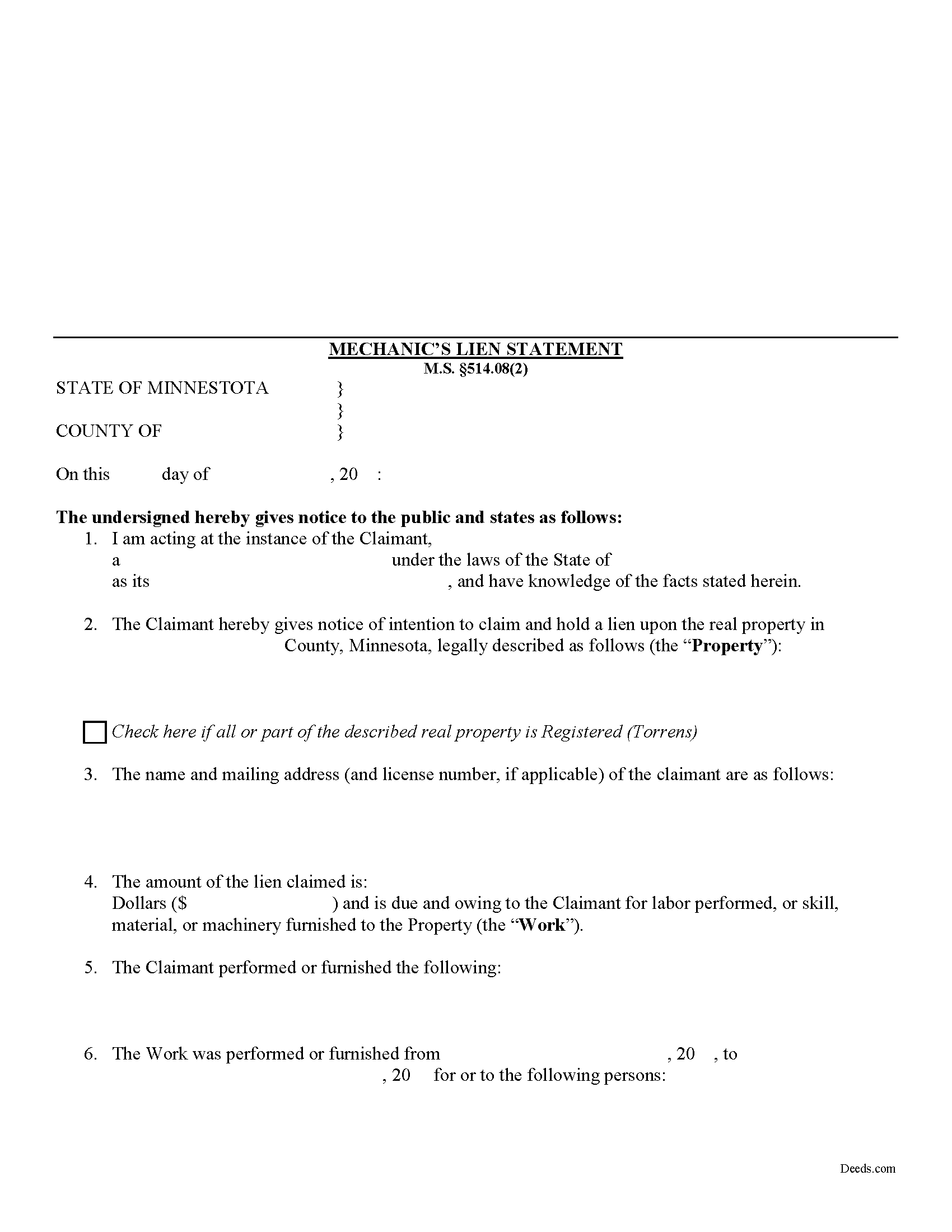

Fillmore County Mechanics Statement of Lien Form

Fillmore County Mechanics Statement of Lien Form

Fill in the blank Mechanics Statement of Lien form formatted to comply with all Minnesota recording and content requirements.

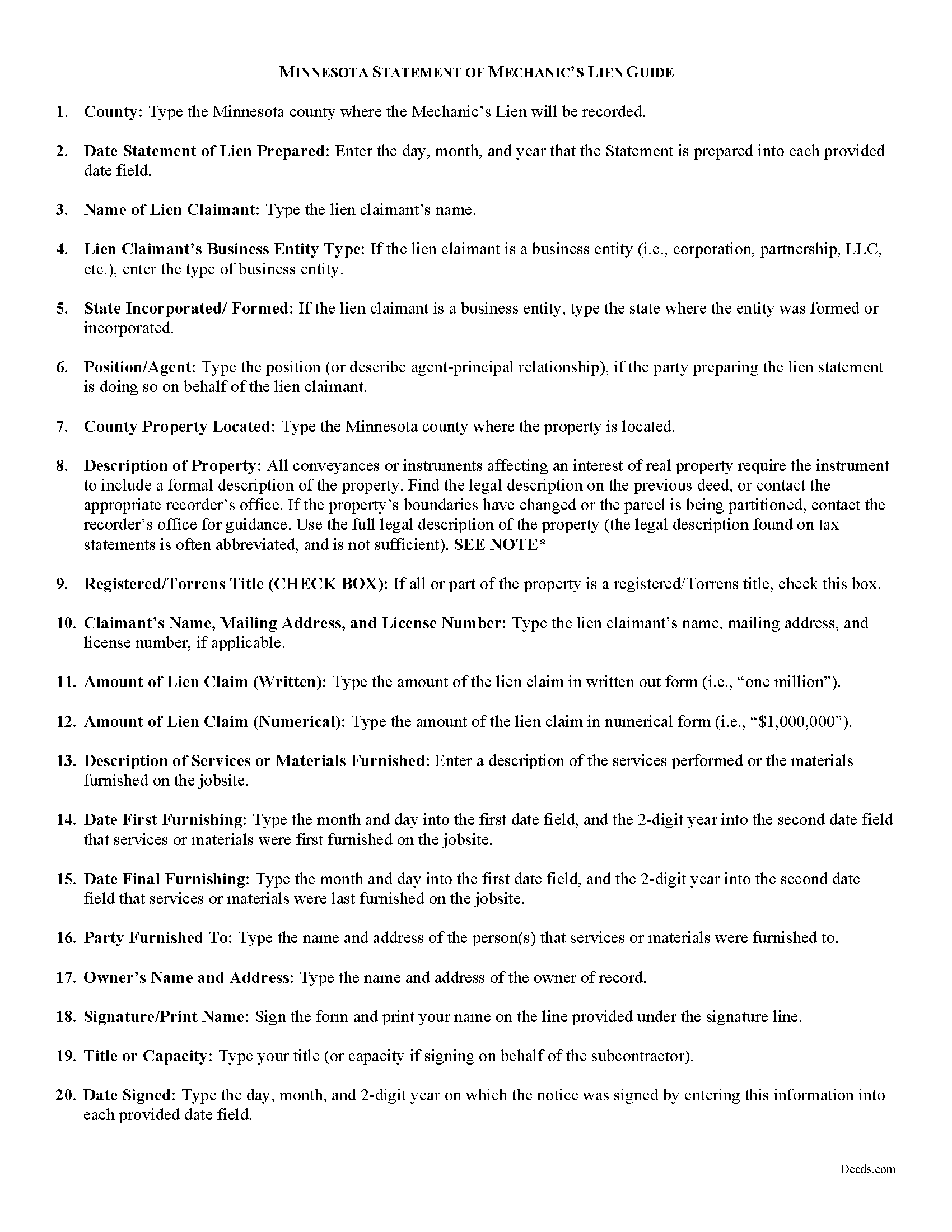

Fillmore County Mechanic Statement of Lien Guide

Line by line guide explaining every blank on the form.

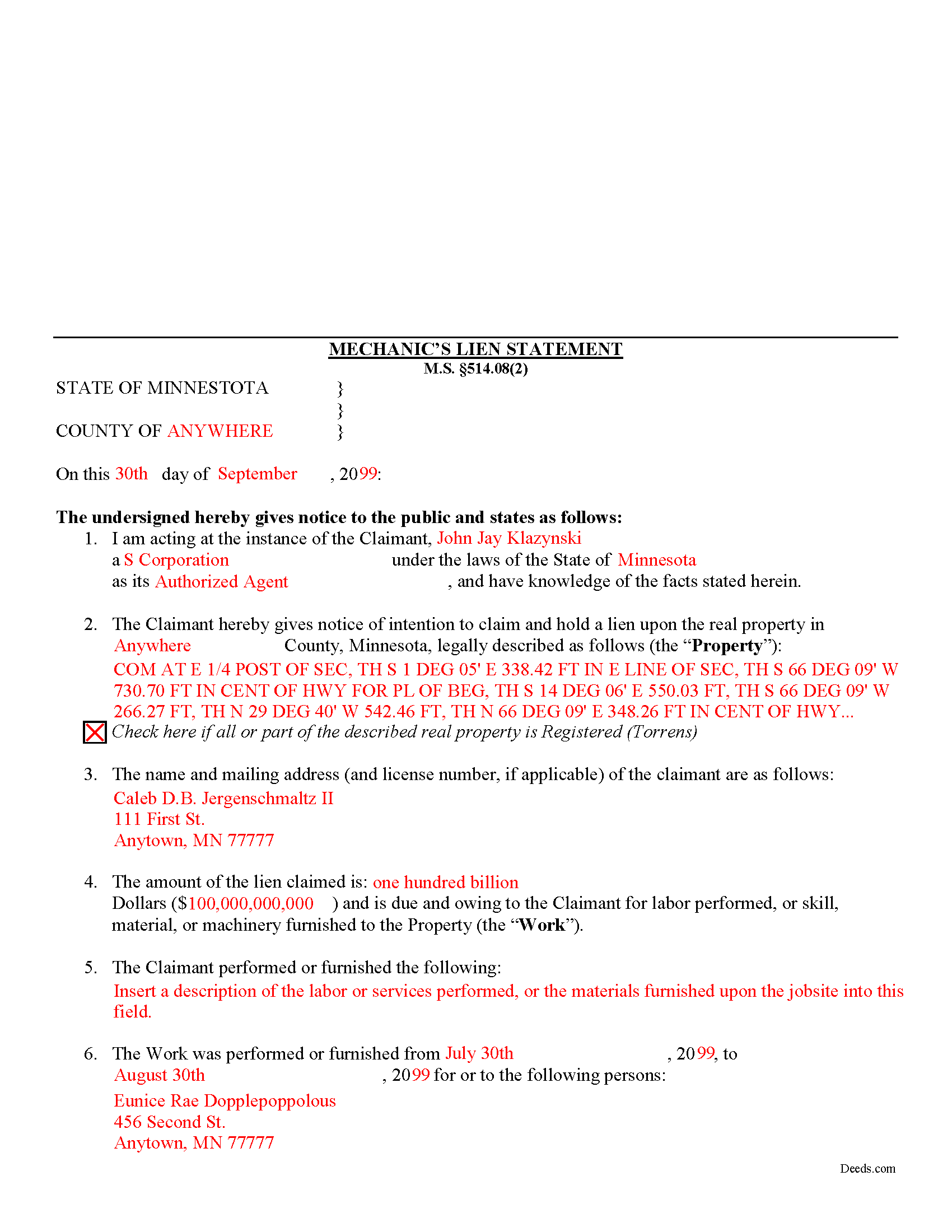

Fillmore County Completed Example of the Mechanic Statement of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Fillmore County documents included at no extra charge:

Where to Record Your Documents

Fillmore County Recorder

Preston, Minnesota 55965

Hours: 8:00am to 4:30pm M-F

Phone: (507) 765-3852

Recording Tips for Fillmore County:

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Fillmore County

Properties in any of these areas use Fillmore County forms:

- Canton

- Chatfield

- Fountain

- Harmony

- Lanesboro

- Mabel

- Ostrander

- Peterson

- Preston

- Rushford

- Spring Valley

- Wykoff

Hours, fees, requirements, and more for Fillmore County

How do I get my forms?

Forms are available for immediate download after payment. The Fillmore County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fillmore County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fillmore County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fillmore County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fillmore County?

Recording fees in Fillmore County vary. Contact the recorder's office at (507) 765-3852 for current fees.

Questions answered? Let's get started!

Recording a Statement of Lien in Minnesota

Claims for mechanic's liens are used to recover unpaid balances for services rendered or materials delivered by placing an encumbrance (block) on the owner's title until the owner pays up and the claimant grants the owner a release. To obtain a mechanic's lien in Minnesota, claimants draft and record a form called a "Statement of Lien," but only after giving the required preliminary (pre-lien) notice to the property owner and other interested parties within 45 days of first starting the work or delivering any materials. M.S. 514.011.

The lien statement must be made by or at the instance of the lien claimant and be verified by the oath of some person shown by the verification to have knowledge of the facts stated. M.S. 514.08(2). The lien statement contains the following information: (1) a notice of intention to claim and hold a lien, and the amount thereof; (2) that such amount is due and owing to the claimant for labor performed, or for skill, material, or machinery furnished, and for what improvement the same was done or supplied; (3) the names of the claimant, and of the person for or to whom performed or furnished; (4) the dates when the first and last items of the claimant's contribution to the improvement were made; (5) a description of the premises to be charged, identifying the same with reasonable certainty; (6) the name of the owner at the time of making such statement, according to the best information available; (7) the post office address of the claimant (the failure to insert such post office address will not invalidate the lien statement); (8) that claimant acknowledges that a copy of the statement must be served personally or by certified mail within the 120-day period provided in this section on the owner, the owner's authorized agent or the person who entered the contract with the contractor as provided herein; and (9) that notice as required by M.S. 514.011(2), if any, was given. Id.

When the claimant files the notice, the Social Security number of an individual owner or the Internal Revenue Service taxpayer identification number for an owner other than an individual is not required. Id.

The statement of the claim must be filed with the county recorder or, if registered (Torrens title) land, with the registrar of titles of the county in which the improved premises are situated within 120 days of the last furnishing. M.S. 514.08(1). If the claim is made under M.S. 514.04 (for railway, telegraph or similar projects), the statement must be filed with the secretary of state. Id. After recording, a copy of the statement must be served personally or by certified mail on the owner or the owner's authorized agent (or the person who entered the contract with the contractor) within the same 120-day period. Id.

Once you the lien is in place, the claimant gains a valuable bargaining chip to help persuade the owner to arrange payment for the services of materials provided. Be aware that liens don't last forever. Because liens affect the owner's title, the legislature gives them an expiration period for enforcement actions. No lien shall be enforced in any case unless the holder files a complaint or answer with the court administrator, within one year after the date of the last item of the claim as set forth in the recorded lien statement. M.S. 514.12(3).

This article is provided for informational purposes only and is not intended to be relied upon a substitute for the advice of an attorney. Please contact a Minnesota-licensed attorney with any questions about recording a lien statement or other related issues.

Important: Your property must be located in Fillmore County to use these forms. Documents should be recorded at the office below.

This Mechanics Statement of Lien meets all recording requirements specific to Fillmore County.

Our Promise

The documents you receive here will meet, or exceed, the Fillmore County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fillmore County Mechanics Statement of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Judy W.

January 9th, 2021

Very easy to fill out the form especially with the detailed guide and the sample. I will use deeds.com again if needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

star v.

July 19th, 2019

i have used you guys once and i am happy with the service i will be using you guys again

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer H.

October 12th, 2020

Deeds.com is amazing. It made finding out how to file legal documents worry free and easily understood. Thank You

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly H.

June 24th, 2021

Excellent and Helpful as well as patient. Great Service.

Thank you!

JOHN L.

November 17th, 2020

Not just good, very good. Very intuitive and very responsive. It just works!

Thank you for your feedback. We really appreciate it. Have a great day!

David R A.

April 18th, 2023

Way overpriced But serves the Purpose.

Thank you for your feedback. We really appreciate it. Have a great day!

Jan M.

June 5th, 2019

Fantastic company. They are the absolute best and helped me get the information I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Caroline K.

August 16th, 2019

SIMPLE, THAT IS GOOD

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah C.

April 30th, 2022

I just printed out my documents and they are so helpful. Now I will sit and fill out my documents and submit them to the PG County deed Office. Thanks for having this infomation online. Regards,

Thank you!

Claudia S.

May 23rd, 2024

Website is very easy to navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marck G.

March 23rd, 2022

This is an excellent service..thank you

Thank you!

Patricia S.

August 3rd, 2022

The forms was easy to use and the guides was helpful

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James R.

July 4th, 2019

Easy to understand instructions. Love the examples. Info on the deeds purpose easily comprehendible. Able to Kiosk record without difficulty. Am I pleased? Oh Yeah!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!