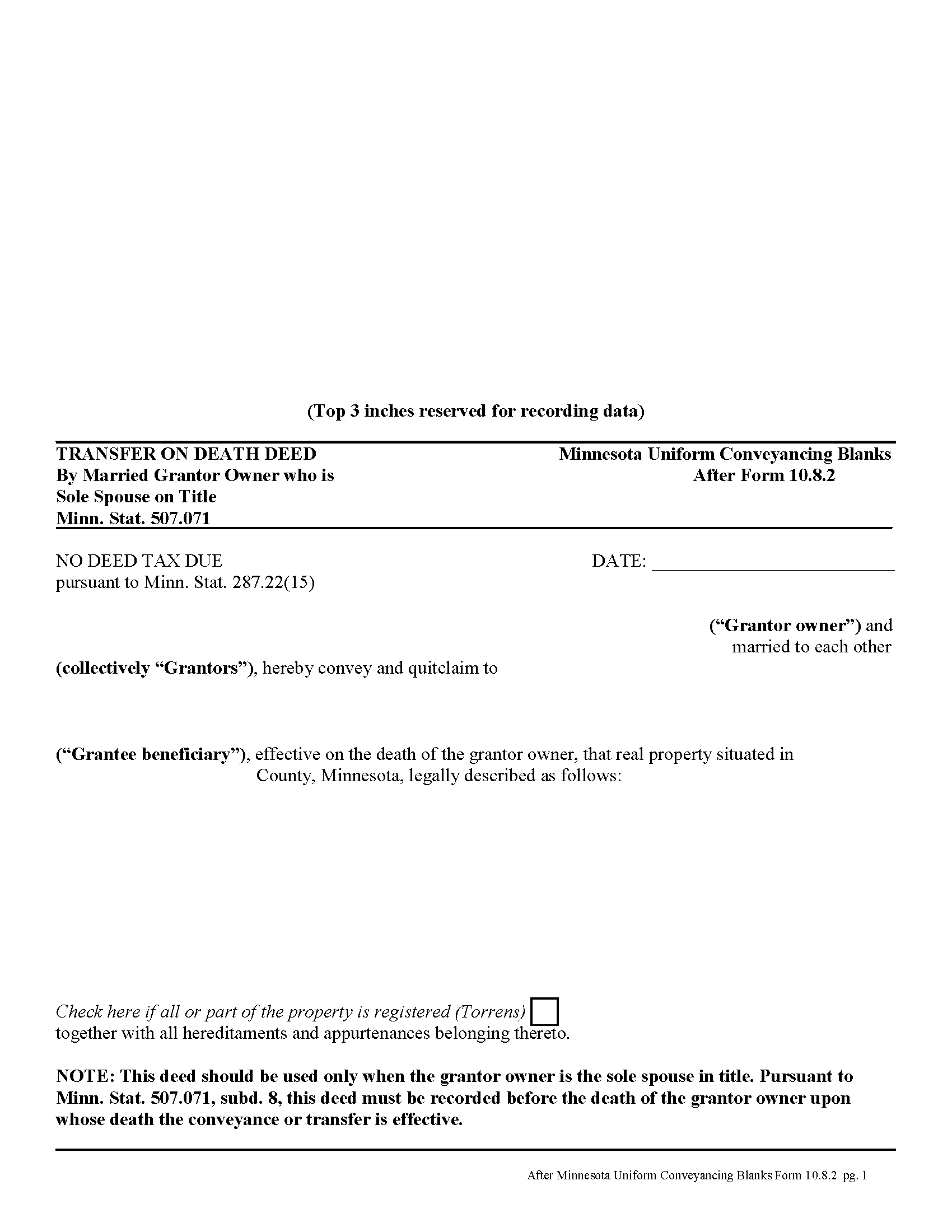

Morrison County Transfer on Death Deed by Married Sole Owner Form

Morrison County Transfer on Death Deed by Married Sole Owner

Fill in the blank form formatted to comply with all recording and content requirements.

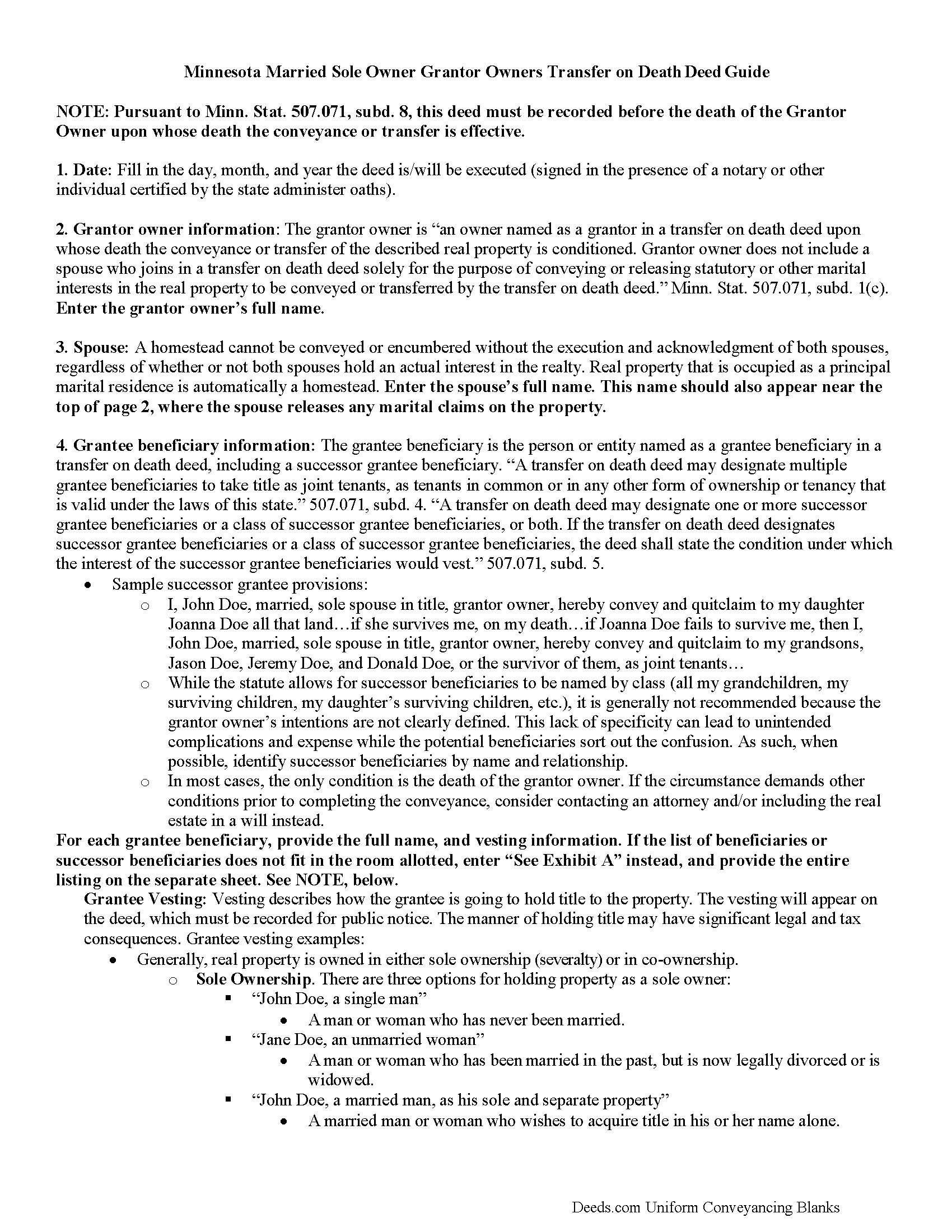

Morrison County Transfer on Death Deed by Married Sole Owner Guide

Line by line guide explaining every blank on the form.

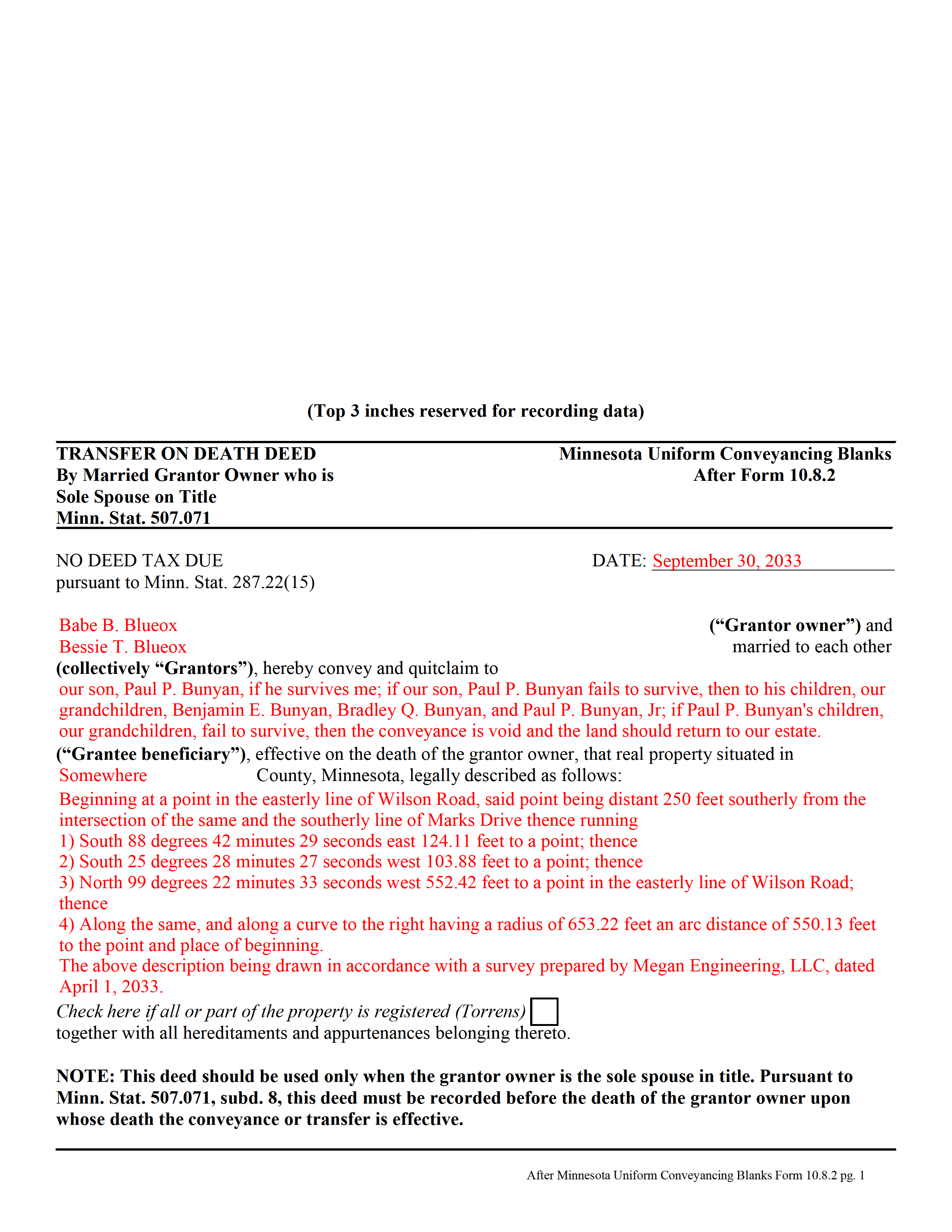

Morrison County Completed Example of the Transfer on Death Deed by Married Sole Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Morrison County documents included at no extra charge:

Where to Record Your Documents

Morrison County Recorder

Little Falls, Minnesota 56345

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (320) 632-0146

Recording Tips for Morrison County:

- Request a receipt showing your recording numbers

- Ask about their eRecording option for future transactions

- Recording fees may differ from what's posted online - verify current rates

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Morrison County

Properties in any of these areas use Morrison County forms:

- Bowlus

- Buckman

- Cushing

- Flensburg

- Hillman

- Lastrup

- Little Falls

- Motley

- Pierz

- Randall

- Royalton

- Swanville

- Upsala

Hours, fees, requirements, and more for Morrison County

How do I get my forms?

Forms are available for immediate download after payment. The Morrison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Morrison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morrison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Morrison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Morrison County?

Recording fees in Morrison County vary. Contact the recorder's office at (320) 632-0146 for current fees.

Questions answered? Let's get started!

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. One such situation occurs when a married property owner holds sole title to the real estate he or she wishes to convey with a transfer on death deed. A correctly-completed basic statutory form is valid in most cases, but because the owner's husband or wife may be able to claim spousal interest in the property, these deeds require the spouse to sign a statement releasing any marital rights. Without this release, the non-probate transfer on death may not occur, and the property could revert to the deceased owner's estate for probate distribution instead. To prevent such unintended outcomes, there is a special deed for this circumstance.

This transfer on death deed form is for use ONLY by married grantor owners who are the sole spouse on the property's title.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Married Sole Owner Package includes form, guidelines, and completed example)

Important: Your property must be located in Morrison County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed by Married Sole Owner meets all recording requirements specific to Morrison County.

Our Promise

The documents you receive here will meet, or exceed, the Morrison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morrison County Transfer on Death Deed by Married Sole Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Robert T.

January 2nd, 2019

Perfect. Downloaded the forms with no issues, filled them out, had them notarized and recorded all in just a few hours (most of that time was spent at the recorder's office). Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Lee J.

February 20th, 2023

Very good so far -- downloading all the forms. So many forms -- I had no idea ....

Thank you for your feedback. We really appreciate it. Have a great day!

Danna F.

May 29th, 2020

VERY INFORMATIVE

Thank you!

Thomas D.

January 6th, 2019

Can I use this for easement in gross ? Like to grant cousins easement to use river front property with riparian rights ?

Sorry, we are unable to give advice on specific legal situations.

Kimberly S.

November 19th, 2019

It's so easy to use. Well worth the price. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Charlene H.

July 22nd, 2025

Deeds.com is a wonderful website. I highly recommend them and would use them again in the future.

Thank you, Charlene! We're so glad to hear you had a great experience. We truly appreciate your recommendation and look forward to helping you again in the future.

Susan C.

January 16th, 2019

Hi When and how will I get the copy of my deed ? Thanks

Thanks for reaching out. Looks like the document you ordered has been available for you to download from your account since January 15, 2019 at 11:46 am.

Leonard H.

November 21st, 2019

Just perfect for what I needed. Made the property transfer very easy.

Thank you!

Turto T.

February 5th, 2021

The documents were accurate and event well packaged. They contained all the information that was needed to establish revocable trusts and transfer the property into the trusts. All of this with decent price.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph L.

February 11th, 2019

Very easy to fill out and and saved a lot of extra cost by doing it ourselves and getting it notarized.

Thank you Joseph, we really appreciate your feedback.

Lesa F.

May 14th, 2021

Excellent service for recovering a couple of deeds that had been misplaced. They were fast and efficient at a fair price. I would definitely use them again.

Thank you!

Vince D.

August 6th, 2020

Great product and service, really makes me rethink the value I provide to my customers.

Thank you!

O. Peter P.

June 21st, 2019

I find your forms hard to use, inasmuch as the forms cannot be converted to a Word Document. Editing and deleting of extra lines is not possible, making for a deed with large blank spaces. Document that results is not usable for me.

Sorry to hear that we did not meet your expectations. We have canceled your order and payment. We do hope you find something more suitable to your needs elsewhere. Have a wonderful day.

Jack A.

March 26th, 2021

First time user. Great service. If I need other forms, I'll definitely be using Deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!