Fillmore County Quitclaim Deed Divorce Form

Fillmore County Quitclaim Deed Divorce Form

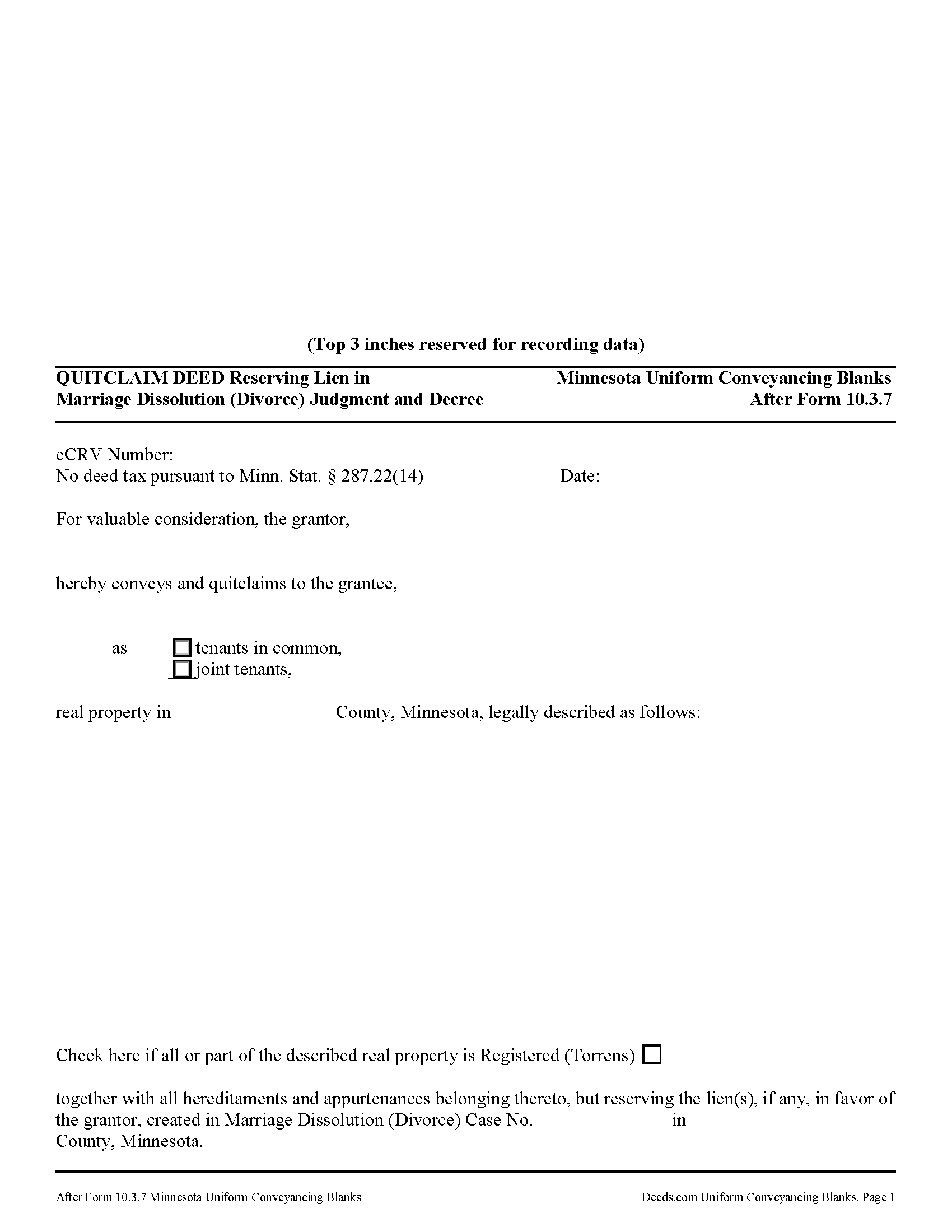

Fill in the blank Quitclaim Deed Divorce form formatted to comply with all Minnesota recording and content requirements.

Fillmore County Quitclaim Deed Divorce Guide

Line by line guide explaining every blank on the Quitclaim Deed Divorce form.

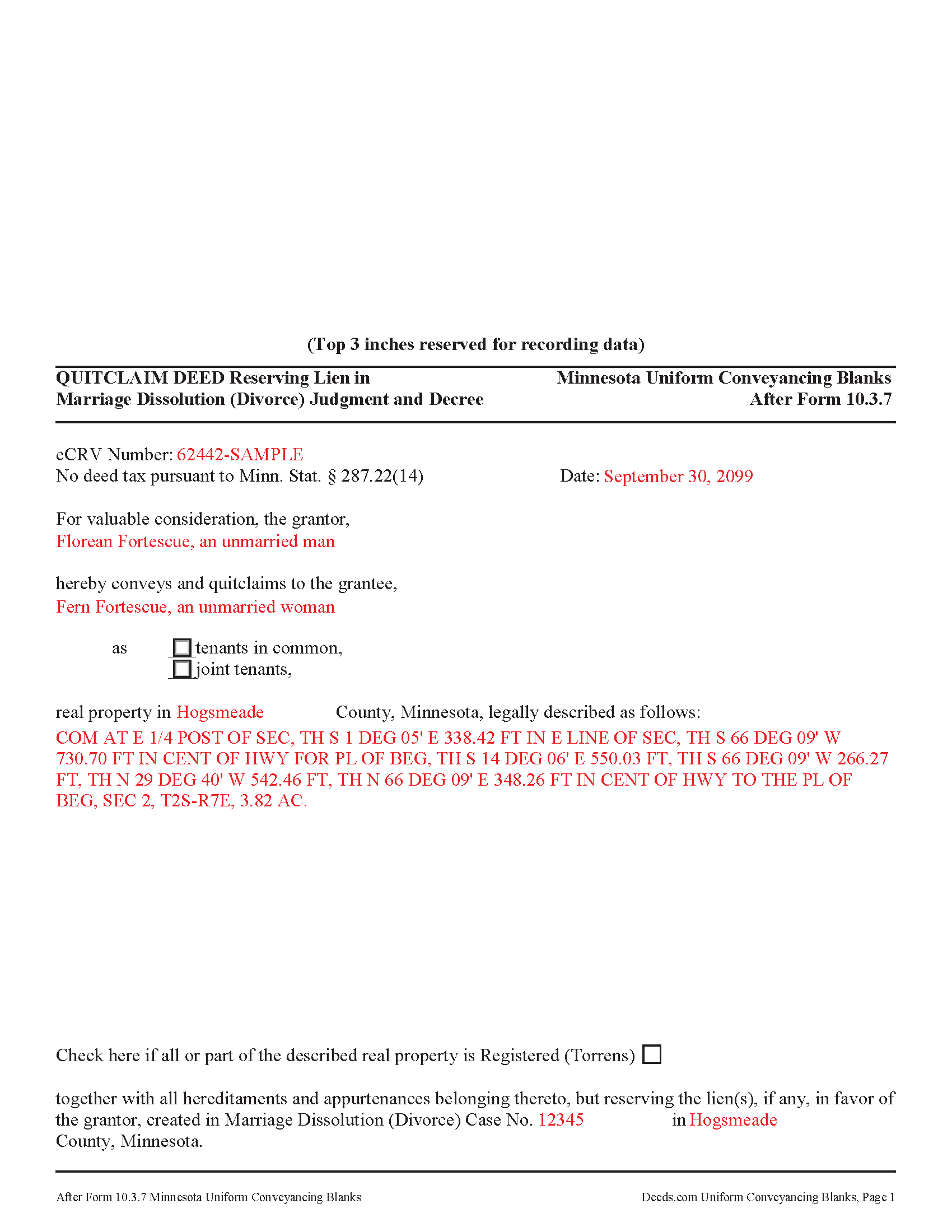

Fillmore County Completed Example of the Quitclaim Deed Divorce Document

Example of a properly completed Minnesota Quitclaim Deed Divorce document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Fillmore County documents included at no extra charge:

Where to Record Your Documents

Fillmore County Recorder

Preston, Minnesota 55965

Hours: 8:00am to 4:30pm M-F

Phone: (507) 765-3852

Recording Tips for Fillmore County:

- Avoid the last business day of the month when possible

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Fillmore County

Properties in any of these areas use Fillmore County forms:

- Canton

- Chatfield

- Fountain

- Harmony

- Lanesboro

- Mabel

- Ostrander

- Peterson

- Preston

- Rushford

- Spring Valley

- Wykoff

Hours, fees, requirements, and more for Fillmore County

How do I get my forms?

Forms are available for immediate download after payment. The Fillmore County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fillmore County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fillmore County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fillmore County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fillmore County?

Recording fees in Fillmore County vary. Contact the recorder's office at (507) 765-3852 for current fees.

Questions answered? Let's get started!

Minnesota Quitclaim Deed Reserving a Lien in Marriage Dissolution

Use this form to transfer title to real property as needed following a decree of dissolution in divorce proceedings.

This form transfers title to the appropriate party and reserves a martial lien, which attaches to the title. Marital liens are used to divide spousal property by preserving a spouse's portion of the homestead's equity or to secure obligations of a spouse.

Use of a quitclaim deed to transfer title pursuant to a judgment and decree of dissolution may follow use of the summary real estate disposition, a statutory form under Minn. Stat. 518.191.

Record the completed deed in the office of the county recorder (or registrar of titles, if registered land) where the subject property is located.

Consult a lawyer with questions.

(Minnesota QCD Divorce Package includes form, guidelines, and completed example)

Important: Your property must be located in Fillmore County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed Divorce meets all recording requirements specific to Fillmore County.

Our Promise

The documents you receive here will meet, or exceed, the Fillmore County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fillmore County Quitclaim Deed Divorce form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

David S.

April 6th, 2024

This site was recommended by my County's Clerks office website. Let me tell you when I received my specific State and County's Quit Claim Deed forms from Deeds.com, every conceivable form that could be needed in addition to the full instructions, and a sample filled out form, I was impressed (five stars) and made things so easy for me to feel confident in my legal activity on a land transaction.

Thank you for your positive words! We’re thrilled to hear about your experience.

Anthony L.

February 15th, 2020

I recently needed an affidavit of death. The form and help tools made it easy to fill out and file. the Recorder accepted this form . Which made the experience painless and easy . All things considered..

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pauletta C.

February 12th, 2022

worked like a charm

Thank you!

Raymond P.

August 7th, 2019

User Friendly- so easy to fill in online!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly R.

March 18th, 2024

Love this site. Very informative and helpful!

Thank you for your feedback. We really appreciate it. Have a great day!

Fernando V.

February 28th, 2023

Excellent!

Thank you!

Willie S.

January 5th, 2021

So easy and fast. Since covid-19 is here, this option is perfect.

Thank you!

JESSICA B.

June 25th, 2020

easy to move through the site and create an account.

Thank you!

Lori A.

February 14th, 2023

It was quick and easy. A little expensive but convient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robby T.

February 16th, 2022

Most people coming to this sight will not have the knowledge for deeds. Therefore, I wish there were more instructions on when the Grantor signs and when the Grantee signs and the process steps to making the transaction final. I would give it 4 out of 5 starts

Thank you for your feedback. We really appreciate it. Have a great day!

James H.

December 7th, 2020

Clear and easy instructions. Prompt processing and confirmation. I am still in the middle of submitting my document for recording, but I am confident that the Deeds.com service will deliver as promised. Definitely a valuable tool with important legal doucments.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ronald P.

July 24th, 2025

Forms easy to download but experienced problems trying to type in my information into the forms. Then when I went to print a form, Adobe wanted to charge me for printing. I ended up printing the blank forms and then filling them out manually.

Thank you, Ronald. We're glad you found the forms easy to download, though we're sorry to hear about the printing and fill-in experience. Our forms are designed to be fillable and printable using free software like Adobe Reader. If you ever run into issues, our support team is happy to help!

Wes C.

March 26th, 2022

The forms are easy to use and the examples and guidance are easy to understand and follow.

Thank you for your feedback. We really appreciate it. Have a great day!

Shirley W.

August 26th, 2021

I found the form easy to file out. But everything else was confusing with very little direction and help.

Thank you!

Sharon M.

October 18th, 2023

Purchasing the real estate deed form from your platform was a breeze. The form was easy to fill out and the instructions provided were clear and concise. I was able to quickly complete my property transaction without any hitches. I highly recommend your services to anyone in need of real estate documentation. Thank you for making this process so straightforward!

Thanks a million for the positive feedback! It truly means a lot to us.