Franklin County Quitclaim Deed with Covenants Form

Franklin County Quitclaim Deed with Covenants Form

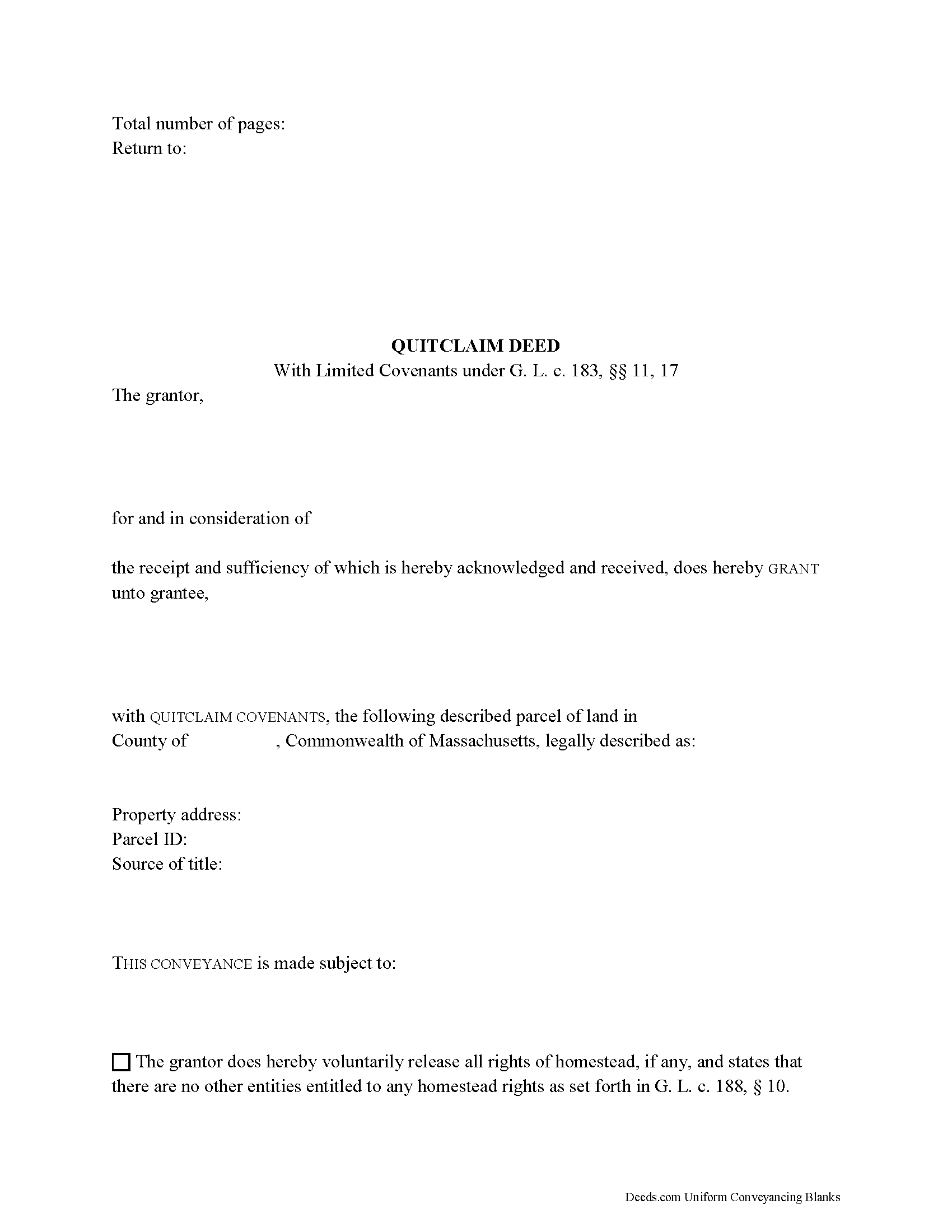

Fill in the blank Quitclaim Deed with Covenants form formatted to comply with all Massachusetts recording and content requirements.

Franklin County Quitclaim Deed with Covenants Guide

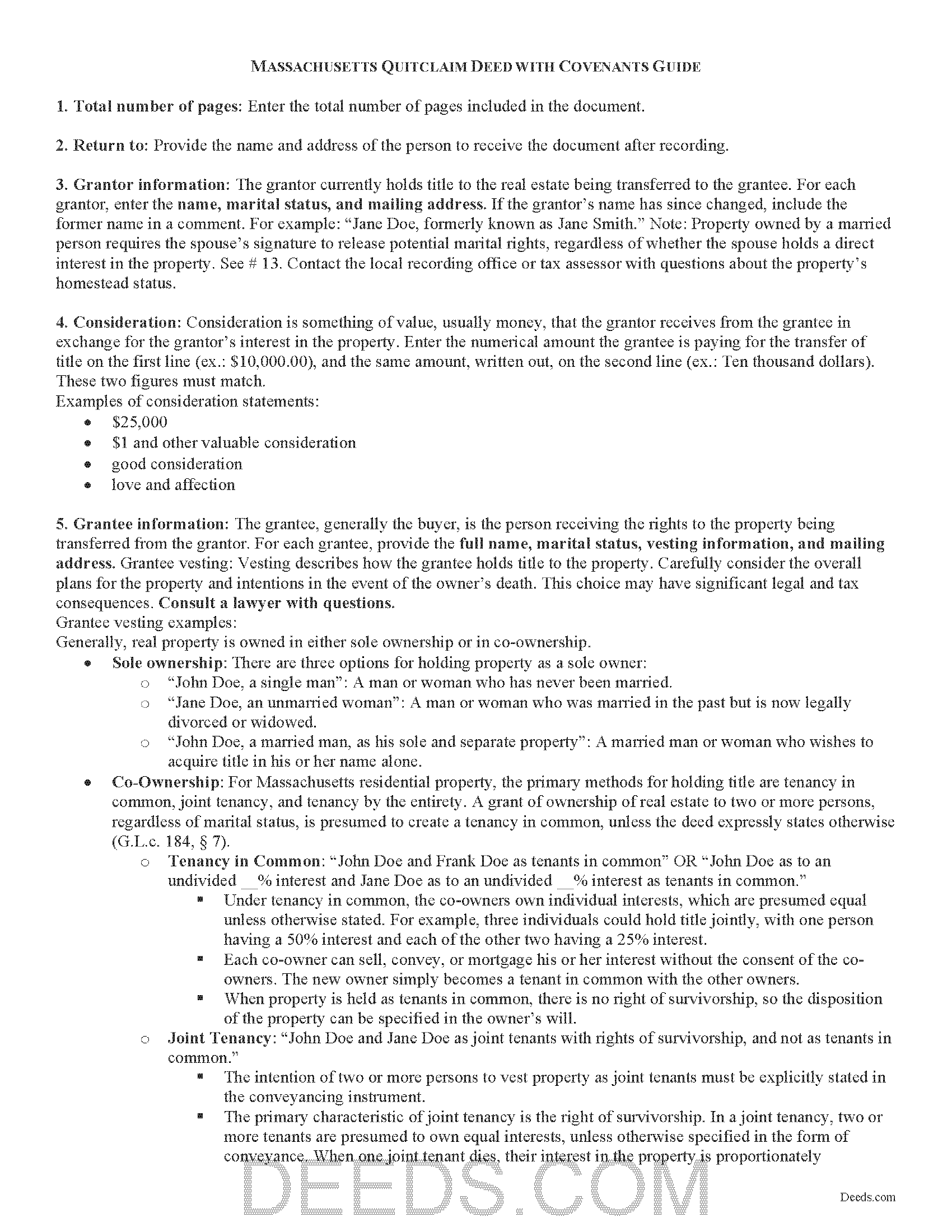

Line by line guide explaining every blank on the Quitclaim Deed with Covenants form.

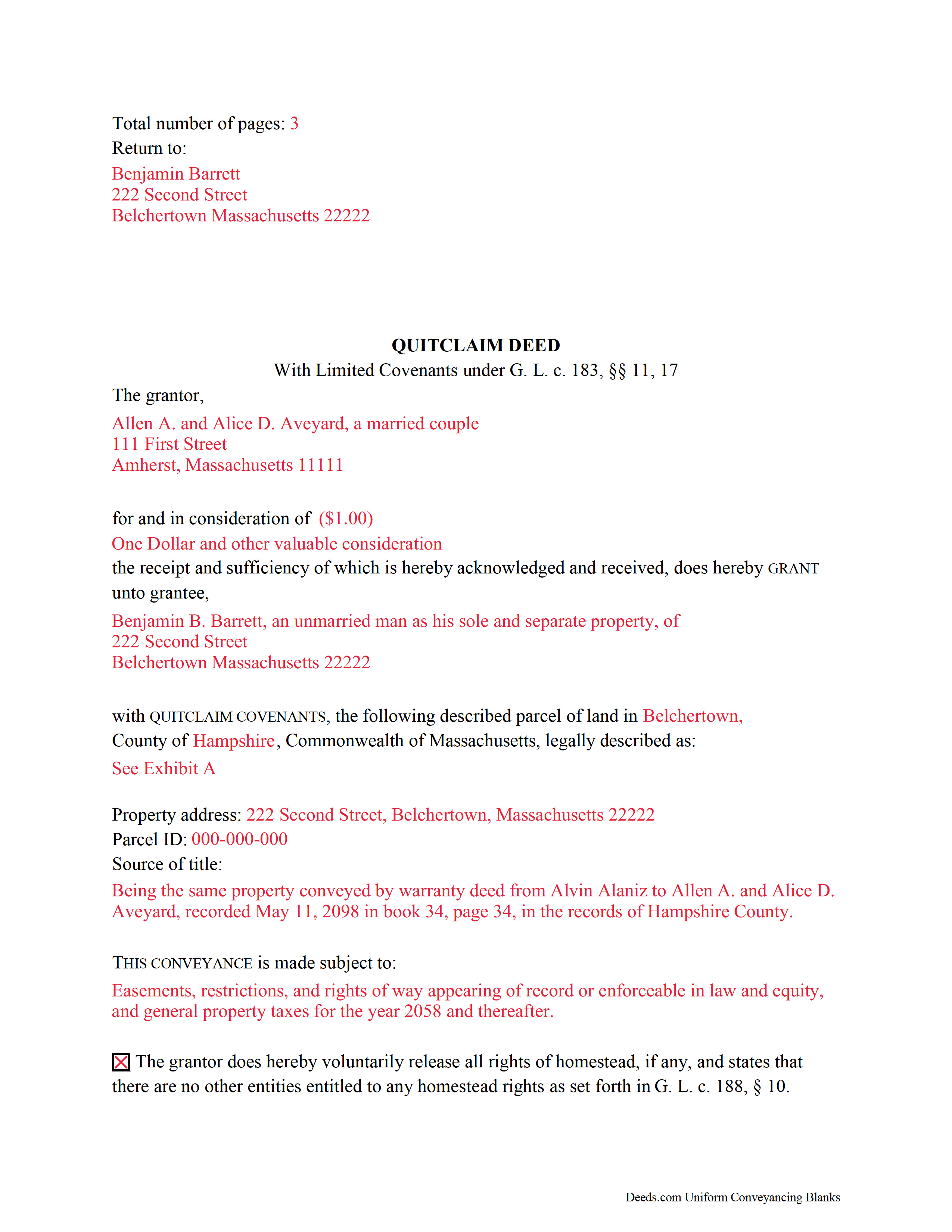

Franklin County Completed Example of the Quitclaim Deed with Covenants Document

Example of a properly completed Massachusetts Quitclaim Deed with Covenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Massachusetts and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin Registry of Deeds

Greenfield, Massachusetts 01302

Hours: 8:30 to 4:15 Monday through Friday

Phone: (413) 772-0239

Recording Tips for Franklin County:

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Ashfield

- Bernardston

- Buckland

- Charlemont

- Colrain

- Conway

- Deerfield

- Erving

- Gill

- Greenfield

- Heath

- Lake Pleasant

- Leverett

- Millers Falls

- Monroe Bridge

- Montague

- New Salem

- Northfield

- Orange

- Rowe

- Shelburne Falls

- Shutesbury

- South Deerfield

- Sunderland

- Turners Falls

- Warwick

- Wendell

- Wendell Depot

- Whately

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (413) 772-0239 for current fees.

Questions answered? Let's get started!

Real estate conveyances in Massachusetts are governed under Massachusetts General Laws Chapters 183 and 184.

Quitclaim deeds with limited covenants are used to transfer the rights, title, and interest in real estate, if any, from the grantor (seller) to the grantee (buyer). When using this kind of deed, the grantor "covenants that the property is free from all encumbrances," and that he will "warrant and defend the same to the grantee forever against the lawful claims and demands of all persons claiming by, through or under the grantor, but against none other" (G.L.c. 183 sec. 17). Because of these covenants, this form is valid as-is for use as a special warranty deed in Massachusetts.

In addition to meeting all state and local standards for recorded documents, a lawful deed identifies the name, address, and marital status of each grantor and grantee (G.L.c. 183 sec. 6). State law requires that all land records contain information on how the grantee will hold title (G.L.c. 184 sec. 7). For Massachusetts residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by the entirety. A grant of ownership of real estate to two or more persons, regardless of marital status, is presumed to create a tenancy in common, unless the deed expressly states otherwise (G.L.c. 184 sec. 7).

As with any conveyance of real estate, a quitclaim deed with limited covenants requires a complete legal description of the parcel. The deed must state the amount of the full consideration, or the total price for the conveyance (G.L.c. 183 sec. 6). Based on the consideration paid, an excise tax (also known as a transfer tax or stamp tax) is collected from the seller (G.L.c. 64D sec. 1,2).

Record the completed deed at the local County Registry of Deeds office. Some counties (Berkshire, Bristol, Essex, Middlesex, Worcester) are split into two or more recording districts. Make sure to record the deed in the correct recording district. If the deed pertains to registered land, submit the deed to the Registry District of the Land Court. Include all relevant affidavits, forms, and fees along with the deed for recording. For guidance related to supplemental documentation, speak with the local Registry of Deeds office.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact a lawyer with questions about quitclaim deeds with limited covenants or transfers of real property in Massachusetts.

(Massachusetts QCD with Covenants Package includes form, guidelines, and completed example)

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed with Covenants meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Quitclaim Deed with Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4606 Reviews )

GLENN A M.

November 26th, 2019

I loved the easy to understand and use system, very user friendly.

Thank you!

Gary K.

November 15th, 2019

Straightforward and pretty easy to use. The only downside is that there is no way to contact them directly. The number on the website is answered only by a voicemail with no return calls. Pricing seems fair compared to other services and much more efficient that filing "over the counter."

Thank you for your feedback. We really appreciate it. Have a great day!

Robert D.

March 7th, 2019

These forms made it so easy to update the property deed and the instructions and sample filled out form were most helpful. You might want to add some brief information on when or why to use the Acknowledgment in Individual Capacity notary form. In my case the notary was required to use it but also filled in the brief notarize section on the Affidavit as well. She said the one on the Affidavit had some value because it showed she had witnessed the my signature. But this was only after I suggested both be filled in as she initially thought to just strike through it and just use the Acknowledgment in Individual Capacity form.

Thank you for your feedback. We really appreciate it. Have a great day!

Albert G.

December 7th, 2019

Download was smooth. I'll post an update after I get a change to work with the forms.

Thank you!

Glenn W.

May 5th, 2021

I love this tool and it is easy to work with. The interface is straight forward and notifications are consistently accurate.

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN F.

May 24th, 2023

Quick and easy! I had previously prepared a Lady Bird deed, submitted it through Deeds.com and it was accepted/recorded by my county in just a few hours. The Deed.com $21 fee was well worth it as I saved fuel, tolls and parking costs not to mention at least 2-3 hours of my time that it would've taken to get downtown and back home!

Thanks for the feedback John. We appreciate you taking the time to share your experience. Have an amazing day!

Robert B.

April 2nd, 2019

Excellent, easy to operate, saved $$$ by doing this TOD deed myself. WILL BUY AGAIN!!

Thank you Robert. Have a fantastic day!

Vonnie F.

January 26th, 2021

This service is very user-friendly and efficient.

Thank you!

Sandra P.

July 25th, 2020

Thank so much! It' was pretty easy with the help of my Brother in-law .

Thank you for your feedback. We really appreciate it. Have a great day!

Chanda B.

September 9th, 2025

So easy to use!

Thank you!

Jennifer O.

March 2nd, 2022

Quick, easy, affordable, eliminated the need for a lawyer.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles F.

April 28th, 2020

Hi Please do not take time to respond to my previous inquiry - - - I figured it out. Deeds.com is a great tool for those of us who have occasional need for your type of services. Thanks ! Chuck

Thank you!

Michael S.

September 16th, 2024

Great product and service. So convenient.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Victoria L.

February 25th, 2019

This is a fantastic website and financial savings to many. Being able to download and complete the document I needed vs having my attorney complete saved me $800. I would highly recommend this website.

Thank you for the kind words Victoria. Have a great day!

Donna M.

November 22nd, 2021

Appreciated the ability to not only download the form but the instruction's AND a sample.

Thank you for your feedback. We really appreciate it. Have a great day!