Isanti County Transfer on Death Deed by Married Joint Tenants Form

Isanti County Transfer on Death Deed by Married Joint Tenants Form

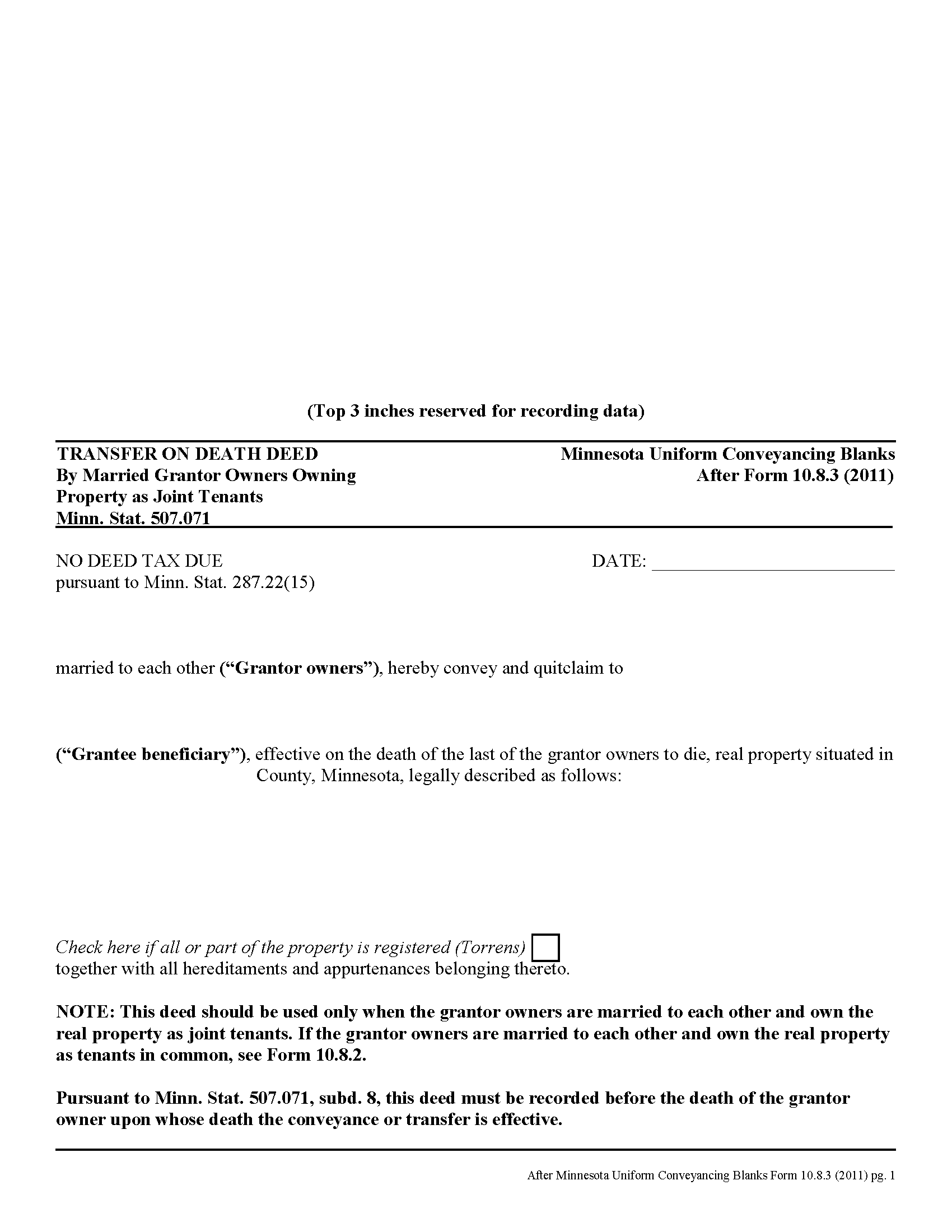

Fill in the blank Transfer on Death Deed by Married Joint Tenants form formatted to comply with all Minnesota recording and content requirements.

Isanti County Transfer on Death Deed by Married Joint Tenants Guide

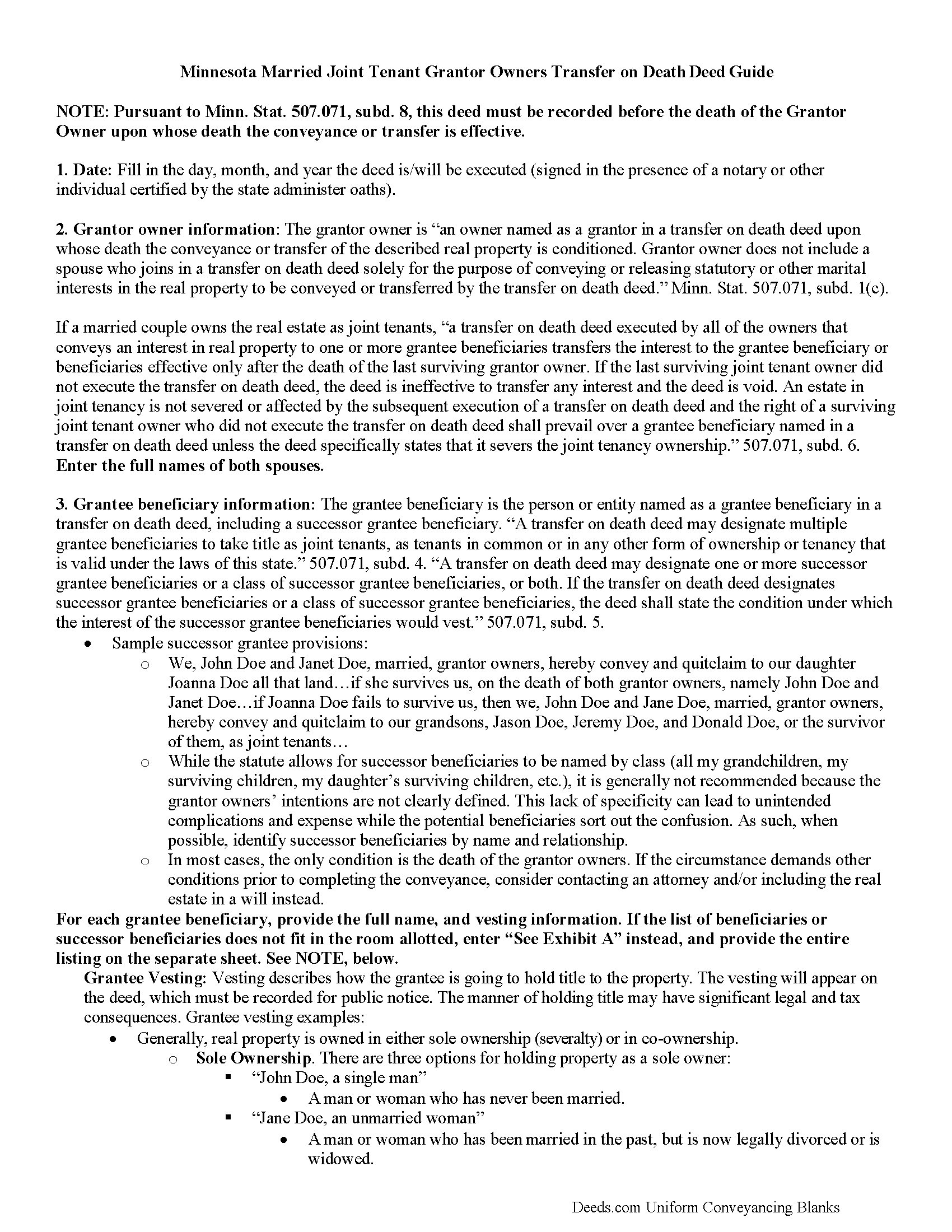

Line by line guide explaining every blank on the form.

Isanti County Completed Example of the Transfer on Death Deed by Married Joint Tenants Document

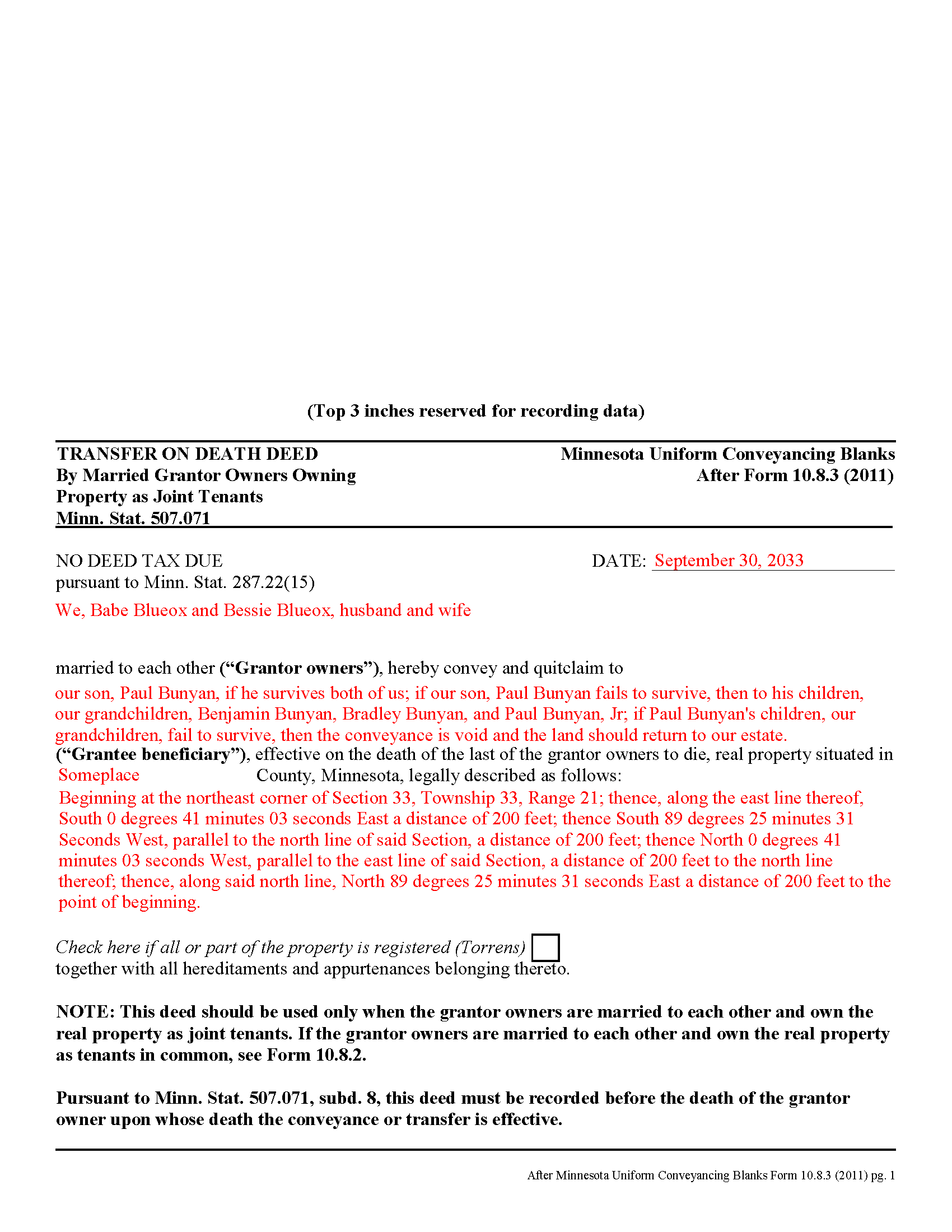

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Isanti County documents included at no extra charge:

Where to Record Your Documents

Isanti County Recorder

Cambridge, Minnesota 55008

Hours: 8:00 to 4:30 M-F

Phone: (763) 689-1191

Recording Tips for Isanti County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Isanti County

Properties in any of these areas use Isanti County forms:

- Braham

- Cambridge

- Dalbo

- Grandy

- Isanti

- Stanchfield

Hours, fees, requirements, and more for Isanti County

How do I get my forms?

Forms are available for immediate download after payment. The Isanti County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Isanti County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Isanti County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Isanti County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Isanti County?

Recording fees in Isanti County vary. Contact the recorder's office at (763) 689-1191 for current fees.

Questions answered? Let's get started!

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. Transfer on death deeds are useful estate planning tools for those who wish to pass real estate down to designated beneficiaries, outside of the probate process.

Mistakes or omissions in such deeds can force the property back into the estate and subject it to probate distribution, despite the grantor owner's best intentions. For example, the rules for joint tenants who wish to convey property with a transfer on death deed are found in 507.071, subd. 6. A correctly-completed basic statutory form is effective in many cases, but because joint tenants are often married to one another, and to ensure that all the required information is included, there is a special deed for this circumstance.

This transfer on death deed form is for use ONLY by married grantor owners who hold title as joint tenants.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Married JT Package includes form, guidelines, and completed example)

Important: Your property must be located in Isanti County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed by Married Joint Tenants meets all recording requirements specific to Isanti County.

Our Promise

The documents you receive here will meet, or exceed, the Isanti County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Isanti County Transfer on Death Deed by Married Joint Tenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Douglas S.

June 30th, 2021

Nice site, easy to maneuver around, and walks you thru completing forms. However, at the end, the forms listed poorly explained. It would be helpful to have better explanations of the forms so people know which forms they really need to download.

Thank you for your feedback. We really appreciate it. Have a great day!

Judy K.

February 23rd, 2021

Your customer service is superb. I ordered the wrong form, and you were so quick to resolve my problem. I will be using your site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna B.

November 24th, 2020

Got exactly what I was looking for and for one price! Accessing the documents was super easy! Love this site and will definitely recommend to family and friends!

Thank you!

Rick F.

April 27th, 2020

Your website was very easy to navigate and I accomplished my single task successfully. It was accomplished with zero issues and in a timely fashion. When or if the need arises, I will definitely use your service again. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Tiffany Dawn J.

September 28th, 2019

Would be nice to have a better description on how to complete the forms if it is separated couple and one is signing the deed over to the other. I am still unsure how it should be worded. Disappointed that the guide didn't have better explanations.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine S.

December 19th, 2019

Description of document could have been better

Thank you!

Neil S.

January 3rd, 2019

Very impressive. The only change I would suggest is a smaller font on the title.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia E.

October 12th, 2024

Disappointed that you were not able to provide me with the information requested. They did issue a refund but I don’t think it’s come through yet.

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Candace K.

April 1st, 2021

I was able to find the Certificate of Trust after a little searching. Once found, the remainder of the process was easy. My task was done in no time. It's a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Roy K.

February 15th, 2019

Just what we were looking for. Very easy to fill out. Thanks

Thank you Roy. We appreciate your feedback.

KRISSA O.

January 2nd, 2025

Smooth process, no issues.

Thank you!

Raecita H.

March 19th, 2022

This was the first time I had ever had to fill out a Warranty Deed, so if it was not for your example form on how to fill one out, I would be still be here completely lost. I had originally gone to another site for a Warranty Deed & they wanted double the amount of your price & their website had no examples forms. I am so happy with your site & service. Thank you for giving us the opportunity to be able to download the forms as much as we need to because as many mistakes I made,I had to print quite a few to be able to get it done right.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARC G.

June 26th, 2020

Very easy. Very helpful.

Thank you!

Brenda K R.

October 1st, 2021

Hello, I like how easy the form is to follow. I'm unsure however of how to proceed as what I am trying to do is have my name added to the deed so in event of death I have ownership.

Thank you for your feedback. We really appreciate it. Have a great day!

Klint D.

October 2nd, 2020

Quick and easy

Thank you!