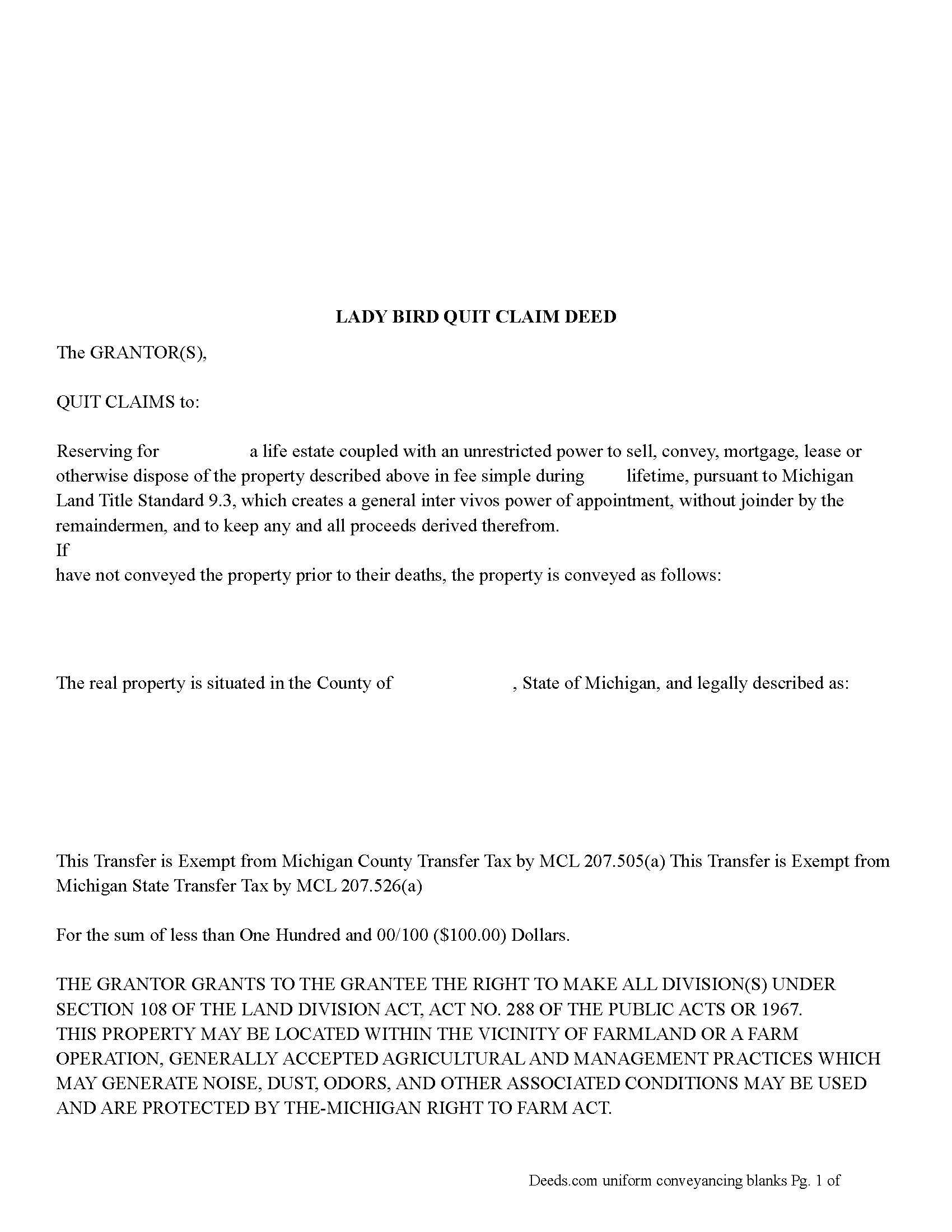

Mason County Lady Bird Quitclaim Deed Form

Mason County Lady Bird Quitclaim Deed Form

Fill in the blank Lady Bird Quitclaim Deed form formatted to comply with all Michigan recording and content requirements.

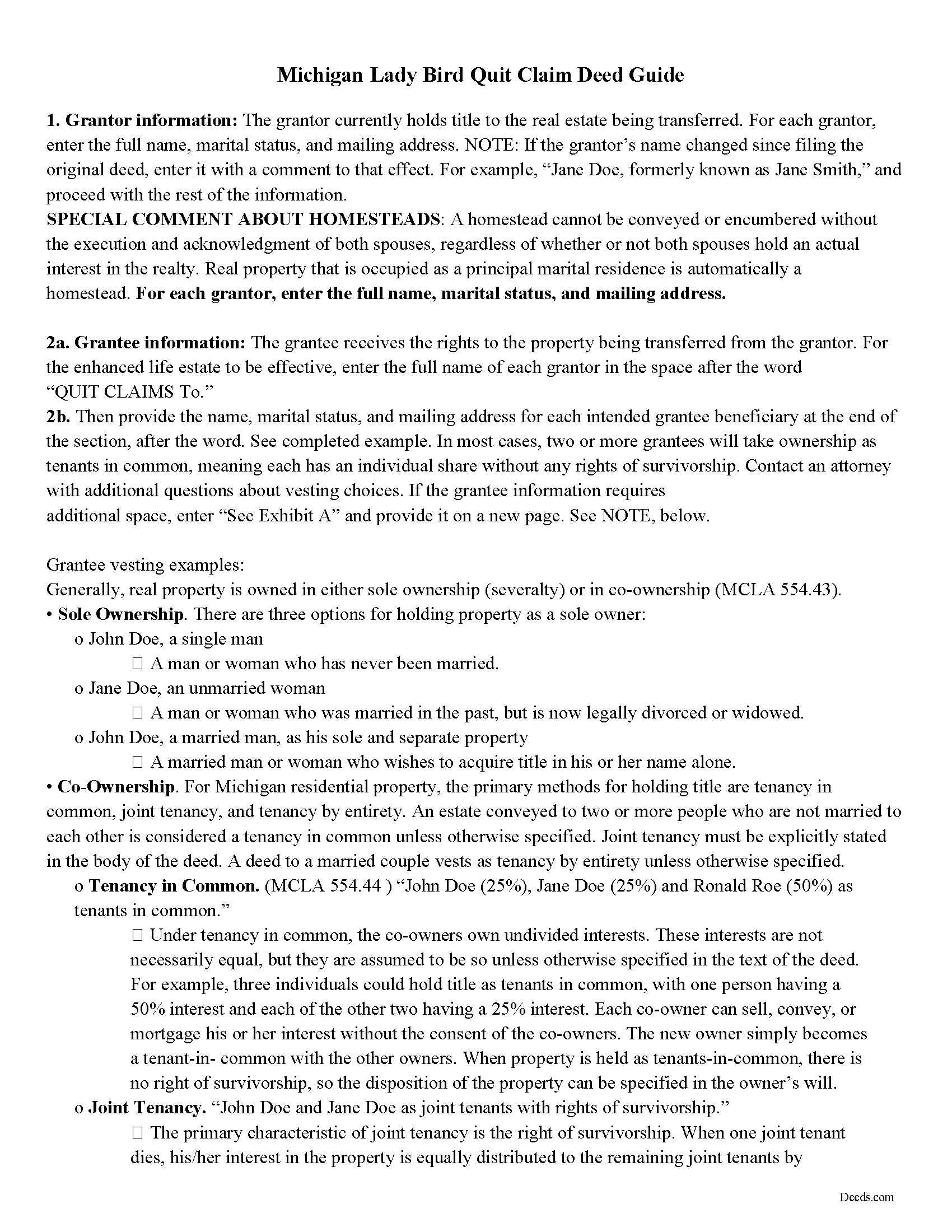

Mason County Lady Bird Quitclaim Deed Guide

Line by line guide explaining every blank on the Lady Bird Quitclaim Deed form.

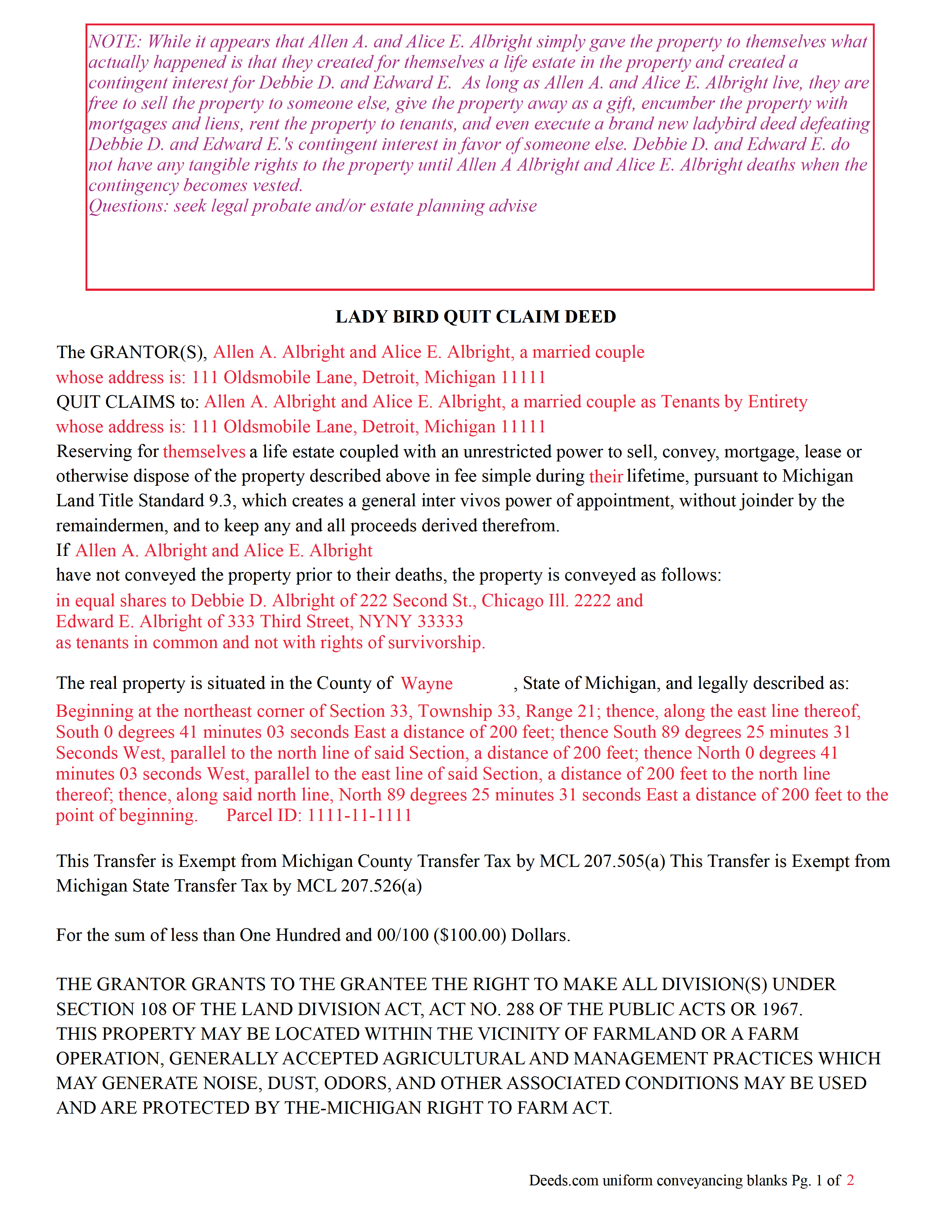

Mason County Completed Example Version 1 of the Lady Bird Quitclaim Deed Document

Example of a properly completed Michigan Lady Bird Quitclaim Deed document for reference.

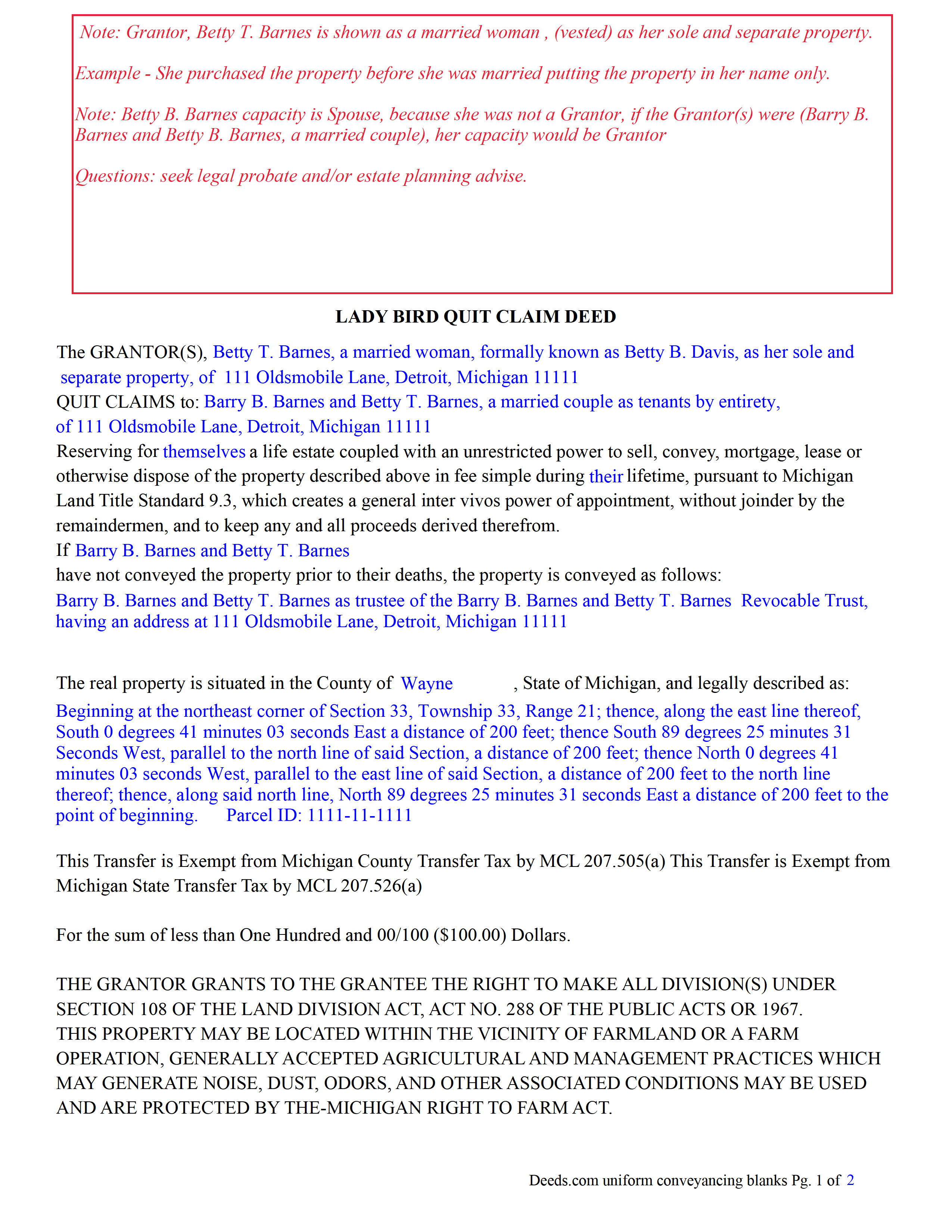

Mason County Completed Example Version 2 of the Lady Bird Quitclaim Deed Document

Example of a properly completed Michigan Lady Bird Quitclaim Deed document for reference.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Mason County documents included at no extra charge:

Where to Record Your Documents

Mason County Register of Deeds

Ludington, Michigan 49431

Hours: 9:00 to 5:00 M-F / Recording until 4:30

Phone: (231) 843-4466

Recording Tips for Mason County:

- Make copies of your documents before recording - keep originals safe

- Leave recording info boxes blank - the office fills these

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Mason County

Properties in any of these areas use Mason County forms:

- Branch

- Custer

- Fountain

- Free Soil

- Ludington

- Scottville

- Walhalla

Hours, fees, requirements, and more for Mason County

How do I get my forms?

Forms are available for immediate download after payment. The Mason County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mason County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mason County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mason County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mason County?

Recording fees in Mason County vary. Contact the recorder's office at (231) 843-4466 for current fees.

Questions answered? Let's get started!

A Michigan lady bird quitclaim deed is based on the statutes regarding power of appointment. According to Michigan Land Standards 6th Edition, Standard 9.3

Michigan Land Title Standards Act 9.3 reads: The holder of a life estate, coupled with an absolute power to dispose of the fee estate by inter vivos conveyance, can convey a fee simple estate during the lifetime of the holder. If the power is not exercised, the gift becomes effective.

In Michigan, a Lady Bird Deed Quitclaim Deed is a type of Quitclaim Deed that allows the Grantor, to transfer their property upon their death to a named beneficiary. This is a great tool for estate planning and helps to avoid probate court. These courts deal with someone's assets and belongings after they pass away. Going through this court is typically expensive and time-consuming.

As long as the Grantor lives, he/she/they are free to sell the property to someone else, give the property away as a gift, encumber the property with mortgages and liens, rent the property to tenants, and even execute a brand-new ladybird deed defeating Grantee's contingent interest in favor of someone else. Grantee(s) does/do not have any tangible rights to the property until Grantor's death when the contingency becomes vested.

Consult an estate planning attorney with questions including ladybird deeds.

(Michigan Lady Bird QCD Package includes form, guidelines, and completed example)

Important: Your property must be located in Mason County to use these forms. Documents should be recorded at the office below.

This Lady Bird Quitclaim Deed meets all recording requirements specific to Mason County.

Our Promise

The documents you receive here will meet, or exceed, the Mason County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mason County Lady Bird Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Douglas C.

July 24th, 2020

Even for a novice like me, this site was easy to use, with very clear & simple options and instructions. I wish every web site was as good!

Thank you for your feedback. We really appreciate it. Have a great day!

Shari W.

July 30th, 2020

Fast and easy. Great service. Thanks.

Thank you!

Sharon D.

December 29th, 2018

Very easy to understand forms...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol W.

March 14th, 2021

The only reason for the low review was I could not find the form that I needed.

Sorry to hear that we did not have what you needed. We hope you found it somewhere. Have a wonderful day.

Viola G.

July 7th, 2022

Some of the forms I ordered didn't have enough space for all of the information, but were useful as a guide for creating what I needed. Now I'll be trying the e-recording to see how that goes.

Thank you!

Paul S.

March 18th, 2021

Very satisfactory

Thank you!

James B.

July 31st, 2019

Your website is very easy to use. No problem downloading the forms.

Thank you!

Hugh B R.

February 24th, 2021

Very user friendly and fast. Pleasure using this site.

Thank you for your feedback. We really appreciate it. Have a great day!

James J.

October 2nd, 2021

Thank you for service. The deed process was easy to complete. My new deed was accepted by the county clerk and the tax assessors office.

Thank you for your feedback. We really appreciate it. Have a great day!

Pamela J.

January 7th, 2021

The form was short, and explainable.. so that is my feed back on that...but we have not received anything back to actually see if we filled the form out correctly. So I definitely can not say if I'm satisfied with it or not until I know that it is approved. I would recommend Coos County web site for Forms to people. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Rhonda D.

February 24th, 2021

The boxes do not allow you to add the entire information. The after recording return to box would not let me add a zipcode.

Thanks for the feedback Rhonda, we’ll take a look at that input field.

Michelle D.

March 4th, 2019

Very professional service, they were timely and proficient with answers and sending in the documents that I requested. Will work with them again in the future

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lucus S.

May 19th, 2022

I tried to do it myself by copying an old deed and ended up with a bunch of headaches (expensive ones) wish I would have used these documents first. Live and learn.

Thank you!

James W.

February 27th, 2021

We were able to find deceased parents' deed.

Thank you!

Georgana T.

May 28th, 2019

Not clear information on ownership, which is what I wanted.

Sorry to hear that we were unable to find the information you need Georgana. Your account has been credited. Have a wonderful day.