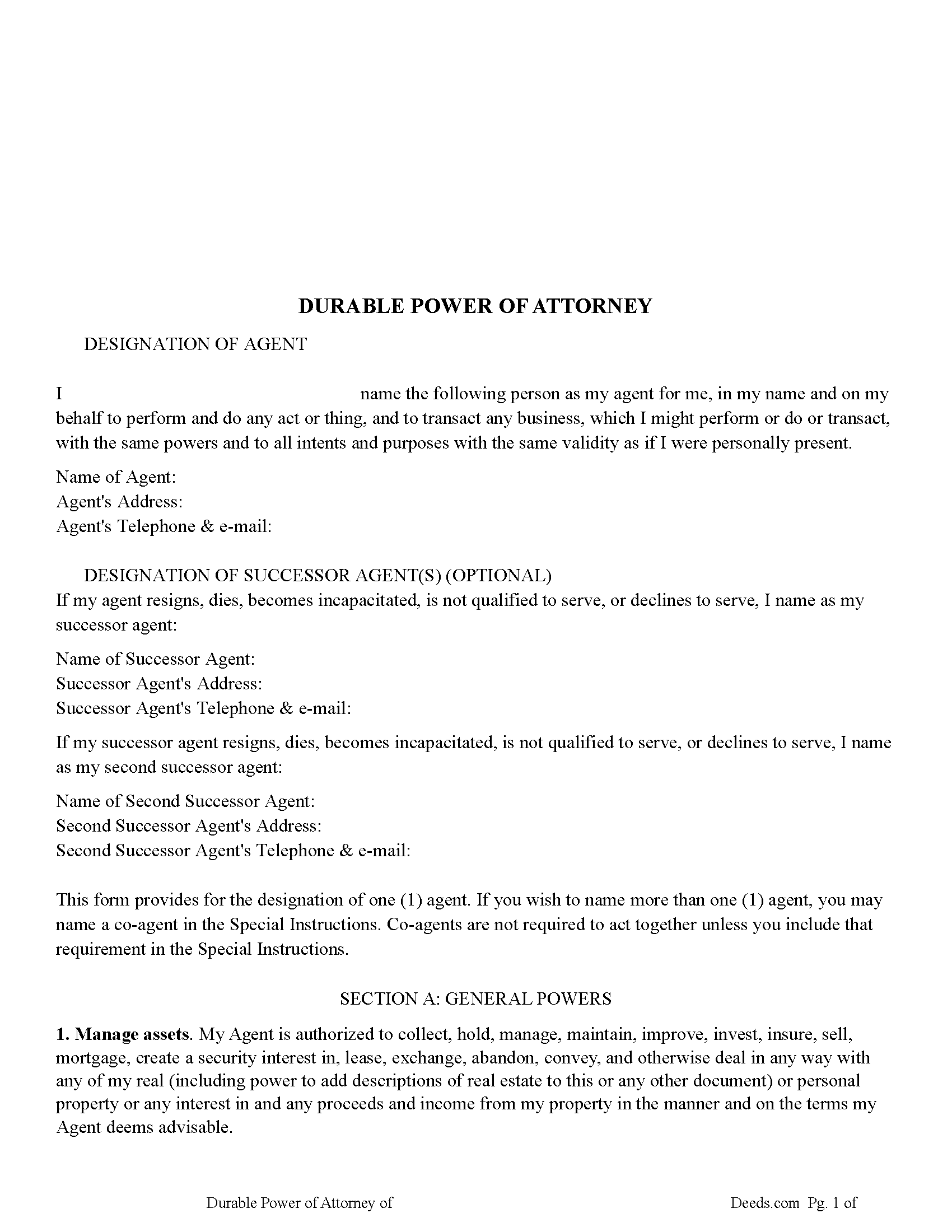

Lapeer County Durable Power of Attorney Form

Lapeer County Durable Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

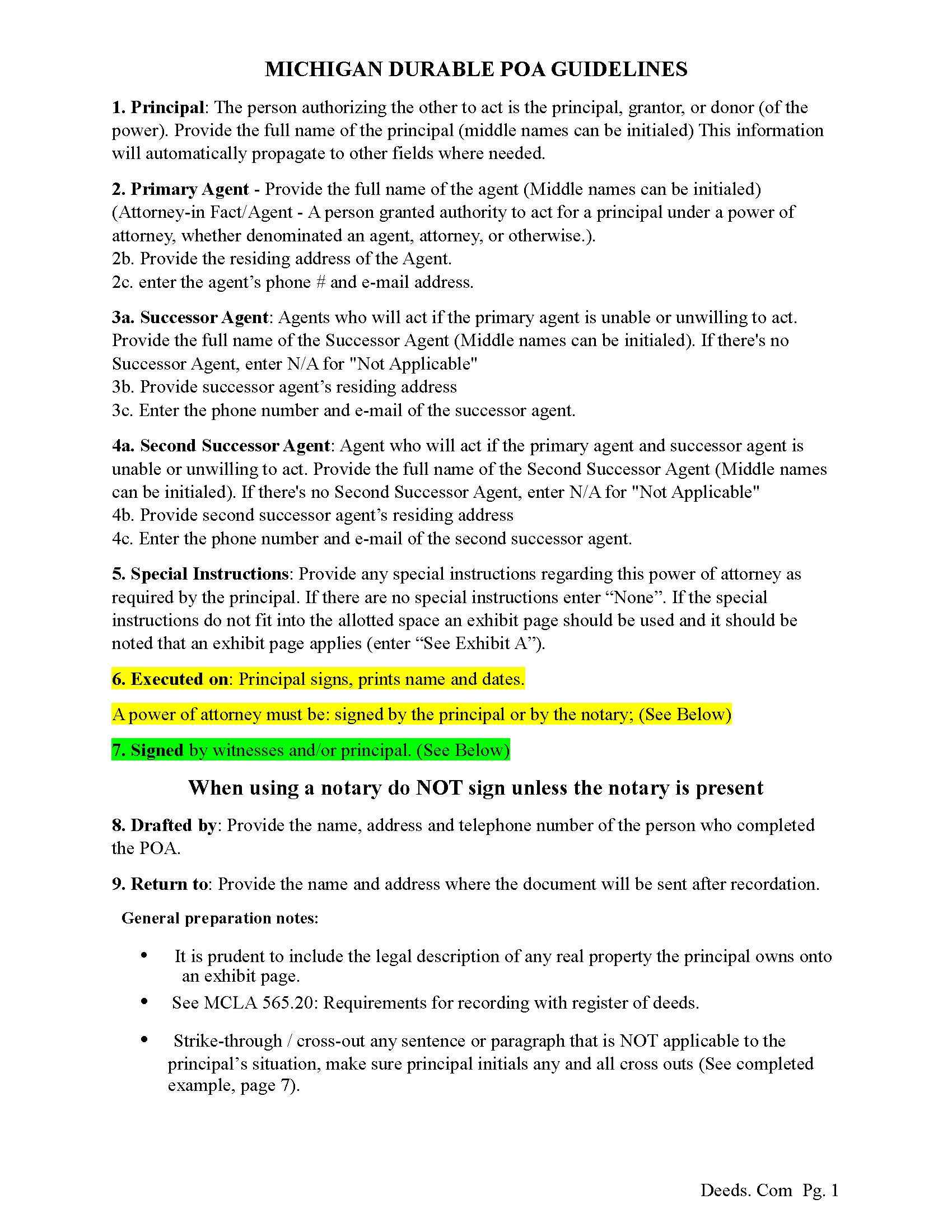

Lapeer County Guidelines Durable Power of Attorney

Line by line guide explaining every blank on the form.

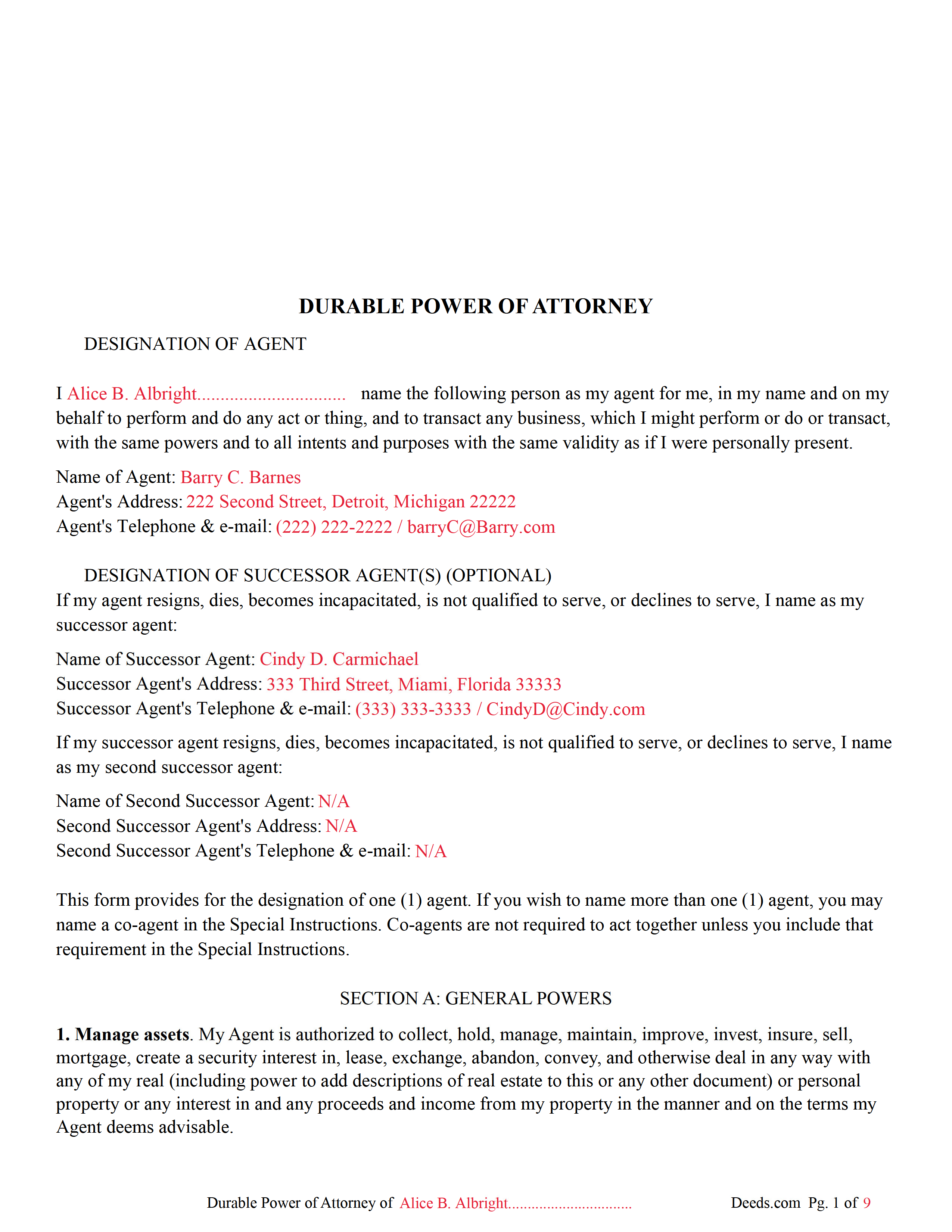

Lapeer County Completed Example of the Durable Power of Attorney Document

Example of a properly completed form for reference.

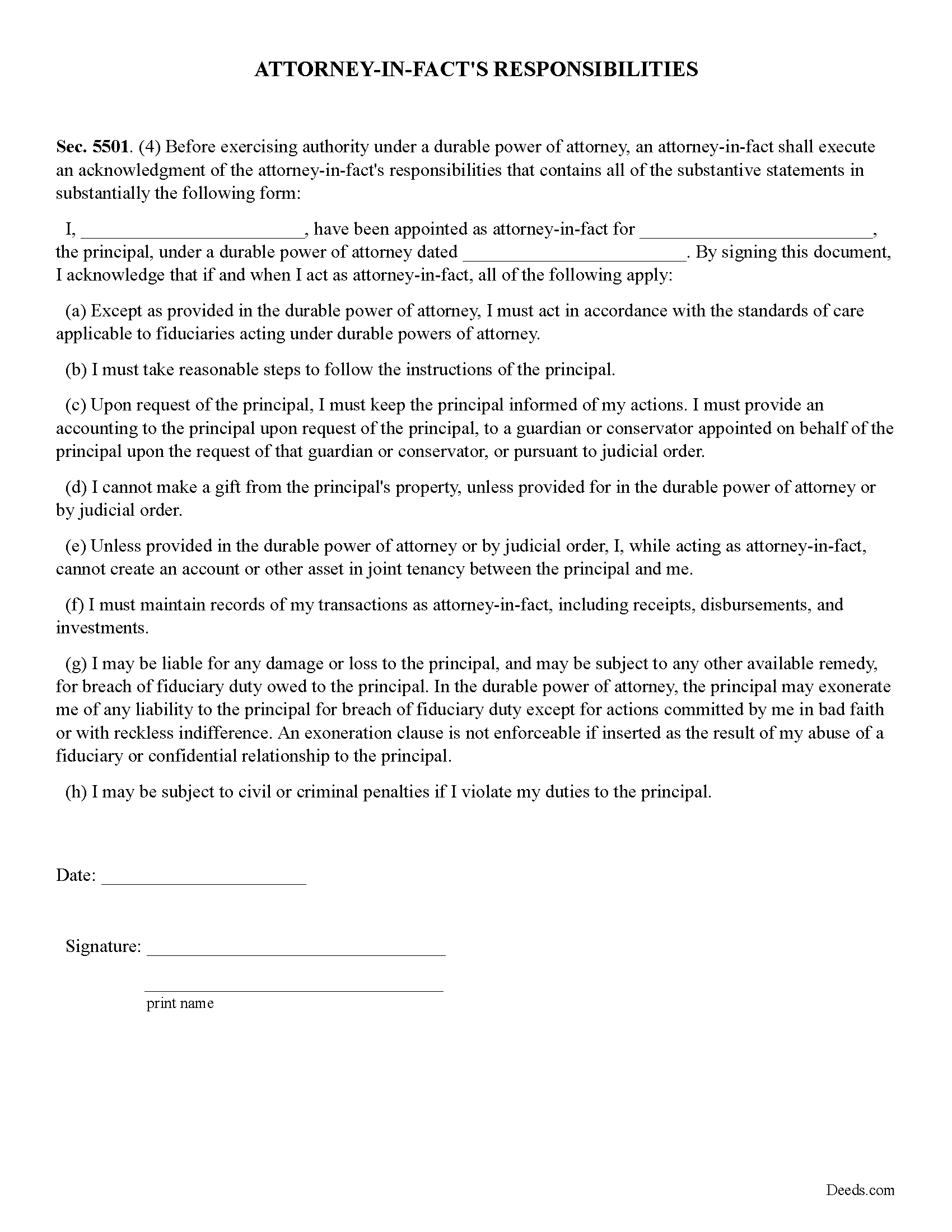

Lapeer County Attorney in Facts Responsibilities Form

Statutory Form, often required by third parties.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Lapeer County documents included at no extra charge:

Where to Record Your Documents

Lapeer County Register of Deeds

Lapeer, Michigan 48446

Hours: 8:00 to 12:30 & 1:30 to 5:00 Mon-Fri

Phone: (810) 667-0211

Recording Tips for Lapeer County:

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Lapeer County

Properties in any of these areas use Lapeer County forms:

- Almont

- Attica

- Clifford

- Columbiaville

- Dryden

- Hadley

- Imlay City

- Lapeer

- Metamora

- North Branch

- Otter Lake

- Silverwood

Hours, fees, requirements, and more for Lapeer County

How do I get my forms?

Forms are available for immediate download after payment. The Lapeer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lapeer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lapeer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lapeer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lapeer County?

Recording fees in Lapeer County vary. Contact the recorder's office at (810) 667-0211 for current fees.

Questions answered? Let's get started!

The Principal designates an attorney in fact and contains the words ("This power of attorney is not affected by the principal's subsequent disability or incapacity, or by the lapse of time", or "This power of attorney is effective upon the disability or incapacity of the principal" or similar words showing the principal's intent that the authority conferred is exercisable notwithstanding the principal's subsequent disability or incapacity and, unless the power states a termination time, notwithstanding the lapse of time since the execution of the instrument) (sec.5501.(a))

Sec 5501. (3) An attorney-in-fact designated and acting under a durable power of attorney has the authority, rights, responsibilities, and limitations as provided by law with respect to a durable power of attorney, including, but not limited to, all of the following:

(a) Except as provided in the durable power of attorney, the attorney-in-fact shall act in accordance with the standards of care applicable to fiduciaries exercising powers under a durable power of attorney.

(b) The attorney-in-fact shall take reasonable steps to follow the instructions of the principal.

(c) Upon request of the principal, the attorney-in-fact shall keep the principal informed of the attorney-in-fact's actions. The attorney-in-fact shall provide an accounting to the principal upon request of the principal, to a conservator or guardian appointed on behalf of the principal upon request of the guardian or conservator, or pursuant to judicial order.

(d) The attorney-in-fact shall not make a gift of all or any part of the principal's assets, unless provided for in the durable power of attorney or by judicial order.

(e) Unless provided in the durable power of attorney or by judicial order, the attorney-in-fact, while acting as attorney-in-fact, shall not create an account or other asset in joint tenancy between the principal and the attorney-in-fact.

(f) The attorney-in-fact shall maintain records of the attorney-in-fact's actions on behalf of the principal, including transactions, receipts, disbursements, and investments.

(g) The attorney-in-fact may be liable for any damage or loss to the principal, and may be subject to any other available remedy, for breach of fiduciary duty owed to the principal. In the durable power of attorney, the principal may exonerate the attorney-in-fact of any liability to the principal for breach of fiduciary duty except for actions committed by the attorney-in-fact in bad faith or with reckless indifference. An exoneration clause is not enforceable if inserted as the result of an abuse by the attorney-in-fact of a fiduciary or confidential relationship to the principal.

(h) The attorney-in-fact may receive reasonable compensation for the attorney-in-fact's services if provided for in the durable power of attorney

MICHIGAN DURABLE POA

SECTION A: GENERAL POWERS

1. Manage assets.

2. Debts and expenses.

3. Bank Accounts.

4. Deposits and withdrawals.

5. Checks.

6. Borrowing.

7. Collection powers.

8. Safe deposit box.

9. Securities and investments.

10. Litigation

11. Insurance, annuities, and benefit plans.

12. College savings accounts

13. Taxes

14. Services.

15. Support.

16. Government benefits.

17. Medicaid Qualification

18. Access to Digital Assets (Including Content).

SECTION B: EXTRAORDINARY POWERS AND LIMITATIONS

1. Gifts

2. Gifts from trust

3. Creating Joint Tenancy.

4. Create trusts

5. Amend, revoke, restate, reform, and terminate trusts

6. Transfer assets to trusts

7. Withdraw income and principal from trusts

8. Disclaimer.

9. Intent of Principal with regard to paying for my care and needs

10. Limitation on Agent liability for investments

11. Limitation on Agent liability for preservation of the estate plan

12. Amend/Revoke Funeral Representative Designation

SECTION C: POWERS RELATED TO MY PERSONAL CARE

l. Establish residency.

2. Care contracts

3. Medical and personal records

4. Privacy rights

SECTION D: OTHER PROVISIONS

l. Incidental authority

2. Nomination of Agent as conservator

3. Compensation of Agent

4. Use of copies

5. Durability.

6. Third-party reliance

7. Special Instructions

(Michigan DPOA Package includes form, guidelines, and completed example) For use in Michigan only.

Important: Your property must be located in Lapeer County to use these forms. Documents should be recorded at the office below.

This Durable Power of Attorney meets all recording requirements specific to Lapeer County.

Our Promise

The documents you receive here will meet, or exceed, the Lapeer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lapeer County Durable Power of Attorney form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Carol M.

January 13th, 2020

Great service

Thank you!

Martin B.

August 12th, 2020

Excellent Detailed and clear Easy to use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sheryl B.

March 2nd, 2019

Great forms. Just what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!

Christian M.

June 11th, 2019

Easy to find the necessary documents needed

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

WILLIAM H.

April 17th, 2021

i also need a "NOTE" and this trust deed is not exactly what i wanted. it may work but not to well.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald S.

July 7th, 2020

Good

Thank you!

Jamie P.

December 9th, 2024

Got it next business day in the morning. Saved me phone call and perhaps a trip to courthouse. Very pleased.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Sinh L.

January 13th, 2020

Deeds.com did such a wonderful job that I had to leave a positive review. I did a deed retrieval and ran across some hiccups. Deeds.com was able to help me get my deed and even went beyond to help me have a more in depth understanding of it's title history. They responded quickly to all my messages. Great customer service. Definitely recommend! Thank you Deeds.com and thank you KVH.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen G.

May 7th, 2021

easy to complete. directions and forms where great!!

Thank you for your feedback. We really appreciate it. Have a great day!

Gary B.

March 30th, 2021

After spending $21 to obtain a Quit Claim Deed form, I realized that I was in over my head. There are a lot of legal considerations and I am not familiar enough with the legal terms and choices to feel confident doing it myself. I since hired a paralegal service to prepare my Quit Claim. I wish I knew the knowledge required before I purchased.

Glad to hear you sought the assistance of a legal professional familiar with your specific situation Gary. We always recommend this to anyone not completely sure of what they are doing.

Anita M.

March 10th, 2019

This was a very easy process to find the correct documents and download them. The price was also reasonable.

Thank you for your feedback. We really appreciate it. Have a great day!

Kirk G.

October 23rd, 2021

Excellent! I will be back!

Thank you!

Martha G.

January 7th, 2020

Well-designed site. Incredibly easy to find what I needed, very reasonable cost.

Thank you for your feedback. We really appreciate it. Have a great day!

John G.

October 4th, 2022

Fast turn-around, very efficient!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!