Lapeer County Partial Unconditional Waiver of Lien Form

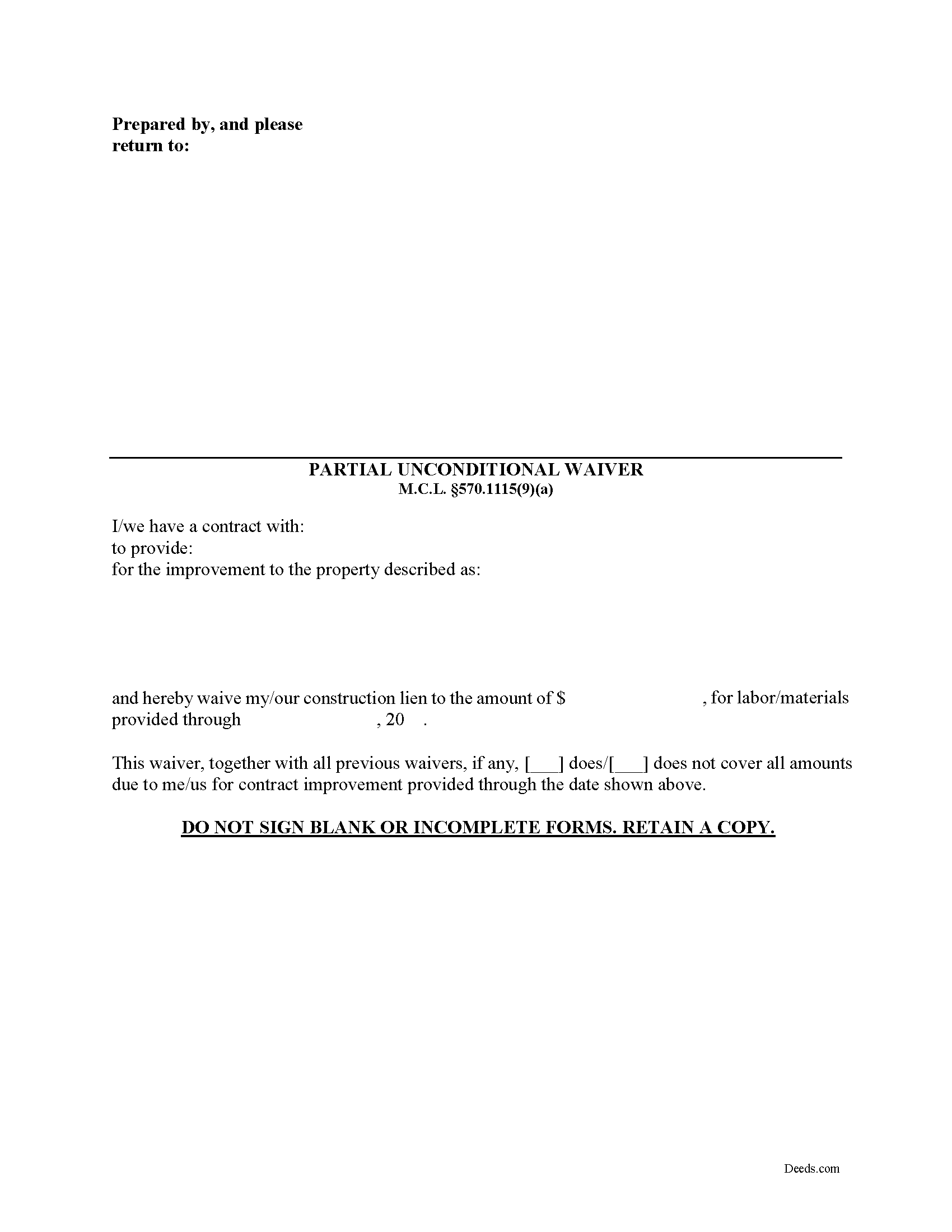

Lapeer County Partial Unconditional Waiver of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

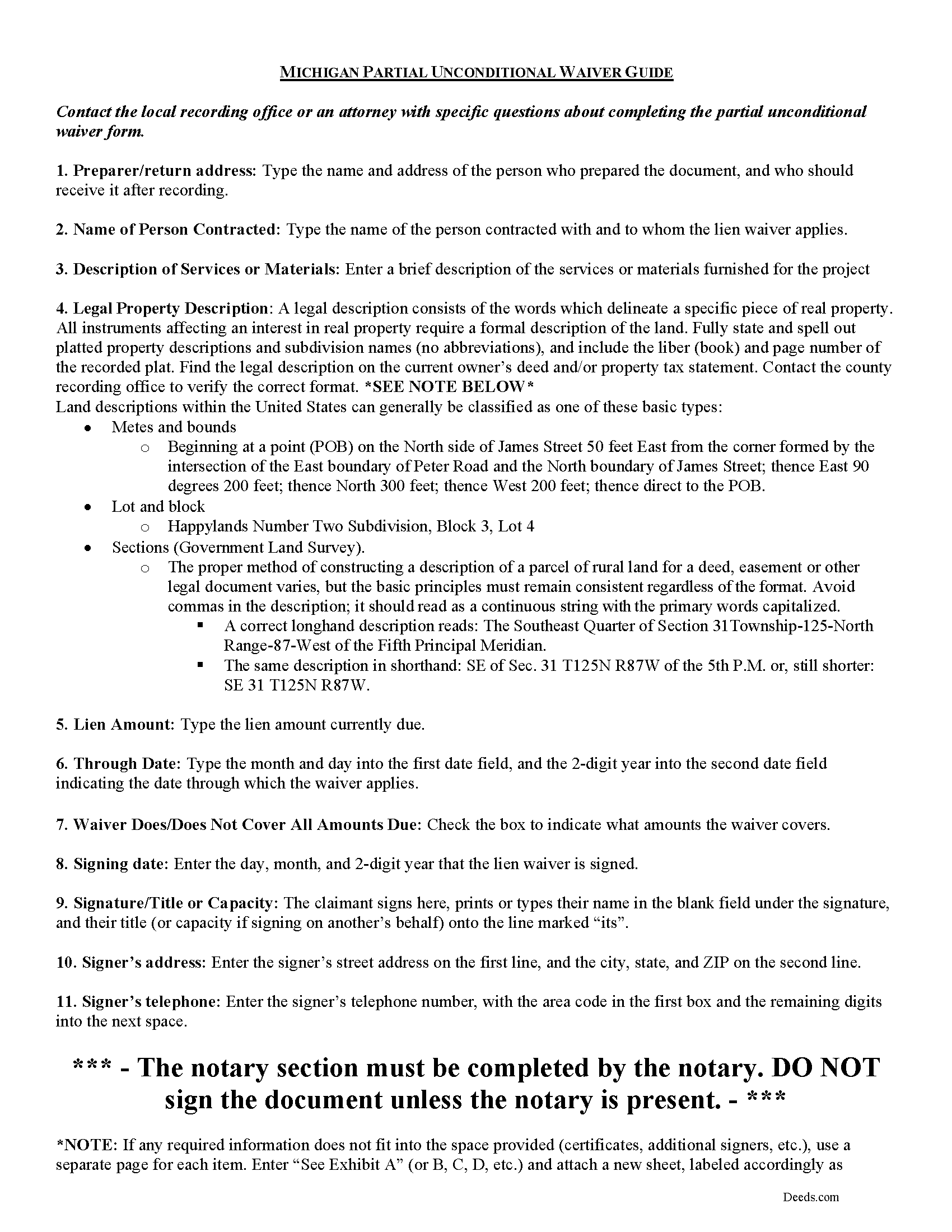

Lapeer County Partial Unconditional Waiver of Lien Guide

Line by line guide explaining every blank on the form.

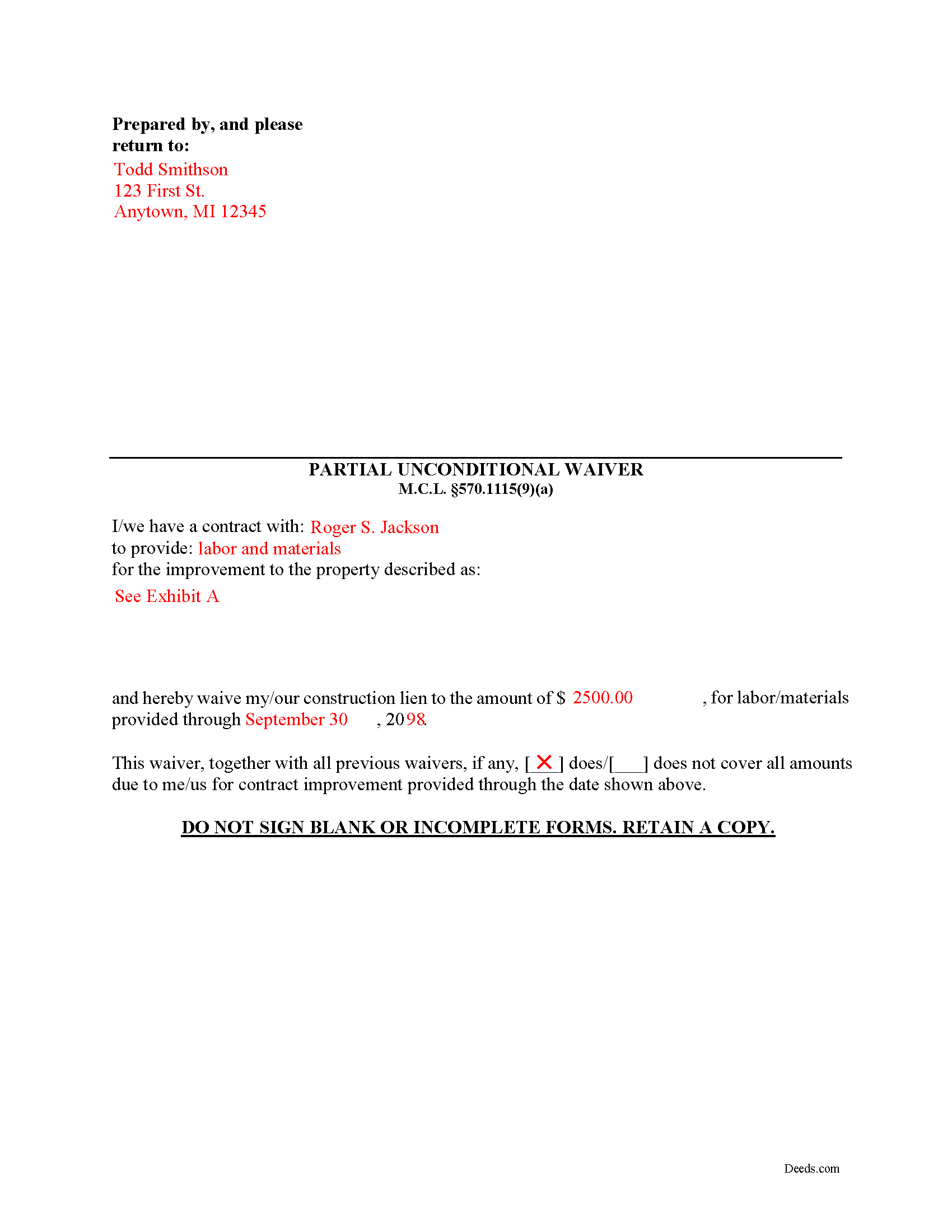

Lapeer County Completed Example of the Partial Unconditional Waiver of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Lapeer County documents included at no extra charge:

Where to Record Your Documents

Lapeer County Register of Deeds

Lapeer, Michigan 48446

Hours: 8:00 to 12:30 & 1:30 to 5:00 Mon-Fri

Phone: (810) 667-0211

Recording Tips for Lapeer County:

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Lapeer County

Properties in any of these areas use Lapeer County forms:

- Almont

- Attica

- Clifford

- Columbiaville

- Dryden

- Hadley

- Imlay City

- Lapeer

- Metamora

- North Branch

- Otter Lake

- Silverwood

Hours, fees, requirements, and more for Lapeer County

How do I get my forms?

Forms are available for immediate download after payment. The Lapeer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lapeer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lapeer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lapeer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lapeer County?

Recording fees in Lapeer County vary. Contact the recorder's office at (810) 667-0211 for current fees.

Questions answered? Let's get started!

During the construction process, a property owner (or his or her lessee) may ask the contractor for a lien waiver in exchange for a full or partial payment.

Michigan defines four permissible types of lien waivers. These include: (1) Partial Unconditional Waiver, (2) Partial Conditional Waiver, (3), Full Unconditional Waiver, and (4) Full Conditional Waiver. M.C.L. 570.1115(9).

Use a partial unconditional waiver of lien when the claimant receives an agreed-upon payment for his or her contract from the owner, lessee, or designee. M.C.L. 570.1115(3). This partial payment may be a scheduled disbursement, be tied to a progress point in the improvement process, or another circumstance as set out in the original contract.

A waiver under this section takes effect when a person makes payment relying on the waiver, unless at the time the payment was made, the person making the payment had written notice that the payment or consideration for the waiver has failed (i.e., the check bounced at the bank). M.C.L. 570.1115(6).

Lien waiver forms must be in writing and must comply with Michigan law to be valid. Include the names of the contractor and the property owner, and identify the property and dates covered by the recorded lien.

Lien waivers can be confusing, and issuing the wrong type of waiver (or issuing one too early) can lead to dire consequences for construction liens. Contact an attorney with questions about waivers or any other issues related to liens in Michigan.

Important: Your property must be located in Lapeer County to use these forms. Documents should be recorded at the office below.

This Partial Unconditional Waiver of Lien meets all recording requirements specific to Lapeer County.

Our Promise

The documents you receive here will meet, or exceed, the Lapeer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lapeer County Partial Unconditional Waiver of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Cheryl B.

November 20th, 2021

Seems easy enough, may have downloaded forms I don't need, however I'm hoping that these are the only I'll need. Did a lot of research and Deeds.com looks to be the best for anything you need. I am very happy at finally being able to find the forms I was looking for so easily. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barry B.

November 19th, 2020

I was very impressed on how simple the process was to record the documents I needed recorded. Thank you for all of your help.

Thank you!

David K.

March 16th, 2023

Price seemed high (~$28) for just some forms (especially because we may not actually use the forms), but it beats navigating the Hawaii state and Honolulu county websites for forms. It would be better if a single button push would download all 7 or 8 forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Carol T.

February 26th, 2020

Very east process. Good job!

Thank you for your feedback. We really appreciate it. Have a great day!

Gary A.

March 15th, 2019

I believe this is the way to go without the need of a lawyer. Fast downloads, very informative, Now the work starts

Thank you Gary.

Karen C.

October 23rd, 2019

Legal documents that served the purpose nothing too exciting.

Thank you Karen. Have a great day!

Carol M.

March 14th, 2019

worked very well

Thank you for your feedback. We really appreciate it. Have a great day!

Kathryn S.

September 16th, 2024

So quick. So easy. Worth every penny!

Thank you for your feedback. We really appreciate it. Have a great day!

Gary J.

September 15th, 2020

Whomever "KCH" is, that person was of great help. It took me several tries due my inexperience with ADOBE SCAN, but that certainly is no fault of yours!! KVH was very patient with me, and in fact resolved the things I was doing wrong for me, without my even requesting the assistance.

Thank you!

Adan S.

February 9th, 2020

Five star

Thank you!

chungming a.

March 30th, 2019

easy to use website.

Thank you!

Michaela D.

February 27th, 2019

I purchased this form to add my boyfriend to the deed of our home. He owns his own business so he cannot be on our mortgage. The guide doesn't clearly explain adding a person rather than focusing on transferring during a purchase or selling of a home. For future, I'd recommend make a few different examples for those who are trying to use this for the other options a Quit Claim Deed is needed for.

Thank you for your feedback. We really appreciate it. Have a great day!

eduardo r.

June 29th, 2022

Very easy to fill out forms thank you very much

Thank you!

Thomas N.

May 9th, 2019

TODD Form would not print surveyor degrees character (superscript "o") in Exhibit A. It also would not print the "Return Address" or "Prepared By" entries with my middle name as your example showed.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert A.

August 5th, 2020

A well constructed site, easy to navigate and a pleasure to use. I'd give it a 10 on 10

Thank you for your feedback. We really appreciate it. Have a great day!