Middlesex County Estate Tax Affidavit Form (Massachusetts)

All Middlesex County specific forms and documents listed below are included in your immediate download package:

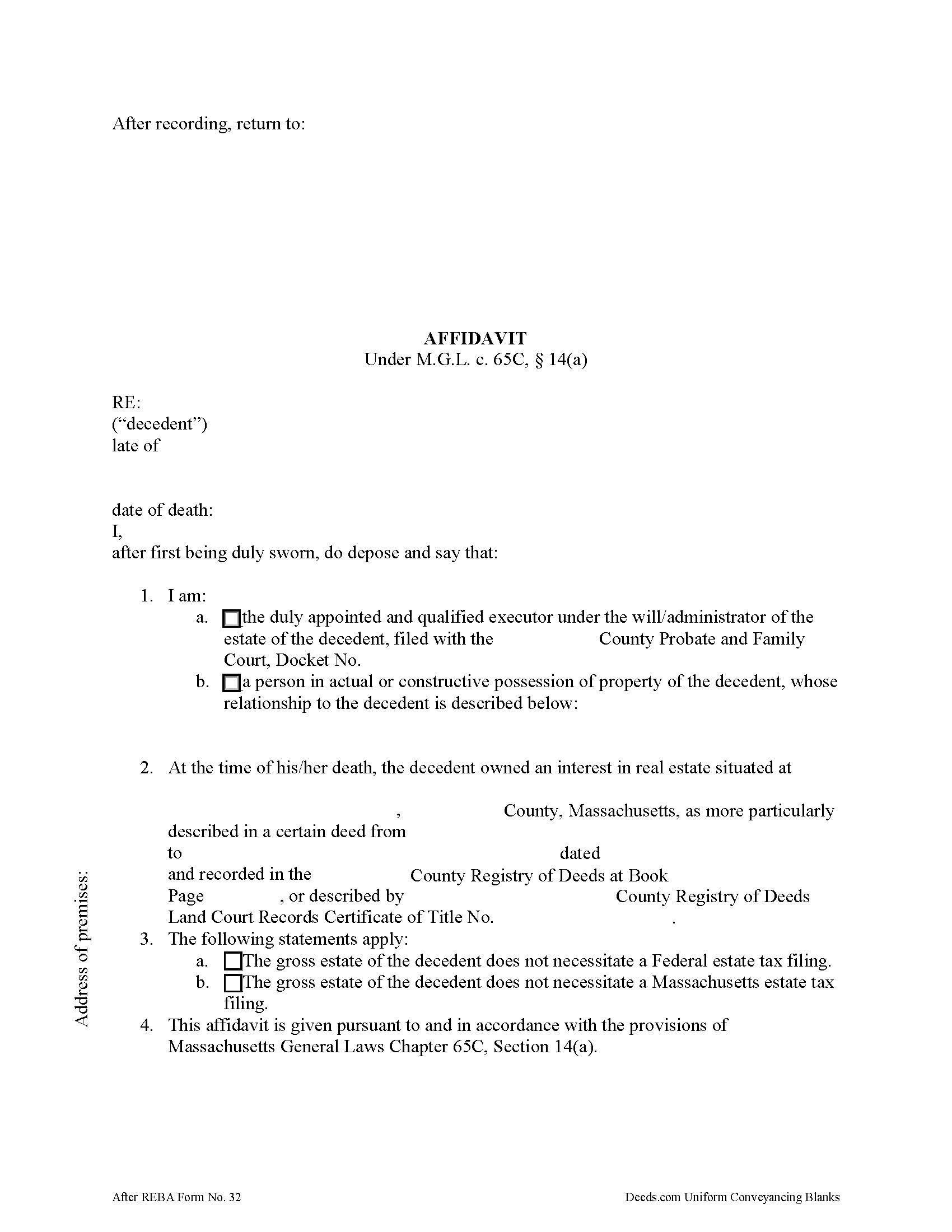

Estate Tax Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Middlesex County compliant document last validated/updated 4/10/2024

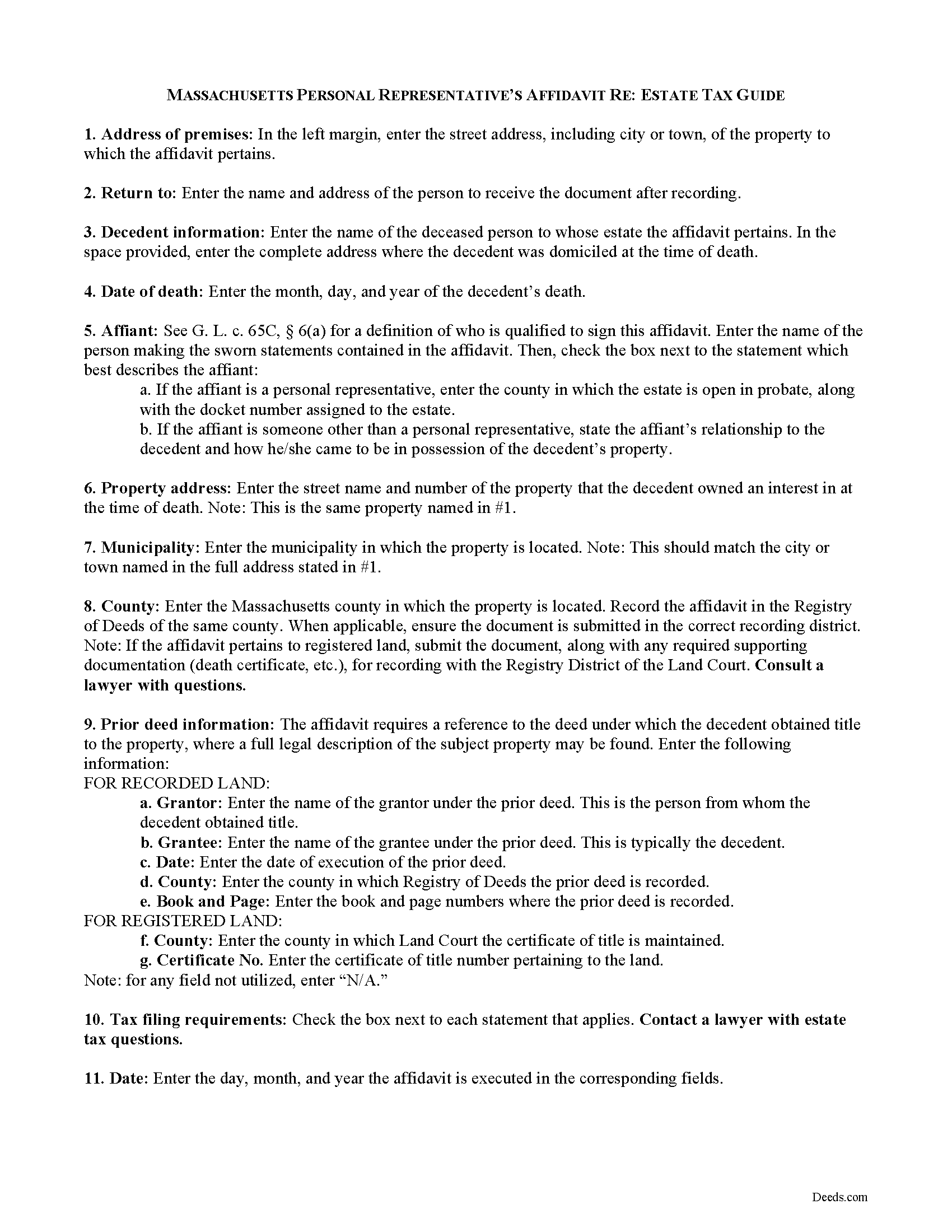

Estate Tax Affidavit Guide

Line by line guide explaining every blank on the form.

Included Middlesex County compliant document last validated/updated 6/26/2024

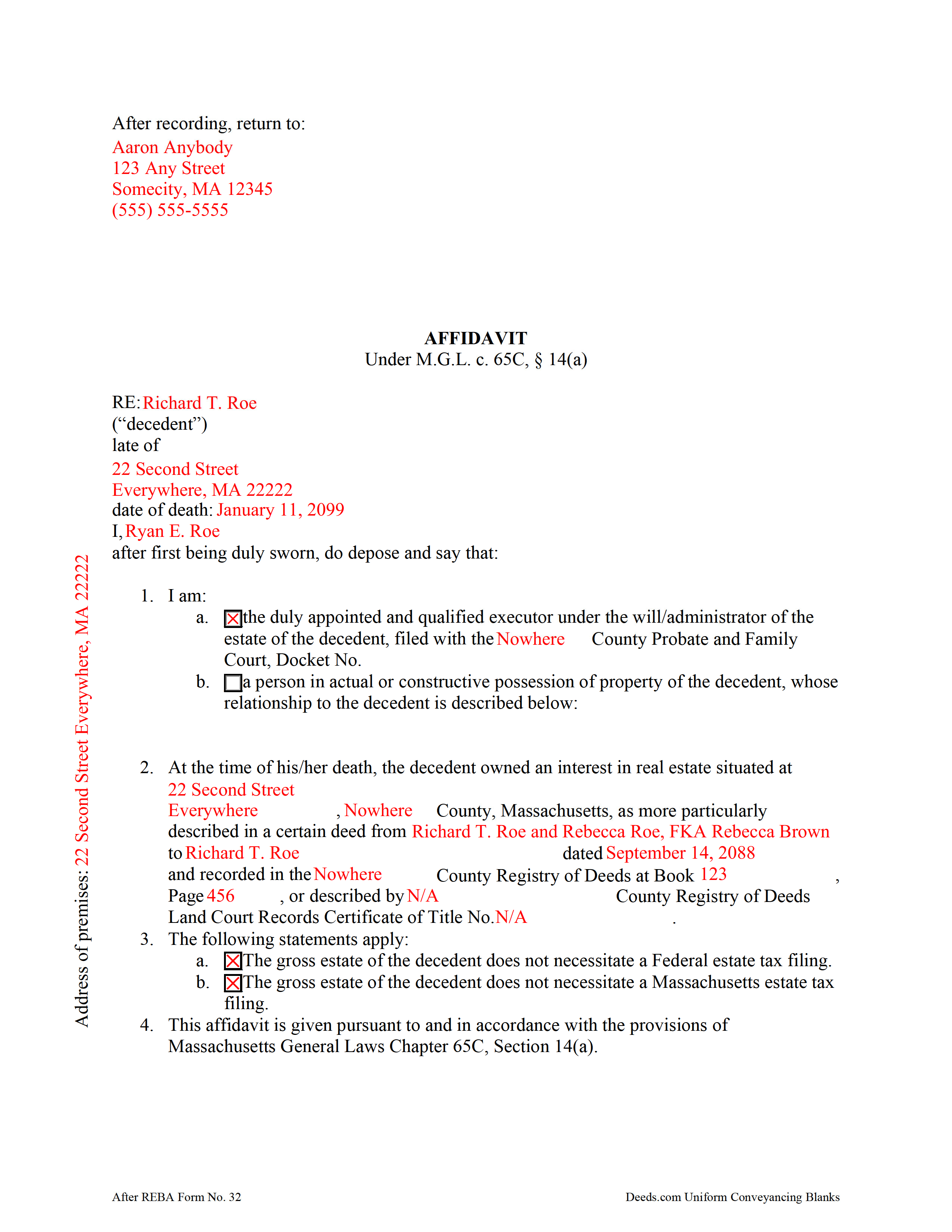

Completed Example of the Estate Tax Affidavit Document

Example of a properly completed form for reference.

Included Middlesex County compliant document last validated/updated 3/13/2024

The following Massachusetts and Middlesex County supplemental forms are included as a courtesy with your order:

When using these Estate Tax Affidavit forms, the subject real estate must be physically located in Middlesex County. The executed documents should then be recorded in one of the following offices:

Middlesex North Registry of Deeds

360 Gorham St, Lowell, Massachusetts 01852

Hours: 8:30 to 4:30 M-F / Recording until 4:15

Phone: (978) 322-9000

Middlesex South Registry of Deeds

208 Cambridge St / PO Box 68, Cambridge, Massachusetts 02141

Hours: 8:00am to 3:45pm M-F

Phone: (617) 679-6300

Local jurisdictions located in Middlesex County include:

- Acton

- Arlington

- Arlington Heights

- Ashby

- Ashland

- Auburndale

- Ayer

- Bedford

- Belmont

- Billerica

- Boxborough

- Burlington

- Cambridge

- Carlisle

- Chelmsford

- Chestnut Hill

- Concord

- Devens

- Dracut

- Dunstable

- Everett

- Framingham

- Groton

- Hanscom Afb

- Holliston

- Hopkinton

- Hudson

- Lexington

- Lincoln

- Littleton

- Lowell

- Malden

- Marlborough

- Maynard

- Medford

- Melrose

- Natick

- New Town

- Newton

- Newton Center

- Newton Highlands

- Newton Lower Falls

- Newton Upper Falls

- Newtonville

- Nonantum

- North Billerica

- North Chelmsford

- North Reading

- North Waltham

- Nutting Lake

- Pepperell

- Pinehurst

- Reading

- Sherborn

- Shirley

- Somerville

- Stoneham

- Stow

- Sudbury

- Tewksbury

- Townsend

- Tyngsboro

- Village Of Nagog Woods

- Waban

- Wakefield

- Waltham

- Watertown

- Waverley

- Wayland

- West Groton

- West Medford

- West Newton

- West Townsend

- Westford

- Weston

- Wilmington

- Winchester

- Woburn

- Woodville

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Middlesex County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Middlesex County using our eRecording service.

Are these forms guaranteed to be recordable in Middlesex County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Middlesex County including margin requirements, content requirements, font and font size requirements.

Can the Estate Tax Affidavit forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Middlesex County that you need to transfer you would only need to order our forms once for all of your properties in Middlesex County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Massachusetts or Middlesex County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Middlesex County Estate Tax Affidavit forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Massachusetts, upon death, a lien attaches to a decedent's real property for ten years, or until the estate tax is paid, or an affidavit showing that the decedent's gross estate does not require an estate tax filing is recorded by a personal representative (or other qualified person under G. L. c. 65C, 6(a)) in the Registry of Deeds.

Use the affidavit of estate tax under M.G.L. c. 65C, 14(a) to release the lien on the decedent's property. The affidavit should include the name, address, and date of death of the decedent. The affiant shall indicate whether he/she is the personal representative of the decedent's probated estate, or, if the property is not subject to probate, then the affiant's relationship to the decedent.

The document's recitals also include the address of the premises affected and the prior instrument containing a legal description of the property. All statements contained within the affidavit are made by the affiant on penalty of perjury and sworn to before a notary public.

Contact a lawyer with questions about the Massachusetts estate tax and affidavits relating to decedents' estates in the Commonwealth of Massachusetts.

(Massachusetts ETA Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Middlesex County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Middlesex County Estate Tax Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4363 Reviews )

AARON D.

July 26th, 2024

Forms were great ! Cancelled my lawyer's appointment & utilized your forms.rn

We are grateful for your feedback and looking forward to serving you again. Thank you!

Anne H.

July 25th, 2024

After some initial general confusion -- (we sold a small piece of land privately and therefore do not typically prepare such documentation (!)) -- we were able to purchase and download all forms from Deeds.com and understand how to complete it/them. The help is all there, we just needed to read and study it - the "Example" helped alot. We were able to complete the Document per your online form(s) and then take it to be signed/notarized - and take the completed paper document to the Registry -- and it is now all registered and we are All Set. rn Took the morning (only). THANK YOU. A wonderful tool!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

charles b.

July 21st, 2024

The product I needed was available, easy to download, access and complete. The instructions were very helpful. I had previously purchased another product which was terrible. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerome R.

July 22nd, 2021

great service clean and accurate

Thank you for your feedback. We really appreciate it. Have a great day!

Hayley C.

November 19th, 2020

Love this site, so easy to work with and customer service is amazing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shirley C.

November 17th, 2019

I liked that the documents could be filled in on my computer. All the documents came out nice, better than I expected really.

Thank you Shirley, we appreciate your feedback. Have a great day!

Miles B.

June 15th, 2019

Fast, professional work at a great price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dean P.

October 6th, 2021

Very fast, efficient, and convenient - thanks Deeds.com! I would recommend this service to everyone needing to record documents, especially out-of-state customers such as myself.

Thank you for your feedback. We really appreciate it. Have a great day!

Logan S.

April 27th, 2020

Wonderful experience. Was preapred to wait days, recording was finished in less than an hour.

Thank you!

Evaristo R.

October 6th, 2020

I was very excited to use the website but unfortunately they had a problem retrieving my Deed but thank you for the opportunity.

Thank you for your feedback. We really appreciate it. Have a great day!

brian d.

May 26th, 2020

I am a Loan Officer and this website saves me a bunch of time. Love it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon D.

December 29th, 2018

Very easy to understand forms...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen M.

July 19th, 2020

Excellent and easy process to use the online fill in the blank sections, especially when you provided a example of what each topic/section should look like. Highly recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James M.

June 3rd, 2021

Very good experience.

Thank you!

Rosa D.

June 18th, 2019

Obtaining a quick claim deed from this website was easy and friendly I must say. Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!