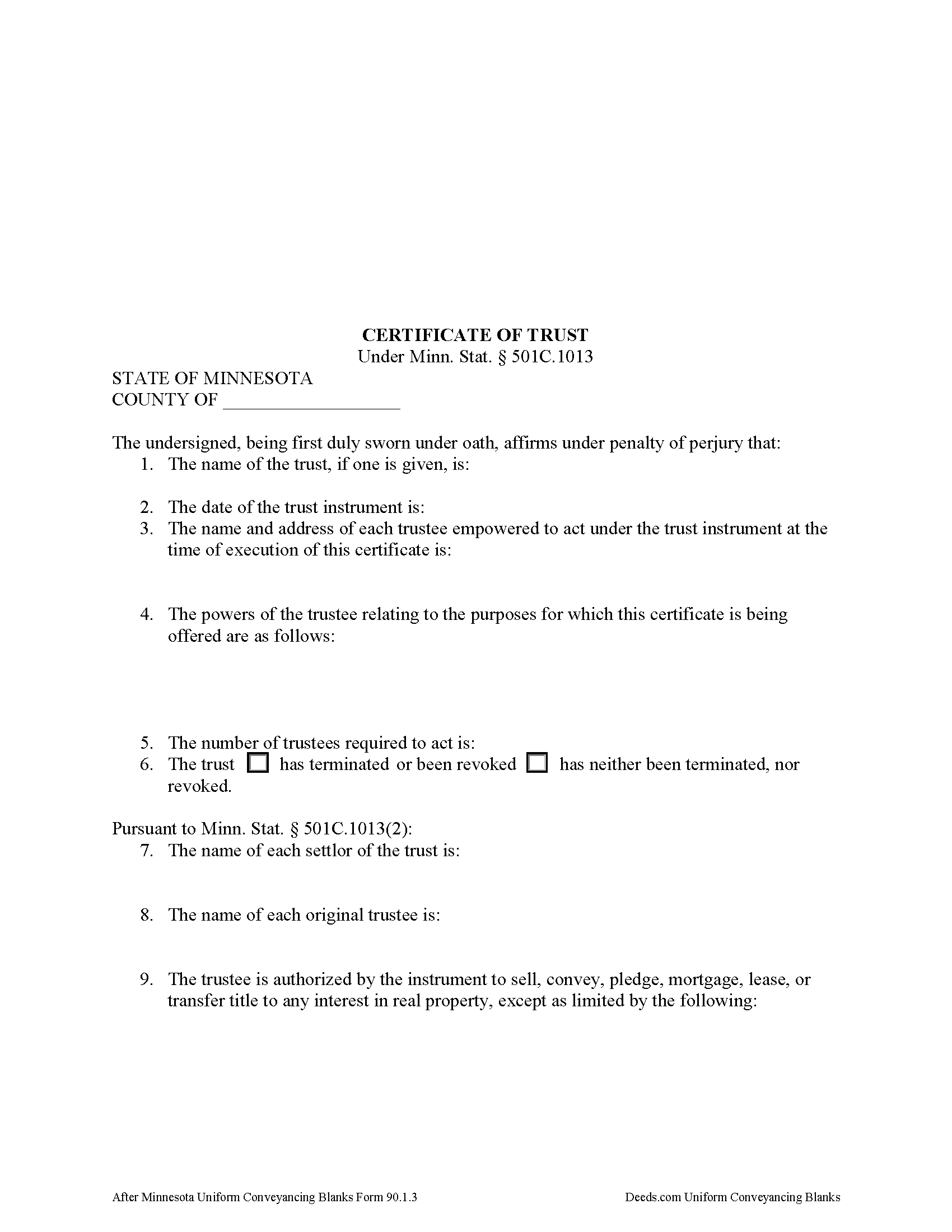

Rock County Certificate of Trust Form

Rock County Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

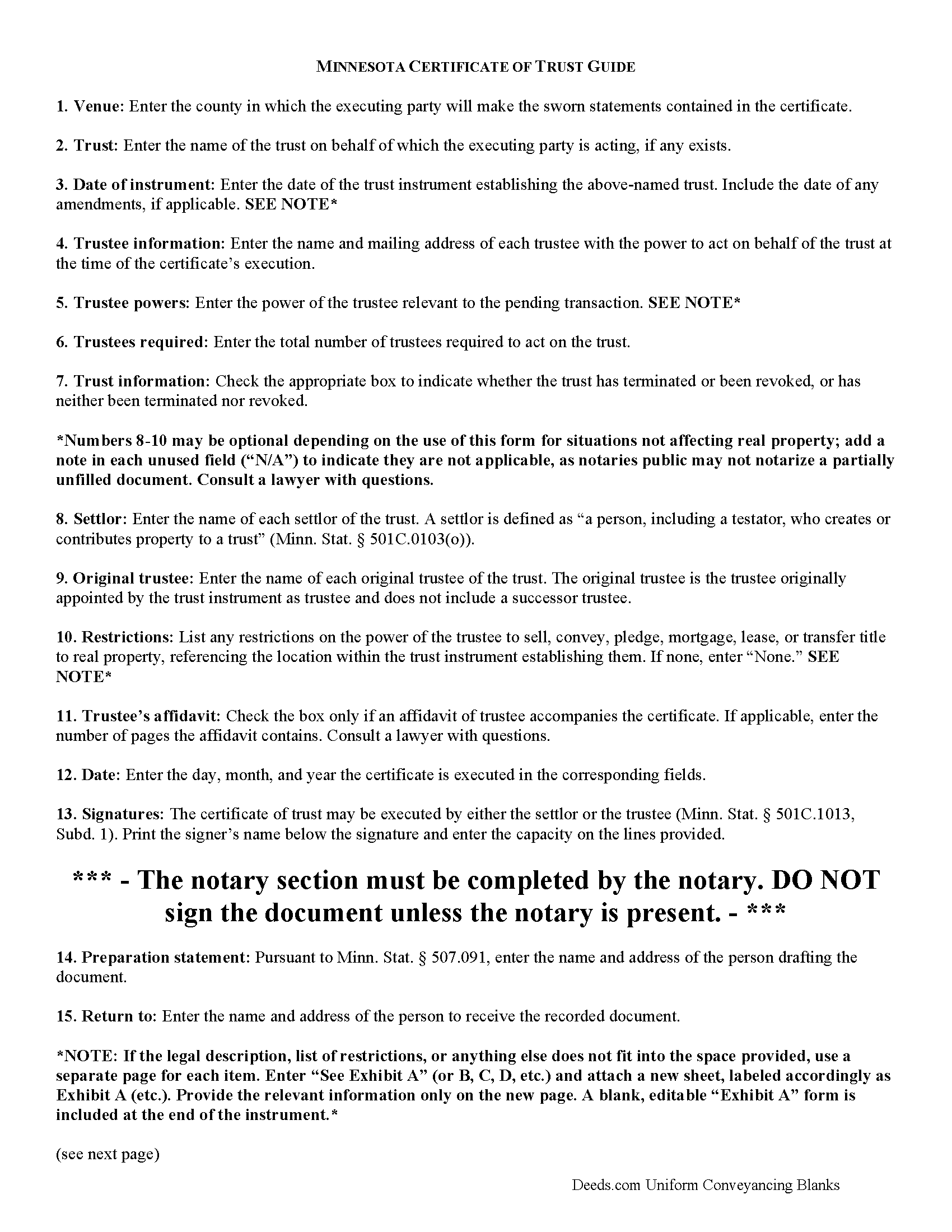

Rock County Certificate of Trust Guide

Line by line guide explaining every blank on the form.

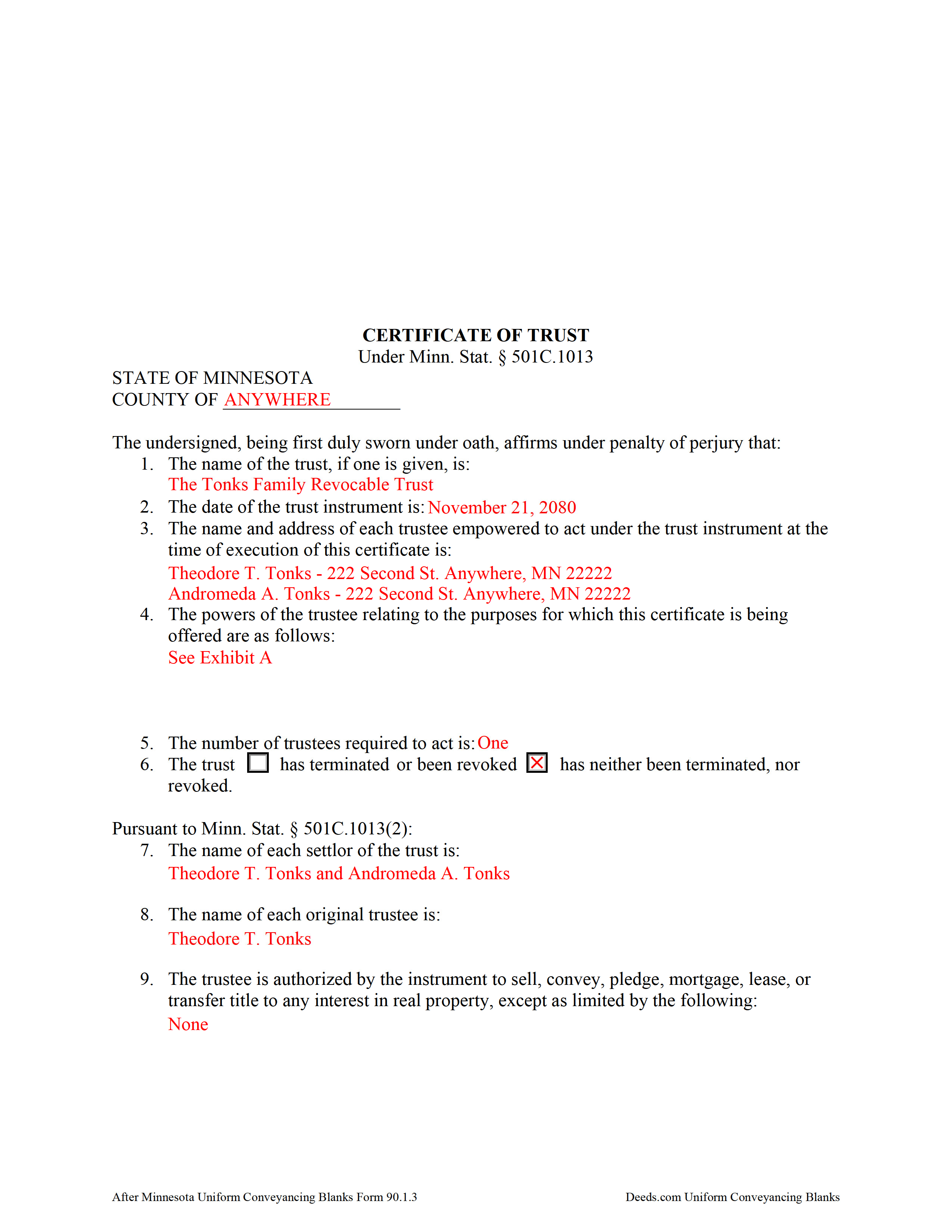

Rock County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Rock County documents included at no extra charge:

Where to Record Your Documents

Land Records Office

Luverne , Minnesota 56156

Hours: 8:00am to 5:00pm M-F

Phone: (507) 283-5022

Recording Tips for Rock County:

- Bring your driver's license or state-issued photo ID

- Make copies of your documents before recording - keep originals safe

- Check margin requirements - usually 1-2 inches at top

- Avoid the last business day of the month when possible

- Have the property address and parcel number ready

Cities and Jurisdictions in Rock County

Properties in any of these areas use Rock County forms:

- Beaver Creek

- Hardwick

- Hills

- Jasper

- Kenneth

- Luverne

- Magnolia

- Steen

Hours, fees, requirements, and more for Rock County

How do I get my forms?

Forms are available for immediate download after payment. The Rock County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rock County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rock County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rock County?

Recording fees in Rock County vary. Contact the recorder's office at (507) 283-5022 for current fees.

Questions answered? Let's get started!

The certificate of trust is codified under the Minnesota Trust Code at Minn. Stat. 501C.1013.

This document is an abstract of the trust instrument setting forth "fewer than all of the provisions . . . and any amendments to the instrument," and contains only essential information relevant to the transaction for which it is being presented (Minn. Stat. 501C.1013, Subd. 1). It "serves to document the existence of the trust, the identity of the trustees, the powers of the trustees and any limitations on those powers, and other matters the certificate of trust sets out, as though the full trust instrument had been recorded or presented" (Subd. 4).

Presented to a recipient in situations regarding personal property, or filed with the county recorder in situations regarding real property, a certificate of trust is "prima facie proof as to matters contained in it" (Subd. 4).

A certificate is valid when executed by settlor or trustee "any time after the execution or creation of a trust" (Subd. 1). The basic content requirements include the name of the trust; the date of the trust instrument; the name and address of each acting trustee; the number of trustees required to act; and the powers of the trustee relevant to the transaction at hand. The certificate also declares whether the trust has terminated or the trust instrument has been revoked (Subd. 1 (1-6)).

For use in real property transactions, the certificate requires the name of each settlor and original trustee, along with a specific statement relating to the authority of the trustee and any restrictions on the trustee's power "to sell, convey, pledge, mortgage, lease, or transfer title to any interest in real property" (Subd. 2). Transactions affecting real property may also require an affidavit of trustee under Minn. Stat. 501C.1014.

The representations contained within the certificate are made by the executing trustee or settlor under oath before a public notary and as such the executing party ensure there are no provisions in the trust instrument or subsequent amendments to limit the power of the trustee in the transaction or "to exercise any other power identified in the certificate" (Subd. 1).

Contact an attorney with any questions regarding trusts or certificates of trust, as each situation is unique.

(Minnesota COT Package includes form, guidelines, and completed example)

Important: Your property must be located in Rock County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Rock County.

Our Promise

The documents you receive here will meet, or exceed, the Rock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rock County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Carolyn G.

January 15th, 2023

This information was extremely helpful and needed. The price is so worth it also.

Thank you!

Jessica S.

December 21st, 2018

Paid the money, but never received any information; not even an email saying they couldn't find anything.

Thank you for your feedback. Reviewing your account, looks like the property detail report you ordered was completed on December 14, 2018 at 10:56am. The report has been available for you to download in your account ever since.

Gary H.

October 18th, 2023

The package was very helpful and very easy to use. I saved me a lot of time and eliminated attorneys being involved. I would highly recommend your forms.

It was a pleasure serving you. Thank you for the positive feedback!

Beatrice V.

August 27th, 2020

I was in despair as I needed to file two (2) very important documents with the County. Due to Covid the office was closed and my only recourse was to E-Fie with a service provider. I was fortunate enough to hear about Deeds.com. They were specific, courteous, patient and most of all productive. My documents will take awhile for the final filing but that is because the County happens to have a slow turn around time. Otherwise, I am now relieved that this part is over. Thank you Deeds.com. You are awesome.

Thank you for the kinds words Beatrice.

John V.

June 17th, 2020

getting the proper forms was easy--filling them out, not so much

Thank you!

Todd J.

February 4th, 2021

Super Easy!

Thank you!

Nanette G.

March 4th, 2020

The Website was easy to use. I live in Houston Texas and mother recently passed away in California and I need affidavit of joint tenant forms. I was provided all the forms necessary to complete the documents. I had been a legal secretary in California about 20 years ago and just need the current forms and received them all very quickly.

Thank you!

Pamela J.

October 10th, 2021

Thank you the service was prompt and efficient.

Thank you!

Julie A.

December 17th, 2018

After receiving the forms online and reviewing them, it was very easy to fill this out and the additional information was very helpful. Saved a lot of money by not having to use a lawyer/paralegal to do this simple task. Will definitely use Deeds.com in the future for any further needs. Thank you

Thank you Julie. We appreciate you taking the time to leave your review. Have a wonderful day.

Susan H.

November 10th, 2024

I used the quitclaim deed form, it was easy to fill out, had notarized and was accepted by the county's recorders office. Having a example form made it so much easier to fill out.

Thank you for your positive words! We’re thrilled to hear about your experience.

Brian W.

February 20th, 2025

Quick, Simple and a Ton of Time Saved...

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Herbert R.

November 12th, 2022

Your website was very helpful. Hopefully, I will have it completed correctly prior to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen D.

January 15th, 2019

Very good hope to use in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald C.

January 31st, 2019

My goal was to find the Covenant, Conditions, and Restrictions for my HOA. From what I can read, these documents should be attached to our Deed (single family, patio home in New Hanover County). I am not sure if I have a copy of my Deed. I would need to check my Safe Deposit Box. Unfortunately, I was not successful at finding these documents from your Website. If you can help me find them, I would appreciate that.

It is most common to obtain a copy of CC&Rs directly from the HOA. Alternatively, they are also usually a matter of public record recorded with the local recorder and you can obtain a copy there.

juanita S.

May 6th, 2019

Easy to fill with explanations to accompany

Thank you Juanita, we really appreciate your feedback.