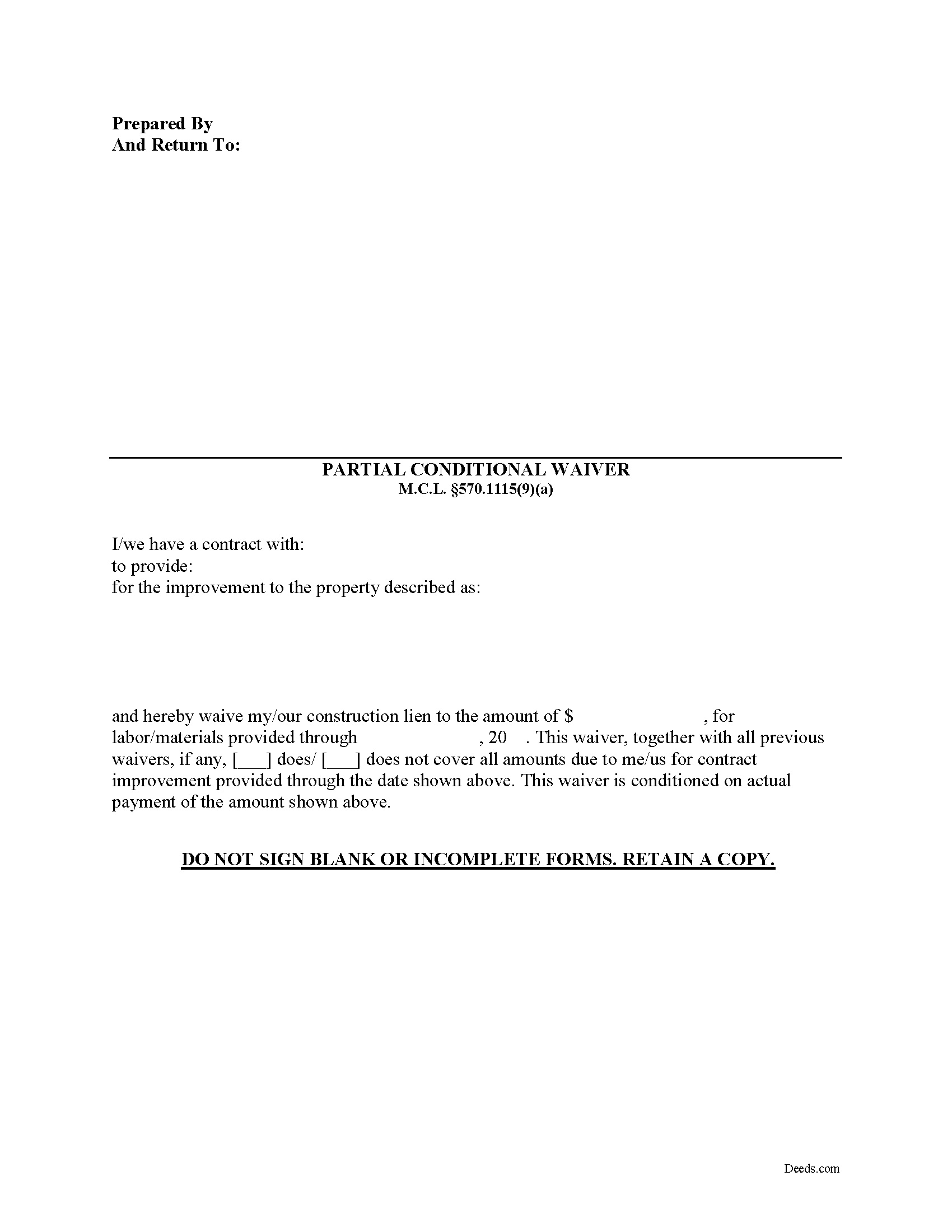

Mason County Partial Conditional Waiver of Lien Form

Mason County Partial Conditional Waiver of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

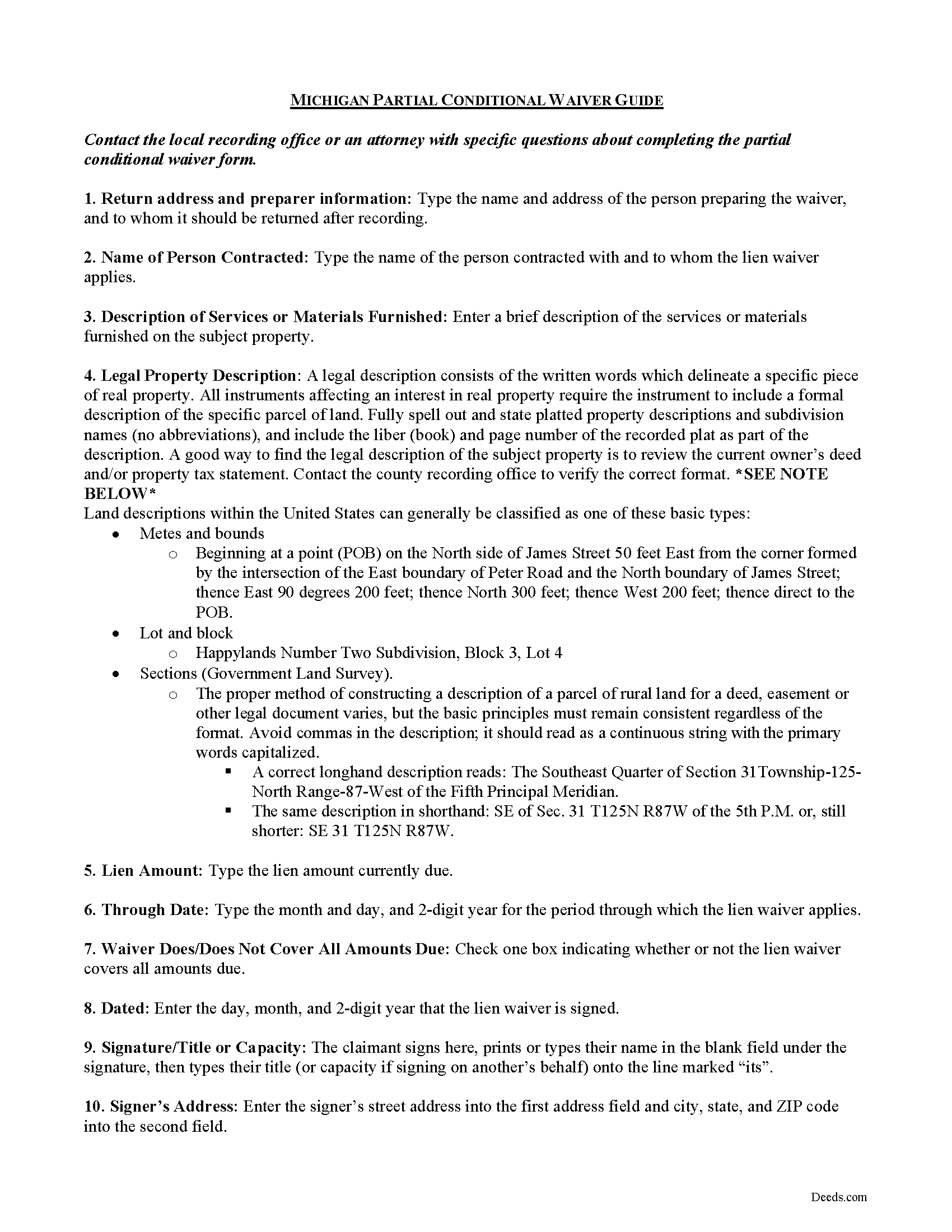

Mason County Partial Conditional Waiver of Lien Guide

Line by line guide explaining every blank on the form.

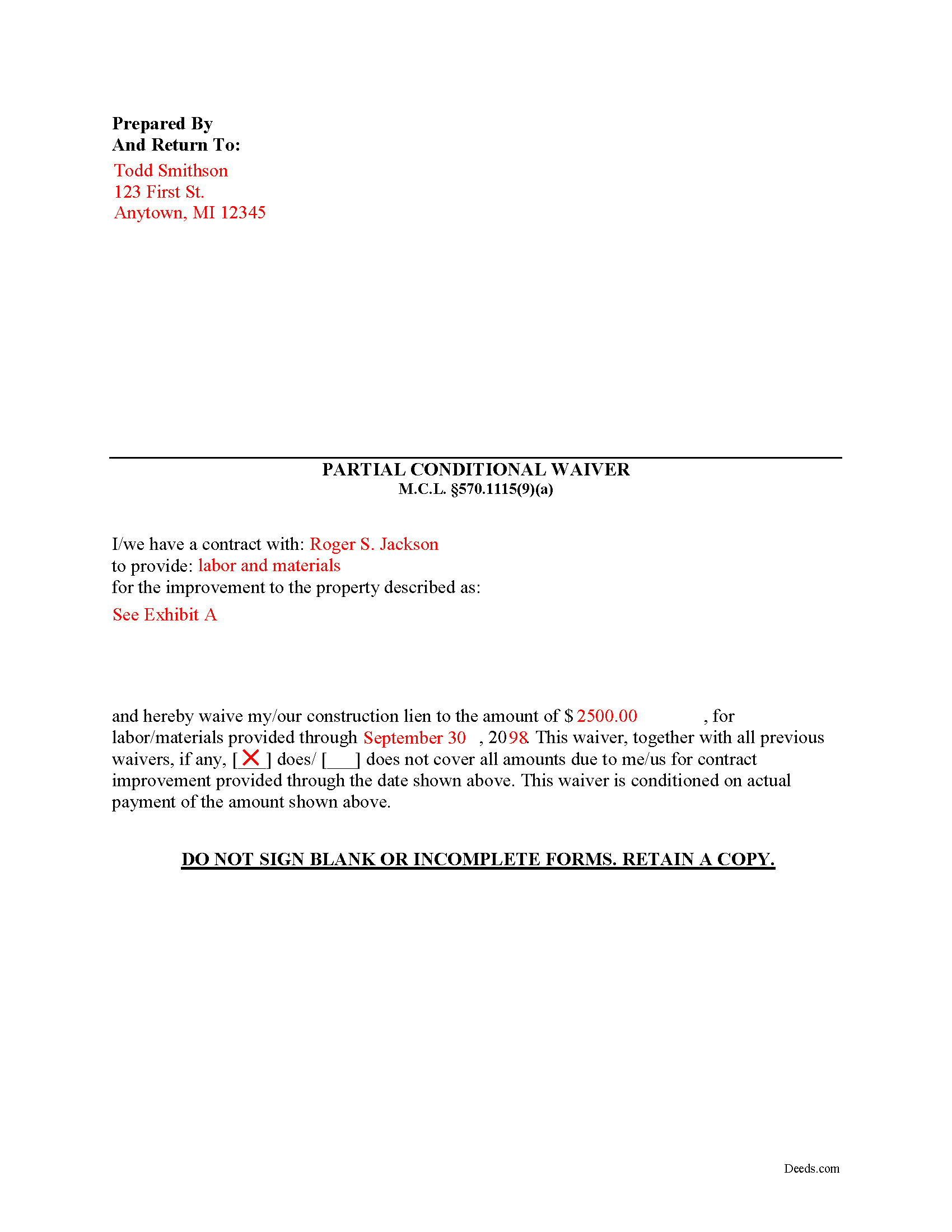

Mason County Completed Example of the Partial Conditional Waiver of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Mason County documents included at no extra charge:

Where to Record Your Documents

Mason County Register of Deeds

Ludington, Michigan 49431

Hours: 9:00 to 5:00 M-F / Recording until 4:30

Phone: (231) 843-4466

Recording Tips for Mason County:

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Mason County

Properties in any of these areas use Mason County forms:

- Branch

- Custer

- Fountain

- Free Soil

- Ludington

- Scottville

- Walhalla

Hours, fees, requirements, and more for Mason County

How do I get my forms?

Forms are available for immediate download after payment. The Mason County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mason County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mason County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mason County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mason County?

Recording fees in Mason County vary. Contact the recorder's office at (231) 843-4466 for current fees.

Questions answered? Let's get started!

During the construction process, a property owner (or his or her lessee) may ask the contractor for a lien waiver in exchange for a full or partial payment.

Michigan defines four permissible types of lien waivers. These include: (1) Partial Unconditional Waiver, (2) Partial Conditional Waiver, (3), Full Unconditional Waiver, and (4) Full Conditional Waiver. M.C.L. 570.1115(9).

Use a partial conditional waiver of lien when the claimant receives an agreed-upon payment for his or her contract from the owner, lessee, or designee. M.C.L. 570.1115(4). This partial payment may be a scheduled disbursement, be tied to a progress point in the improvement process, or another circumstance as set out in the original contract.

A waiver under this section takes effect when a person makes payment relying on the waiver, unless at the time the payment was made, the person making the payment had written notice that the payment or consideration for the waiver has failed (i.e., the check bounced at the bank). M.C.L. 570.1115(6).

Lien waiver forms must be in writing and must comply with Michigan law to be valid. Include the names of the contractor and the property owner, and identify the property and dates covered by the recorded lien.

Lien waivers can be confusing and issuing the wrong type of waiver (or issuing one too early) can lead to dire consequences for construction liens. Contact an attorney with questions about waivers or any other issues related to liens in Michigan.

Important: Your property must be located in Mason County to use these forms. Documents should be recorded at the office below.

This Partial Conditional Waiver of Lien meets all recording requirements specific to Mason County.

Our Promise

The documents you receive here will meet, or exceed, the Mason County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mason County Partial Conditional Waiver of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Linda s.

October 10th, 2020

This was such an easy process and even tho you had to pay a $15 - to me it was well worth not having to drive downtown etc or take the risk of mailing the documents (fearing that they would get lost). I'll be using this from now on...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel S.

July 6th, 2020

So far, so good. Waiting for the County Recorder to accept and record my document, but use of the Deeds.com system has been easy.

Thank you for your feedback. We really appreciate it. Have a great day!

RUSSELL E.

August 5th, 2020

The process sure was easy and fast. Not sure why a rep would question why I am requesting an exhibit page on the Deed when that's a common practice here in AZ. They recorded it the way I sent it so all good.

Thank you!

Ma Luisa R.

July 2nd, 2020

Great service and fast

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

james e.

August 23rd, 2022

Would be nice if these things downloaded with the type of document rather than a number

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffrey B.

August 1st, 2021

Love Deeds.com! I was a little confused as to how to go about Quitclaiming, but you made it very easy! Thank you SO much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James N.

December 14th, 2018

The purchasing process was very slick and my credit card was charged IMMEDIATELY. The deliver went well as the link was provided immediately. However I asked a question via the "Contact Us" link and days later I get a survey but no reply. I may have been directed to the wrong forms via my County and I wanted to confirm that...but still no answer. What would that deserve as a rating???

Also, your history on our site shows no messages sent via our contact us page.

Cheryl M.

April 12th, 2020

Easy.

Thank you!

Laurie S.

May 24th, 2023

This was amazingly easy to access.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura L.

July 22nd, 2023

The website looks good and probably like it is easy to use, but I needed a deed in lieu and couldn't fine one.

Thank you for your feedback. We really appreciate it. Have a great day!

star v.

July 19th, 2019

i have used you guys once and i am happy with the service i will be using you guys again

Thank you for your feedback. We really appreciate it. Have a great day!

Sam A.

September 18th, 2022

The form is just what I needed! Super easy access and user friendly. Exactly what I needed. Worth every dollar!!

Thank you for your feedback. We really appreciate it. Have a great day!

Masud K.

June 20th, 2020

Deeds.com did an excellent job in providing me the Real Estate documents I needed. You delivered the documents fast and they were accurate. I greatly appreciate your help. Thanks for everything

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patsy B.

February 19th, 2020

This website is very user friendly. I easily found the form I needed and was given an example for filling it out. Highly recommend this website!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norma O.

March 10th, 2020

good

Thank you!