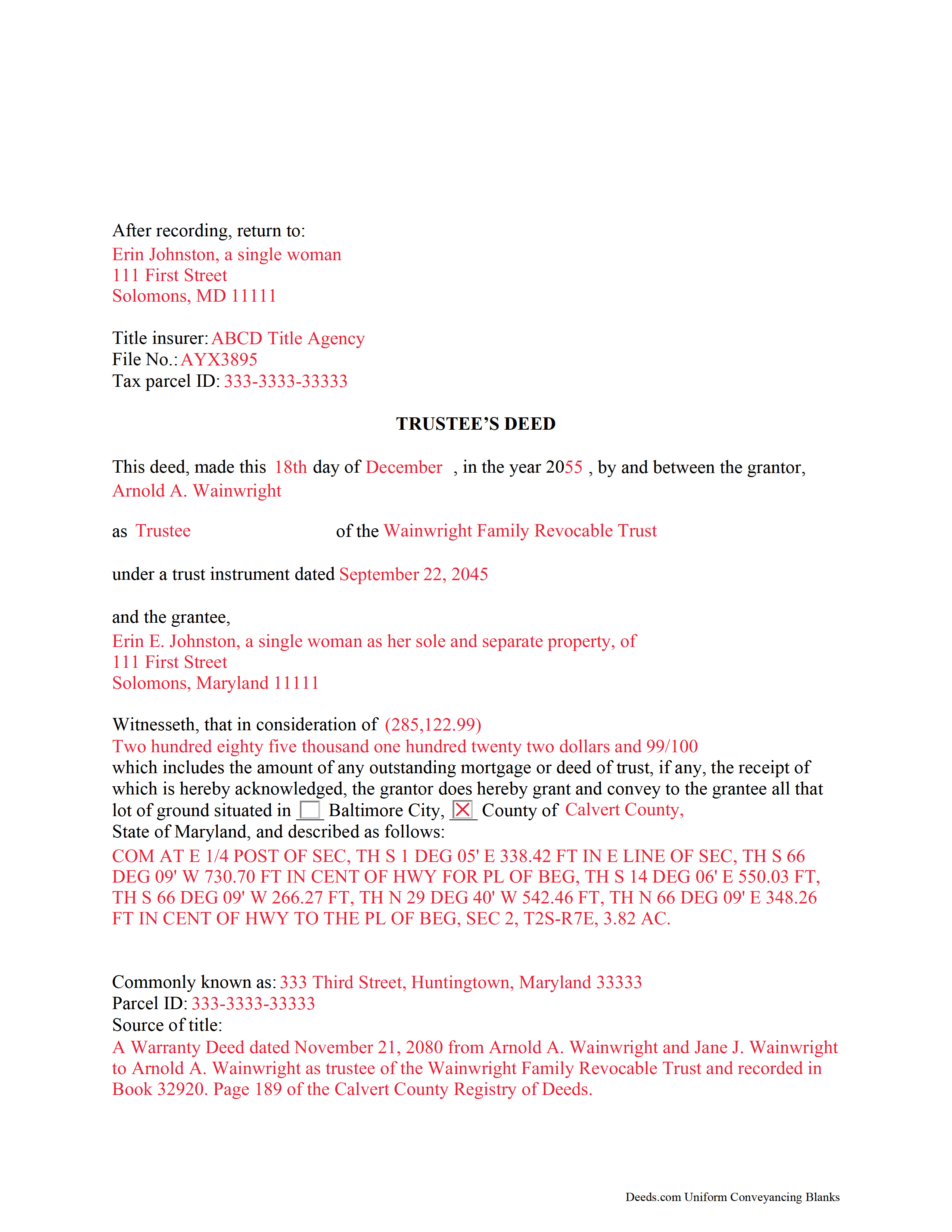

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Baltimore County compliant document last validated/updated 4/17/2025

The following Maryland and Baltimore County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Baltimore County. The executed documents should then be recorded in the following office:

Baltimore County Clerk of the Court

County Courts' Building - 401 Bosley Ave, Towson, Maryland 21204

Hours: 8:30 to 4:30 M-F

Phone: 410-887-3088

Local jurisdictions located in Baltimore County include:

- Baldwin

- Baltimore

- Boring

- Brooklandville

- Butler

- Catonsville

- Chase

- Cockeysville

- Dundalk

- Essex

- Fork

- Fort Howard

- Freeland

- Glen Arm

- Glyndon

- Gwynn Oak

- Halethorpe

- Hunt Valley

- Hydes

- Kingsville

- Long Green

- Lutherville Timonium

- Maryland Line

- Middle River

- Monkton

- Nottingham

- Owings Mills

- Parkton

- Parkville

- Perry Hall

- Phoenix

- Pikesville

- Randallstown

- Reisterstown

- Riderwood

- Rosedale

- Sparks Glencoe

- Sparrows Point

- Stevenson

- Towson

- Upper Falls

- Upperco

- White Marsh

- Windsor Mill

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Baltimore County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Baltimore County using our eRecording service.

Are these forms guaranteed to be recordable in Baltimore County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Baltimore County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Baltimore County that you need to transfer you would only need to order our forms once for all of your properties in Baltimore County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Maryland or Baltimore County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Baltimore County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Trusts formed in Maryland are governed by the Estates and Trusts Article of the Maryland Code. Effective since January 1, 2015, the Maryland Trust Act (MTA) under Title 14.5 is adapted from the Uniform Trust Code and supplements the prior Maryland Discretionary Trust Act codified under Title 14.

According to Black's Law Dictionary, 8th ed., a trust is "a property interest held by one person (the trustee) at the request of another (the settlor) for the benefit of a third party (the beneficiary)." The settlor executes a trust instrument establishing the terms of the trust and "contributes property to a trust" (Md. Code Ann., Estates and Trusts 14.5-103(v)(1)).

In a living trust, the trustee holds title to property at the request of the settlor, and as such, conveyances of trust property must be made through the trustee, who generally has a power of sale under the trust instrument. Transferring real property held in trust to another party requires the use of a trustee's deed.

Trustees' deeds take their name from the person conveying the property, rather than from the type of warranties of title they carry, as with warranty deeds or quitclaim deeds. In Maryland, the trustee's deed is a fee simple conveyance. The deed can contain certain covenants of title, such as special warranty language that warrants the title against claims arising under the grantor's tenure.

The trustee conveys title to real property held by the trust as the grantor of the trustee's deed. The deed names each acting trustee and the name and date of the trust on behalf of which they are acting in addition to vesting title in the name of the grantee. As with all documents affecting real property, the trustee' deed requires a legal description of the property conveyed, as well as a reference to the prior instrument under which the trustee as grantor received title.

In Maryland, consideration statements must include the actual amount of money paid for the transfer, including the amount of a mortgage or deed of trust assumed by the grantee. State transfer tax is calculated from the consideration, with an increased rate for the first-time Maryland homebuyers purchasing a principal place of residence.

Pursuant to Md. Code Ann., Real Prop. 3-104(f)(1), deeds require a signed statement that the document has been prepared by or under the supervision of a Maryland attorney, or a party listed on the instrument. The deed must be signed by each acting trustee in the presence of a notary public before submitted for recording. In addition to meeting state and local recording standards, trustee's deeds may also require supporting documentation, which may vary from case to case.

Contact an attorney with any questions regarding Maryland trusts and trustee's deeds.

(Maryland TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Baltimore County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Baltimore County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

SAMANTHA P.

September 19th, 2021

Very easy very clear very informative of direct information stating the obvious and the underlining of both contexts. Right place for the right Tools to establish ,verify ,correct then guidance for not only myself, but for our legacy that should and will be live on to be know. Thank you deeds.com!

Thank you!

Elizabeth L.

November 5th, 2019

Used this site and the forms a few times now and always a good experience. It's so nice to be able to download these forms to my computer and work on them there. So many others want you to do everything online, pain in my opinion. Thank you Deeds!

Thank you for your feedback. We really appreciate it. Have a great day!

Cheryl M.

April 12th, 2020

Easy.

Thank you!

Kathryn C.

October 17th, 2023

The process to get my needed documents worked easily. I was pleased how quickly I was able to access the documents.

Your positive feedback is a testament to our efforts, and it truly made our day. We are committed to keeping up this level of service and making your future interactions with us equally, if not more, pleasing.

Thank you once again for taking the time to share your positive experience. We look forward to serving you again soon!

Robert S.

June 10th, 2022

Thank you! You are so awesome. Its amazing to be able to get everything together in a download packet. You make it so easy for the user.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eddie S.

May 19th, 2022

love the site very helpful and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ingrid K.

December 18th, 2020

Prompt efficient service.

Thank you!

Mary D. B.

May 11th, 2023

BIG THANK YOU EXCELLENT WEBSITE

Thank you!

Janet J.

January 17th, 2020

The download process was quick and efficient. Here's hoping the printing process will be as easy. Appreciate this access to forms so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Melissa S.

March 24th, 2024

Simple & easy to navigate. At time of writing this, guide & example of purchased deed is included. Plus lots of extra information to help secure your property. Would recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ron B.

September 15th, 2019

Solved my requirement. Happy to have found the site

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy O.

September 20th, 2024

This would be a great form but I couldn’t tell what size the font was. Also, I didn’t know how to save it so I will have to type it all over again. I’m sure I did it incorrectly.

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.